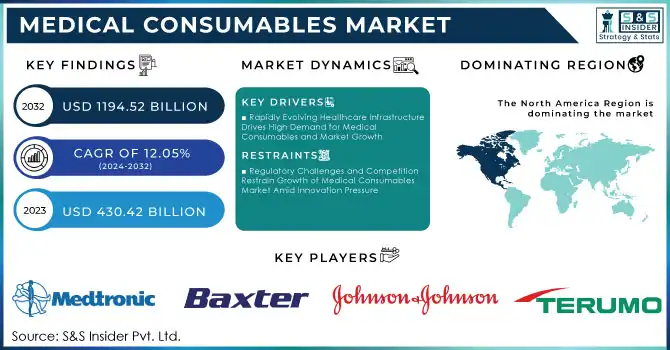

MEDICAL CONSUMABLES MARKET KEY INSIGHTS:

The Medical Consumables Market Size was valued at USD 430.42 Billion in 2023 and is expected to reach USD 1194.52 Billion by 2032 and grow at a CAGR of 12.05% over the forecast period 2024-2032. The Medical Consumables market is increasing due to the growing occurrence of chronic diseases and an aging population. Chronic disease leads to an increase in general medical care, and consequently in the use of consumables (e.g., syringes, gloves, catheters). The increase in demand is also attributed to the rising emphasis on infection control and hygiene standards, compelling healthcare practitioners to adopt disposable products to reduce the risk of cross-contamination. This increasing commitment to hygiene standards in health care entails the consumption of about 350 billion medical gloves per year. According to the World Health Organization (WHO), approximately 71% of all deaths globally are due to chronic diseases such as cardiovascular diseases, cancers, respiratory diseases, and diabetes. Moreover, 6 in 10 adults in the U.S. have a chronic disease and 4 in 10 adults live with two or more chronic conditions, according to the Centers for Disease Control and Prevention (CDC), which is another factor contributing to the growth of this market.

Get More Information on Medical Consumables Market - Request Sample Report

Moreover, technological improvements and product innovation in medical consumables also boost the market growth. Manufacturers have already been working on making products less cumbersome while making the outcomes better for patients and processes best in healthcare. For example, Smart medical devices and new materials for consumables enhance function and safety. While increasing the efficiency of healthcare delivery, these innovations attract investments in health institutions allowing a better market atmosphere. A study in Health Affairs shows that recent advances in medical technologies have decreased the hospital readmission rate by 25%, also pointing toward a critical role of innovative consumables here for enhanced patient care and safety. Combined with improved standards of living and health insurance coverage for a higher number of patients who need them, there are so many things you can bank on driving this growth well into the future medical consumables have a habit of being an integral part of the modern healthcare practice.

MARKET DYNAMICS

KEY DRIVERS:

-

Rapidly Evolving Healthcare Infrastructure Drives High Demand for Medical Consumables and Market Growth

State and private sectors are pouring a lot of energy into making the healthcare centers more efficient. Modernization also often involves upgrading medical equipment and consumables, which further accentuates demand for the former. There is a high demand for medical consumables, from regular items, such as gloves and syringes, to more sophisticated products such as catheters and surgical instruments to ensure better health facilities. In 2023, the United States imported syringes totaling 3.20 billion items. The major sources included Mexico, with 1.35 million items Asia at 22.48 million items, China at 1.9 billion items, and Italy at 14 billion items. With hospitals and clinics increasing their capacity, the demand for reliable, quality consumables is becoming even more critical thereby boosting market growth. The WHO estimates that around 16 billion syringes are used annually for vaccinations, highlighting their importance in healthcare, while the AHA reports over 6,120 hospitals in the U.S. are expanding and modernizing to enhance patient care.

-

Growing Focus on Preventive Healthcare Fuels Demand for Medical Consumables and Innovations in Self-Care

With the focus of healthcare globally moving more towards prevention rather than treatment, this is leading to an increase in supply and demand for products that offer early diagnosis or management of health issues. It encompasses consumables such as diagnostic kits, testing strips, and monitoring devices that are crucial to patient proactive care. Over 34 million Americans have diabetes, resulting in an annual demand for approximately 3 billion testing strips.

Additionally, a National Health Council survey revealed that 88% of adults are focused on improving their health through preventive measures, boosting the use of diagnostic kits and health monitoring devices. Furthermore, another driver of the trend is gaining attention among consumers about health and wellness where they are more rapidly using medical consumables in home care settings. With the rising number of people being proactive with their health management, more consumables that promote self-monitoring and preventive care enter the market, leading to innovation and growth in this area.

