Thyroid Cancer Diagnostics Market Report Scope & Overview:

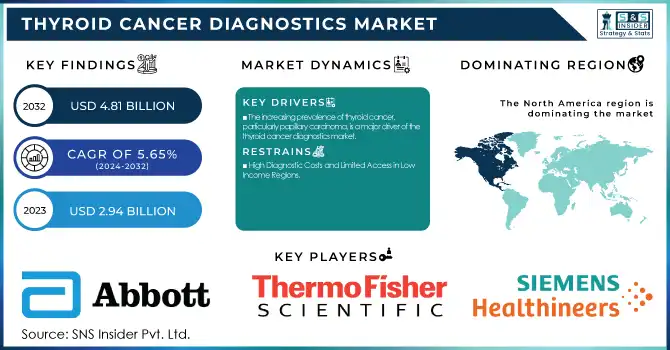

The Thyroid Cancer Diagnostics Market size was estimated at USD 2.94 billion in 2023 and is expected to reach USD 4.81 billion by 2032 with a growing CAGR of 5.65% during the forecast period of 2024-2032.

To get more information on Thyroid Cancer Diagnostics Market - Request Free Sample Report

This Report underscores the increasing incidence and prevalence of thyroid cancer, as well as regional differences in trends in diagnostic procedures and uptake of newer diagnostic technologies. The research analyzes healthcare expenditure on thyroid cancer diagnostics, evaluating how regions invest in early detection and treatment. It also investigates regulatory trends and approvals, which are pivotal in influencing market dynamics and ensuring the safety and efficacy of diagnostic equipment. The report also explores current research and development, highlighting the innovations contributing to better diagnostic accuracy and enhanced patient outcomes.

Thyroid Cancer Diagnostics Market Dynamics

Drivers

-

The increasing prevalence of thyroid cancer, particularly papillary carcinoma, is a major driver of the thyroid cancer diagnostics market.

The increasing prevalence of thyroid cancer is a major driving force for technological advancements in diagnostics. The American Cancer Society reported that in 2023, about 44,000 new cases of thyroid cancer were diagnosed in the U.S., which highlights the importance of early detection and accurate diagnostic tools. With the growing trend of papillary and medullary thyroid carcinoma, medical professionals are moving towards more sophisticated molecular testing techniques to enhance diagnostic efficacy and patient care.

Next-generation sequencing (NGS) has proven to be an important tool, as it provides exhaustive genetic profiling of thyroid tumors to recognize mutations like BRAF, RET, and RAS, which are significant in the determination of targeted therapies. Liquid biopsy is also increasingly used as a less invasive substitute for conventional tissue biopsy, facilitating the detection of circulating tumor DNA (ctDNA) in the blood at an early stage. Additionally, the use of artificial intelligence (AI) in imaging diagnostics has greatly improved ultrasound and PET-CT scan precision, minimizing false positives and allowing disease stratification to be improved. Support from regulators is also firming up the market, as with the FDA's selpercatinib (Retevmo) approval for RET-mutant medullary thyroid cancer, a move towards precision medicine and biomarker-based treatments. These innovations, together, have led to improved survival rates and better clinical decision-making, thereby reinforcing the importance of technological advancements in thyroid cancer diagnostics.

Restraints

-

High Diagnostic Costs and Limited Access in Low-Income Regions

The expense of molecular and genetic testing is still a significant impediment to the universal use of sophisticated thyroid cancer diagnostics. Next-generation sequencing (NGS) tests, which are essential for identifying genetic mutations like BRAF, RET, and RAS, can cost between USD 1,000 and USD 5,000 per test, which is economically prohibitive for most patients, especially in middle- and low-income nations. The exorbitant prices are due to high-tech equipment, specialized skills, and time-consuming procedures, thus making it available only to highly funded healthcare centers.

