Duchenne Muscular Dystrophy Drugs Market Overview & Scope

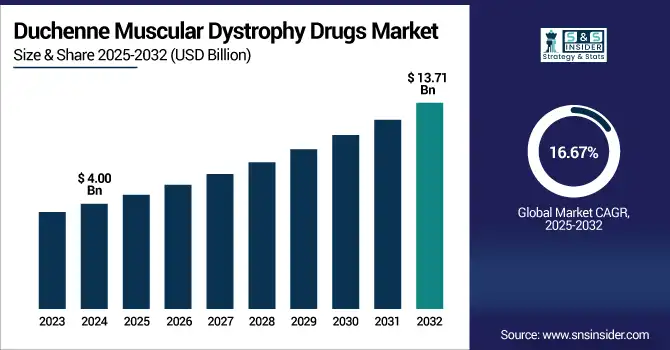

The duchenne muscular dystrophy drugs market size was valued at USD 4.00 billion in 2024 and is expected to reach USD 13.71 billion by 2032, growing at a CAGR of 16.67% over the forecast period of 2025-2032.

The global duchenne muscular dystrophy drugs market is expected to grow at a rapid pace, mainly due to the huge progress in gene therapy, which targets the primary root of the genetic cause instead of only treating the symptoms. FDA approval of paradigm-shifting treatments, including Sarepta’s ELEVIDYS, has changed the narrative over symptom management to curative potential, escalating market demand, and investment. Gene therapies that provide functioning dystrophin genes also appear to be a runway to muscle strength recovery, given strong R&D pipelines. Whilst safety and cost issues remain, continued advances in vector design and manufacturing are generating improvements in outcomes and access, underpinning commercial opportunities and patient adoption in the U.S., Europe, and beyond.

For instance, on 28 February 2024, Sarepta reported USD 135 million in Q4 2023 ELEVIDYS sales, projecting over USD 500 million in 2024 due to expanded commercial uptake.

To Get more information on Duchenne muscular dystrophy drugs market - Request Free Sample Report

The U.S. Duchenne Muscular Dystrophy Drugs Market was valued at USD 1.54 billion in 2024 and is expected to reach USD 5.21 billion by 2032, growing at a CAGR of 16.53% over 2025-2032.

The U.S. dominates the Duchenne muscular dystrophy drugs market due to accelerated FDA approvals, aid from the government for rare disease treatment, and the urgent need for innovative drugs in the paediatric sector. Policies are tending to favour fast-track access with surrogate endpoints, including micro-dystrophin expression, allowing an early uptake of gene therapies, including Sarepta’s Elevidys. Moreover, the U.S. health care system often funnels expensive treatments through strong reimbursement channels. These factors lead the U.S. having the largest duchenne muscular dystrophy drugs market share globally and are expected to grow at a rapid pace and innovate.

For instance, in June 2024, the FDA expanded Elevidys' approval to non-ambulatory DMD patients aged 4+, increasing the eligible U.S. patient pool by over 40%, boosting market growth.

Duchenne Muscular Dystrophy Drugs Market Dynamics

Drivers:

-

Rising Incidence and Prevalence, Driving the Duchenne Muscular Dystrophy Drugs Market Growth

The rising incidence of duchenne muscular dystrophy in developing countries will remain the key driver of the Duchenne muscular dystrophy market's growing patient pool. This is the impetus for pharmaceutical research and development in gene and exon-skipping therapies, earlier diagnosis, and greater therapy eligibility. Higher prevalence in North America and Asia Pacific, and a conducive healthcare system and funding aid the adoption and progression of the expected Duchenne muscular dystrophy drugs market through 2030.

For instance, in April 2024, the U.S. CDC and Japan expanded newborn screening for DMD, targeting to boost early diagnoses by 25%–30% over the next five years.

Restraints:

-

Diagnostic Delays in Duchenne Muscular Dystrophy, Restraining the Duchenne Muscular Dystrophy Drugs Market Growth

Diagnostic delays in duchenne muscular dystrophy result in anxiety, heartache, and frustration for the families, which further underlines the need for early intervention. These mental strains and lost treatment windows underscore the urgent need for faster diagnosis and mental health assistance. As prevalence increases, it promotes early screening, early diagnosis, and demand for effective treatments, which also accelerates the duchenne muscular dystrophy drugs market growth by inducing a global increase in the size and growth of the market.

