Long-chain Polyamide Market Report Scope & Overview:

Get E-PDF Sample Report on Long-chain Polyamide Market - Request Sample Report

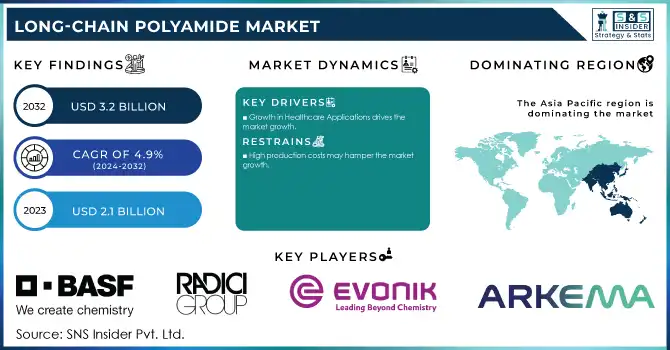

The Long-chain Polyamide Market size was USD 2.1 billion in 2023 and is expected to reach USD 3.2 billion by 2032 and grow at a CAGR of 5.0% over the forecast period of 2024-2032.

The increasing demand for long-chain polyamides in automotive applications is driven by the industry's focus on lightweight to enhance fuel efficiency and meet stringent emission standards. These polyamides are distinguished by their excellent mechanical strength, chemical resistance, and thermal stability and thus may be suitable replacements for traditional metals used in automotive components. They are used as under-the-hood components, in fuel systems, and as structural parts, and they need to be durable and perform under extreme conditions. Such regulatory frameworks, including the EU's Green Deal and the EPA's emissions reduction policies, also incentivize lightweighting through advanced materials for improved vehicle weight and carbon footprint. The demand for long-chain polyamides is also driven by the change in the automotive sector from conventional vehicles to electric vehicles (EVs), which widely applies long-chain polyamides in battery casing and light body parts for maximizing performance and energy efficiency.

According to the U.S. Department of Energy, a 10% reduction in vehicle weight can result in a 6%–8% improvement in fuel economy. This weight reduction also contributes to lower carbon dioxide (CO₂) emissions, aligning with regulatory frameworks such as the European Union's CO₂ emission performance standards, which aim for a 100% reduction in emissions from new cars and vans by 2035.

The rising demand for long-chain polyamides in consumer goods is driven by their exceptional durability, flexibility, and resistance to wear and tear, making them ideal for a wide range of applications. These are used to make polyamides which have great repeat usage for sports, cooking utensils, and other personal care items without losing performance. Elsewhere, the demand for lightweight, high-performance materials in consumer goods has driven up the uptake of long-chain polyamides, especially in the upper and emerging segments of the market. In addition to this, the rising trend of sustainability is pushing the manufacturers towards bio-based polyamides, resulting in the high penetration of polyamide products in the market, due to which the growing awareness among consumers regarding eco-friendly products is also driving polyamide products. Government incentives and regulations pushing the use of recycled and renewable materials in consumer goods further strengthen this transition and ensure a rapid growth trend of long-chain polyamides on the market.

In 2023, Invista introduced a new range of high-temperature-resistant polyamides designed for automotive and industrial applications. The products aim to meet the increasing demand for lightweight, durable components while complying with stricter environmental regulations.

Long-chain Polyamide Market Dynamics:

Drivers

-

Growth in Healthcare Applications drives the market growth.

The growth in healthcare applications is a significant driver of the long-chain polyamide market, as the demand for durable, biocompatible, and sterilizable materials continues to rise. Improved mechanical strength, flexibility, and resistance to chemicals and sterilization processes have led to the growing use of long-chain polyamides in medical devices such as catheters, surgical instruments, and implantable components. Portraying the high safety, reliability and performance requirements of the healthcare environment, these materials are ideal for critical healthcare environments. Apart from this, rapid healthcare infrastructure expansion worldwide, induced by rising investments and government initiatives, is further boosting the demand for these long-chain polyamides. As an example, the 2023 Global Health Initiative initiated by the World Bank, increased the funds for medical equipment in developing areas, which in turn drove the demand for high-performance polymers. The healthcare sector is one of the key verticals where continuous innovation is on the agenda, be it in minimally invasive techniques or portable diagnostic devices, and as the innovations add value in terms of functionality and durability with the long-chain polyamides, drives the growth of long-chain polyamide market, hence fueling the demand for long-chain polyamide market.