RESTRAIN:

-

Regulatory Challenges and Competition Restrain Growth of Medical Consumables Market Amid Innovation Pressure

In the US and Europe, healthcare products are regulated by authorities like the FDA in the US and EMA in Europe. Complying with these regulatory requirements can be complicated, taking time and hampering innovations in new products. New surgical gloves, for example, may take longer to hit the market because they require extensive quality and safety tests making them costlier for manufacturers. Competition from generics and similar products is yet another challenge. Over time, as lower-cost alternatives come to market from emerging companies in the field, larger brands may find it difficult to retain their share of attention. As an illustration, the availability of syringe and IV kit generic forms can initially motivate original manufacturers to lower prices or to improve their product line, thereby creating a more complex business environment for them as well as decreased profitability. This provides companies with the continual challenge of innovating and making their products unique in a saturated market.

KEY SEGMENTATION ANALYSIS

BY PRODUCT

Non-woven product segment held a major share of the medical consumables market retaining over 20% revenue share in 2023, due to various factors contributing to economic growth, increasing demand for medical safety and hygienic non-woven products. In the medical realm, non-woven solutions can be found in several products, including surgical drapes and gowns, masks, and dressings that are lightweight, breathable, and highly absorbent towards human blood. Non-woven ones have become the most preferred choice of sanitary products for healthcare providers due to their efficiency in infection prevention and control, especially in surgical disciplines and outpatient care. Moreover, since the benefits of disposability reduce the chances of cross-contamination, they also act as a catalyst in their growth in hospitals and clinics.

The IV solutions segment is anticipated to be the fastest-growing category, projected to achieve a significant CAGR from 2024 to 2032, due to the rising incidence of chronic diseases being treated intravenously like diabetes, cancer, and cardiac diseases. Additionally, there is an increase in surgical procedures among patients who need fluids or medications via IV routes. Additionally, the development of IV solutions such as smart infusion systems and pre-mixed solutions help mitigate medication errors making them an attractive option for healthcare providers by improving patient safety and treatment efficiency. These factors contribute to IV solutions being one of the fastest-growing segments among medical consumables.

BY END USE

The hospitals segment dominated the market with 54% of the market share in 2023. This dominance is mainly attributable to the consumption rate of items consumed in hospitals, given the diversity of medical procedures conducted each day. The hospitals need consumables constantly, syringes gloves, and IV kits are made used for patient treatment, surgical treatment as well as emergencies. With substantial investments in hospital infrastructure and a higher generation of patients, the demand for these products keeps rising.

The Home Healthcare segment is expected to grow at the fastest CAGR from 2024-2032. The market is primarily driven by the rising trend towards a shift of patient care from hospital to home environment. This shift is being propelled by a variety of factors, including an aging population, the rising burden of chronic diseases and conditions, and an increasing focus on personalized care. Further, the growth of medical technology with the rapid development of portable, user-friendly consumables has made it easier for patients to make contact with their health in home settings. Thus, the increasing use of monitoring devices, wound-care products, and medication delivery systems for home-based healthcare services, are likely to cater to high demand in upcoming years and make this segment the most lucrative in terms of growth rates among other segments.

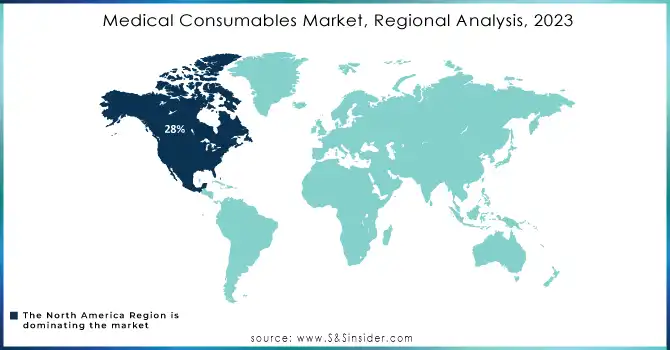

REGIONAL ANALYSIS

North America dominated the market with a 28% share in 2023. The dominance of this region is due to advanced infrastructure for healthcare, high expenditure on healthcare, and well-established markets like hospitals and clinics in North America. The U.S. spends more on health care per capita than any other nation in the world, stimulating demand for a variety of medical devices and disposables. Moreover, major manufacturing companies and many innovative small medical device startups are present in North America and they launch new medical devices every year to sustain the market growth. This translates to a stronghold in the market and leading companies such as Medtronic, Baxter International, etc., are capitalizing on this by launching advanced consumables as well with a diverse product portfolio.

