Robotic Sensors Market Size & Trends:

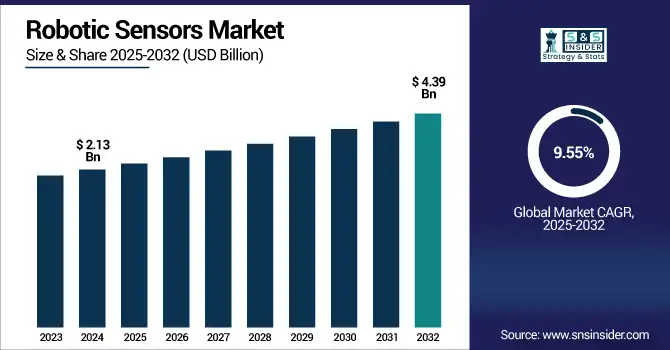

The Robotic Sensors Market size was valued at USD 2.13 billion in 2024 and is expected to reach USD 4.39 billion by 2032, growing at a CAGR of 9.55% over the forecast period of 2025-2032. Robotic sensors market trends include the integration of AI-powered vision and force sensors, miniaturization, and rising demand for collaborative and autonomous robots across industrial and service sectors globally.

The increasing adoption of robotics in emerging applications including precision agriculture, medical surgery, and hazardous environment handling has been driving the robotic sensors market growth. There are also several factors that are contributing to it, including government initiatives supporting automation, advancements in edge computing (for processing sensor data in real-time), and the increasing costs of labor. Moreover, there is a growing interest in sophisticated sensing technologies implanted in various robotic frameworks due to the increasing need for flexible and reconfigurable robotic systems in small and medium-sized enterprises (SMEs).

To Get more information on Robotic Sensors Market- Request Free Sample Report

-

As of 2025, over 30,000 agricultural robots equipped with advanced sensors (proximity, vision, and GPS) are operational globally, supporting tasks, such as weeding, fruit picking, and yield mapping.

The U.S. robotic sensors market size was valued at USD 0.44 billion in 2024 and is projected to grow at a CAGR of 9.13%, reaching USD 0.87 billion by 2032. The U.S. robotic sensors market share is projected to increase due to introduction of industrial automation, rising trend of deployment of service robots to perform different tasks, increased support from government for progressive manufacturing and Quick Adoption of AI-integrating sensors in smart robotics.

Robotic Sensors Market Dynamics:

Key Drivers:

-

Industrial Automation and AI Integration Propel Growth of Intelligent Robotic Sensors Across Multiple High Precision Sectors

The rapid evolution of industrial automation coupled with high penetration of collaborative robots in various sectors including manufacturing, logistics, and electronics are accelerating the market expansion for global robotic sensors market during the forecast timeframe. The expansion in demand for high precision application and increasing output in VFEG applications with safety and repeatability, such as electronics assembly, automotive, and healthcare, has enacted the advancement of modern sensing technology including higher level of vision, force/torque, and proximity sensors with further integration. In addition to that, advancement in AI and Machine learning has made a big impact on development of Intelligent sensing systems, which can make decisions in real time understand the environment and perform Adaptively.

-

In 2024, global installations of industrial robots reached 590,000 units, with over 60% equipped with advanced sensor suites including force, vision, and proximity sensors.

Restraints:

-

Integration Complexity and Skilled Workforce Shortage Limit Growth of Sensor Based Robotic Systems in Developing Regions

One of the main factors hindering the growth of the robotic sensors market is the high complexity to integrate such sensors and network between individual systems. Advanced programming, lots of calibration, and standardization is needed to get things working together between sensor types (vision, force/torque, and inertial units), which slows the deployment rate down. Moreover, shortage of qualified workforce to manage and maintain the sensor-dense robotic systems still stands as one of the largest hindrances, particularly in the developing countries.

Opportunities:

-

Emerging Robotic Applications Drive Demand for Smart Sensor Solutions in Agriculture Healthcare and SME Automation

Additional applications, such as precision agriculture, surgical robotics, and autonomous mobile robotics represent important sources of growth. Furthermore, the deployment of Industry 4.0 and tabletop factory projects across the globe is generating a requirement for grid-connected sensor-loaded robotic solutions. The move toward miniaturized, energy-efficient sensors and also robotics in small and medium enterprises (SMEs) is another area that has yet to reach its total potential.

-

In 2024, over 90,000 AMRs were deployed in logistics and manufacturing globally, with most equipped with vision, LiDAR, and proximity sensors for navigation and collision avoidance.

