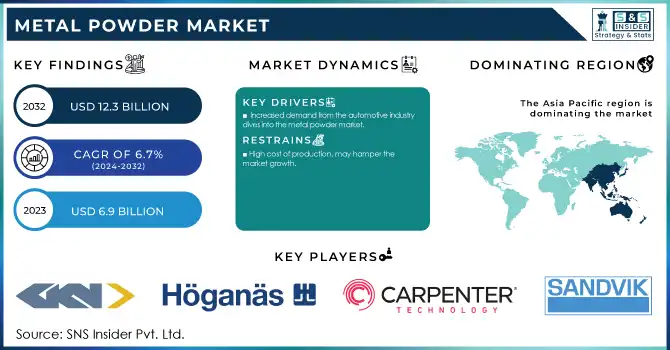

Metal Powder Market Size:

The Metal Powder Market size was USD 6.9 billion in 2023 and is expected to reach USD 12.3 billion by 2032 and grow at a CAGR of 6.7% over the forecast period of 2024-2032.

Get more information on Metal Powder Market - Request Sample Report

The increased adoption of additive manufacturing (AM), commonly known as 3D printing, is a significant growth driver in the metal powder market. Metal powders with high properties serve as raw materials for Additive Manufacturing (AM) technologies such as selective laser melting (SLM), electron beam melting (EBM), or binder jetting, and are fundamental to achieving high precision in complex lightweight components. AM is being used in industries such as aerospace, automotive, healthcare, and energy to minimize material waste, simplify production steps, and manufacture tailored components. Aerospace is another industry utilizing titanium and nickel alloy powders as extremely lightweight but strong turbine blades and engine components. Likewise, AM is used in the healthcare industry to manufacture implants and prosthetics using metal powders that are biocompatible to the body. Advancements in metal powder additive manufacturing have become a key enabler of new levels of flexibility and efficiency, driving innovation and growth in this fast-growing market segment.

In 2022, NIST awarded USD 3.7 million in grants to address barriers to the widespread adoption of metals-based additive manufacturing through measurement science research. This investment aims to enhance the quality and reliability of metal AM processes, thereby promoting industry adoption.

High-performance applications represent the growing trend towards the use of advanced alloys, which will drive this sector of the overall metal powder market. Advanced alloys, including titanium, nickel-based superalloys, and aluminum alloys, provide high strength-to-weight ratios, corrosion resistance, and thermal stability, making these materials vital for critical industries like aerospace, automotive, and medical. For aerospace, high-performance jet engine components are manufactured using nickel-based superalloys because they can withstand very high temperatures. Sister to this trend, titanium alloys are being used more and more in the biomedical industry, as implants and prosthetics need to be biocompatible. In auto parts, aluminum alloys are used for light weight parts with the purpose of improving fuel efficiency and reducing emissions. Growth in the metal powder market continues to be driven by the development and application of advanced metal alloys to meet the requirements of performance and sustainability-driven industries.

The DOE's Advanced Alloys Signature Center (AASC) focuses on developing and deploying alloys with improved performance capabilities for energy applications, aerospace, defense, and biomedical sectors.

Metal Powder Market Dynamics

Drivers

-

Increased demand from the automotive industry dives into the metal powder market.

High demand for metal powder especially from the automotive sector, acts as a factor largely contributing to the growth of the metal powder market. With an ongoing emphasis on lightweight materials in the automotive sector to achieve greater fuel efficiencies and lower carbon emissions, there will continue to be an upward trend of use of metal powders to manufacture lightweight and strong parts, particularly aluminum and steel powders for items like engine parts, gears, and structural components. Another factor fuelling this trend is the increasing shift towards electrification in the automotive industry, where EVs demand advanced components to deliver power delivery, energy storage and thermal management. It presents advanced powder metals for automotive production, as it gives automotive producers the capacity to produce complex-form, tailor-made parts with lower fabric waste through additive generating and powder metallurgy approaches. Some of the new solutions in powder technologies, like 3D printing with metal powders, help to manufacture lightweight automotive components which can achieve outstanding properties of efficiency, durability and precision. This increasing need for metallic powders will be further integrated into automotive manufacturing processes as automakers adopt new technologies and sustainable practices.

