Medical Billing Market Overview:

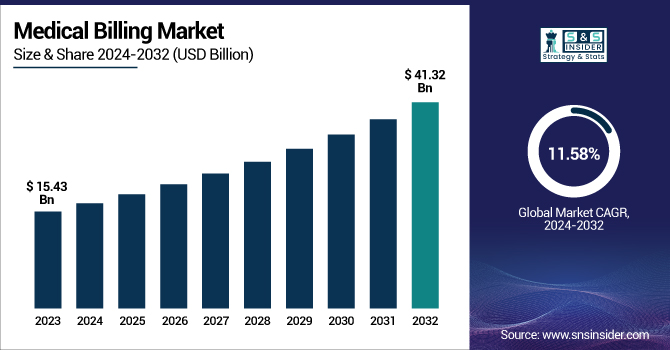

The Medical Billing Market was valued at USD 15.43 billion in 2023 and is expected to reach USD 41.32 billion by 2032, growing at a CAGR of 11.58% over the forecast period 2024-2032.

To Get more information on Medical Billing Market - Request Free Sample Report

The Medical Billing Market report highlights in-depth insights about the key industry trends impacting the growth of the Medical Billing market. The report discusses the growth of the market and adoption trends for such technologies, and it shows an increasing move to automated billing solutions. The report also reviewed trends around claims processing, including acceptance/rejection rates and processing efficiency. It explores billing mistakes and denial rates and searches for common challenges that hinder revenue cycles. It also helps decipher technology and automation adoption with an extra emphasis on AI-powered solutions and EHR-integrated billing. Revenue distribution and payer mix, which show contributions from Medicare, Medicaid, private insurance, and out-of-pocket payments, are also presented in the study. The report examines regulatory and compliance trends, including policy changes such as ICD-11 and HIPAA updates. It also allows stakeholders to manage intelligently changing billing trends. Rising healthcare spending and regulatory compliance are driving the medical billing market. Market growth is further fueled by the shift toward value-based care and electronic health records (EHRs).

Medical Billing Market Dynamics

Drivers:

-

The integration of artificial intelligence and machine learning enhances accuracy in billing and coding.

Artificial intelligence (AI) and machine learning have revolutionized the field of medical billing, making it more accurate and efficient than ever before. Claims are now processed with over 95% accuracy by AI-powered coding systems that significantly reduce errors compared to traditional manual methods. Such extreme accuracy helps avoid claim denials, leading to speedy reimbursements and an effective revenue cycle for the medical practice. Additionally, approximately 50% to 75% of time spent on billing can be automated by AI, improving operational efficiency and decreasing administrative workload. This automation speeds up the billing process by 30% to 40% and reduces operational costs by 10% to 20%. AI-powered systems, on the other hand, process an average of 750 claims a minute at a single instance of time.

Apart from processing efficiency, AI promotes compliance by sifting through billing patterns to detect possible fraud with 95% accuracy. Such functionality ensures compliance with regulatory requirements and minimizes the potential for financial penalties. Moreover, AI-powered predictive analytics accurately predicts patient payment behaviours with 80% accuracy and equips healthcare organizations to implement proactive revenue collection strategies. The use of AI in medical billing comes with its own set of challenges. As the example of the algorithm that devolved without supervision illustrates, AI systems cannot function properly without lots of human oversight. Therefore, while AI offers substantial benefits in enhancing billing accuracy and efficiency, continuous human involvement remains crucial to address complexities and maintain system effectiveness.

Restraints:

-

Shortage of skilled professionals in the medical billing industry leads to inefficiencies.

The medical billing industry is currently facing a significant challenge due to a shortage of skilled professionals, leading to inefficiencies and increased operational stress. This shortage contributes to heightened stress among healthcare providers, with 68% identifying medical billing as their primary source of stress. The complexity of billing processes exacerbates this issue, as over 50% of providers consider it a major challenge. Despite the industry's growth, with the U.S. medical billing industry employing over 206,000 people, the demand for skilled professionals continues to outpace supply, leading to inefficiencies in billing operations. This imbalance underscores the need for training programs and technological solutions to mitigate the impact of this workforce shortage.

Opportunities:

-

Developing specialized billing services for niche medical specialties captures untapped market segments.

The medical billing market is witnessing a significant opportunity in developing specialized billing services tailored to niche medical specialties. This trend caters to the domain-specific billing needs of different medical practices, resulting in improved revenue cycle management as well as operational efficiency. Offshore medical billing is one of the most commonly adopted strategies by healthcare providers. This is due in part to third-party providers' extensive services that facilitate billing, cut down on administrative work, and increase performance efficiency. Service providers must mitigate billing errors and comply with constant regulations by integrating advanced technologies. The use of such technology streamlines billing processes, making specialty billing services accurate and efficient.