-

Technologies that are developing in the manufacturing sectors drive the market growth.

Technological advancement of manufacturing processes is one of the great factors driving the market for Long-chain Polyamides across the globe. Innovative production techniques such as 3D printing with new materials and advanced injection molding technologies to produce complex, lightweight, and high-performance parts with lower scrap and better precision offer manufacturers new opportunities. These technologies enable the precise tailoring of polyamide materials to enhance specific properties, including, but not limited to, thermal resistance, mechanical strength, and flexibility. In addition, automation and robotic systems are increasingly being adopted and implemented in the manufacturing process, due to speed, cost, and consistency benefits, which is propelling demand for advanced materials such as long-chain polyamides. Furthermore, the advancement of digitalization in manufacturing, such as smart sensors and AI-powered systems, allows for real-time tracking and adjusting of production processes which produces improved quality control and minimizes wastage. All these technology innovations will not only increase the penetration of long-chain polyamide markets in industries like automotive, electronics, and consumer goods but also facilitate market growth overall.

Furthermore, the U.S. Department of Defense has contracted with companies like ICON to 3D print military barracks, highlighting the government's investment in advanced manufacturing technologies.

Restraint

-

High production costs may hamper the market growth.

Long-chain polyamides account for a high production cost, which is expected to act as a major restraint for the growth of the market, sugar-roasted Cranberry said. These materials are produced through complicated and highly energy-consuming processes (e,g, synthesis of raw materials like castor oil for bio-based counterparts). Such production processes will employ technologies that are more advanced and incur high operational costs, which make the long-chain polyamides significantly more costly compared to standard polyamides or metals. This additional cost can limit their usage among price-sensitive markets and industries, where the cost factor is of paramount importance. Moreover, variations in the supply and prices of feedstocks, be they petroleum-based chemicals or renewable feedstocks, may amplify this cost burden. Since the price for end users is generally based on the production price, this also leads to the competitiveness of long-chain polyamides against competitive materials.

Long-chain Polyamide Market Segmentation

By Type

PA12 (Polyamide 12) held the largest market share around 32% in 2023. It has unique properties that balances ideal properties for a wide range of applications. One of the main advantages of PA12, other than being very resistant to most chemicals, and having very low moisture absorption, in combination with a high dimensional stability is the fact it is great for most applications for automotive, electronics, and consumer goods. Moreover, its lightness and easy processing, especially for injection molding and extrusion, explain the large use of PA12.

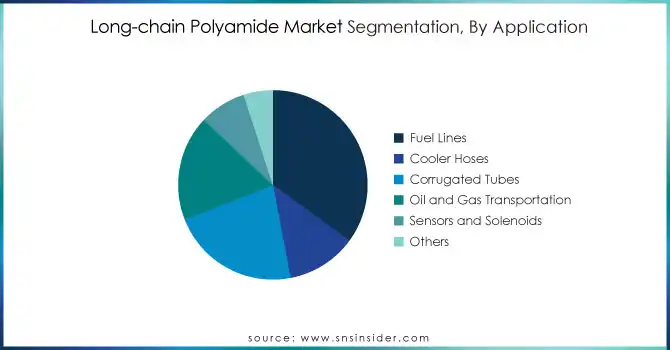

By Application

Fuel Lines held the largest market share around 35% in 2023. It is owing to the ability of the material to meet the stringent specifications for fuel system applications. Long-chain polyamides, PA12 in particular, possess excellent chemical resistance (e.g. to fuels, oils and some chemicals), durability and flexibility, which is more sufficient to endure to be exposed to a variety of fuels, oils and some automotive and industrial harsh chemicals. Long-chain polyamide fuel lines, lightweight in nature, help to reduce the overall weight of the vehicle and enhance the fuel efficiency level, which has consistently been at the forefront of automotive developments as manufacturers focus more on sustainability. Coupled with their low moisture absorption property and the high-temperature stability of these materials, the line integrity and function under extreme condition, i.e. under engine constant high-temperature environment and pressure fluctuation, are guaranteed.