The Asia Pacific will show the fastest CAGR between 2024 and 2032 due to the boom in demand for medical consumables is due to rapid urbanization, a burgeoning middle class, and improved access to healthcare in China and India. Take, for instance, the Chinese emphasis on refining its healthcare infrastructure in light of COVID-19, it has invested billions in terms of dollars into health infrastructure and now requires more consumables such as personal protective equipment (PPE) and diagnostic kits. In addition, the expanding population of India and the presence of chronic ailments are creating a healthy appetite for home healthcare technologies as well as medical consumables. These trends will see the medical consumables market grow immensely over the next few years, with the Asia Pacific region being a vital one.

Need Any Customization Research On Medical Consumables Market - Inquiry Now

Key Players

Some of the major players in the Medical Consumables Market are:

-

Medtronic (Syringes, IV Sets)

-

Baxter International (IV Solutions, Hemodialysis Products)

-

Johnson & Johnson (Surgical Sutures, Wound Care Products)

-

Cardinal Health (Medical Gloves, Surgical Instruments)

-

3M (N95 Respirators, Medical Tapes)

-

Smith & Nephew (Wound Dressings, Surgical Devices)

-

Boston Scientific (Catheters, Guidewires)

-

Fresenius Kabi (IV Solutions, Infusion Pumps)

-

Halyard Health (Surgical Drapes, Masks)

-

Owens & Minor (Surgical Packs, PPE)

-

Terumo Corporation (Blood Collection Tubes, Syringes)

-

Medline Industries (Non-woven Disposable Products, Procedure Trays)

-

Ecolab (Infection Prevention Products, Surface Disinfectants)

-

ConvaTec (Wound Care Products, Ostomy Products)

-

Coloplast (Catheters, Wound Care Products)

-

Hologic (Diagnostic Kits, Breast Imaging Solutions)

-

Zimmer Biomet (Surgical Blades, Orthopedic Devices)

-

Draeger (Anesthesia Products, Patient Monitoring Systems)

-

Stryker (Surgical Instruments, Hospital Beds)

-

Acelity (Wound Care Products, Surgical Dressings)

Some of the Raw Material Suppliers for Medical Consumables Companies:

-

BASF

-

DuPont

-

Eastman Chemical Company

-

SABIC

-

Mitsubishi Chemical

-

Covestro

-

3M

-

Royal DSM

-

Celanese Corporation

-

Lonza Group

RECENT TRENDS

-

In July 2024, The Federal Executive Council approved the purchase of 7,887 dialysis consumables to improve healthcare access for Nigerians with kidney diseases, addressing the rise of non-communicable diseases like hypertension and diabetes.

-

In August 2024, The Plateau State government received USD 400,000 worth of medical equipment from foreign partners to enhance healthcare delivery. The donation was made by Widows and Orphans International USA, supported by the US-Nigeria Law Group and the Solomon and Mary Lar Foundation.

-

In May 2024, India reversed a longstanding trend and became a net exporter of medical consumables and disposables for the first time. Previously, the market for items such as needles and catheters was dominated by foreign products.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 430.4 Billion |

| Market Size by 2032 | USD 1194.5 Billion |

| CAGR | CAGR of 12.05% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Medical Gloves, IV Kits, Medical Gauze & Tapes, Disposable Syringes, Sharps Disposable Containers, Catheters, Non-woven Disposable Products, Surgical Blades, Medicine Cups, Cannula, Guidewires, Thermometer, Stethoscope, Glucometer Strips, IV Solutions, BP Monitors, Procedure Trays, Others) • By End Use (Hospitals, Home Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Medtronic, Baxter International, Johnson & Johnson, Cardinal Health, 3M, Smith & Nephew, Boston Scientific, Fresenius Kabi, Halyard Health, Owens & Minor, Terumo Corporation, Medline Industries, Ecolab, ConvaTec, Coloplast, Hologic, Zimmer Biomet, Draeger, Stryker, Acelity |

| Key Drivers | • Rapidly Evolving Healthcare Infrastructure Drives High Demand for Medical Consumables and Market Growth • Growing Focus on Preventive Healthcare Fuels Demand for Medical Consumables and Innovations in Self-Care |

| Restraints | • Regulatory Challenges and Competition Restrain Growth of Medical Consumables Market Amid Innovation Pressure |