Drone Camera Market Size:

Get more information on Drone Camera Market - Request Sample Report

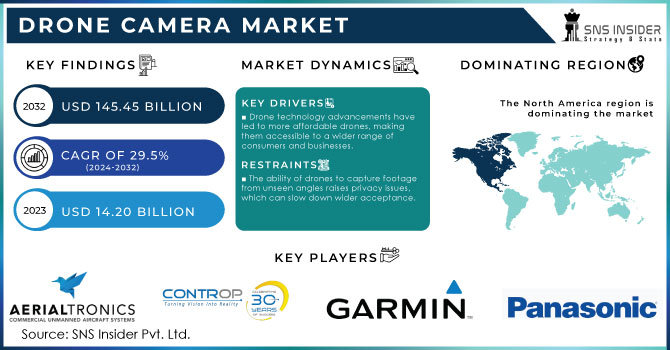

The Drone Camera Market Size was valued at USD 14.20 billion in 2023 and is expected to reach USD 145.45 billion by 2032 and grow at a CAGR of 29.5% over the forecast period 2024-2032.

The drone camera market is on a rise, fueled by a booming drone market growing at nearly 29% and continuous technological advancements. Developing countries with increasing drone use present exciting future opportunities. Miniaturization is a game-changer, with lighter batteries and innovative materials allowing for smaller drones with impressive capabilities. Imagine bird-sized drones carrying significant payloads, reaching kilometers away, and soaring to new heights! Autonomy is another major trend. Drones that can dodge obstacles, plan complex routes, and adapt to weather are on the horizon. This tech, along with swarming functionalities, is boosting the military and defense sectors. Beyond tech, affordability is driving consumer adoption, with some models dipping below $100. From search and rescue to agriculture and security, GPS-equipped drones with LiDAR technology are expanding possibilities. Breathtaking aerial photography and videography remain a major draw. The ability of drones to provide live feeds and access hard-to-reach areas makes them invaluable for security and risk mitigation, further propelling market growth.

Drone Camera Market Dynamics:

KEY DRIVERS:

-

Drone cameras provide unique angles and perspectives for photography and videography, making them increasingly popular for filmmakers, photographers, and even hobbyists. This demand is across industries like real estate, media, and entertainment.

-

Drone technology advancements have led to more affordable drones, making them accessible to a wider range of consumers and businesses.

RESTRAINTS:

-

The ability of drones to capture footage from unseen angles raises privacy issues, which can slow down wider acceptance.

-

Drone malfunctions or misuse can pose safety risks to people and property. As the technology matures, addressing these concerns is crucial.

The ability of drones to capture footage from unseen angles raises significant privacy issues that can slow down the wider acceptance of drone technology. Drones equipped with cameras can easily fly over private properties and capture images or videos of people and places without consent. This intrusion into personal privacy can lead to concerns about surveillance and data misuse, potentially causing individuals to feel uneasy about the presence of drones in their vicinity.

As drones become more prevalent, there is an increasing need to establish clear regulations to protect privacy and define appropriate uses of drone technology. Laws governing where and when drones can operate, as well as what they can capture, are essential to balancing innovation with respect for individuals' privacy rights.

OPPORTUNITIES:

-

The development of better battery life, longer flight ranges, higher resolution cameras, and autonomous flying capabilities will open doors for even more applications.

-

The expansion of drone camera application areas such as GPS, lidar, and mapping services is expected to provide lucrative opportunities.

The development of better battery life, longer flight ranges, higher resolution cameras, and autonomous flying capabilities in drones will significantly expand the scope of drone applications across various industries. Improved battery technology extends flight time, allowing drones to cover larger areas and carry out tasks for longer periods, which is particularly useful for applications like aerial surveying, agricultural monitoring, and inspection services.