In addition, inconsistent or unsatisfactory reimbursement policies in different regions complicate the affordability of these tests for patients. Most insurance companies do not cover biomarker-based and molecular diagnostics in full, requiring patients to pay out-of-pocket. Moreover, the lengthy and complicated regulatory approval process for new diagnostic technologies also delays their introduction into the market. All these factors combined prevent the adoption of advanced thyroid cancer diagnostic solutions, limiting timely and precise disease diagnosis.

Opportunities

-

Expansion of AI and Personalized Medicine in Thyroid Cancer Diagnosis

The convergence of artificial intelligence (AI) into diagnostic imaging and the increased emphasis on personalized medicine open up rich prospects for industry participants. AI-enabled solutions, such as deep-learning algorithms used for ultrasound image analysis, are enhancing early detection and minimizing false positives. The expansion of targeted therapies, such as BRAF and RET inhibitors, is stimulating the demand for companion diagnostics to enable the identification of qualified patients for targeted treatments. Further, growing investment in R&D on non-invasive testing technologies like liquid biopsy will be expected to open new growth opportunities for the market.

Challenges

-

Stringent regulatory approval processes and varying compliance standards across different countries pose challenges for new diagnostic technologies.

The process of regulatory approval for molecular diagnostic tests and imaging equipment is extremely stringent, involving large-scale clinical verification, safety testing, and conformity to regional standards including FDA (U.S.) and CE (Europe). This results in a substantial lag time in market introduction, hindering the uptake of new diagnostic technologies. Large-scale clinical studies have to be carried out by companies to establish the validity and reliability of new technology, a process that takes years before obtaining approval.

Furthermore, the worldwide shortage of trained professionals, such as pathologists, radiologists, and molecular oncologists, is an increasing issue. Proper diagnosis of thyroid cancer involves proficiency in biopsy analysis, genetic testing, and imaging interpretation, but most developing countries lack specialized staff. This shortage results in increased diagnostic turnaround times, misdiagnosis, and delayed treatments, ultimately impacting patient outcomes. These issues need to be addressed through investments in workforce training, regulatory simplification, and enhanced access to advanced diagnostics globally.

Thyroid Cancer Diagnostics Market Segmentation Insights

By Type

Papillary carcinoma held the highest market share of 89.2% in 2023 and is the most common type of thyroid cancer. Its high market share is largely due to its high incidence rate, which constitutes almost 80–85% of all thyroid cancers globally. Moreover, improved diagnostic methods, such as ultrasound imaging, fine-needle aspiration biopsy (FNAB), and molecular testing, have greatly enhanced early detection and treatment planning for papillary carcinoma.

The follicular carcinoma segment is likely to expand at the highest rate over the forecast period as awareness increases and molecular diagnostic technology advances. Although less prevalent than papillary carcinoma, thyroid cancer of follicular type tends to necessitate supplementary diagnostic studies like genetic analysis and imaging for detecting metastases, driving demand for more advanced diagnostic methods.

By Technique

The imaging segment captured the highest market share of 37.8% in 2023, mainly because it plays a crucial role in the detection of thyroid nodules and evaluation of cancer development. Diagnostic and monitoring methods like ultrasound, CT scans, MRI, and PET scans are commonly used and provide non-invasive and highly precise results. The growing use of AI-based imaging analysis and enhanced imaging resolution have also driven the segment's growth.

Biopsy, especially fine-needle aspiration biopsy (FNAB), should be the fastest-growing segment based on its vital role in final cancer diagnosis. With the rising use of molecular and genetic analysis in thyroid cancer diagnosis, biopsy procedures are also increasingly using next-generation sequencing (NGS) and biomarker analysis to support individualized treatment plans.

By End-use

Hospital labs held 40.6% of the market share in 2023 due to the large number of diagnostic tests performed in hospitals. Hospitals are still the main site of care for thyroid cancer diagnosis, providing extensive testing services, such as blood tests, imaging, and biopsy procedures. Hospital-associated laboratories also enjoy superior infrastructure, access to experienced professionals, and quick adoption of new diagnostic technologies.

