Ophthalmic Clinical Trials Market Report Scope & Overview:

The Ophthalmic Clinical Trials Market size was valued at USD 1.64 billion in 2024 and is expected to reach USD 2.73 billion by 2032, growing at a CAGR of 6.62% over the forecast period of 2025-2032.

To Get more information on Ophthalmic Clinical Trials Market - Request Free Sample Report

The ophthalmic clinical trials market is witnessing steady growth with the growing incidence of eye diseases, such as macular degeneration, glaucoma, and diabetic retinopathy. Growth in R&D spending by pharma and biotech firms and improvements in ophthalmic diagnostics and therapeutics are propelling trial activity. Support from regulatory authorities for expedited approvals and developments in drug delivery systems is also driving the market growth.

For instance, according to the CDC, about 1.8 million Americans aged 40 and older suffer from age-related macular degeneration (AMD). Also, about 7.3 million people with large drusen have an increased risk of getting the disease. AMD is the leading cause of irreversible loss of reading and close-up vision in people aged 65 and older.

The U.S. ophthalmic clinical trials market size was valued at USD 0.67 billion in 2024 and is expected to reach USD 1.10 billion by 2032, growing at a CAGR of 6.41% over the forecast period of 2025-2032.

The U.S. dominates the North American ophthalmic clinical trials market based on its developed healthcare infrastructure, robust pharmaceutical and ophthalmic clinical trials companies' presence, and favorable regulatory environment. Moreover, the high level of ophthalmic research activities and clinical trial activity in the country further solidifies its leadership position in the region.

Ophthalmic Clinical Trials Market Dynamics:

Drivers:

-

Increasing Prevalence of Eye Diseases is Driving the Ophthalmic Clinical Trials Market Trends

The increasing incidence of eye diseases, such as age-related macular degeneration (AMD), glaucoma, diabetic retinopathy, and cataracts, is one of the significant drivers for the ophthalmic clinical trials market. For instance, according to the CDC, about 20.5 million Americans aged 40 and above, 17.2% of this population, suffer from cataracts in one or both eyes, and about 6.1 million (5.1%) have had lens removal surgery. The increase in patients affected by such diseases, especially in light of an aging population globally, has raised a significant demand for cutting-edge treatments. This, in turn, drives demand for clinical trials aimed at developing new drugs and devices for treating these diseases.

-

Increasing Investment in Ophthalmic Research and Development is Propelling the Market Growth

The rising investment in ophthalmic research and development from both the public and private sectors is another major impetus for the market growth. Pharmaceutical and biotech firms are also investing more in clinical trials to get new drugs, biologics, and medical devices on the market. Moreover, academic institutions, research institutes, and industry players are also collaborating and further driving the growth of the ophthalmic clinical trials market.

Restraints:

-

High Costs of Clinical Trials are Restraining the Market Growth

One major constraint for the market is the expense of clinical trials. Clinical trials are usually very costly due to the treatments for eye diseases are complicated, and advanced technologies are required for diagnosis and monitoring. The expense of executing ophthalmic clinical trials market analysis, such as recruitment of patients, high-tech equipment, and extensive trial duration, may be expensive enough to disallow entry from smaller firms to the market. The expense further increases due to regulatory requirements and owing to long follow-up periods required to determine treatment safety and effectiveness. This economic hurdle can create a delay in innovation and inhibit market expansion.

Ophthalmic Clinical Trials Market Segmentation Analysis:

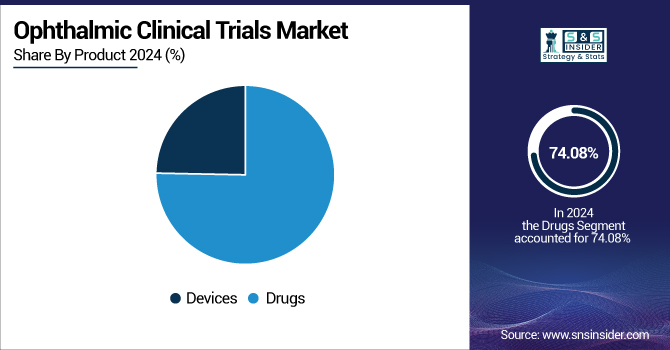

By Product

In 2024, the drugs segment dominated the market with a 74.08% market share due to a strong pipeline of new drugs for common eye diseases, such as macular degeneration, glaucoma, and diabetic retinopathy. The intense need for new ophthalmic drugs and biologics has been a key stimulator. For instance, the U.S. FDA approval of Apellis Pharmaceutical's SYFOVRE, the first such therapy to gain approval, was a milestone demonstrating the growth segment. Such breakthroughs support the focus of drug development toward filling unmet medical needs for ophthalmic applications.

