High Electron Mobility Transistor Market Size & Trends:

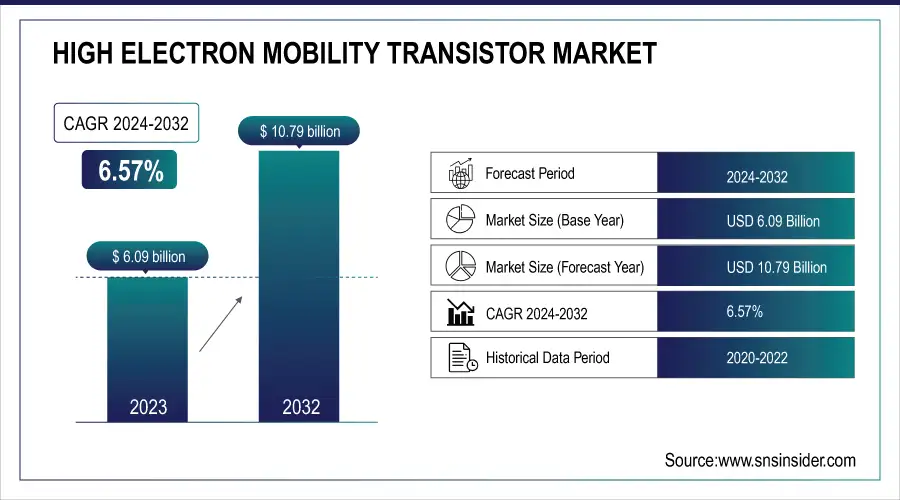

The High Electron Mobility Transistor Market was valued at 6.09 Billion in 2023 and is projected to reach USD 10.79 Billion by 2032, growing at a CAGR of 6.57% from 2024 to 2032.

Key market drivers include the increasing demand for high-frequency and high-power transistors in sectors like telecommunications, aerospace, defense, and electric vehicles.

To Get more information on High Electron Mobility Transistor Market - Request Free Sample Report

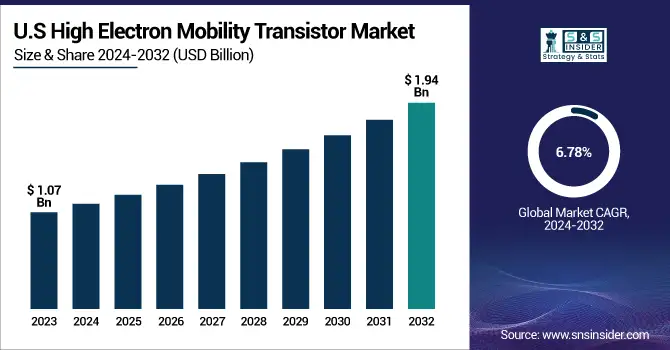

In the U.S., the market was valued at USD 1.07 billion in 2023 and is expected to reach USD 1.94 billion by 2032, with a CAGR of 6.78%.Regulatory policies and standards promoting energy efficiency and the adoption of 5G technologies are accelerating growth. Additionally, environmental sustainability trends and the focus on reducing carbon footprints are influencing the market. Disruptive technologies, such as advancements in GaN and SiC materials, are further driving innovation, while enhanced supply chain resilience, particularly in response to global semiconductor shortages, ensures steady market development.

High Electron Mobility Transistor (HEMT) Market Dynamics:

Drivers:

-

GaN-Powered Mobility Driving the HEMT Revolution in EVs and AI

The accelerating adoption of electric vehicles (EVs) is driving strong demand for High Electron Mobility Transistors (HEMTs), especially Gallium Nitride (GaN)-based types, due to their high efficiency in power conversion and motor control. Intel Foundry’s recent breakthroughs such as subtractive ruthenium interconnects enabling up to 25% capacitance reduction, Selective Layer Transfer (SLT) technology offering 100x throughput improvement in chiplet assembly, and the gate-all-around (GAA) Ribbon FET CMOS transistors are revolutionizing semiconductor performance. These technologies are crucial for delivering smarter, smaller, and more power-efficient chips essential for EVs and data-intensive AI systems. Intel’s innovations enhance scalability and energy savings, aligning with the U.S. CHIPS Act to boost domestic production and secure supply chains. As EVs shift toward connected, autonomous platforms and AI demands intensify, these advancements in HEMTs and chip packaging are central to semiconductor market growth.

