Medical Laser Market Key Insights:

To Get More Information on Medical Laser Market - Request Sample Report

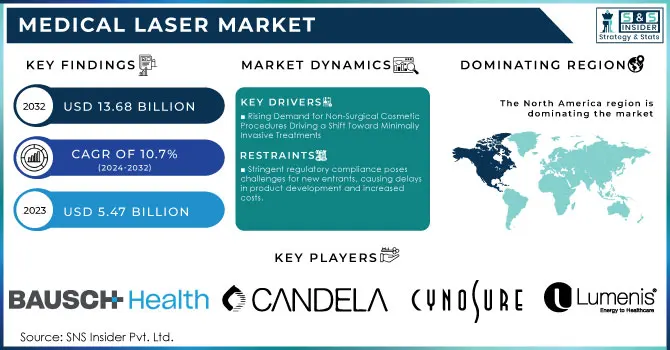

The Medical Laser Market Size was valued at USD 5.47 billion in 2023 and is expected to reach USD 13.68 billion by 2032 and grow at a CAGR of 10.7% over the forecast period of 2024-2032.

The medical laser market is likely to emerge robustly globally, mostly as a result of the growing use of non-invasive cosmetic procedures and the surging demand for minimally invasive devices. This is because more people prefer such treatments that involve much lower risk and faster recovery times for patients; this allows for finer results and is almost imperceptible. Increased awareness and acceptance will likely be the major driving force behind market growth in the next few years, with the dual element. For instance, the British Association of Aesthetic Plastic Surgeons claimed that a whopping 31,057 cosmetic surgery procedures were conducted in the UK last year, and the number showed an incredible 102% increase from 2022. In addition, a significant demand rise of age-related medical treatments and aesthetic procedures is prevalent, which has increased in developing countries. As reported by the American Society for Aesthetic Plastic Surgery, Americans spent over USD 13 billion on aesthetic treatments in 2022. This includes various procedures such as preventing acne and body contouring and drives more demand in the market.

As healthcare facilities began re-opening to continue providing services during the aftermath of the pandemic, there has been a resurgence of interest in medical lasers. During the fiscal year 2021, Iridex Corporation experienced a boom of 48.3% in revenues related to laser systems, and this figure even peaked at USD 53.9 million. This market growth is further fueled by technological advancements, as the Refractive Surgery Council reports growing volumes of laser vision correction procedures. The LASIK, SMILE, and PRK procedures increased by 48.0% in the third quarter of 2021 compared with the same period last year. Moreover, new products will emerge on the market, such as IRIDEX Corporation's Iridex 532 and 577 Lasers, released in January 2024, to treat retinal diseases and glaucoma with increased efficiency.

Chronic diseases have increased significantly, and the development and implementation of high-tech medical equipment are necessary. Even the American Cancer Society still puts out statistics that skin cancer is at an all-time high in the United States with more than 5.4 million yearly diagnoses. Along with this is the great responsibility that medical lasers take in treating and handling chronic diseases, including oncology and ophthalmology procedures. The expansion of application fields of lasers in various clinical fields, despite the high cost of medical laser devices, is one of the major growth opportunities for the medical laser market. The market would experience significant growth during 2023, even with the worst economic recession. The root cause of this recession was a sharp decline in healthcare spending.

Medical Laser Market Dynamics

Drivers

-

Rising Demand for Non-Surgical Cosmetic Procedures Driving a Shift Toward Minimally Invasive Treatments

A rapidly growing trend toward non-invasive, not surgical laser therapy is being observed in the cosmetic medicine market. This is a less invasive, safer alternative to traditional surgical treatments. Laser therapy and microdermabrasion have become the most popular treatments because they offer natural results and treat various cosmetic concerns. The most important advantage is the relatively short time that would be needed to abstain from their daily activities, because of which recuperation is swift, and overall major interference to their daily lives is kept minimum. This inbuilt factor makes these treatments compatible with a cross-section of age groups, besides making these accessible and incorporating the requirements of the individual.

These non-invasive treatments do offer an attract for the patient, as these ensure that the scar is avoided or minimized, which is one of the greatest apprehensions in patients' minds unwilling to undergo surgical procedures that leave behind scars. However, these treatments are performed by qualified healthcare professionals who can assure safety and effectiveness. It would be nonsensical to indicate that a plan is required without consulting health care providers. This builds on the qualifications of caution and knowledge that most notably has been applied to aesthetic treatments. Therefore, the growing acceptance of non-surgical techniques and their convenience, which is coupled with efficacy, will be substantial contributors to market growth in the medical laser market.

Restraints

-

Stringent regulatory compliance poses challenges for new entrants, causing delays in product development and increased costs.

-

Global regulatory variations limit practitioner flexibility and necessitate ongoing education, highlighting the importance of patient safety and compliance.

Medical Laser Market - Key Segmentation

By Product Type

The major products used in the 2023, medical laser market were solid-state laser systems accounting for about 45.0% of the product market. Their use is dominated by being very versatile reliable and efficient in a wide variety of medical applications including surgery, dermatology, and ophthalmology. Solid-state lasers have proven to provide high precision and excellent performance, making them very desirable for many treatments and procedures.

The diode laser systems segment is experiencing high growth, reflecting a CAGR of 15.0% over the forecast period. This can be attributed to its compact size, cost-effectiveness, and adaptability for diverse applications like hair removal and skin resurfacing. A boom in non-invasive cosmetic procedures has added much value to the take-up of diode lasers, which are often favored by professionals and patients alike.

