Lithium-Sulfur Battery Market Size Analysis:

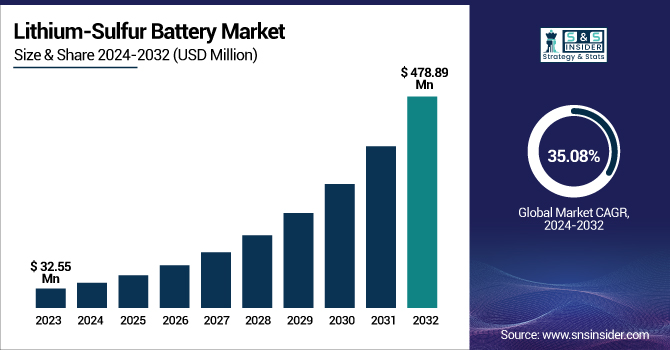

The Lithium-Sulfur Battery Market was at USD 32.55 million in 2023 and is expected to reach USD 478.89 million in 2032, growing with a CAGR of 35.08 % during the years 2024 to 2032. Such growth is being driven by the growing demand for portable electronics, electric vehicles, and drones, wherein efficient and high-capacity energy storage is required. Technological progress in sulfur cathode technology and attempts to break cycle stability barriers are also speeding up adoption, and lithium-sulfur batteries are becoming a potential next-generation option in the global energy sector.

To Get more information on Lithium-Sulfur Battery Market - Request Free Sample Report

The U.S. Lithium-Sulfur Battery Market has a vast growth potential, with its value increasing from USD 17.41 million in 2023 to a forecasted USD 231.30 million by 2032, at an impressive CAGR of 33.54%. The boost comes due to the growing demand for lightweight, high-energy storage systems across industries like aerospace, defense, electric vehicles, and renewable energy. The U.S. is also seeing robust research efforts and investments toward the overcoming of technical constraints such as limited cycle life and low conductivity. Supported by government resources and private innovation, the nation is becoming a major player in the adoption of next-generation battery technology.

Lithium Sulfur Battery Market Dynamics

Key Drivers:

-

Growing Demand for High-Energy, Lightweight Storage Solutions in Electric Vehicles Boosts Lithium-Sulfur Battery Market Growth.

The transition to electric vehicles (EVs) has considerably raised the demand for batteries with greater energy density and lower weight. Lithium- sulfur (Li- S) batteries offer almost five times the energy density of conventional lithium-ion batteries, which makes them extremely sought after by EV makers looking to increase driving range and efficiency. Their light structure also complements the automotive sector's emphasis on lowering the overall weight of the vehicle to enhance performance and sustainability. With the worldwide drive toward decarbonization and EV uptake, the distinctive features of Li-S batteries are driving market growth, making them a central innovation in future energy storage technologies.

Restrain:

-

Limited Cycle Life and Poor Conductivity of Sulfur Cathodes Restrains the Adoption of Lithium-Sulfur Batteries.

Lithium-sulfur batteries have great potential but are hindered by technical obstacles from widespread commercial use. The most significant issue is that they have a relatively short cycle life due to the polysulfide shuttle effect, resulting in material loss and rapid capacity loss over repeated charges. Moreover, the intrinsic low conductivity of sulfur cathodes necessitates sophisticated engineering solutions, including the application of costly composite materials and protective coatings, raising production complexity and cost. These challenges diminish the attractiveness of Li-S batteries for long-term, high-performance applications and restrict their competitiveness against more established lithium-ion technologies in the energy storage market.

Opportunity:

-

Rising Investments in R&D and Government Support for Clean Energy Technologies Create New Opportunities for lithium- sulfur Batteries.

The increasing focus on clean and green energy technologies is prompting governments and private industries to invest heavily in the R&D of lithium- sulfur batteries. Funding schemes and grants in regions such as the U.S., EU, and Asia are financing innovations related to improving the performance, security, and lifespan of the batteries. This investment is stimulating the engineering of solid-state electrolytes, new cathode materials, and production methods to break the limitations that exist today. With global efforts moving towards the integration of renewable energy and low-emission transportation, Li-S batteries are finding increasing popularity, creating large commercialization opportunities in aerospace, automotive, and grid storage markets.