Restraints:

-

GaN-based HEMTs face challenges in heat dissipation and thermal management, affecting performance and lifespan.

GaN-based High Electron Mobility Transistors (HEMTs) are praised for their high efficiency, but they face significant challenges regarding material properties and packaging. A key issue is heat dissipation these semiconductors operate at high power densities, leading to potential thermal management problems. With even more advanced performance comes the potential for overheating that can shorten the life of devices and undercut performance, necessitating advanced cooling solutions. Moreover, the packaging of GaN-based HEMTs has not been able to fulfill the requirements of their high thermal conductivity and power levels. Traditional packaging materials cannot address the thermal expansion mismatch, requiring more advanced and expensive solutions such as flip-chip and embedded die technologies. These sophisticated packaging techniques add complexity and expense to production. This material and packaging limitations will remain as significant barriers to the wide adoption of GaN HEMTs in electric vehicles and telecommunications domains, until effective and cost-efficient packaging solutions are realized.

Opportunities:

-

GaN HEMTs Powering the Future of 5G and Satellite Communication Systems

The expansion of 5G networks is creating significant demand for High Electron Mobility Transistors (HEMTs), particularly GaN-based types, due to their exceptional efficiency, high-frequency switching, and thermal management capabilities. GaN HEMTs are integral to optimizing telecom infrastructure, including 5G base stations, amplifiers, and future satellite communication systems. As 5G adoption accelerates globally, GaN HEMTs are becoming critical components in next-generation communication systems. The integration of GaN HEMTs in power amplifiers (PAs) has significantly enhanced space and terrestrial transmitters, meeting stringent power consumption and efficiency requirements for active antennas. Key metrics for evaluating PA performance include gain, output power (Pout), bandwidth (BW), drain efficiency (DE), chip area, peak-to-average-power ratio (PAPR), and power-added efficiency (PAE). Doherty PAs, a widely used architecture, have achieved over 30 dB of gain, 11.5 PAPR, 81% PAE, and operate at frequencies above 29 GHz, with some GaN HEMT-based PAs exceeding 192 GHz and producing over 282 W of output power. These advancements are expanding GaN HEMT applications across 5G, satellite, and future communication systems.

Challenges:

-

GaN HEMTs are advancing through improvements in material selection and substrate engineering to overcome limitations and enhance performance.

Material and substrate mismatches continue to pose significant hurdles in the development of GaN HEMTs. When GaN is grown on substrates like silicon or sapphire, the differences in lattice structure and thermal expansion can lead to defects, affecting device reliability and longevity. Although silicon carbide (SiC) offers excellent thermal conductivity and better lattice compatibility, its high cost makes large-scale adoption challenging. This trade-off between performance and affordability limits the broad commercial deployment of GaN HEMTs, particularly in cost-sensitive markets. Innovations in substrate engineering and alternative materials are actively being explored to overcome these limitations and enable more efficient, scalable production of GaN-based devices.

HEMTs Market Segment Analysis:

By Type

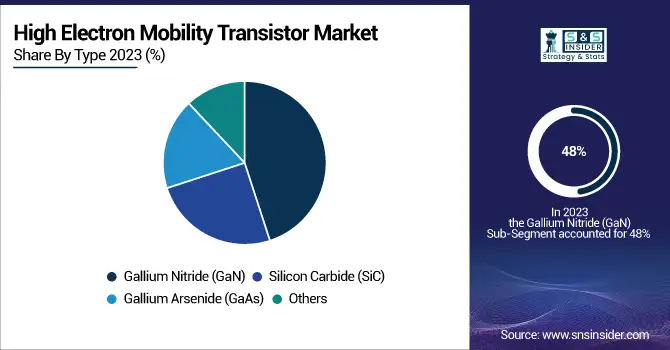

The Gallium Nitride (GaN) segment is to dominated the market, accounting for around 48% of the total revenue by 2032. This growth is driven by GaN's superior properties, such as high efficiency, high-frequency operation, and better thermal management compared to traditional materials. GaN is widely used in power electronics, RF devices, and optoelectronics, with significant demand across industries like telecommunications, automotive, and consumer electronics. Its application in next-generation technologies, including 5G networks, electric vehicles, and satellite communication systems, further boosts market expansion. The continuous advancements in GaN technology, especially with improvements in material quality and device reliability, ensure its growing market share and dominance in the coming years. As a result, GaN is expected to play a critical role in shaping future high-performance electronic systems.

