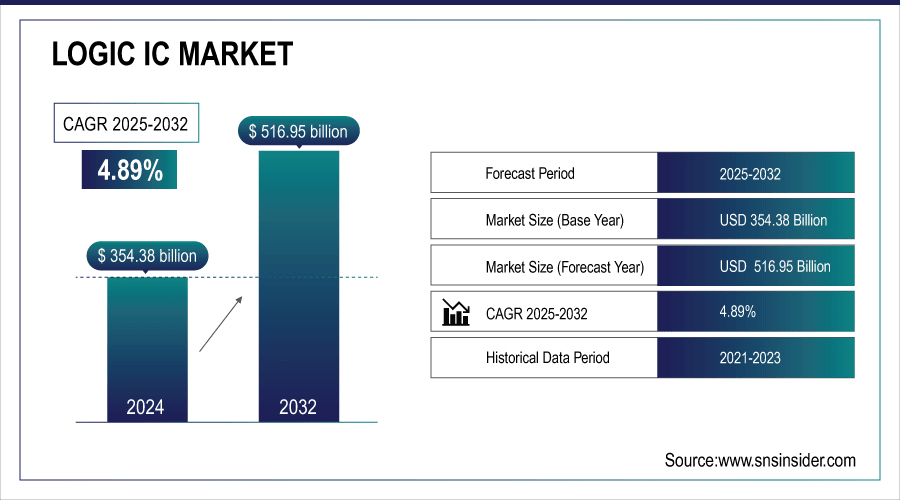

Logic Integrated Circuit Market Size & Growth:

The Logic IC Market size was valued at USD 354.38 billion in 2024 and is expected to reach USD 516.95 billion by 2032 and grow at a CAGR of 4.89% over the forecast period of 2025-2032.

The global Logic Integrated Circuit (IC) Market consists of segmentation by product type, application, technology, end-user, and region, and the market dynamics provide a comprehensive study of the drivers, restraints, opportunities, challenges, and statistical insights of the market. The strong growth is driven by increasing demand in the consumer electronics, automotive, and telecommunications industries. Moreover, progress in semiconductor design and miniaturization, and increases in global semiconductor production capability are serving as tailwinds for the continued adoption of electronic applications. This is further significant market expansion, while strengthening the global coverage of the logic IC industry as its investment in R&D continues to increase, and government support in some regions become brighter.

For instance, more than 18 billion IoT devices and 6 million AI servers rely on logic IC integration globally as of 2024.

To Get more information on Logic IC Market - Request Free Sample Report

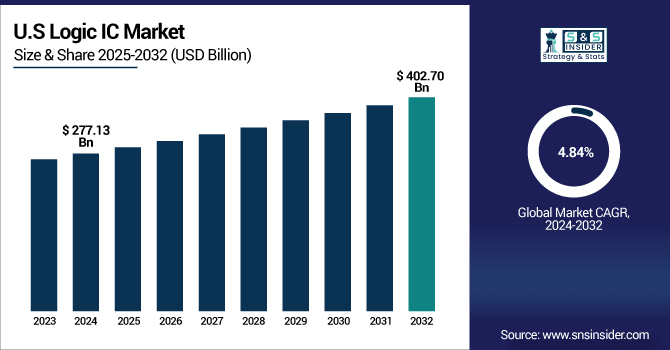

The U.S. Logic IC Market size was USD 277.13 billion in 2024 and is expected to reach USD 402.70 billion by 2032, growing at a CAGR of 4.84% over the forecast period of 2025–2032.

The U.S. semiconductor design ecosystem, ongoing innovations in AI and high-performance computing, and strong public policies, such as the CHIPS Act are helping drive logic IC market growth. Accelerated growth from rapid adoption of Logic ICs in data centers, 5G infrastructure and automotive electronics. These elements together support the country leading in high-end integrated circuit technologies and maintaining a significant position in the global semiconductor development and competition landscape.

For instance, over 70% of the U.S. data centers are integrating Logic ICs optimized for AI workloads.