Outsourced billing service vendors offer the freedom to adapt to changing patient volumes without the added management burden of hiring in-house billing staff. This versatility is especially useful for niche specialties that may get more or less activity, allowing for stable and productive billing processes. This growth is propelled by an influx of patients, increasing complexity in medical billing & coding procedures, broadened coverage of healthcare insurance, and growing healthcare expenditure.

Challenges:

-

Integration of advanced technologies and AI solutions in medical billing systems presents complexities.

Integrating advanced technologies and artificial intelligence (AI) into medical billing systems presents significant challenges, primarily due to the need for substantial human oversight and the potential for AI-driven errors. Despite the promise of AI to automate healthcare processes, in practice, every implementation must be watched over and adjusted by humans. The University of Pennsylvania Health System reported a similar decline from an AI algorithm used to produce support/prognostic tools for its oncologists, an instance that emphasizes the need for continued human oversight to monitor and control the performance of AI over time. Health insurers have also been criticized for using AI in claims decision-making. There are companies, including Cigna, that have done this, using AI algorithms to deny massive numbers of care requests in an instant, at a rate of a decision every 1.2 seconds on average. These practices have led to legislative proposals aimed at restricting the use of AI in patient care, like the bill proposed by Connecticut Senator Saud Anwar, which seeks to limit the use of AI to improve patient care while ensuring that profit is not prioritized over patients. These examples underscore the complexities and ethical considerations associated with integrating AI into medical billing, emphasizing the critical role of human oversight to prevent potential errors and ensure equitable patient care.

Medical Billing Market Segmentation Analysis

By Component

The services segment held the largest market share in the medical billing industry in 2023. Services lead this dominance owing to their extensive provision of complete billing solutions and specialized expertise, which enhance healthcare providers billing process. Services range from critical functions such as medical coding, claims submission, denial management, and revenue cycle management, which ensure maximum reimbursement and financial performance. Compliance is mandated by government regulations such as HIPAA, which drives the service segment to contribute the maximum share. This scalability enables these services to adapt to shifting patient volumes and practice scales, rendering them essential for healthcare practices. Advanced technologies such as AI and machine learning in billing services increase efficiency and accuracy, which is one of the reasons behind their growing popularity. Additionally, the need for regulatory compliance and the complexity of billing processes make specialized services essential for healthcare providers.

By Facility Size

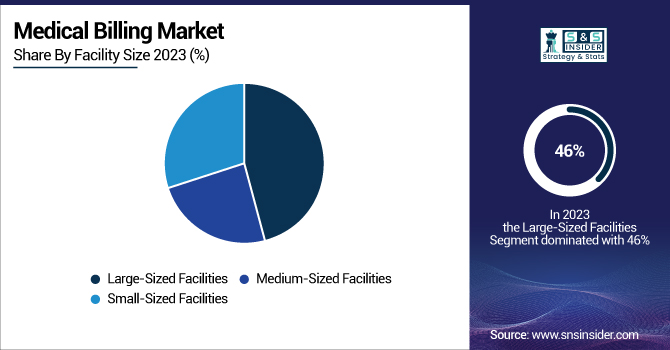

In 2023, large sized facilities accounted for around 46% of the market. This is due to their extensive resources and ability to invest in advanced billing systems, which streamline revenue cycle management and improve reimbursement rates. Large facilities typically have more advanced billing requirements, and as a result, they require advanced solutions that can process a lot of claims and do it quickly. The government initiatives in support of digital health technologies further spur large facilities to embrace modernized billing systems, improving their operational efficiency and readiness for the future. Large facilities benefit from economies of scale in billing operations and are, therefore more likely to invest in state-of-the-art technologies that can help to lower administrative costs and increase billing accuracy.

By End User

In 2023, the hospitals segment accounted for approximately 45% of the global market share. Hospitals also require a complete billing solution because they perform a high volume of services, and services can be complex. Government policies and regulations, like Medicare and Medicaid, play a very important role in how hospitals submit their bills for services rendered to patients, and this results in complex systems of billing to take care of such legislative avenues to maximise the reimbursement to the hospitals. Hospitals adopting EHR and digital billing systems reinforce their dominance in the market because these technologies improve billing efficiency and accuracy. The billing demands are even more complicated for hospitals, which provide everything from emergency care and surgeries to life-long treatments. This complexity requires advanced billing systems capable of handling diverse claims and ensuring timely reimbursement.