Restraint

-

High cost of production, may hamper the market growth.

A significant restraint which can hinder the growth of metal powder market is the high cost of production. Metal powders can be produced by many different methods; however, many of high-quality powders associated with advanced applications (aerospace, automotive, additive manufacturing and more) are already generally produced by relatively complex, expensive processes (e.g., gas atomization or water atomization). These processes involve expensive instrumentation, high energy consumption, as well as strict quality control to ensure that the powders meet exact specifications and this all results in high costs of production. The materials themselves are expensive, titanium and nickel-based superalloys for instance, and their extraction and preparation create additional costs over the price. Such a high cost of production makes metal powders expensive and non-viable, particularly for smaller manufacturers and businesses whose budgets are tighter than others. This thereby limits the overall growth of the market as the application of metal powders in some sectors may be slow due to the high-cost competitiveness needed in industries.

Metal Powder Market Segmentation

By Material

Ferrous held the largest market hare around 68% in 2023. It is owing to their large-scale application, low cost, and versatile properties. Ferrous powders, which are used in industries such as automotive, manufacturing and construction for components such as gear, bearings and structural parts. These materials possess good mechanical properties with high strength, high durability and easy to work, making them well-suited for a variety of applications. Furthermore, it is easier and cheaper to produce ferrous powder than non-ferrous powder such as titanium or nickel alloy powder, thus it is advantageous for manufacturers to manufacture ferrous powder as much as possible to consider both performance and cost. Geographically, it is beautiful that helps them in taking major coverage in the market is their demand for ferrous powders by the automotive industry as they manufacture engine parts and other critical components using it.

By Technology

Press & Sinter held the largest market share around 35% in 2023. It is due to their cost-effectiveness, efficiency, and ability to produce large volume of high precision components. The press and sinter process with metal powders, where high packing pressures compact powder into molds, along with heating in a sintering furnace, allows for the bonding of the particles to produce parts in a solid form. This process is frequently used in the automotive, aerospace, and industrial equipment sectors to produce parts including gears, bearings, and filters. Press and sinter provide advantages over traditional machining methods, such as the ability to produce complex shapes while minimizing material losses, making it more cost-effective. Moreover, it can be used with various metal powders that cover ferrous and non-ferrous materials, expanding its application even more.

By Application

Automotive segment held the largest market share around 63% in 2023. Due to the high-strength, impact; wear, and corrosion-resistant properties required for these components, metal powders can be used as advanced powder metallurgy and additive manufacturing processing methods. Furthermore, the transition to EVs has increased demand for light materials for improving energy efficiency and battery life, both of which are positive developments for metal powders as well. In addition to component property improvement, one of the reasons for widespread adoption of this technique is due to the cost-effective production of the metal powders which has always been vital for the automotive industry. This extends the automotive industry's dependence on metal powders for both traditional and electric vehicle parts, making automotive the largest application segment of the metal powder market.

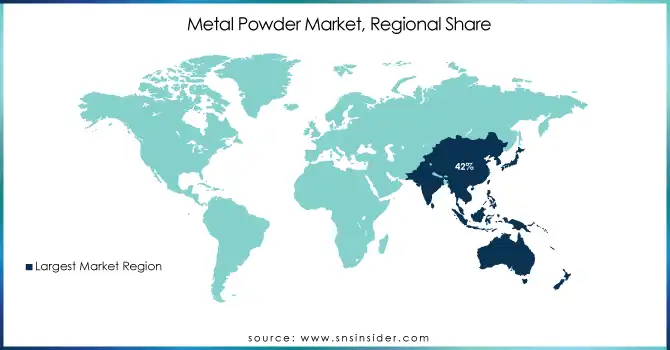

Metal Powder Market Regional Analysis

Asia Pacific held the largest market share around 42% in 2023. It can be attributed to the high number of manufacturing industries and rapidly growing industrialization as well as growing metal powder need from automotive, aerospace, and electronics industries. China, Japan and India led the metal powder production and consumption due to large-scale manufacturing facilities and cost advantages, and abundant raw material supply. China Is an Especially Large Producer of Metal Powders While Supported by Its Developed Industrial Base Plus Government Support for Advanced Manufacturing Technologies Asia-pacific metal powder market is fast-growing with high demand for metal powders from automotive and electronics sectors such as engine parts, battery, sensor etc. Moreover, the upsurge for innovation within the region, especially in additive manufacturing and powder metallurgy, has further boosted the growth of the market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