Logic Integrated Circuit (IC) Market Dynamics:

Key Drivers:

-

Expanding Demand for Consumer Electronics and Smart Devices is Driving Global Logic IC Adoption and Volume Growth Across Multiple End-User Markets

Increasing demand for smartphones, tablets, wearables, and smart home devices is a major factor driving the expansion of the Logic IC Market. As consumers demand that their devices be faster, more energy-efficient, and smaller, manufacturers are turning to more powerful, yet low-power logic ICs to boost their processing and energy efficiency. In addition, the growing quantity of IoT devices and networks is increasing demand for high-performance chips, speed adoption. Last but not least, companies including Qualcomm and MediaTek are ramping up consumer-centric SoCs equipped with logic IC cores, allowing us to build products that meet changing user demands.

For instance, over 60% of newly launched smartphones now include on-device AI accelerators powered by logic ICs.

Restraints:

-

Global Semiconductor Supply Chain Disruptions and Component Shortages Impacting Production Stability and Delivery Timelines for Logic IC Manufacturers

The Logic IC Market is negatively affected by global supply chain challenges, such as silicon wafer shortages, global geopolitical trade sanctions, logistic delays, and more. Lead times stretch and we get pricing pressure, as demand for semiconductors is typically greater than supply capability. The COVID-19 pandemic, among other recent events, exposed vulnerabilities with an overdependence on a limited number of regional foundries in Asia. Widespread shortages of raw materials and production delays also throw a wrench into production schedules and have a negative impact on related industries including automotive and consumer electronics. These chronic constraints inhibit the kind of growth required to accelerate innovation and put supply on stable footing.

Opportunities:

-

Rising Integration of Artificial Intelligence and 5G Infrastructure Creating New High-Performance Demand for Advanced Logic IC Solutions Globally

The growing advancement regarding AI, edge computing, and 5G networks is providing a big scope for the growth of Logic IC Market. These high-speed, low-latency processors for AI accelerators, cloud data centers, and edge devices generate strong demand for specialized logic ICs. Likewise, deployments of 5G infrastructure are demanding ICs, which enable applications optimized for increased bandwidth and low latency. NVIDIA and AMD continue to innovate in AI-centric processors while Qualcomm incorporates 5G-compatible logic designs within mobile SoCs enabling all industry end-users to adopt. The confluence reinforces markets at a global level. Comprehensive logic IC market analysis highlights these drivers shaping future growth.

For instance, more than 70% of new cloud services incorporate AI accelerators, dependent on logic IC performance.

Challenges:

-

Complexities of Miniaturization and Node Scaling Driving Increased R&D Costs and Technical Barriers for Logic IC Manufacturers Globally

With the semiconductor industry working toward 3nm and lower nodes, manufacturing and design drive complexities begin to add up quickly. For smaller but nimble firms, advanced lithography techniques, such as EUV are prohibitively expensive and technically complex, making it difficult to remain competitive. The rise in transistor density also brings problems of power leakage, heat dissipation and reliability. This forced a higher R&D cost resulting in push for manufacturers creating technical hurdles. Very few companies will have access to the enormous resources required to drive this scaling race, TSMC and Intel are among only a handful that have a chance of managing the process.

Logic IC Market Segmentation Analysis:

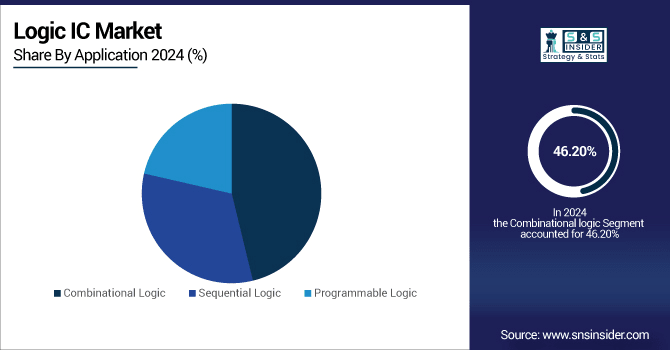

By Application

In 2024, the Combinational logic led the market with approximately 46.20% of the total revenue. It dominates as it is at the heart of digital systems performing arithmetic, making decisions, and essential processing. These circuits sit at the heart of many processors and electronics in various industries. This widespread use of combinational logic makes the technology particularly crucial, given the immense integration of combinational logic in modern CPUs from Intel, making efficiency vital for modern computing devices, telecommunications infrastructure, and industrial applications, making it the backbone of recent electronic systems.

