Modulator Drivers Market Size Analysis:

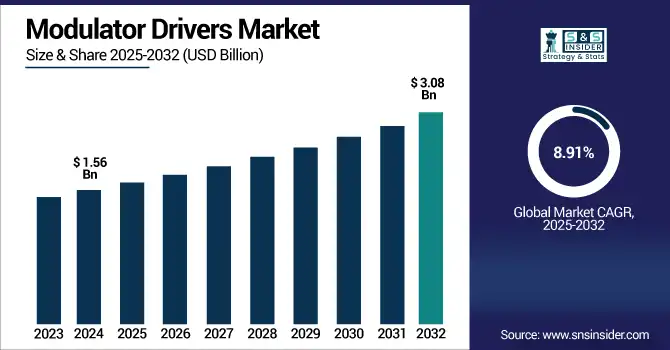

The Modulator Drivers Market Size was valued at USD 1.56 billion in 2024 and is expected to reach USD 3.08 billion by 2032 and grow at a CAGR of 8.91% over the forecast period 2025-2032. The Global Modulator Drivers Market analysis includes drivers, restraints, opportunities, challenges, and segmentations by type, technology, application, end-user, and region. The optical communication, internet & data traffic and telecommunication infrastructure developments are the key factors driving the rapid growth. Growing investment in advanced modulator drivers to accelerate next-generation communication and data transmission systems across Asia Pacific, North America, and Europe is driving their adoption in the market.

To Get more information on Modulator Drivers Market- Request Free Sample Report

For instance, 85% of enterprise workloads are now cloud-based, increasing the need for fast, reliable optical drivers in high-throughput server interconnects.

The U.S. Modulator Drivers Market size was USD 0.39 billion in 2024 and is expected to reach USD 0.74 billion by 2032, growing at a CAGR of 8.58% over the forecast period of 2025–2032.

The U.S. market is witnessing significant growth due to the increasing 5G infrastructure investments, expanding installation of high-speed optical communication systems and increasing demand for high-frequency modulation technologies from aerospace and defense. Moreover, semiconductor development and data center expansion continue to innovate, driving ongoing demand for next-generation digital and optical modulator driver solutions to maintain U.S. critical mass in the development of technologies across communication systems globally.

For instance, over 1.3 million route miles of optical fiber have been deployed across the U.S. as of 2024, fueling demand for high-speed optical drivers in backbone networks.

Modulator Drivers Market Dynamics:

Key Drivers:

-

Growing Data Traffic and High-Speed Optical Communication Are Driving Demand for Efficient Modulation Solutions

Rising adoption of internet-based technologies, 5G rollouts and hyperscale data centres have resulted in an increased demand for high-speed data transmission. With optics there is a higher frequency, you can do more things with, but to get there you have to have those modulators, those modulator drivers, they are very critical, they just allow you for seamless signal processing and signal conversion at those high frequencies and high speeds. The ongoing digitalization across the industries at a fast pace with increasing fiber optic networks has notably driven the acceptability of modulator drivers. Telecommunication, medical imaging, and industrial automation are essential industries deploying high-performance modulator drivers to address growing demands for bandwidth and reliability.

For instance, nearly 70% of global manufacturers are undergoing digital transformation initiatives that involve real-time data transmission—boosting use of optical modulators in factory networks.

Restraints:

-

Thermal Management and Signal Distortion at High Frequencies Hamper Performance and Reliability

At higher frequencies, especially higher than some gigahertz, it is difficult to keep the signal at an acceptable quality and to dissipate the heat generated. Thermal drift, power inefficiency, and nonlinear signal distortions (particularly during sustained high-speed operation) plague modulator drivers. Such technical limitations compromise their availability in critical applications where reliability is an important design specification such as aerospace, defense and healthcare diagnostics. Whereas the effort to maintain stable performance and long shelf lives becomes engineering challenges, as devices smaller and multifunctional.

Opportunities:

-

Growing Applications in Medical Imaging, Lidar, and Industrial Automation Open Non-Telecom Market Potential

Apart from telecom, modulator drivers are finding new applications in autonomous vehicle LiDAR systems, medical imaging diagnostics, and industrial control systems. Modulator drivers enable high-speed data acquisition and real-time signal processing, which lead to these industries. Conversely, the requirement for higher performance, accuracy, and data rate in non-communication fields represents a significant market opportunity for product diversification and expansion. Sector-specific innovation is a pathway for manufacturers to unearth niche but lucrative market segments.

For instance, over 70% of industrial systems now utilize real-time Ethernet protocols, where fast signal modulation is critical for deterministic control.