By Application

Aesthetic and dermatology lasers were the dominant application segment in 2023, with nearly 40.0% share in the total market. The surge in demand for non-surgical cosmetic treatments combined with higher awareness of their importance and need in maintaining healthy skin led to this growth in this segment. Rising acceptance of laser hair removal, tattoo removal, and skin rejuvenation contributed to the increased demand for aesthetic lasers.

The ophthalmology lasers segment is likely to be the industry's fastest-growing application, having a CAGR of 12.0%. The growth in the incidence of eye disorders, particularly cataracts and refractive errors, coupled with technological advancements in laser treatments that result in better outcomes will be driving factors for this segment. Increased LASIK procedures and new laser system launches would promote this application further.

By End User

The medical lasers market is dominated by hospitals, which account for approximately 50.0% of the overall market in 2023. This is because most hospitals have an extensive infrastructure that allows for advanced applications of laser technology in surgery and therapy. Besides, due to the large number of patients they have to treat, the usage levels of medical lasers also see a substantial increase.

The fastest growth can be witnessed in the dermatology and cosmetic clinics segment with a projected CAGR of 14.0%. This growth is mainly attributed to the upsurge in demand for aesthetic treatments and increasing self-care among consumers. Increased requests for non-invasive treatments have led to the increased adoption of advanced laser technologies by dermatology and cosmetic clinics as it helps them to satisfy patient expectations and also treat patients accordingly.

Medical Laser Market Regional Analysis

In 2023, North America led the medical laser market by generating a revenue share of 48.9%. This positioning can be sustained throughout the forecast period. There can be several key factors with this dominance, including strong demand for minimally invasive medical procedures, high preference for cosmetic treatments, and accelerating adoption of novel technologies in the United States. The latest available data reported by the American Society of Plastic Surgeons explains that 23.7 million minimally invasive cosmetic procedures and 1.5 million cosmetic surgical procedures were carried out in 2022, reflecting strong market activity within the region.

Asia Pacific is the second-biggest market in 2023 and will see the fastest growth over the next several years. This growth could be interlinked with the continuous development of healthcare infrastructure and on-the-rise laser centers across this region. Furthermore, the need for anti-aging treatments is rising, and hair removal procedures, which would be driving the demand for aesthetic lasers. The Asia Pacific market will be expected to see expansion and will follow the patterns of broader consumer preferences for treatment, along with significant advancements in medical technology, as consumers increasingly demand effective and non-invasive solutions.

Do You Need any Customization Research on Medical Laser Market - Enquire Now

Key Players and Their Medical Laser Offerings

-

Bausch Health Companies Inc. - LASIK and cataract laser systems

-

Cynosure - Aesthetic laser systems for hair removal, skin rejuvenation, and tattoo removal

-

Lumenis Be Ltd. - Dermatology, surgical, and ophthalmology laser devices

-

Candela Corporation - GentleMax Pro laser system for hair removal and skin treatments

-

TOPCON CORPORATION - Ophthalmic laser technology for retinal and cataract surgery

-

IRIDEX Corporation - Lasers for glaucoma treatment and aesthetic applications

-

Sisram Medical Ltd (Alma Lasers) - Aesthetic laser devices for skin resurfacing and body contouring

-

BIOLASE, Inc. - Dental lasers for soft tissue surgery and teeth whitening

-

El.En. S.p.A. - Aesthetic laser systems for hair removal and skin treatments

-

LAMEDITECH - Laser technology for cosmetic and medical applications

-

Artivion, Inc. - Laser technology for surgical applications, particularly in cardiovascular procedures

-

Novartis AG - Laser therapies in ophthalmology

-

Boston Scientific Corporation - Laser systems for surgical applications

-

Lumibird Medical - Laser technologies for ophthalmology

-

Koninklijke Philips N.V. - Laser solutions for medical applications

Recent Developments

-

In Aug 2024, MedWorld Advisors officially announced the formation of the MedTech Laser Group, a milestone achieved through the acquisition of shares in A.R.C Laser GmbH and G.N.S. neoLaser Ltd.

-

In June 2024, UVA Health launched an outpatient eye surgery clinic that provides laser vision correction procedures, featuring the popular LASIK surgery among its offerings.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.47 Billion |

| Market Size by 2032 | USD 13.68 Billion |

| CAGR | CAGR of 10.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Solid State laser systems, Gas laser systems, Dye laser systems, Diode laser systems) • By Application (Ophthalmology lasers, Surgical lasers, Aesthetic and Dermatology Lasers, Others) • By End User (Hospital, Dermatology and Cosmetic Clinics, Ophthalmic Clinics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bausch Health Companies Inc., Cynosure, Lumenis Be Ltd., Candela Corporation, TOPCON CORPORATION, IRIDEX Corporation, Sisram Medical Ltd (Alma Lasers), BIOLASE, Inc., En. S.p.A., LAMEDITECH, Artivion, Inc., Novartis AG, Boston Scientific Corporation, Lumibird Medical, Koninklijke Philips N.V., and Others |

| Key Drivers | • Rising Demand for Non-Surgical Cosmetic Procedures Driving a Shift Toward Minimally Invasive Treatments |

| Restraints | • Stringent regulatory compliance poses challenges for new entrants, causing delays in product development and increased costs. • Global regulatory variations limit practitioner flexibility and necessitate ongoing education, highlighting the importance of patient safety and compliance. |