Medical Billing Market Regional Insights

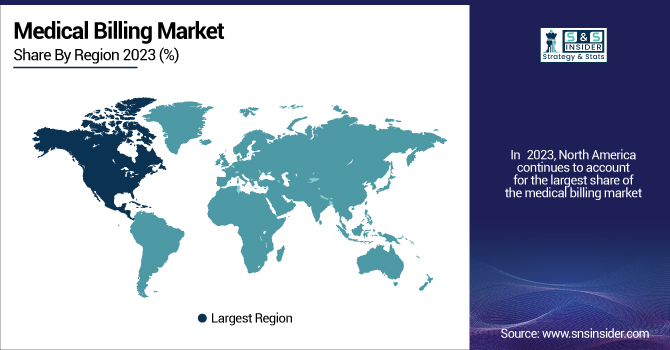

In 2023, North America continues to account for the largest share of the medical billing market, with considerable regional disparities. The reason behind this dominance is attributed to the advanced healthcare infrastructure, greater healthcare spending, and higher adoption rate of electronic health records (EHRs) in the region. The healthcare market in the U.S. is already mature, with a focus on digital technologies, paving a suitable platform for the medical billing market to grow. Regulatory Initiatives by the government, including the Centers for Medicare & Medicaid Services (CMS), also significantly influence markets, establishing mandates that require billing to be efficient. The Asia-Pacific region is growing the fastest due to rising investments in healthcare infrastructure and the adoption of digital health. This growth is being driven by countries such as India and China with government initiatives to enhance healthcare accessibility and efficiency. For example, India's National Digital Health Mission (NDHM) envisages a digital health ecosystem, replete with an advanced billing infrastructure to facilitate healthcare services. The growth in this region is also a result of the demand for efficient billing solutions to accommodate the increasing volume of healthcare services.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Medical Billing Industry

Key Service Providers/Manufacturers

-

Kareo (EHR, Practice Management Software)

-

Infinitercm (Revenue Cycle Management, Credentialing Services)

-

Cerner (PowerChart, Millennium)

-

eClinicalWorks (eClinicalWorks EHR, eClinicalWorks PM)

-

R1 RCM (Revenue Cycle Management Services, Physician Advisory Services)

-

CureMD (CureMD EHR, Practice Management)

-

AdvancedMD (AdvancedMD EHR, Practice Management)

-

PracticeSuite (PracticeSuite EHR, Medical Billing Software)

-

BillingParadise (Medical Billing Services, Denial Management)

-

GeBBS Healthcare Solutions (Revenue Cycle Management, Health Information Management)

-

Tebra (Practice Operations Platform, Patient Experience Enhancements)

-

Veradigm (Practice Management Solutions, EHR Technology)

-

Hyland Software (OnBase, Alfresco)

-

McKesson Corporation (Pharmaceutical Distribution, Health Information Technology)

-

Abridge (AI-Powered Documentation Platform, Clinical Note Transcription)

-

CodaMetrix (AI for Medical Coding, Revenue Cycle Automation)

-

Cohere Health (Prior Authorization Automation, Care Coordination)

-

Anysphere (AI Coding Assistant, Cursor)

-

Attention (CRM Automation, Natural Language Processing Tools)

-

Decagon (AI Support Agents, Customer Inquiry Management)

Recent Developments

-

Veradigm, LLC (US) announced in November 2023, the launch of Veradigm Intelligent Payments, powered by RevSpring within Veradigm Payerpath, which streamlines payment processing and minimizes manual reconciliation for healthcare providers.

-

The U.S. Department of Health and Human Services has made operating EHRs in concert with billing systems a priority to help streamline error reduction and improve reimbursement rates. This integration is expected to become more widespread as healthcare providers seek to optimize their billing processes.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 15.43 Billion |

| Market Size by 2032 | USD 41.32 Billion |

| CAGR | CAGR of 11.58% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services {Professional Services, Managed Services}) • By Facility Size (Large-Sized Facilities, Medium-Sized Facilities, Small-Sized Facilities) • By End User (Ambulatory Surgery Centers, Hospitals, Specialty Centers {Orthopedic Centers, Oncology Centers, Cardiology Centers, Radiology & Imaging Centers, Other Specialty Centers}, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Kareo, Infinitercm, Cerner, eClinicalWorks, R1 RCM, CureMD, AdvancedMD, PracticeSuite, BillingParadise, GeBBS Healthcare Solutions, Tebra, Veradigm, Hyland Software, McKesson Corporation, Abridge, CodaMetrix, Cohere Health, Anysphere, Attention, Decagon |