Challenges:

-

Lack of Standardization Across Applications and Interfaces Restricts Scalability and Cross-Vendor Compatibility

Interoperability problems appear due to the fact that there are no globally accepted standards for modulator drivers design and communication between different technologies (RF, baseband, optical). The architectures developed by vendors are not openly available and are often not in line with the overall ecosystem of the system, making it difficult to integrate. This challenge becomes more pronounced in hybrid applications with multiple transmission modes. Widespread adoption requires standardization and ensuring compatibility across platforms, which also is achingly hard to pull off over such a fragmented tech landscape.

Modulator Drivers Market Segmentation Analysis:

By Type

Digital Modulator Drivers held the largest Modulator Drivers Market share of around 44.7% in 2024, due to their extensive application in high-speed digital communication and data transmission. These drivers deliver superior signal integrity, low latency, and support for next generation standards. The main market driver for this space is the need for accurate and high-performance scalable modulation performance for advanced telecom networks, data centers, and cloud-based infrastructures, which is where the likes of Analog Devices, Inc. excels with its deep product lines.

The Hybrid Modulator Drivers are anticipated to be the fastest growing segment with a CAGR of approximately 9.73% during the forecast period 2024–2032, attributed to the potential of hybrid modulators to efficiently integrate both analog and digital functionality of compact, power-efficient systems. This suits them for new domains such as defense systems, automotive electronics, and industrial applications. Qorvo, Inc. are also actively developing hybrid driver designers for applications needing flexible control of high-frequency signals and rugged performance for a wide range of operating conditions.

By Application

In 2024, telecommunications accounted for a 41.8% revenue share of the Modulator Drivers Market and also accounted for the fastest growing segment, with over the forecast period from 2024–2032, the telecommunications segment is projected to register a CAGR of 9.58%. Rising data consumption from all over the world and the expansion of 5G networks and fiber optics deployments are the reason for this. MACOM Technology Solutions provides telecom-grade modulator drivers with high-speed performance. In addition to this, the Modulator Drivers market growth reveals increased expansion from Inphi Corporation (a unit of Marvell), which continued to develop its complex technology in the digital and optical drivers for certain multi-terabit telecom systems or edge computing networks.

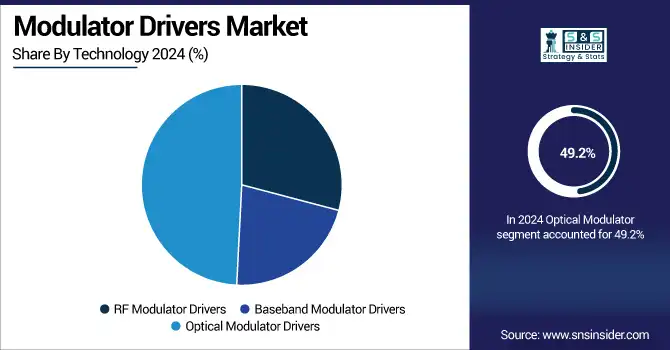

By Technology

Optical Modulator Drivers accounted for 49.2% share and is expected to grow with highest CAGR of 9.14% by 2032. Their dominance arises from their importance for high-speed, low-loss data transmission in optical communication systems. Innovation powered by Broadcom Inc. integrated optical driver technology At the same time, NeoPhotonics Corporation is broadening its portfolio to meet the rising demands of hyperscale data centers and cloud infrastructure setting up around the globe.

By End-User

In 2024, telecom was the highest end-user with 43.2% of the revenue share and also the fastest-growing, with a forecasted compound annual growth rate (CAGR) of 9.47% over the period of 2025 to 2032. Ongoing deployment of 5G, expansion of satellite internet, and demand for high-capacity networks are fueling growth. Keysight Technologies offers the advance testing equipment and modulation driver tools for telecom ecosystems. Marvell Technology, Inc. also offers integrated driver solutions to provide optimized drivetrain control for scalable energy-efficient telecom network infrastructure across core and edge architecture environments globally.

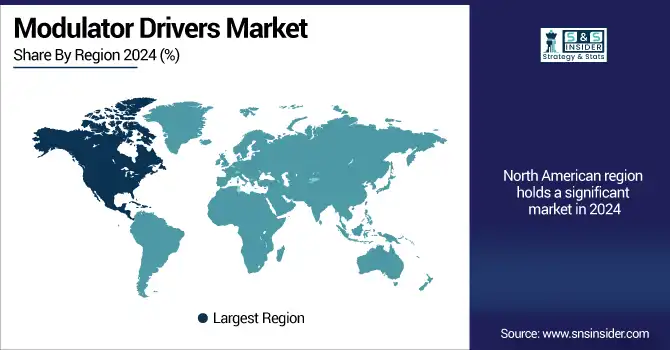

Modulator Drivers Market Regional Analysis:

North America Modulator Drivers Market captured a lucrative share due to mature telecom infrastructure, booming 5G deployments, and significant optical communication systems demand. U.S. investments are leading the way in the region — in defense, data centers, and semiconductor development. The rising deployment of high-speed, low-latency networks will continue to drive digital and optical modulator drives demand.

