Medical Robots Market Report Scope & Overview:

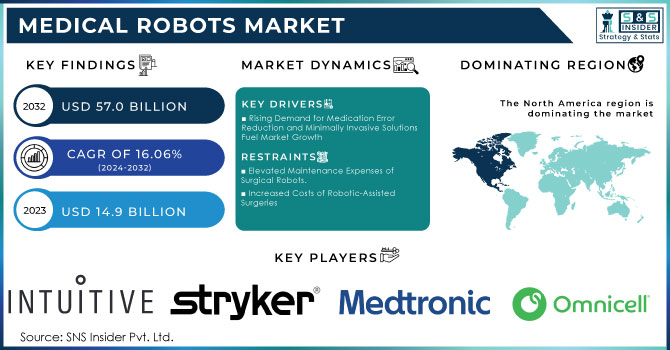

The Medical Robots Market Size was valued at USD 14.9 billion in 2023 and is expected to reach USD 57.0 billion by 2032 and grow at a CAGR of 16.06% over the forecast period 2024-2032.

Get More Information on Medical Robots Market - Request Sample Report

The medical robots market is witnessing significant growth with the evolution of technology in its core forms, healthcare automation, enhanced funding, and the development of healthcare infrastructure. This trend of growth is further spurred by an increase in chronic diseases and population aging in the world. Growth is due to the high demand for the reduction of medication errors and improvement in precision for laparoscopic and other surgeries. For instance, the increasing levels of trauma injuries and the requirement for various surgical interventions among the aging population have given medical robots a place in high demand. There is a significant shift toward minimally invasive surgeries (MIS) compared to traditional open surgical procedures across the world, thus increasing the market opportunities available for the use of medical robots and promoting sales. It has been estimated that in the forecasting period, medical robotics will experience steady growth due to better advancements in the field of laparoscopic robotics and the introduction of procedure-specific new robots.

The market also benefits from fewer post-surgical complications, short durations of hospital stay, and lower operational costs relevant to robotic-assisted surgery. Increased neurological and orthopedic disorders alongside increased investment by companies in R&D and advanced healthcare infrastructure are further driving the medical robot market toward positive growth. Other factors revving the market forward include the popularity of MIS, the aging population, increased funding for research on robots, and acceptance of robotic-assisted laparoscopic procedures.

Expansion of healthcare centers, increasing patient visits, and increased government spending on the healthcare industry towards better care processes are also boosting demand for medical robots worldwide. Emerging markets present considerable opportunities for growth as these have an increasing number of surgical procedures, increased patient base, and growing medical tourism. India is one such market that provides low-cost treatment compared with developed economies and has relaxed regulation standards. The explosion of affordable healthcare and business-friendly policies encourages medical robot companies to focus on emerging markets in Asia-Pacific and Latin America. Coupled with rising healthcare spending, technological advancements, and expansive operations by larger players, such a trend will propel the global medical robots market share toward significant growth over the next few years.

| Application Area | Description | Example Technologies | Benefits |

|---|---|---|---|

| Surgery | Performing complex surgical procedures | Robotic surgical systems | Minimally invasive options |

| Rehabilitation | Assisting patient recovery and mobility | Exoskeletons, therapy robots | Faster recovery, increased independence |

| Diagnostics | Enhancing diagnostic accuracy and speed | Robotic imaging systems | Timely and accurate diagnoses |

| Telemedicine | Facilitating remote consultations | Telepresence robots | Expanded patient access |

| Hospital Logistics | Automating supply chain and delivery | Autonomous delivery robots | Cost and time efficiency |

Medical Robots Market Dynamics

Drivers

-

Rising Demand for Medication Error Reduction and Minimally Invasive Solutions Fuel Market Growth

The growing demand for the reduction of medication errors has become one of the significant driving forces behind increased automation in healthcare: medical robots. Medication errors - as defined by the National Coordinating Council for Medication Error Reporting and Prevention as any preventable event that may result in the following circumstances: improper medication use or patient harm to explain the most common causes for hospital readmission globally. Some of the current issues that may lead to such errors include poor communication between healthcare providers, look-alike packaging, similar prescriptions, and poor drug storage practices. To avoid all these types of medication errors, automated systems for pharmacies such as ADMs and ADCs have been found to help significantly minimize such errors and create safe environments in which care can be provided to patients. With this, more governments are promoting the adoption of such automated systems, which in turn extends pharmacy automation across the globe.