For instance, in January 2025, A survey showed 41% of DMD parents experience moderate to severe anxiety, with late diagnoses doubling emotional burnout, highlighting the urgent need for faster diagnosis and support.

Duchenne Muscular Dystrophy Drugs Market Segmentation:

By Treatment

Molecular-Based Therapies were the dominant segment in the Duchenne muscular dystrophy drugs market analysis, with a market share of 43.86% share in 2024, owing to their specific influence on the genetic basis of the disease, with enhanced potency compared with standard therapies. This section holds the majority of the Duchenne muscular dystrophy drugs market share, driven by improved FDA-approved tests, an increase in R&D spending, and a surge in unmet clinical needs.

Steroid-based therapies are emerging as the fastest-growing segment in the duchenne muscular dystrophy drugs market trend, with the highest CAGR of 17.23% over the forecast period, as they are known to slow down muscle degeneration and restore mobility. These treatments are widely available and are being increasingly recommended at an early stage of the condition in support of disease management. Their low cost and proven clinical efficacy are the major factors that boost the Duchenne muscular dystrophy drugs market growth, particularly in developing regions with economic constraints.

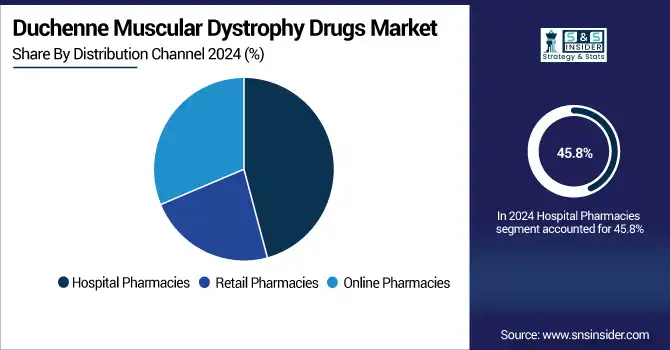

By Distribution Channel

In 2024, the Hospital Pharmacies segment controlled the global Duchenne muscular dystrophy drugs market share, owing to their vital role in the execution of complex treatments, including gene therapy, and controlling very expensive specialty medications. Their potential for integration with diagnostic and specialist care allows for precisely-timed drug delivery. It is estimated that this segment will hold the maximum share of the duchenne muscular dystrophy drugs industry, owing to centralized treatment guidelines and improved patient access in hospitals.

The Online Pharmacies are the fastest-growing segment in the Duchenne muscular dystrophy drugs industry, fuelled by growing digital adoption, home delivery convenience, and better availability in far-flung regions. Demand is further raised by the rising levels of awareness, by patient assistance programs, and by the growing integration of telemedicine. In remote areas and technology-enabled spaces, the new model improves access to treatment and makes a key contribution to the Duchenne muscular dystrophy drugs market growth.

Regional Insights: Duchenne Muscular Dystrophy Drugs Market Trends

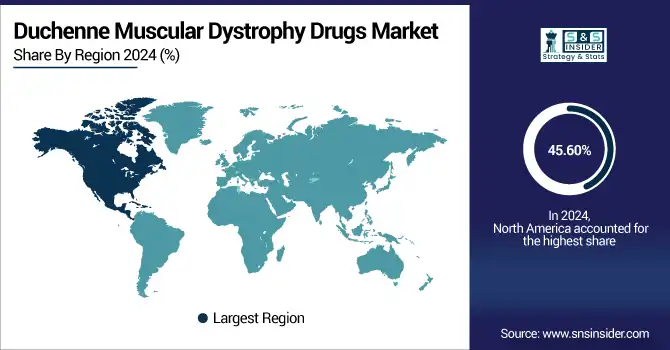

In 2024, the North American region dominated the duchenne muscular dystrophy drugs industry and accounted for 45.60% of the overall revenue share, owing to its well-established system of healthcare, early diagnosis initiatives, and access to sophisticated treatments. The numbers support rapid adoption of new therapies, with major pharmaceutical companies on the ground, robust regulatory environments courtesy of the FDA’s accelerated approval process, and high healthcare spending. Furthermore, higher patient health awareness levels, insurance coverage have promoted the therapy adoption rate, and thereby the region in North America is dominating the Light-Therapy market in terms of the market value and innovation. With ongoing clinical trials, government initiatives, and early intervention strategies, the duchenne muscular dystrophy treatment space is witnessing steady growth throughout the region.