Higher-resolution cameras enable drones to capture detailed footage, benefiting fields such as real estate, construction, and infrastructure maintenance by providing precise visuals for inspections and progress tracking. Autonomous flying capabilities, powered by advanced AI and machine learning, enable drones to operate with minimal human intervention. This opens the door for new applications such as autonomous delivery services, where drones can transport goods efficiently and safely.

CHALLENGES:

-

Negative perceptions about drone use, such as concerns about privacy and safety, can create resistance to adoption in some communities.

-

Operating drones effectively often requires specific training and expertise. A shortage of skilled drone pilots could limit the growth of certain applications.

-

Drones collecting and transmitting data raise cybersecurity concerns. Ensuring data privacy and security requires robust measures.

IMPACT OF RUSSIAN-UKRAINE

The Russian-Ukrainian war has significantly impacted the drone camera market in several ways. Supply chain disruptions have affected the availability of key components like batteries and sensors, leading to production delays and increased costs for manufacturers. Geopolitical tensions have resulted in stricter export controls and regulations, affecting the global trade of drone technology. The conflict has also driven up demand for advanced drone cameras for military and defense applications, particularly for surveillance, reconnaissance, and intelligence gathering. This focus on military uses may divert resources away from civilian markets, potentially slowing down innovation and development in non-military sectors.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown can impact the drone camera market by affecting both demand and supply. Reduced consumer spending can lead to a decline in sales of drones for recreational use, as individuals prioritize essential expenses over luxury items. Similarly, businesses facing financial constraints may cut back on investments in drone technology for applications such as agriculture, real estate, and construction, leading to lower demand in these sectors. Project delays in infrastructure and other industries that use drone cameras for surveying and monitoring can further slow adoption. Companies may also reduce research and development investments, potentially hindering innovation and the introduction of new features.

Drone Camera Market Segment Overview:

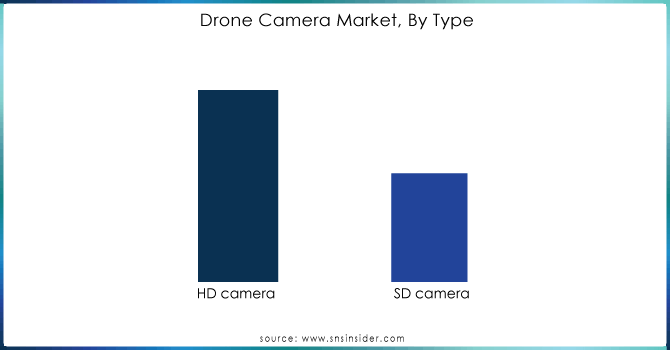

BY TYPE

During the forecast period, HD cameras are anticipated to lead the market. These cameras deliver high-quality images with superior resolution, typically at either 720p or 1080p. HD cameras are increasingly prevalent in the drone camera market, thanks to their advanced features, which enable the capture of high-resolution videos and top-quality aerial images.

Get Customized Report as per your Business Requirement - Request For Customized Report

BY RESOLUTION

The 32 MP and above segment accounted for approximately 48% of drone camera market revenue in 2023. Drones equipped with cameras of 32 MP or higher are primarily used for security and defense operations, providing detailed information and monitoring suspicious areas. Growing national safety and security concerns, coupled with increased defense budget allocations, have led to the adoption of UAVs featuring advanced components such as high-resolution cameras and navigation systems.

BY APPLICATION

The drone camera market is segmented into photography and videography, thermal imaging, and surveillance. Surveillance is expected to grow at the highest CAGR and dominate the market during the forecast period. Drones equipped with cameras are used to monitor potential suspects or areas, tracking their movements. They offer benefits such as superior image quality and ease of use, making them an excellent choice for security applications.