Another rapid growth in the medical robots market is due to the rising demand for MIS (minimally invasive surgeries). Surgical robots, specifically in complex laparoscopic procedures, have become more efficient with greater accuracy and better patient outcomes. Advances in technology in medical robotics are building up these applications and represent a trend toward more automated, minimally invasive healthcare solutions. Key trends driving the market for medical robots include automation and precision-based procedures, set to expand further into higher healthcare needs and better concerns over patient safety.

Restraints

-

Elevated Maintenance Expenses of Surgical Robots

-

Increased Costs of Robotic-Assisted Surgeries

Medical Robots Market Segmentation Overview

By Robotic System

In 2023, surgical robots led the medical robots market, with nearly 65.0% share. This is largely because surgical robots are widely used in minimally invasive surgeries, especially orthopedics, neurosurgery, and laparoscopic procedures. Here, precision is high, and patients require minimal recovery time. These systems are increasingly becoming popular in hospitals as well as specialized surgical centers because their inclusion has been to enhance surgical accuracy and patient outcomes.

The fastest-growing segment of robotic systems is rehabilitation robots, expected to grow at a CAGR of over 17%. Physical rehabilitation needs among aging populations along with advancements in robotic-assisted therapy have accelerated the demand in this segment. Rehabilitation robots increase patient mobility and independence and are an attractive product for rehabilitation centers to provide more efficient, personal care.

By Application

As per application, laparoscopy dominated the market in 2023, accounting for about 40.0% share of the application market. It is more dominant because it plays a critical role in treating most medical conditions with minimal invasiveness, hence it is considered preferred in modern surgical practices. Demand for surgical robots in laparoscopy is growing continuously as patients and providers seek faster recovery times and fewer complications associated with traditional surgeries.

Neurosurgery is expected to grow the fastest, at 19% CAGR. The benefits of medical robots have been noticed most profoundly in neurosurgery when it comes to precision, which is one of the decisive factors in producing a proper outcome. Robotic-assisted neurosurgery reduces risk, maintains patient safety, and improves precision and is, therefore in great demand by hospitals and surgery centers.

By End-User

The end-user segment dominated by the hospital segment in 2023 held almost 60.0% of the market share. Hospitals are mostly adopting medical robots due to extensive resources and their ability to handle high-volume surgical and therapeutic applications. The growing hospital concern for improved patient outcomes and efficiency of operations has been a prime driver behind the adoption of surgical and pharmacy automation robots.

The fastest-growing end-user is rehabilitation centers, which is anticipated to grow at a CAGR of 16%. The demand for robotic assistance in rehabilitation centers is growing because such facilities emphasize advanced treatment methods to help patients recover. Rehabilitation robots facilitate customized interaction with patients, quickened recovery times, and self-reliance; thus, they form a core part of rehabilitation centers that would like to promote their service provision.

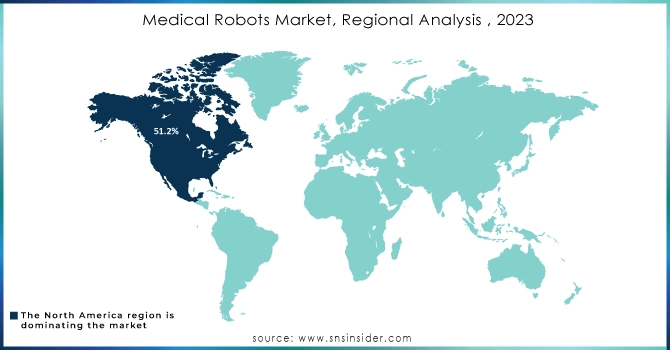

Medical Robots Market Regional Analysis

In 2023, North America accounted for 51.2% of the market share, due to its established healthcare network and mass investment from key players focused on developing new robotic technology. The region also boasts the highest patient adoption rates of minimally invasive surgical procedures, thereby propelling the demand for robotics to make operations more accurate and secure. This trend continues to gain momentum through intense focus on research and development in North America; constant improvements and expansion of robotic solutions contribute to a more advanced and efficient healthcare landscape.