Programmable logic will achieve the greatest CAGR, at 5.24% during the forecast period of 2024-2032. Its expansion is fueled by demand in adaptive AI accelerators, data centers, and edge computing. Less reliance on ASIC design of cycles with programmable logic. Enabling the future of programmable logic with scale AMD, as the new Xilinx, empowers the market for innovative and programmable logic-based reconfigurable solutions that target real-time workloads, accelerating adoption in high-performance computing and 5G infrastructure globally.

By Product Type

In 2024, Application-Specific Integrated Circuits (ASICs) held the largest revenue share in the logic IC market at 42.10%. This dominance comes from performance optimization, reducing power usage, and cost efficiency for high-volume products such as smartphones and automotive systems. Qualcomm, as one of the leaders in mobile chipsets, leverages ASICs to cement their ubiquity in consumer electronics and automotive, with the goal of efficiency and speed of customized system-on-chip solutions. Current Logic IC Market trends emphasize ASIC dominance across key applications.

Programmable Logic Devices (PLDs) will be the fastest-growing segment with the highest CAGR of about 5.07% during the period of 2024-2032 as they are ideal for AI, IoT, and 5G applications due to their ability to be reconfigured and adapted to different tasks, keeping up with the computing power of the years that lie ahead of them. PLDs allow for rapid prototyping and flexible design, in contrast to fixed-function chips. Xilinx (AMD) is the leading vendor of PLDs for edge computing and networking markets and they continue to innovate in PLD technology to increase time-to-market and scalable performance for high-performance computing environments that drive their deployment through emerging, innovation-driven industries globally.

By Technology

CMOS technology dominated the logic IC market share in 2024, accounting for approximately 62.30% of total revenue. A scalable, cost-optimized solution with optimum power efficiency is how it leads. CMOS technology is king in consumer electronics, IoT and even automotive systems. This dominance is underpinned by TSMC as the global standard for integrated circuit design, manufacturing, and production, advancing CMOS arrays at smaller process nodes, while assuring superior performance, high-volume production, and low cost.

The GaAs technology is expected to grow at the fastest CAGR of 6.07% during 2024-2032. This makes it ideal for RF, 5G and satellite applications requiring high-frequency performance and low noise. GaAs integrated circuits (ICs) are becoming increasingly important for advanced communications and defense systems. Brodbancom is one of the main innovators of GaAs-based ICs which have been enabled the technology capable of enabling high-speed connectivity solutions, hence contributing to global rapid adoption of GaAs-based ICs in diverse applications, especially proprietary in aerospace, telecommunications, and other high-frequency performance-driven markets.

By End-User

In 2024, Consumer Electronics held the largest share in the Logic IC Market, accounting for approximately 40.10% of total revenue. This growth is fuelled by an increasing demand for smartphones, wearables, and home automation. In consumer products, logic ICs are an important factor for compact design and power efficiency. The dominance of custom logic in the semiconductor landscape is also underscored by the inclusion of the most advanced custom logic ICs into devices from the world leader in electronics, Apple, as it uses for its most advanced chips, those used in iPhones and Macs, highly desired products these days, which is a clear indication of the demand for high performance and energy-efficient technologies for consumers globally.

Automotive is expected to witness fastest CAGR of 6.25% throughout the forecast period of 2024-2032. Logic IC shares in safety, infotainment, and navigation applications are growing due to the increasing adoption of EVs and their integration with autonomous driving technology and ADAS, which push demand for logic ICs. It seems these chips which allows to take decisions in real time. NXP is a market leader in automotive logic IC supply with winning technologies that energize connected and electric vehicles, propelling growth in the automotive electronics ecosystem globally.

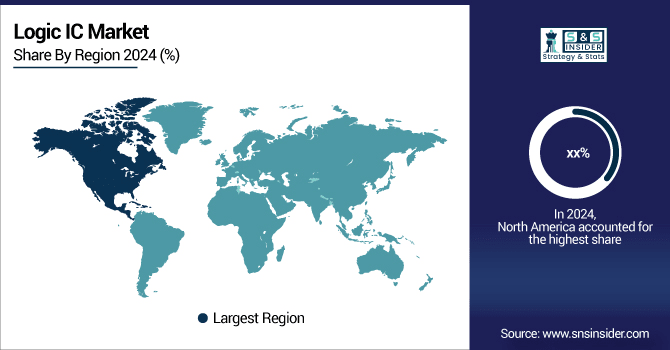

Logic IC Market Regional Outlook:

North America is driven by robust consumer electronics, automotive, and data center industries demand. U.S. is the most important innovation leader with strong Semiconductor R&D, government supports, such as the CHIPS Act, and most embedded advanced foundry capabilities. This forms a tightly coupled regional ecosystem for Logic IC adoption and growth, where Canada and Mexico, each contributes through electronics manufacturing and automotive supply chains respectively.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

The U.S. dominates North America’s Logic IC Market due to advanced semiconductor design expertise, strong R&D investments, and government-backed initiatives such as the CHIPS Act, enabling leadership in data centers, 5G networks, and automotive electronics integration.