Challenges:

-

AI Powered Robotic Systems Face Challenges in Data Security Real Time Processing and Harsh Environments

Especially in robotic systems that are connected to the cloud and enabled by AI, data security and real-time processing are two of the most significant hurdles. End-users are hesitant due to breach scandals around sensor data, delays in decision-making, and system vulnerabilities. Additionally, environmental constraints, such as degraded performance or reliability of sensors exposed to dust, humidity, or high vibration conditions act as additional barriers of adoption in industrial or outdoor applications.

Robotic Sensors Market Segmentation Analysis:

By Type

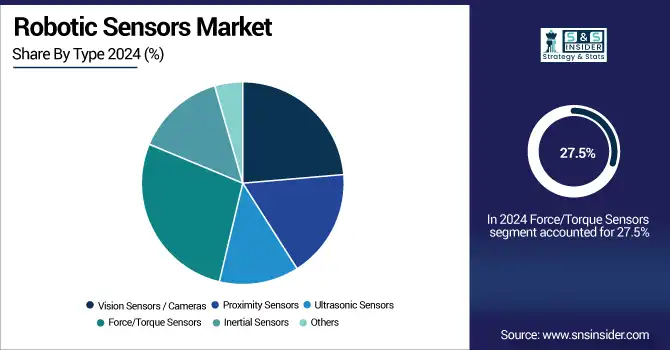

the global robotic sensors market is expected to be driven by Force/Torque Sensors, which made up 27.5% of the total revenue in 2024, as they are an essential component to improving the accuracy and dexterity of robotic arms in industrial automation, collaborative robots (cobots), and surgical robotics. Such subtle forces can be challenging to detect but can speak volumes, and these sensors have been designed to deliver the feedback for robust yet safe human-robot interaction, specifically in automotive assembly, electronics and metal fabrication sectors.

During 2025-2032, the Vision Sensors/Cameras segment will register the fastest CAGR driven by strong demand for real-time image processing, 3D vision systems, and AI-enabled machine vision in robotics. They are increasingly being used in warehouse automation, quality inspection, and autonomous navigation.

By Application

Object Detection & Recognition accounts for the largest robotic sensors market share at 37.2% of revenue in 2024. It is the most crucial area of development as it helps the robots to identify, classify, and interact with objects in different environments, thus securing the largest market share. They are widely used in manufacturing and logistics, and even in security systems to improve productivity and operational accuracy. A step further is the development of AI algorithms and deep learning that facilitates not only high-performance object detection but also where robot use cases become more prevalent.

Navigation & Mapping is estimated to exhibit the highest CAGR over 2025-2032 as autonomous robots are increasingly being adopted globally for use in warehouses, agriculture, and smart cities. By advances in LiDAR, SLAM (Simultaneous Localization and Mapping), and sensor fusion technology, robotics mobility became more efficient with path planning and situational awareness of the surrounding environment.

By Robot Type

Industrial Robots was the leading segment in the robotic sensors market in 2024 accounting for 39.5% revenue share, primarily due to the high adoption of industrial robots in the automotive and electronics manufacturing sector along with the metal processing industry. These kinds of robots are heavily dependent on sophisticated sensors to perform functions, such as Precision welding, assembling, material handling, and quality inspection. These machines can work at high-speed and precision even in extreme environments, and are therefore, irreplaceable in large-scale production lines particularly in countries that are transitioning toward automation and Industry 4.0.

Over the forecast period of 2025-2032, the service robots segment is expected to grow at the fastest CAGR owing to growing demand from healthcare, logistics, hospitality, and domestic applications. These robotic sensors assure them that they can move around without bumping into a wall or a person while making deliveries, cleaning, or taking care of elderly patients.

Robotic Sensors Market Regional Insights:

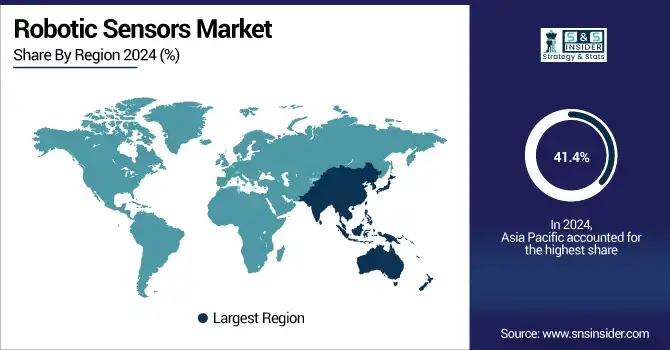

The robotic sensors market was led by Asia Pacific, accounting for 41.4% of revenue in 2024, and is estimated to propel at the fastest growth rate, registering a CAGR of 9.96% over 2025-2032. Its growth is attributed to the swift industrialization, plentiful governmental support for mechanical automation, and elevated adoption of smart manufacturing technologies in the region. In this context, several countries in the region are sparing no effort in promoting the massive catch-up by investing heavily in robotics to improve productivity, particularly in sectors as diverse as electronics, automotive, and logistics. Furthermore, help robots outfitted with innovative sensors are fueled by development factors, for instance, the development of e-Commerce and the maturing populace.