The aging population, with a strong demand for minimally invasive and non-invasive surgical interventions, will fuel the growth of the Asia-Pacific medical robots market during 2024-2032. China will command the largest share in this region, primarily because of its large and significant health technology progress and increased investment in robotic solutions. India will be the leading market in Asia-Pacific- a sign of growing healthcare infrastructure, increasing patient awareness, and the adoption of advanced medical technologies. These factors combined support the Asian Pacific region to lead in terms of the global share of the medical robots market, which is likely to forecast this region to be a hotbed for growth and development over the years ahead.

Need Any Customization Research On Medical Robots Market - Inquiry Now

Key Players in the Medical Robots Market

-

Intuitive Surgical, Inc. (da Vinci Surgical System)

-

Stryker Corporation (Mako Robotic-Arm Assisted Surgery)

-

Medtronic Plc (Robotic-assisted surgery platform)

-

Becton, Dickinson, and Company (Automated medication dispensing systems)

-

Omnicell, Inc. (Robotic dispensing systems)

-

Arxium (Automated pharmacy solutions)

-

Asensus Surgical, Inc. (Senhance Surgical System)

-

Zap Surgical Systems, Inc. (Zap-X platform)

-

Renishaw Plc (Robotic systems for neurosurgery)

-

Smith & Nephew Plc (CORI Surgical System)

-

Zimmer Biomet Holdings, Inc. (Rosa robotic surgical system)

-

DIH Holdings US Inc. (Robotic healthcare solutions)

-

Accuray Incorporated (CyberKnife System)

-

CMR Surgical (Versius Surgical Robot)

-

Ekso Bionics Holdings, Inc. (Exoskeletons for rehabilitation)

-

Bionik Laboratories Corp. (Robotic rehabilitation devices)

-

Lifeward, Inc. (Robotic healthcare solutions)

-

Cyberdyne Inc. (HAL - Hybrid Assistive Limb)

-

Avateramedical GmbH (Robotic surgical systems)

-

Johnson & Johnson (Surgical robots and technologies)

-

Swisslog Healthcare (Automated pharmacy solutions)

-

Relay Robotics (Disinfection and delivery robots)

-

Aethon (TUG robots)

-

Xenex Disinfection Services Inc. (UV-C disinfection robots)

-

Zoll Medical Corporation (Automated cardiac care devices)

Recent Developments

-

In April 2024, iRobot Corporation introduced the Roomba Combo Essential Robot, a launch aimed at making robotic cleaning solutions more affordable for consumers.

-

In May 2024, Medrobotics Corporation sold its assets to address bankruptcy issues, resulting in a decrease in the company's market share within the industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 14.9 billion |

| Market Size by 2032 | US$ 57.0 billion |

| CAGR | CAGR of 16.06% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Robotic Systems (Surgical Robots, Rehabilitation Robots, Telepresence Robots, Others) • By Application (Laparoscopy, Radiation Therapy, Orthopedic Surgery, Neurosurgery, Pharmacy, Others) • By End-User (Hospitals, Ambulatory Surgical Centers, Rehabilitation Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Intuitive Surgical, Inc., Stryker Corporation, Medtronic Plc, Becton, Dickinson and Company, Omnicell, Inc., Arxium, Asensus Surgical, Inc., Zap Surgical Systems, Inc., Renishaw Plc, Smith & Nephew Plc, Zimmer Biomet Holdings, Inc., DIH Holdings US Inc., Accuray Incorporated, CMR Surgical, Ekso Bionics Holdings, Inc., Bionik Laboratories Corp., Lifeward, Inc., Cyberdyne Inc., Avateramedical GmbH, Johnson & Johnson, Swisslog Healthcare, Relay Robotics, Aethon, Xenex Disinfection Services Inc., Zoll Medical Corporation |

| Key Drivers | • Rising Demand for Medication Error Reduction and Minimally Invasive Solutions Fuel Market Growth |

| Restraints | • Elevated Maintenance Expenses of Surgical Robots • Increased Costs of Robotic-Assisted Surgeries |