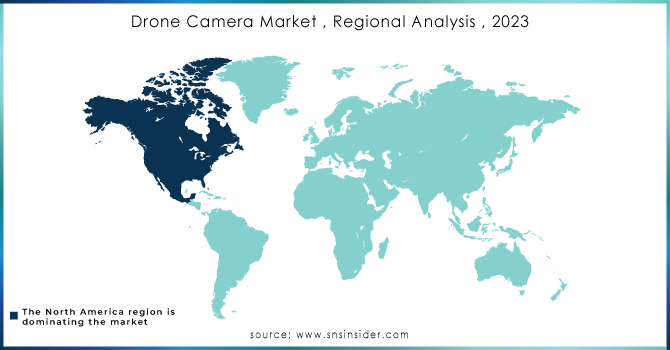

Drone Camera Market Regional Analysis:

In 2023, North America leads the drone camera market and is anticipated to experience significant CAGR growth during the study period. This growth is driven by the rapid adoption of advanced technologies and substantial investments, especially from the military and defense sectors. According to the Federal Aviation Administration (FAA), drone flights are allowed in the United States. Additionally, factors such as favorable FAA regulations, substantial opportunities for research and innovation from tech hubs like Silicon Valley, and a robust drone ecosystem contribute to revenue growth in the region.

Europe holds the second-largest market share in the drone camera market during the forecast period, driven by increasing demand for drones in infrastructure assessment, oil spill monitoring, air transport of medical supplies, and enhanced regulatory support.

The Asia-Pacific drone camera market is projected to grow at the fastest CAGR from 2024 to 2031, fueled by increased high-value funding from the military and defense sectors and rising R&D initiatives for advanced military drones for security and surveillance, along with rapid digitalization, particularly in rural areas.

KEY PLAYERS:

The key players in thedrone camera market are Aerialtronics DV, Controp Precision Technologies, DST Control, Garmin, Panasonic Corporation, Canon, DJI, FLIR Systems, GoPro, Sony Corporation & Other Players.

Recent Development

In July 2023: DJI, a leading global provider of drone technology, introduced its latest drone model, the DJI Air 3. This semi-flagship drone stands out due to its dual camera system, providing enhanced photo and video capabilities compared to its predecessor, the Air 2s. The Air 3 features a dual 4K camera setup with a wide-angle lens offering a 24mm equivalent focal length and f/1.7 aperture, alongside a medium telephoto lens with a 70mm equivalent focal length and f/2.8 aperture. Both lenses are 1/1.3-inch in size and support dual native ISO.

In July 2023: SimActive Inc., a global leader in photogrammetry software, announced new pricing for its Correlator3D software for larger drone cameras. The low-priced UAV license option now includes cameras up to 61 megapixels, previously capped at 50 MP, addressing the growing demand for larger drone sensors such as the Sony A7R IV.

In April 2023: DJI launched the Mavic 3 Pro, the world's first drone with three optical cameras. This model, succeeding the Mavic 3, provides creators, filmmakers, and drone pilots with enhanced creative flexibility. The Mavic 3 Pro features a Hasselblad camera and dual telephoto lenses, offering advanced imaging capabilities.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 14.20 Billion |

| Market Size by 2032 | USD 145.45 Billion |

| CAGR | CAGR of 29.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (HD Camera, SD Camera) • By Resolution (12 MP, 12 To 20 MP, 20 To 32 MP, 32 MP And Above) • By Application (Thermal Imaging, Photography & Videography, Surveillance) • By End User (Commercial, Homeland Security, Military) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Aerialtronics DV, Controp Precision Technologies, DST Control, Garmin, Panasonic Corporation, Canon, DJI, FLIR Systems, GoPro and Sony Corporation. |

| Key Drivers |

• Drone cameras provide unique angles and perspectives for photography and videography, making them increasingly popular for filmmakers, photographers, and even hobbyists. This demand is across industries like real estate, media, and entertainment. • Drone technology advancements have led to more affordable drones, making them accessible to a wider range of consumers and businesses. |

| Restraints |

• The ability of drones to capture footage from unseen angles raises privacy issues, which can slow down wider acceptance. • Drone malfunctions or misuse can pose safety risks to people and property. As the technology matures, addressing these concerns is crucial. |