By End-User

Automotive and transportation held the largest market share around 36% in 2023. This is owing to the increasing consumption of lightweight, durable, and high-performance materials in this sector. Therefore, long-chain polyamides are used for automotive applications (fuel lines, connectors, under-the-hood, and interior components) due to their excellent chemical resistance, high-temperature stability, and impact resistance. Currently, long-chain polyamides are increasingly used in the automotive industry to replace metal parts in manufacturing light-weight components because vehicle weight has become a vital aspect especially to accommodate fuel efficiency and stringent emissions standards. It also drives the evolution of global auto demand for lightweight and high-performance materials used in vehicle assembly and battery components that makes long-chain polyamides a material of choice in traditional electric vehicles.

Long-chain Polyamide Market Regional Analysis

Asia Pacific held the largest market share around 54% in 2023. It is due to rapid urbanization and demand for high-performance materials that are propelling the long-chain polyamide market. China, Japan, South Korea, and India are some of the largest automotive manufacturing hubs in the region, with long-chain polyamides used in various automotive applications such as fuel lines, connectors, and under-the-hood parts. With these nations emphasizing fuel efficiency, emissions reductions, and meeting increasingly stringent regulatory requirements, demand for lightweight and durable materials, such as PA12, remains high. Furthermore, the growing electronics and consumer goods industries in the Asia Pacific are also responsible for driving the market where long-chain polyamides are used in electrical components such as electrical connectors, casings, and other consumer goods products. Furthermore, there is a cheap and extensive manufacturing base in the region, enabling industries to manufacture high-end polyamide gains at comparatively low costs, driving the market in turn. Asia Pacific is the largest region in the long-chain polyamide market as the rapid industrialization, increase in disposable income, and shift towards sustainability is expected to prevail in the region.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

-

BASF SE (Ultramid Advanced N, Ultraform)

-

Radici Group Spa (Radilon D, Raditeck)

-

Evonik Industries AG (VESTAMID, VESTOSIN)

-

DSM (EcoPaXX, Stanyl)

-

EMS-Chemie Holding AG (VESTAMID, EMS-GRIVORY)

-

Arkema (Rilsan PA11, Orgasol)

-

Nylon Corporation of America, Inc. (NYCOA) (Vydyne, Akulon)

-

DuPont (Zytel, Delrin)

-

Solvay (Amodel PPA, Ryton PPS)

-

Toyobo Co., Ltd. (Nylon 610, Toyolac)

-

Huntsman Corporation (Vitel PBT, Nylast)

-

Lanxess (Durethan, Pocan)

-

Ube Industries Ltd. (Amilan PA66, Amilan PA12)

-

Saudi Basic Industries Corporation (SABIC) (Ultramid, Lexan)

-

Mitsui Chemicals, Inc. (Duracon POM, Toyolac)

-

Kraton Polymers (Kraton Polymers, Cariflex)

-

Asahi Kasei Corporation (Leona PA66, Leona PA6)

-

Koc Holding (Peraform, Peraform PA66)

-

SGL Carbon (SGL Long Chain Polyamide, SGL Composite Materials)

-

Ascend Performance Materials (Vydyne, Zytel)

Recent Development:

-

In 2024: BASF launched a new range of sustainable engineering plastics under its Ultramid brand. These products are designed to meet the increasing demand for environmentally friendly solutions in automotive and industrial applications. The company aims to expand its use of recycled materials, aligning with the growing global trend towards sustainability.

-

In 2023: Radici Group introduced Radilon D, a new line of polyamide 6.6-based products. These materials are designed for high-performance applications, including automotive components that require enhanced heat resistance and dimensional stability.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.1 Billion |

| Market Size by 2032 | US$ 3.2 Billion |

| CAGR | CAGR of 5.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (PA11, PA12, PA611, PA612, Others) • By Application (Fuel Lines, Cooler Hoses, Corrugated Tubes, Oil and Gas Transportation, Sensors and Solenoids, Others) • By end-user industry ( Highway and Road Construction, Energy and Mining, Government and Municipality, Landfill Construction and Maintenance, Infrastructure Development, Industrial Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE (Germany), Radici Group Spa (Italy), Evonik Industries AG (Germany), DSM (The Netherlands), EMS-Chemie Holding AG (Switzerland), Arkema (France), Nylon Corporation of America, Inc. (NYCOA) (US) and DuPont (US). |

| Key Drivers | • Growth in Healthcare Applications drives the market growth. • Technologies that are developing in the manufacturing sectors drive the market growth. |

| Restraints | • High production costs may hamper the market growth. |