The devices segment is anticipated to grow at the fastest rate in the market. This growth is traced to technological innovation in ocular medical devices, including the incorporation of artificial intelligence for improved diagnostics and patient observation. Developments, such as Ora, Inc.'s EyeCup platform, which leverages AI for real-time patient data collection and analysis, are characteristic of this trend. Such innovations are transforming eye care by enhancing diagnostic acumen and patient outcomes, thus driving the expansion of the devices segment in clinical trials.

By Indication

In 2024, the retinopathy segment dominated the market with a 26.52% market share, driven largely by the rising incidence of diabetic retinopathy and extensive research and development activities aimed at the disease. For instance, in India, more than 17% of those with diabetes suffer from diabetic retinopathy, with 3.6% experiencing potential vision-threatening complications. This excessive disease burden has fueled many clinical trials and new treatments, such as Ocuphire Pharma's Phase 2 ZETA-1 trial evaluating oral APX3330 for diabetic retinopathy. These efforts highlight the priority of treating retinopathy, further solidifying its market supremacy.

For instance, according to the CDC, Diabetic retinopathy (DR) risks can be reduced by effectively controlling blood sugar, blood pressure, and cholesterol. Early detection and timely treatment greatly minimize the potential for vision loss. Yet, almost 50% of patients with DR either do not receive regular eye exams or are diagnosed late for successful intervention. It is estimated that 4.1 million Americans have retinopathy, and about 899,000 cases are vision-threatening.

The glaucoma segment is expected to witness the fastest growth in the market over the forecast period. The segment’s growth is fueled by an improving pipeline of glaucoma medicines and enhanced investment by contract research organizations in research to develop glaucoma treatments. The key drugs in the glaucoma pipeline include candidates such as NCX 470, Cromakalim prodrug 1, Omidenepag isopropyl, QLS-101, and GS010. Such advancements, combined with increasing awareness and early detection programs, are driving the sharp growth of glaucoma-targeted clinical trials.

By Phase

In 2024, the clinical phase segment led the ophthalmic clinical trials market with 78.14% market share. This leadership is mainly attributable to the rise in clinical research in the ophthalmology treatment sector. Most therapeutics remain under observational clinical practices, hence driving the segment's growth. For instance, in March 2023, Bausch + Lomb and Novaliq GmbH revealed positive Phase III results on NOV03 (perfluorohexyloctane) in the American Journal of Ophthalmology. Chengdu Shengdi Pharmaceutical Co. also received marketing authorization approval from the Chinese National Medical Products Administration for its eye drops, cyclosporine ophthalmic solution, in the treatment of dry eye disease. Such trends highlight the strong pipeline of clinical products, ranging from Phase I to the observational commercialization phase, which is fueling the growth in the clinical phase segment in the market.

The preclinical phase segment will continue to experience the fastest growth in the market during the forecast period. This growth is driven by the increasing interest of researchers in finding and developing new therapeutics for eye diseases. The rise in research and development activities has caused contract research organizations (CROs) to become a major player in the market. Many pharmaceutical and biopharmaceutical firms have outsourced their preclinical services to CROs to speed up the drug discovery processes.

By Sponsor Type

In 2024, the pharmaceutical/biopharmaceutical companies segment dominated the ophthalmic clinical trials market share with 60.30%. This is due to the growing number of companies that are engaged in the research and development of new ophthalmic medicines. For instance, in December 2022, Ocuphire Pharma, Inc., a biopharmaceutical company that specializes in ophthalmic research-based drugs, filed a new drug application with the U.S. FDA for the Ophthalmic Phentolamine Solution for the treatment of presbyopia, reversal of pharmacologically-induced mydriasis, and night vision disturbances. Such initiatives are expected to enhance the growth of the segment in the market.

The other segment, comprising contract research organizations (CROs) and medical institutes, is expected to witness the highest growth in the ophthalmic clinical trials market over the forecast period. This ramp-up can be traced to the rising trend of outsourcing clinical research to contract developers. In July 2022, RegeneRx Biopharmaceuticals, Inc., a drug development firm, announced that its U.S. joint venture partner, HLB Therapeutics (HLBT), agreed with a global ophthalmology contract research organization to conduct phase III clinical trials for neurotrophic keratitis (NK) patients.

