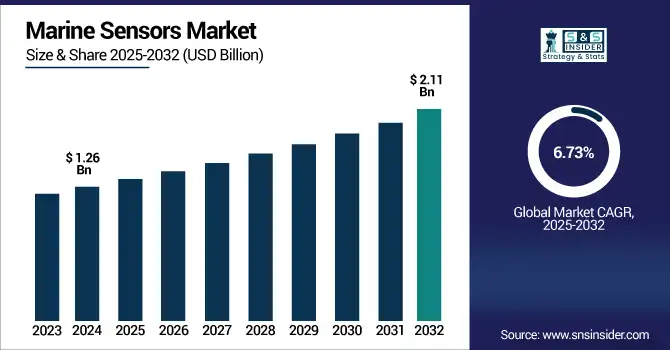

Marine Sensors Market Size & Growth:

The Marine Sensors Market Size was valued at USD 1.26 billion in 2024 and is expected to reach USD 2.11 billion by 2032 and grow at a CAGR of 6.73% over the forecast period of 2025-2032.

To Get more information on Marine Sensors Market - Request Free Sample Report

The global market for marine sensors is experiencing rapid expansion due to the increase in demand for advanced ocean monitoring systems and maritime defense solutions and smart ship solutions the trend of marine Sensors has been significantly rising. With the emergence of advanced technologies including AI-assisted sensing or IoT connectivity, and advanced underwater communication systems, marine sensors are not only more functional but also more accurate. Moreover, growing marine exploration and deep-water resources exploitation will continue to trigger the deployment of sensors. The market is also supported by increasing environmental concerns and tightening of maritime security norms, forcing industries to install advanced sensor techniques for military and commercial marine operations.

According to research, more than 65% of global marine regulatory bodies now mandate real-time environmental data logging via sensor systems for vessels operating in protected or sensitive waters.

The U.S. Marine Sensors Market size was USD 0.19 billion in 2024 and is expected to reach USD 0.34 billion by 2032, growing at a CAGR of 7.46% over the forecast period of 2025–2032.

The U.S. market growth is primarily driven by increasing investments in naval modernization, upswing in demand for homeland security, and rise in applications in offshore oil & gas activities. Leading defence contractors and sensor technology providers underwrite strong market growth, particularly as environmental monitoring and underwater surveillance are emerging as key factors in national defence and energy planning.

According to research, more than 30% of the world's top marine sensor patents originate from the U.S.-based firms, such as Raytheon, Teledyne, and Lockheed Martin.

Marine Sensors Market Dynamics:

Key Drivers:

-

Surge in Maritime Security Concerns and Naval Modernization Initiatives Across Global Economies

Geopolitical tension and maritime law and order instability have driven the modernization of naval surveillance equipment in countries. Countries throughout Asia Pacific, Europe, and North America are outfitting their fleets with smart sensor technology to improve situational awareness, threat detection, and operational safety. These sensors play an important role in anti-submarine warfare, real-time tracking, and underwater reconnaissance. Deployment is also being driven by government schemes and growing defence budgets, particularly with the strategic control of the oceans taking on new importance alongside economic and national security pressures in the world’s multi-polar environment.

Restraints:

-

Data Accuracy Limitations in Harsh Marine Environments Hinder Performance Reliability

Marine environments are inherently challenging, with factors including water salinity, pressure variations, temperature fluctuations, and biofouling affecting sensor performance. Inaccurate readings or sensor failure due to environmental stress can lead to mission-critical errors, especially in defense, offshore drilling, and scientific exploration. Sensor calibration and maintenance are also frequent, increasing operational costs. These limitations create trust issues among end-users and hinder widespread sensor integration unless supported by robust quality assurance protocols and environmental resilience standards in sensor design.

Opportunities:

-

Rising Adoption of Autonomous Underwater Vehicles (AUVs) and Unmanned Surface Vessels (USVs)

The global expansion of AUVs and USVs for oceanographic research, surveillance, and undersea exploration creates significant growth opportunities for marine sensors. These autonomous platforms rely on sensors for navigation, obstacle detection, environmental mapping, and data collection. Increasing investment in maritime robotics, driven by defense innovation and offshore resource management, ensures sustained demand for compact, energy-efficient, and multi-functional sensors. As unmanned systems become more mainstream across marine applications, their dependence on advanced sensor ecosystems is expected to grow exponentially.

According to research, more than 70% of newly developed AUVs and USVs in 2024 are equipped with multi-sensor suites, including sonar, Doppler velocity logs, pressure sensors, and acoustic modems.