In 2024, China held the largest share of the Asia Pacific market due to its extensive manufacturing set up, advanced robotics R&D ecosystem, and large investments in industrial automation and AI technologies.

The continued growth of industrial automation and the availability of major robotics manufacturers and robotics sensor manufacturers in the U.S. region, along with surging technological advancements across several other regions primarily drive North America's robotic sensors market. Strong investment from mechanical, electrical, electronic, and software components with increasing presence of artificial intelligence, machine vision, and autonomous systems in the robotics technologies for automotive, aerospace, healthcare, and logistics industries in the region are boosting the market. The increasing applicability of service robots in smart homes, hospitals, and retail is yet another factor that is helping propel the growth.

In North America, the U.S. led the market, driven by a robust industrial base, extensive innovation ecosystem, and high penetration of robotics across sectors including manufacturing, defense, and healthcare.

Europe has a major presence in the robotic sensors industry as the region has a robust industrial automation industry, particularly for automotive, electronics, and packaging sectors. Its stringent safety and efficiency regulations encourage advanced robotic systems fitted with sensors based robotic systems. R&D projects funded by the EU, and collaborations between tech players are contributing to continuous innovation and performance improvement of sensors themselves. The increasing adoption of robotics across all countries driven by growing focus on smart factories and sustainable automation, will further propel the demand across the continent.

The robotic sensors market in Latin America and the Middle East & Africa are gradually expanding owing to an upsurge in the industrial automation and infrastructure development. Brazil and Mexico are adopting robotics as part of manufacturing and in agriculture across Latin America. On the other hand, the Middle East & Africa is utilizing robotic technologies in oil & gas, logistics and security industries. Both regions are expected to witness a vigorous demand for advanced robotic sensors owing to various government initiatives, foreign investments, and thrust on digital transformation.

Get Customized Report as per Your Business Requirement - Enquiry Now

Robotic Sensors Companies are:

Some of the major players in Global Robotic Sensors Market are Omron Corporation, Keyence Corporation, SICK Aktiengesellschaft, ifm electronic gmbh, Pepperl+Fuchs SE, Rockwell Automation Inc., Honeywell International Inc., TE Connectivity Ltd., STMicroelectronics N.V., Infineon Technologies AG, Robert Bosch GmbH, Analog Devices Inc., Texas Instruments Incorporated, DENSO Corporation, Sensata Technologies Holding plc, Panasonic Industry Co. Ltd., Banner Engineering Corp., Autonics Corporation, Novotechnik Messwertaufnehmer OHG, Delta Electronics Inc.

Recent Developments:

-

In March 2025, Keyence officially released its next‑generation IV4 vision sensor series, featuring onboard AI capabilities such as AI Identify, AI Count, AI OCR, and AI Trigger.

-

In March 2025, Omron released the E3AS‑HF, a Time‑of‑Flight (ToF) sensor offering reliable detection from 5 cm to 6 m, with unique angular installation flexibility ideal for robotics and AGV applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.13 Billion |

| Market Size by 2032 | USD 4.39 Billion |

| CAGR | CAGR of 9.55% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Vision Sensors / Cameras, Proximity Sensors, Ultrasonic Sensors, Force/Torque Sensors, Inertial Sensors and Others) • By Application (Object Detection & Recognition, Navigation & Mapping, Collision Avoidance, Environmental Monitoring and Others) • By Robot Type (Industrial Robots, Service Robots, Mobile Robots, Agricultural Robots and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles |

Omron Corporation, Keyence Corporation, SICK Aktiengesellschaft, ifm electronic gmbh, Pepperl+Fuchs SE, Rockwell Automation Inc., Honeywell International Inc., TE Connectivity Ltd., STMicroelectronics N.V., Infineon Technologies AG, Robert Bosch GmbH, Analog Devices Inc., Texas Instruments Incorporated, DENSO Corporation, Sensata Technologies Holding plc, Panasonic Industry Co. Ltd., Banner Engineering Corp., Autonics Corporation, Novotechnik Messwertaufnehmer OHG, Delta Electronics Inc. |