The Gallium Arsenide (GaAs) segment is expected to experience steady growth from 2024 to 2032, due to its extensive applications in high-frequency production activities, including mobile phones, satellites, and radar through recollections. The electron mobility of GaAs is much higher than that of silicon, thus, it is used for applications requiring very low noise and high-speed switching, particularly in RF microwave devices. Rising demand for GaAs in communication systems, particularly in 5G technology which requires high-performance semiconductors is another factor driving the market growth. Moreover, its use in optoelectronics, in addition to LED and laser diode technology, also continues to propel growth. Thanks to continued improvements in GaAs manufacturing processes yielding higher quality materials and more efficient devices, the segment is set to see continued expansion, especially in the telecommunications, aerospace and defense sectors, where dependable high frequency functioning is essential.

By Application

The Consumer Electronics segment dominated the market, accounting for a substantial 34% of the total revenue in 2023. This segment’s strong performance is largely driven by the increasing demand for advanced electronic devices, including smartphones, tablets, laptops, and wearables. The integration of high-performance semiconductors, such as GaN and GaAs, in these devices has enabled faster processing, higher efficiency, and improved battery life, contributing to the growth of consumer electronics. As technological advancements continue, particularly in the areas of 5G connectivity, AI integration, and the Internet of Things (IoT), the consumer electronics market is expected to maintain its dominant share. Moreover, the ongoing shift towards smart devices and wearable technology further bolsters the demand for high-performance semiconductors, ensuring a strong growth trajectory for this segment.

The Automotive segment is poised for significant growth over the forecast period from 2024 to 2032. This growth is supported by the growing adoption of electric vehicles (EVs), increased development of autonomous driving technologies and the increasing demand for smart and connected car systems. On the one hand, high-performance semiconductors, including GaN and GaAs, are important functions that enhance vehicle power management, energy efficiency and communication systems. As the automotive industry pivots to electrification and further adoption of advanced driver-assistance systems (ADAS), the demand for these semiconductor materials will increase significantly. The growing demand for environmentally friendly transportation options and the expansion of 5G networks to support connected vehicles also contribute to the growth in the automotive segment, further establishing it as a primary catalyst in the semiconductor market.

High Electron Mobility Transistors (HEMTs) Market Regional Outlook:

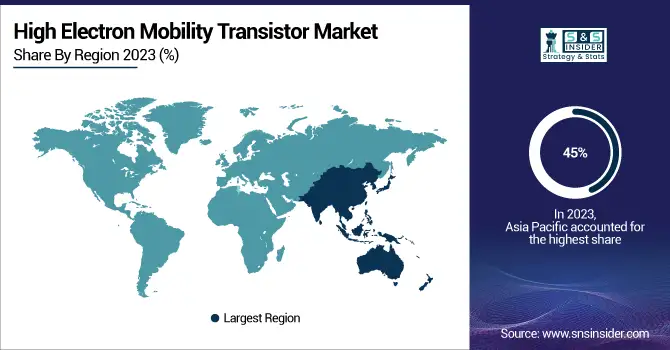

The Asia-Pacific region is projected to dominate the semiconductor market, accounting for around 45% of the total revenue by 2023. This region benefits from a robust manufacturing ecosystem, with major semiconductor producers and suppliers in countries such as China, South Korea, Japan, and Taiwan. The rapid technological advancements, particularly in consumer electronics, automotive, and 5G infrastructure, drive the demand for high-performance semiconductors like GaN and GaAs in the region. The ongoing expansion of electric vehicles (EVs) and smart city projects also contributes to the growing market in Asia-Pacific. Additionally, strong investments in research and development (R&D), along with government incentives to boost semiconductor production and innovation, position this region as a key player in the global semiconductor landscape. The Asia-Pacific market’s growth is further accelerated by its increasing role in the supply chain for advanced electronics and its expanding consumer base.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America is experiencing one of the fastest growth rates in the semiconductor market, projected to see significant expansion from 2024 to 2032. Specifically, the US is a major contributor to this expansion, supported by its strong semiconductor manufacturing capacity, continued technological innovation within the semiconductor industry, and national policies promoting local production. The CHIPS Act the U.S. government enacted to ramp up semiconductor manufacturing and R&D in the country has drastically increased investments in the sector, with large companies such as Intel, TSMC, and Samsung expanding production capacities in the region. Moreover, this growth is driven by the growing demand for semiconductors across various sectors including automotive (especially electric vehicles), telecommunications (5G infrastructure), and consumer electronics. Canada is also helping to drive growth in the region and its emphasis on technology innovation, especially in AI and data processing applications, while Mexico serves as a key manufacturing base for the world’s semiconductor companies. North America shows growth driven by AI, IoT, and renewable energy sectors, which makes it one of the most attractive regions for semiconductor investment.