Regional Outlook

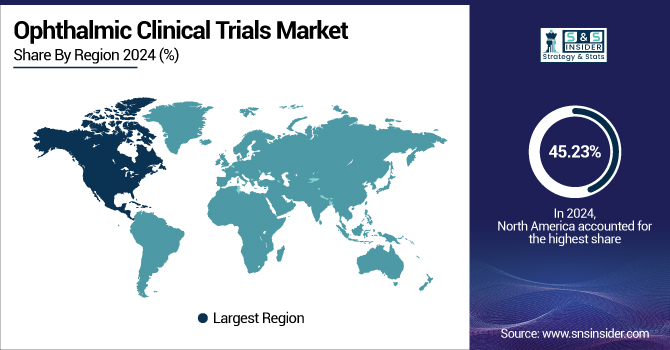

North America Ophthalmic Clinical Trials Market Trends

North America dominated the ophthalmic clinical trials market with a 45.23% share due to its established healthcare infrastructure, high research and development funding, and presence of key pharmaceutical and biotechnology firms. The region is also helped by cutting-edge ophthalmic diagnostic technology and a high incidence of age-related eye disease, including macular degeneration and glaucoma, which fuel ongoing clinical research. Furthermore, favorable regulatory agencies, such as the FDA, allow for easy approval and monitoring of trials, allowing for efficient development timelines.

Asia Pacific Ophthalmic Clinical Trials Market Trends

Asia Pacific is the fastest-growing region in the ophthalmic clinical trials market with 7.26% CAGR over the forecast period, driven by the rising healthcare investments, enhanced eye health awareness, and an expanding patient base with unmet ophthalmic needs. China, India, and South Korea are upgrading their clinical research infrastructure and providing cost-effective trial conduct, which is drawing international sponsors. In addition, government programs to advance clinical research and accelerated regulatory routes are supporting the quick growth of ophthalmic trials in the region.

Europe's dominance of the ophthalmic clinical trials market is driven by its robust healthcare infrastructure, strict regulatory frameworks, and keen emphasis on innovative ophthalmic research. Countries such as the United Kingdom, Germany, and France play a major role, with the UK facilitating through means of state-of-the-art clinical research facilities and a pleasant regulatory environment. Germany is a leading region in the ophthalmic clinical trials arena in Europe through its strong health care infrastructure, high investment in ophthalmology research, and extensive network of specialized eye care facilities.

Latin America and the Middle East & Africa (MEA) regions are experiencing moderate growth in the ophthalmic clinical trials market with advances in healthcare infrastructure, growing patient recruitment, and economically viable conduct of trials. Nations such as Brazil, Mexico, Saudi Arabia, and South Africa are more involved in clinical research through investing and support at a regulatory level.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Market Players:

The key players in the market are Charles River Laboratories International, ICON Plc, IQVIA, Laboratory Corporation of America Holdings, Vial, Medpace, ProTrials Research, Syneos Health, Worldwide Clinical Trials, ProRelix Services, and other players.

Recent Developments in the Ophthalmic Clinical Trials Industry

-

July 2024 – Charles River Laboratories International, Inc. and AAVantgarde entered into a CDMO agreement with a focus on manufacturing Good Manufacturing Practice (GMP) plasmid DNA. Through this collaboration, AAVantgarde, a clinical-stage biotechnology company working on inherited retinal disease therapies using proprietary AAV vector platforms, will leverage Charles River's specialized capabilities in GMP-grade plasmid DNA manufacturing to advance its gene therapy development programs.

Ophthalmic Clinical Trials Market Report Scope:

Report Attributes Details Market Size in 2024 USD 1.64 Billion Market Size by 2032 USD 2.73 Billion CAGR CAGR of 6.62% From 2025 to 2032 Base Year 2024 Forecast Period 2025-2032 Historical Data 2021-2023 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Product (Devices, Surgical & Diagnostics Devices, Vision Care Devices, Drugs, OTC Drugs, Prescription Drugs)

• By Indication (Macular Degeneration, Glaucoma, Dry Eye Disease, Retinopathy, Uveitis, Macular Edema, Blepharitis, Cataract, Optic Neuropathy, Others)

• By Phase (Discovery Phase, Preclinical Phase, Clinical Phase)

• By Sponsor Type (Pharmaceutical/Biopharmaceutical Companies, Medical Device Companies, Others)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) Company Profiles Charles River Laboratories International, ICON Plc, IQVIA, Laboratory Corporation of America Holdings, Vial, Medpace, ProTrials Research, Syneos Health, Worldwide Clinical Trials, ProRelix Services, and other players.