Challenges:

-

Vulnerability of Marine Sensors to Cybersecurity Threats and Signal Interference

As marine sensors become more interconnected through IoT and satellite communication networks, they are increasingly exposed to cybersecurity risks. Threats, such as GPS spoofing, signal jamming, and unauthorized data access can compromise sensor integrity and disrupt marine operations. In high-stakes applications including naval missions or subsea exploration, such vulnerabilities pose significant risks. Additionally, electromagnetic interference from nearby electronic systems can degrade sensor signal quality. Addressing these cybersecurity and interference challenges is essential to ensuring safe, uninterrupted sensor performance in modern marine ecosystems.

Marine Sensors Market Segmentation Analysis:

By Platform

The Military and Defense segment dominated the highest revenue share of around 61.10% in 2024 due to heightened naval modernization programs, increasing maritime border security threats, and rising investments in advanced surveillance and anti-submarine technologies. Companies including L3Harris Technologies have been instrumental in supplying sophisticated marine sensors for tactical defense systems. Strategic deployment of marine sensors on naval vessels, submarines, and underwater drones is significantly boosting demand. Defense forces globally are prioritizing real-time threat detection and tactical decision-making, which has reinforced the dominance of this segment.

The Commercial segment is projected to register the fastest CAGR of approximately 7.68% over 2025-2032, driven by the increasing use of marine sensors in offshore oil exploration, cargo monitoring, and commercial shipping operations. Teledyne Marine plays a crucial role in delivering sensor solutions tailored for commercial fleets and offshore platforms. The rise of smart ports and the growing emphasis on maritime safety, sustainability, and automation are contributing to this surge. Expanding global trade and the integration of sensor-based technologies for efficient fleet management are further accelerating commercial adoption.

By Application

Surveillance & Monitoring held the largest Marine Sensors Market share of 32.28% in 2024, primarily due to the critical need for real-time situational awareness across naval and coastal security applications. Companies, such as Raytheon Technologies have advanced this segment with highly integrated sensor systems for perimeter surveillance. Advanced sensors are widely utilized in submarine detection, environmental assessments, and monitoring platforms. Continuous deployment of sensor arrays ensures precise tracking and anomaly detection, supporting this segment’s strong foothold.

Communication & Navigation is projected to experience the highest CAGR of 7.92% during 2025–2032, owing to the growing integration of marine sensors in satellite-based positioning systems, autonomous vessel navigation, and data transmission infrastructures. Kongsberg Gruppen, a leader in marine technology, is increasingly innovating in communication and navigation systems for modern maritime operations. Technological advancements in sonar, GPS, and wireless communication are enhancing the reliability of marine operations. Rising adoption of digital navigation systems is a key factor driving this growth.

By Type

Flow and Level Sensors dominated the market with a 30.01% revenue share in 2024, driven by their widespread use in monitoring ballast water systems, fuel management, and fluid levels in marine processes. With expertise in fluid dynamics, Endress+Hauser has developed robust sensor technologies ensuring precision and durability in harsh marine environments. These sensors are vital for vessel stability, regulatory compliance, and operational efficiency. Their proven reliability has made them indispensable in shipboard systems across the industry.

Acoustic Sensors are anticipated to expand at the fastest CAGR of 8.45% over 2025-2032, fueled by increasing use in sonar systems, underwater mapping, and marine life detection. Sonardyne is actively pushing innovation in this space with cutting-edge acoustic positioning and communication tools. The surge in autonomous underwater vehicle (AUV) deployments and seabed surveillance is boosting demand for precise acoustic data. These sensors are becoming integral to deep-sea exploration and scientific research applications.

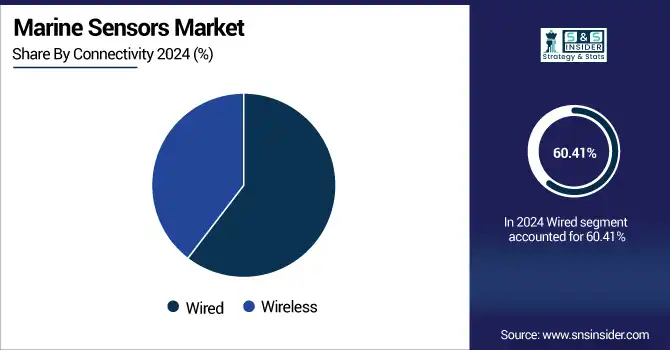

By Connectivity

The Wired segment dominated the largest market share of 60.41% in 2024 due to its reliable performance, high-speed data transmission, and secure connectivity in harsh marine environments. Companies, such as Honeywell have developed robust wired systems that excel in fixed marine installations requiring dependable sensor data flow. Wired systems are preferred in power-sensitive operations and data-intensive networks. Their long-standing presence and mature technology support their continued dominance in marine infrastructure.

The Wireless segment is forecasted to grow at the fastest CAGR of 7.51% over 2025-2032, as advancements in wireless marine communication technologies drive adoption in mobile platforms and autonomous systems. Sea-Bird Scientific is innovating with wireless-capable marine sensors used in oceanographic research and data buoys. The demand for real-time access and flexibility in deployment is driving the shift toward wireless solutions. The rise of IoT-based marine monitoring is further supporting this growth.