In 2024, Asia Pacific leads the logic IC market with a revenue share of about 55.20%, and it is set to grow at the fastest CAGR of about 5.44% during 2024-2032. Hong Kong and China gain great from the scale of consumer electronics and manufacturing. Samsung Electronics fuels this dominance, with a top-ranked position in both chip design and foundry services, enabling innovation surrounding 5G, smartphones and automotive electronics to reinforce Asia Pacific's global leadership in logic IC production and in industries spanning multiple significant technology markets.

-

China dominates Asia Pacific’s Logic IC Market driven by large-scale manufacturing capacity, government support, and rising consumer electronics demand, alongside significant investments in semiconductor self-sufficiency, positioning the country as a major hub for production and innovation.

Europe’s Logic IC Market is expanding steadily, supported by strong demand in automotive electronics, industrial automation, and telecommunications. Countries including Germany and France drive adoption through advanced manufacturing and electric vehicle innovation. Additionally, the EU’s semiconductor strategy and increasing investments in R&D strengthen Europe’s position, fostering technological advancements and reducing dependency on external semiconductor supply chains.

-

Germany dominates the Europe logic IC market with its strong automotive sector, advanced industrial automation, and semiconductor research base. Government initiatives, coupled with investments in electric and autonomous vehicles, further reinforce Germany’s leadership in driving demand for high-performance ICs.

The Middle East & Africa Logic IC Market is dominated by the UAE, fueled by smart city projects, 5G rollouts, and consumer electronics demand. In Latin America, Brazil leads due to strong consumer electronics adoption, growing automotive manufacturing, and supportive government initiatives encouraging semiconductor development and technological advancement.

Logic Integrated Circuit Companies are:

Major Players in Logic IC Market are Intel Corporation, Advanced Micro Devices (AMD), NVIDIA Corporation, Qualcomm Incorporated, Broadcom Inc., Texas Instruments Incorporated, STMicroelectronics N.V., NXP Semiconductors N.V., Infineon Technologies AG, MediaTek Inc., Samsung Electronics Co., Ltd., Taiwan Semiconductor Manufacturing Company (TSMC), Renesas Electronics Corporation, Microchip Technology Inc., Marvell Technology, Inc., ON Semiconductor (onsemi), Toshiba Electronic Devices & Storage Corporation, Analog Devices, Inc. (ADI), Arm Holdings plc, and Lattice Semiconductor Corporation and others.

Recent Developments:

-

In June 2024, Intel unveiled the Gaudi 3 AI accelerator and Xeon 6 processors aimed at data centers, enhancing performance and power efficiency.

-

In April 2025, TSMC introduced the A14 logic process (targeted for 2028), offering up to 15% improved speed or 30% lower power, with enhanced logic density.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 354.38 Billion |

| Market Size by 2032 | USD 516.95 Billion |

| CAGR | CAGR of 4.89% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Microcontrollers, Digital Signal Processors, Application-Specific Integrated Circuits and Programmable Logic Devices) • By Application (Combinational Logic, Sequential Logic and Programmable Logic) • By Technology (CMOS, BiCMOS, Bipolar, GaAs Technology) • By End-User (Consumer Electronics, Automotive, Telecommunications and Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Intel Corporation, Advanced Micro Devices (AMD), NVIDIA Corporation, Qualcomm Incorporated, Broadcom Inc., Texas Instruments Incorporated, STMicroelectronics N.V., NXP Semiconductors N.V., Infineon Technologies AG, MediaTek Inc., Samsung Electronics Co., Ltd., Taiwan Semiconductor Manufacturing Company (TSMC), Renesas Electronics Corporation, Microchip Technology Inc., Marvell Technology, Inc., ON Semiconductor (onsemi), Toshiba Electronic Devices & Storage Corporation, Analog Devices, Inc. (ADI), Arm Holdings plc and Lattice Semiconductor Corporation. |