Challenges:

-

Technical Complexity in Scaling Up Lithium-Sulfur Battery Production Poses a Major Challenge for Market Expansion.

While laboratory-scale breakthroughs in lithium-sulfur batteries are encouraging, scaling up such advances into commercial, large-scale production is the biggest challenge. The moisture sensitivity of sulfur materials and the requirement for unique infrastructure and handling facilities during manufacturing make large-scale production both costly and complicated. Additionally, it has been challenging to maintain uniform quality, safety, and performance across high-volume production, thus hindering commercialization. Businesses have to spend on cutting-edge manufacturing technology and intense quality control systems, adding operational expenses. Such impediments will slow time-to-market and dampen the introduction of Li-S batteries into fast-growing, high-demand markets, keeping their potential growth in the market competition of energy storage under control.

Lithium-Sulfur Battery Industry Segment Analysis

By Battery Capacity

The Above 1000 mAh portion had the highest revenue share of 52.3% of the lithium-sulfur battery market in 2023. This portion is dominated by increased uptake in electric vehicles, aerospace, and large-scale energy storage systems, which require high capacity and lightweight energy solutions. Sion Power, for example, has made tremendous progress with Licerion batteries that go beyond 500 Wh/kg, while OXIS Energy created high-capacity cells suited for aviation. These innovations drive endurance and lower weight in advanced mobility uses. The need for high-power, energy-dense batteries keeps solidifying the lead of this category in the market for lithium-sulfur batteries.

The Below 500 mAh category will develop at the highest CAGR of 37.38% with the spur of accelerating demand in wearables, medical products, and mobile electronics. Companies such as PolyPlus and Imprint Energy are actively working on small-format lithium-sulfur batteries with an emphasis on compact designs with increased energy output. These developments address the micro battery market's demand for ultra-lightweight power sources for space-restricted applications. The application of Li-S chemistry in sub-500 mAh ranges responds to the demand for environmentally friendly, efficient substitutes to coin and button cell batteries and makes this part of the business one of the most vibrant and promising in the energy storage environment.

By Type

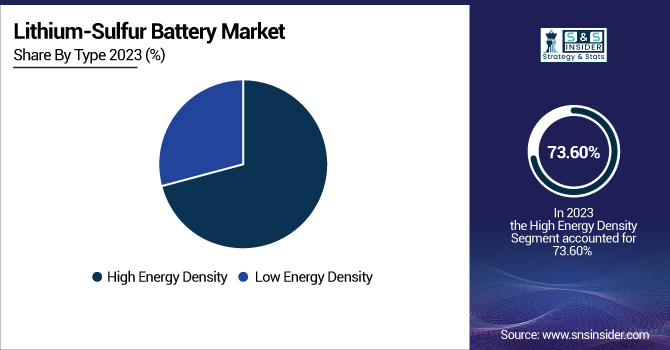

The High Energy Density segment accounted for the highest revenue share in the lithium-sulfur battery market at 73.60% in 2023. This is due to the segment's capacity for increased energy per unit weight, qualifying it as the best for high-demand applications like electric vehicles, aerospace, and defense. Firms such as Sion Power, with its Licerion batteries providing more than 500 Wh/kg, and OXIS Energy, specializing in high-end aviation batteries, are leading this innovation. The increasing demand for high-performance, lightweight batteries is driving investment and innovation in this category, solidifying its market leadership.

The Low Energy Density segment will develop at a stunning 37.80% CAGR, driven largely by its ability to serve cost-sensitive and low-power applications like smart cards, IoT tags, and disposable medical devices. Firms such as Imprint Energy are leading the way in flexible, printable lithium-sulfur batteries where design flexibility trumps energy capacity. Low-density solutions provide safer chemistries and cost savings, which render them suitable for integration into slim consumer electronics. Their fit into micro battery market requirements—particularly thin form factors and environmental considerations—puts this segment on course for fast growth, fueled by innovation and smart technology miniaturization.

By Application

In 2023, the aerospace category dominated the revenue share of 29.40% in the lithium- sulfur battery market due to increased demand for high-capacity, lightweight energy solutions. Lithium- sulfur batteries are best suited for aerospace as they have better energy density and are lighter than conventional lithium-ion batteries. OXIS Energy and Sion Power are some of the companies that have emphasized creating lithium- sulfur batteries for aviation applications, ranging from unmanned aerial vehicles (UAVs) to electric aircraft. For example, OXIS collaborated with Bye Aerospace for high-altitude aircraft systems. These innovations demonstrate how the segment gains from lithium-sulfur's singular characteristics, which enable longer flight durations and improved fuel efficiency.