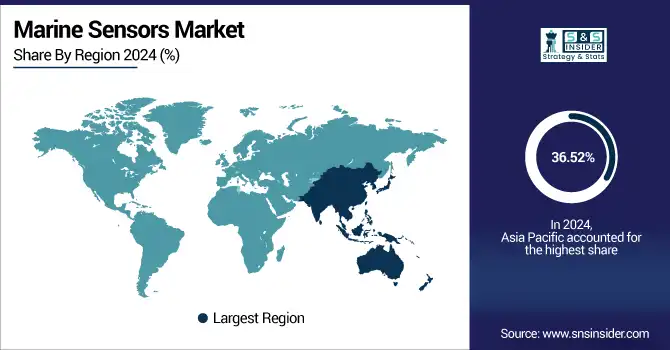

Marine Sensors Market Regional Outlook:

The Asia Pacific region dominated in 2024, capturing 36.52% of the global marine sensors market revenue. This dominance stems from strong shipbuilding industries, growing maritime trade, and increased defense spending by countries including China, Japan, and South Korea. The region's vast coastline, investments in offshore energy projects, and coastal surveillance initiatives continue to drive large-scale sensor deployments across commercial and military sectors.

-

China leads the Asia Pacific marine sensors market, driven by aggressive naval expansion, large-scale shipbuilding, and strategic investments in marine technology. Its focus on maritime surveillance, offshore energy exploration, and digital port infrastructure strengthens its position in both defense and commercial sectors.

North America is projected to witness the fastest CAGR of 8.22% over 2025-2032, supported by the presence of advanced maritime infrastructure, high R&D spending, and a strong focus on naval modernization. The region’s proactive adoption of autonomous maritime systems and emphasis on securing maritime borders are key growth drivers. Additionally, increasing investments in environmental monitoring and underwater exploration technologies further enhance its market growth potential.

-

The U.S. dominates the North American marine sensors market due to its strong naval capabilities, high defense budget, and advanced R&D ecosystem. Extensive deployment of marine sensors in surveillance, oceanographic research, and coastal security applications fuels continued market leadership.

Europe represents a mature and technologically advanced marine sensors market, supported by robust maritime traditions, environmental monitoring regulations, and growing investments in renewable marine energy. Countries including Germany, the U.K., and Norway are key contributors, focusing on sustainability and precision marine technologies. The region also benefits from collaborative defense programs and research initiatives that accelerate innovation in underwater sensing and navigation systems.

-

Germany leads due to its advanced marine engineering sector, strong presence of sensor manufacturers, and significant investments in maritime research and naval modernization. The country’s emphasis on environmental monitoring, offshore wind energy, and precision navigation technologies further strengthens its market leadership in the region.

The Middle East & Africa marine sensors market is led by the UAE, driven by its investments in smart ports, naval modernization, and coastal security. In Latin America, Brazil dominates due to its extensive offshore oil exploration, naval expansion, and growing demand for advanced marine monitoring and navigation technologies.

Get Customized Report as per Your Business Requirement - Enquiry Now

Marine Sensors Companies are:

Major Key Players in Marine Sensors Market are Kongsberg Gruppen ASA, Raytheon Technologies Corporation, Thales Group, Teledyne Technologies Inc., Lockheed Martin Corporation, Northrop Grumman Corporation, Honeywell International Inc., General Dynamics Mission Systems, Fugro N.V., and SAAB AB and others.

Recent Developments:

-

In February 2025, Saab debuted its Coast Control Radar at IDEX in Abu Dhabi—a software-defined, phased-array system for coastal surveillance. This compact, modular radar ensures 360° detection of small vessels, enhancing maritime security.

-

March 2025, Thales delivered the world’s first autonomous surface drone mine-hunting system to the French and Royal Navies under the MMCM program, featuring towed sonar, AI-driven analysis, and a mobile command center.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.26 Billion |

| Market Size by 2032 | USD 2.11 Billion |

| CAGR | CAGR of 6.73% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform (Military and Defense, Commercial) • By Application (Intelligence & Reconnaissance, Communication & Navigation, Electronic Warfare, Target Recognition, Surveillance & Monitoring, Others) • By Type (Acoustic Sensors, Magnetic Sensors, Sonars, Pressure Sensors, Temperature Sensors, Flow and Level Sensors, Others) • By Connectivity (Wired, Wireless) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Kongsberg Gruppen ASA, Raytheon Technologies Corporation, Thales Group, Teledyne Technologies Inc., Lockheed Martin Corporation, Northrop Grumman Corporation, Honeywell International Inc., General Dynamics Mission Systems, Fugro N.V., SAAB AB. |