-

Sandvik AB (Stainless Steel Powder, Powdered Metal)

-

Carpenter Technology Corporation (Carpenter Additive, Custom Metal Powders)

-

Hoganas AB (Hoganas Powder, Atomized Iron Powder)

-

GKN Plc. (High-Performance Powder, Powder Metallurgy Products)

-

Rio Tinto (Titanium Powder, Aluminum Powder)

-

Allegheny Technologies Incorporated (Titanium Alloys, Powder Metallurgy Products)

-

American Chemet Corporation (Copper Powder, Zinc Powder)

-

Carl Schlenk AG (Aluminum Powder, Bronze Powder)

-

Hitachi Chemical Co., Ltd. (Copper Powder, Silver Powder)

-

Metaldyne Performance Group Inc. (Automotive Powdered Metal Parts, High-Strength Steel Powder)

-

Mitsubishi Materials Corporation (Molybdenum Powder, Tungsten Powder)

-

Voestalpine AG (Specialty Steel Powders, Powdered Metal Products)

-

BASF SE (BASF Metal Powders, Alloy Powders)

-

Shaanxi HuaYuan Powder Metallurgy Co., Ltd. (Iron Powder, Copper Powder)

-

Advanced Powder Solutions (Copper and Bronze Powders, High-Performance Alloys)

-

LPW Technology Ltd. (Titanium Powder, Stainless Steel Powder)

-

ArcelorMittal (Iron Powder, Steel Powder)

-

GKN Sinter Metals (Automotive Components, Engineered Powder Metallurgy Parts)

-

Sumitomo Metal Mining Co., Ltd. (Copper Powder, Nickel Powder)

-

Russel Metals Inc. (Metal Alloys, Nickel Powders)

Recent Development:

-

In 2024, Sandvik announced the expansion of its additive manufacturing powder portfolio to include high-performance materials designed for the aerospace and medical industries. This expansion supports the increasing demand for advanced metal powders in high-tech applications like 3D printing and additive manufacturing.

-

In 2023, Hoganas announced the launch of a new powdered metal alloy designed for the production of lighter, more durable automotive components. The new alloy allows for the production of high-performance parts for electric vehicles, catering to the rising demand for EVs and sustainable manufacturing practices.

-

In 2023, GKN Powder Metallurgy introduced an innovative range of high-strength 3D printing powders for the automotive industry. These powders are designed for more complex, lightweight parts, which are crucial for the production of electric and hybrid vehicles.

| Report Attributes | Details |

| Market Size in 2023 | USD 6.9 Billion |

| Market Size by 2032 | USD 12.3 Billion |

| CAGR | CAGR of 6.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Ferrous, Non-Ferrous) • By Technology(Press & Sinter, Metal Injection Molding, Additive Manufacturing, Others) • By Application (Automotive, Aerospace & Defense, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Sandvik AB, Carpenter Technology Corporation, Hoganas AB, GKN Plc., Rio Tinto, Allegheny Technologies Incorporated, American Chemet Corporation, Carl Schlenk AG, Hitachi Chemical Co., Ltd., Metaldyne Performance Group Inc., Mitsubishi Materials Corporation, Voestalpine AG, BASF SE, Shaanxi HuaYuan Powder Metallurgy Co., Ltd., Advanced Powder Solutions, LPW Technology Ltd., ArcelorMittal, GKN Sinter Metals, Sumitomo Metal Mining Co., Ltd., Russel Metals Inc. |

| Key Drivers | • Increased demand from the automotive industry dives into the metal powder market. |

| Restraints | • High cost of production, may hamper the market growth. |