Europe accounts for the second-largest duchenne muscular dystrophy drugs market share, owing to good healthcare infrastructure, Government support, including EMA, and early adoption of treatments, including Translarna and Viltepso. Diagnosis and access are improved by government-supported rare disease programs and expanded newborn screening. Moreover, the rising number of clinical trials and partnerships with biotech companies are viewed as another factor for the increased treatment options that are available, further adding to the sizeable presence of Europe within the Global Duchenne muscular dystrophy drugs industry landscape.

The Asia Pacific region is projected to grow with the fastest CAGR of 17.39% over the forecast period, with growing awareness of disorders, growth in healthcare spending, and greater availability of modern therapies. Nations and systems, including Japan, China, and South Korea, are making significant efforts to fund rare disease research and diagnostics, resulting in earlier diagnosis and initiation of treatment. Government developments are also enhancing affordability and access. Government efforts to incorporate DMD in the national health coverage and rare disease programs are facilitating the expansion of both affordability and access. Furthermore, local pharmaceutical companies were making their way into the market through partnerships and clinical trials, speeding the drug development process. The increasing population, a developed regulatory framework, and an increase in the online pharmacy platforms are also having a positive impact on therapy adoption. All these factors are fueling robust duchenne muscular dystrophy drugs market growth in Asia Pacific

The Middle East & Africa are a relatively smaller but emerging region in the duchenne muscular dystrophy drugs market, on the back of increasing healthcare penetration and increasing rare disease awareness. Another driving factor of the growth in the Middle East is the increased importance of genetic counselling and consanguinity screening programs, especially in the Gulf states, where inherited diseases are common. Government initiatives to establish rare disease registries also contribute to early diagnosis and the availability of future treatment.

The Latin American market is developing in the duchenne muscular dystrophy drugs industry, as the diagnosis rate is expanding, healthcare infrastructure is improving, and healthcare professionals are becoming more aware. Countries including Brazil and Mexico are putting in place rare disease policies and broadening access to life-saving treatments. Nevertheless, obstacles must be overcome by inadequate reimbursement models and high cost of treatment, which causes global non-implementation. The situation is slowly being changed by clinical trials and advocacy.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Driving the Duchenne Muscular Dystrophy Drugs Market

-

PTC Therapeutics

-

Pfizer Inc.

-

NS Pharma

-

Santhera Pharmaceuticals

-

ReveraGen BioPharma

-

Dyne Therapeutics

-

Entrada Therapeutics

-

Genethon and other players.

Recent Developments in the Duchenne Muscular Dystrophy Drugs Industry

-

In June 2024, Sarepta received expanded FDA approval for ELEVIDYS, a gene therapy, to treat ambulatory children with DMD aged 4 to 5, regardless of mutation type.

-

In January 2024, Pfizer shared top-line data over the global CIFFREO Phase 3 trial for fordadistrogene movaparvovec (gene therapy). Results showed no statistical significance in primary endpoints.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4.00 billion |

| Market Size by 2032 | USD 13.71 billion |

| CAGR | CAGR of 16.67% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Treatment (Molecular-Based Therapies, Steroid-Based Therapies, Non-steroidal Anti-Inflammatory Drugs (NSAIDs), Others) •By Distribution Channel(Hospital Pharmacies, Retail Pharmacies, Online Pharmacies)" |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Sarepta Therapeutics, PTC Therapeutics, Pfizer Inc., NS Pharma, Wave Life Sciences, Santhera Pharmaceuticals, ReveraGen BioPharma, Dyne Therapeutics, Entrada Therapeutics, Genethon, and other players |