The Energy Storage Systems (ESS) segment is likely to register the highest CAGR of 37.74% in light of the worldwide transition to renewable energy and grid stabilization solutions. Lithium- sulfur batteries provide increased cycle life and reduced environmental footprint, which makes them suitable for large-scale storage. Lyten and NexTech Batteries are developing Li-S-based ESS prototype products that offer better performance at a lower cost. These advances are consistent with trends in the micro battery market, where demand for effective, scalable energy storage in compact form factors mirrors ESS needs, particularly in smart home systems and distributed power applications.

Lithium-Sulfur Battery Market Regional Outlook

Asia Pacific dominated the market with the largest 45.00% share in the Lithium-Sulfur Battery Market in 2023, led by robust demand from nations like China, Japan, and South Korea in industries including electric mobility, aerospace, and electronics. Next-generation Li-S technologies are being invested in by firms such as CATL and Panasonic, which are backing both automotive and aerospace developments. This regional superiority also supports the micro battery market, as electronics production and R&D are the highest in the Asia Pacific region. The miniaturization drive, combined with increasing adoption of smart devices, creates a cross-industry impulse for small form factor, high-energy batteries across both Li-S and micro battery applications.

North America is expected to record the highest growth in the Lithium-Sulfur Battery Market with a CAGR of 37.62%, driven by growing government investments and private funding into energy storage, EVs, and aerospace. Players based in the US, such as Sion Power and Lyten, are introducing innovative Li-S battery technologies for high-performance and clean energy solutions. The focus of the region on clean energy and advanced defense technologies drives adoption. In the same way, micro battery development is supported by robust support for healthcare wearables, IoT, and defense, with lithium chemistries innovation affecting designs and performance standards across both new battery markets.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Listed in the Lithium-Sulfur Battery Market are:

-

LG Energy Solutions Ltd. ( RESU Home Battery, LG Chem Li-S Prototype )

-

Saft Groupe SA –( Super Lithium Battery, Li-S 4.5Ah Cell )

-

Gelion PLC – ( Gelion Zinc-Bromide Battery, Gelion Lithium-Sulfur Cell )

-

Sion Power Corporation –( Licerion EV Battery, Licerion Aviation Battery )

-

Johnson Matthey – ( eLNO Cathode Material, Lithium-Sulfur Cell Prototype )

-

Giner, Inc. – ( Giner Electrolyzer Stack, Giner Li-S Battery System )

-

Lynntech, Inc. – ( High Energy Li-S Cells, Advanced Battery Management Systems )

-

Ilika Technologies – ( Stereax M50 Micro Battery, Stereax P180 Battery )

-

Williams Advanced Engineering ( Lightweight Battery Modules, High Power Li-S Packs )

-

Guang Dong Xiaowei New Energy Technology Co., Ltd. – ( High-Capacity Li-S Battery, Flexible Li-S Energy Cell )

Recent Trends

-

In March 2025, Sion Power announced advancements in its Licerion lithium- sulfur battery technology, achieving energy densities exceeding 500 Wh/kg, targeting applications in electric vehicles and aerospace.

-

March 2025, Giner, Inc. reported progress in lithium-sulfur battery research, focusing on enhancing cycle life and energy density for potential use in electric vehicles and grid storage.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 32.55 Million |

| Market Size by 2032 | USD 478.89 Million |

| CAGR | CAGR of 35.08 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Battery Capacity – (Below 500 mAh, 500-1000 mAh, Above 1000 mAh ) • By Type – ( Low Energy Density, High Energy Density ) • By Application – ( Automotive, Aerospace, Consumer Electronics, Energy Storage Systems, Medical Devices, Military and Defense ) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | LG Energy Solutions Ltd. , Saft Groupe SA , Gelion PLC , Sion Power Corporation , Johnson Matthey , Giner, Inc. , Lynntech, Inc. , Ilika Technologies , Williams Advanced Engineering , Guang Dong Xiaowei New Energy Technology Co., Ltd. |