Major Players in High Electron Mobility Transistor Market along with their Products:

-

Qorvo (USA) – RF solutions, Power amplifiers, filters

-

Infineon Technologies AG (Germany) – Semiconductors for automotive, industrial, security systems

-

Mouser Electronics, Inc. (USA) – Distribution of semiconductors, capacitors, resistors

-

MACOM (USA) – RF, microwave, millimeter-wave solutions

-

Wolfspeed (USA) – GaN-based transistors, diodes

-

RFHIC Corporation (South Korea) – RF components, GaN-based power amplifiers

-

STMicroelectronics (Switzerland) – Automotive, industrial, consumer electronics semiconductors

-

Texas Instruments (USA) – Analog, embedded processing products

-

Sumitomo Electric Industries, Ltd. (Japan) – Semiconductor components, fiber optics

-

Analog Devices, Inc. (USA) – Analog, mixed-signal solutions

-

NXP Semiconductors (Netherlands) – Automotive, IoT semiconductors

-

Renesas Electronics (Japan) – Microcontrollers, power management ICs

-

Intel Corporation (USA) – Processors, memory, storage

-

Sumitomo Electric Device Innovations, Inc. (Japan) – Semiconductor devices

-

Mitsubishi Electric (Japan) – Power semiconductors, automation solutions

-

Microsemi (USA) – Power management ICs, FPGA devices

-

ROHM Semiconductor (Japan) – Offers semiconductors, including power devices and ICs for automotive, industrial, and consumer electronics.

-

Fujitsu (Japan) – Provides semiconductors, including GaN HEMTs, for wireless communications, radar, and power applications.

List of companies that provide raw materials and components for High Electron Mobility Transistor (HEMT) manufacturing:

-

Dow Chemical Company (USA)

-

Sumitomo Chemical (Japan)

-

Mitsubishi Chemical (Japan)

-

Saint-Gobain (France)

-

Norstel AB (Sweden)

-

Coherent Inc. (USA)

-

Praxair (now Linde) (USA)

-

Samsung Electronics (South Korea)

-

Wolfspeed (Cree) (USA)

-

Ferrotec (Japan)

-

IQE (UK)

-

SK Materials (South Korea)

Recent Development:

-

February 12, 2025, ROHM Semiconductor’s recent development of high voltage GaN solutions, EcoGaN, aims to enhance power efficiency in medium-powered applications such as consumer electronics, EV onboard chargers (OBCs), and DC/DC converters.

-

10 April 2025, Fujitsu has set a new record for GaN HEMTs with 85.2% power-added efficiency at 2.45GHz, improving performance for wireless communications, radar, and power conversion applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.09 Billion |

| Market Size by 2032 | USD 10.79 Billion |

| CAGR | CAGR of 6.57% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Gallium Nitride (GaN), Silicon Carbide (SiC), Gallium Arsenide (GaAs), Others) • By End Use(Consumer Electronics, Automotive, Industrial, Aerospace & Defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Qorvo (USA), Infineon Technologies AG (Germany), Mouser Electronics, Inc. (USA), MACOM (USA), Wolfspeed (USA), RFHIC Corporation (South Korea), STMicroelectronics (Switzerland), Texas Instruments (USA), Sumitomo Electric Industries, Ltd. (Japan), Analog Devices, Inc. (USA), NXP Semiconductors (Netherlands), Renesas Electronics (Japan), Intel Corporation (USA), Sumitomo Electric Device Innovations, Inc. (Japan), Mitsubishi Electric (Japan), Microsemi (USA), ROHM Semiconductor (Japan), and Fujitsu (Japan) are leading companies in the semiconductor industry, providing a wide range of solutions across automotive, industrial, communications, and electronics sectors. |