The research institutes segment will grow the fastest because of the growing investment in cancer biomarker discovery, molecular diagnostics, and research into personalized medicine. The ongoing clinical trials on non-invasive diagnostic methods, artificial intelligence-based pathology analysis, and new blood-based screening technologies will be expected to fuel market growth in this segment.

Thyroid Cancer Diagnostics Market Regional Analysis

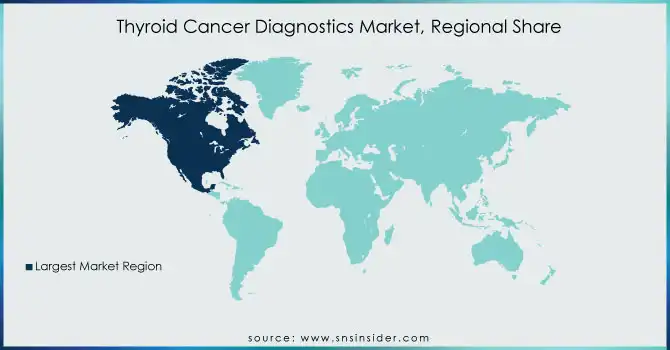

The North American region led the thyroid cancer diagnostics market in 2023 due to the high prevalence of the disease, sophisticated healthcare infrastructure, and rising use of molecular diagnostics. The United States is at the forefront with high investments in genetic testing, AI-based imaging, and biomarker studies, in addition to favorable reimbursement policies that increase diagnostic reach. Canada follows, with support from government-funded screening programs and advancements in technology for detecting thyroid cancer.

The Asia-Pacific market is likely to experience the most rapid growth, driven by the increasing incidence of thyroid cancer, growing healthcare spending, and the expanding diagnostic infrastructure in nations such as China, India, and Japan. The adoption is being driven by government efforts to enhance cancer diagnostics and the increasing role of major market players, while advances in imaging and molecular diagnostics are also accelerating market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Abbott Laboratories: Thyroid Function Tests

-

F. Hoffmann-La Roche Ltd.: Cobas Series

-

Thermo Fisher Scientific, Inc.: Oncomine Dx Target Test

-

Siemens Healthineers: Thyroid Cancer Assays

-

Bio-Rad Laboratories, Inc.: Thyroid-stimulating hormone (TSH) Assays

-

General Electric (GE Healthcare): Ultrasound Imaging Systems

-

Koninklijke Philips N.V.: Ultrasound Machines

-

Toshiba Corporation: Ultrasound Systems

-

Agilent Technologies, Inc.: Liquid Biopsy Kits

-

Illumina, Inc.: Next-Generation Sequencing (NGS) Platforms

-

Eli Lilly and Company: Diagnostic Agents

-

Canon Inc.: Medical Imaging Equipment

-

Danaher Corporation: Diagnostic Solutions

-

Esaote SPA: Ultrasound Equipment

-

Hologic, Inc.: Diagnostic Products

-

PerkinElmer, Inc.: Diagnostic Assays

-

Veracyte, Inc.: Afirma Xpression Atlas

Recent Developments

In Sep 2024, The FDA granted full approval for selpercatinib (Retevmo) for advanced or metastatic RET-mutant medullary thyroid cancer in patients aged 2 years and older requiring systemic therapy. This approval follows the confirmation of RET mutations through an FDA-approved diagnostic test.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.94 billion |

| Market Size by 2032 | USD 4.81 billion |

| CAGR | CAGR of 5.65% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type [Papillary Carcinoma, Follicular Carcinoma, Others] • By Technique [Blood Test, Imaging, Biopsy, Others] • By End-use [Hospital Laboratories, Cancer Diagnostic Centers, Research Institutes, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Abbott Laboratories, F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific, Inc., Siemens Healthineers, Bio-Rad Laboratories, Inc., General Electric (GE Healthcare), Koninklijke Philips N.V., Toshiba Corporation, Agilent Technologies, Inc., Illumina, Inc., Eli Lilly and Company, Canon Inc., Danaher Corporation, Esaote S.p.A., Hologic, Inc., PerkinElmer, Inc., Veracyte, Inc. |