-

The U.S. dominates North America's Modulator Drivers Market due to its advanced telecom infrastructure, strong defense sector, and rapid 5G deployment. Significant investments in data centers and semiconductor innovation further strengthen its leadership in high-speed signal modulation technologies.

Asia Pacific accounted for the maximum share in terms of revenue of approximately 33.5%, in 2024, in the Modulator Drivers Market, due to factors such as fast industrialization paired with high mobile subscriber density in various countries including China, India, and Japan government initiatives for fiber and 5G expansion. Thanks to increased data center installation, the rapid growth of the consumer electronics industry, and the emergence of smart cities with a high dependence on optical and RF signal modulation, the Asia Pacific segment will soon grow at its fastest CAGR, around 9.76%, over the period of 2024–2032.

-

China leads the Asia Pacific Modulator Drivers Market owing to its massive 5G infrastructure rollout, expanding fiber optic networks, and government-backed digital transformation initiatives. The country’s robust electronics manufacturing ecosystem further drives demand for advanced modulator driver components.

Europe is the most prominent, due to increasing fiber optic infrastructure, growth in 5G adoption, and increase in need for higher data transmission. And nations such as Germany and the UK and France are pouring money into high-tech telecom and zip-lock industry stuff. Modulator drivers adoption in different sectors is also propelled with the regions emphasis on smart cities and digitalization.

-

Germany dominates the Modulator Drivers Market in Europe due to strong industrial automation, advanced telecom infrastructure, and a leading semiconductor sector. Its emphasis on Industry 4.0 and automotive electronics drives high demand for efficient, high-speed modulator driver solutions.

Middle East & Africa is dominated by the UAE owing to the deployment of 5G transmission technology and initiatives towards smart cities in the country. Brazil is the top growth driver in Latin America, as telecom service continues to expand rapidly, with a further rise in broadband penetration. These regions reflect growing demand for high-speed modulation technologies in advanced communication infrastructures.

Get Customized Report as per Your Business Requirement - Enquiry Now

Modulator Drivers Companies are:

Major Key Players in Modulator Drivers Market are Broadcom Inc., MACOM Technology Solutions, Analog Devices, Inc., Texas Instruments Incorporated, Qorvo, Inc., Keysight Technologies, Lumentum Holdings Inc., Marvell Technology, Inc., Teledyne Technologies Incorporated, Renesas Electronics Corporation, Maxim Integrated , Skyworks Solutions, Inc., Semtech Corporation, STMicroelectronics, NXP Semiconductors, II-VI Incorporated , Murata Manufacturing Co., Ltd., Infineon Technologies AG, NeoPhotonics Corporation and Anritsu Corporation and others.

Recent Developments:

-

In March 2025, Broadcom announced its next‑gen Sian3 and Sian2M 200 G/lane DSP PHYs—built on 3 nm and 5 nm processes respectively—supporting 800 G and 1.6 T optical modules for AI-centric datacenter interconnects.

-

In March 2025, Qorvo introduced the QPA9862 pre-driver amplifier for 5G mMIMO base stations, offering high gain and wide bandwidth critical for front-end modulation stages in mobile infrastructure.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.56 Billion |

| Market Size by 2032 | USD 3.08 Billion |

| CAGR | CAGR of 8.91% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Analog Modulator Drivers, Digital Modulator Drivers and Hybrid Modulator Drivers) • By Application (Telecommunications, Broadcasting, Radio Broadcasting, Television Broadcasting, Medical Devices and Industrial Automation) • By Technology (RF Modulator Drivers, Baseband Modulator Drivers and Optical Modulator Drivers) • By End-User (Aerospace and Defense, Consumer Electronics, Healthcare, Automotive and Telecom) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Broadcom Inc., MACOM Technology Solutions, Analog Devices, Inc., Texas Instruments Incorporated, Qorvo, Inc., Keysight Technologies, Lumentum Holdings Inc., Marvell Technology, Inc., Teledyne Technologies Incorporated, Renesas Electronics Corporation, Maxim Integrated , Skyworks Solutions, Inc., Semtech Corporation, STMicroelectronics, NXP Semiconductors, II-VI Incorporated , Murata Manufacturing Co., Ltd., Infineon Technologies AG, NeoPhotonics Corporation and Anritsu Corporation. |