MEMS Gyroscopes Market Size

Get More Information on MEMS Gyroscopes Market - Request Free Sample Report

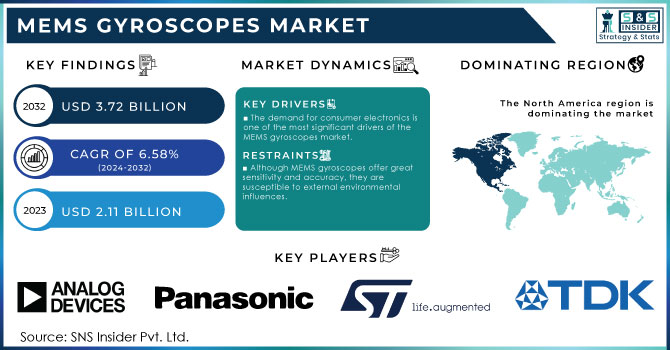

The MEMS Gyroscopes Market Size was valued at USD 2.11 Billion in 2023 and is expected to reach USD 3.72 Billion by 2032 and grow at a CAGR of 6.58% over the forecast period 2024-2032.

The MEMS gyroscopes market is experiencing rapid growth, largely due to the rising demand for mobile applications. Micro-electromechanical system (MEMS) gyroscopes enable the high level of motion-sensing precision required in modern smartphones. These tiny yet powerful sensors are incorporated into a range of consumer electronics, including digital cameras, camcorders, media players, tablet PCs, and gaming devices. MEMS gyroscopes enhance user experiences in consumer electronics by enabling features like screen rotation, motion-based gaming, augmented reality (AR), and virtual reality (VR) in smartphones and tablets.

In the automotive sector, MEMS gyroscopes play a critical role in advanced driver-assistance systems (ADAS), which are designed to improve safety and automation in vehicles. by 2023, 10 out of 14 tracked ADAS features achieved over 50% market penetration, with essential safety technologies such as forward collision warning, automatic emergency braking (AEB), lane departure warning, pedestrian AEB, and pedestrian detection warning—reaching penetration rates between 91% and 94%. In contrast, no ADAS feature had reached 75% penetration in 2020. MEMS gyroscopes enable the accurate measurement of angular movement and orientation essential to ADAS functions like lane-keeping assistance, adaptive cruise control, blind spot warning, automatic high beam control, and lane-centering assistance, all of which have now also surpassed 50% market penetration. These advancements are based on data from around 98 million vehicles across 168 models between 2015 and 2023, covering 80% of the U.S. market as represented by nine major manufacturers, including Ford, General Motors, Honda, Hyundai, Mazda, Mitsubishi Motors, Stellantis, Subaru, and Toyota. For autonomous and semi-autonomous vehicles, MEMS gyroscopes are essential for maintaining balance, detecting orientation changes, and enabling real-time responsiveness. These sensors form the backbone of self-driving technologies, allowing vehicles to navigate complex environments safely and efficiently. As the demand for ADAS and self-driving vehicles grows, MEMS gyroscopes are set to become even more integral to the future of automotive technology.

MEMS Gyroscopes Market Dynamics

Drivers

-

The demand for consumer electronics is one of the most significant drivers of the MEMS gyroscopes market.

Consumer electronics like smartphones, tablets, gaming consoles, and wearable gadgets increasingly depend on MEMS gyroscopes for improved capabilities, such as screen rotation, motion detection, and augmented reality features. With the advancement of these devices to provide more advanced capabilities, the demand for precise motion detection becomes essential, rendering MEMS gyroscopes vital. The compact design of MEMS gyroscopes matches the space-saving demands of contemporary electronics, allowing producers to incorporate these sensors without sacrificing device size or mass. As global smartphone ownership increases and the popularity of smartwatches, fitness trackers, and other wearables expands, the need for MEMS gyroscopes has surged. The use of virtual reality (VR) and augmented reality (AR) applications greatly increases this demand. These applications necessitate accurate motion tracking to produce immersive experiences, which MEMS gyroscopes facilitate efficiently. In gaming consoles, MEMS gyroscopes improve the gameplay experience by sensing and responding to players' movements, which is essential for AR and VR applications. This demand is projected to increase as AR and VR become more popular in entertainment and industrial uses, establishing MEMS gyroscopes as vital elements in consumer electronics.

-

The automotive sector is a significant growth area for MEMS gyroscopes because of the increase in safety features and advanced driver assistance systems (ADAS).

MEMS gyroscopes are essential for automotive safety systems, including electronic stability control (ESC) and rollover detection mechanisms. ESC systems rely on gyroscopes to identify vehicle position and manage possible skidding or control loss, while rollover detection utilizes these sensors to assess car tipping or flipping, allowing for prompt activation of safety features. The drive for autonomous and semi-autonomous vehicles increases the demand for MEMS gyroscopes. Autonomous systems depend on sensors to accurately comprehend vehicle movement and positioning, a field where MEMS gyroscopes excel. They assist in monitoring vehicle dynamics, guaranteeing precise orientation and motion detection even in challenging driving conditions. With the automotive sector advancing in safety and autonomy, the need for gyroscopes is expected to rise, fueled by regulatory mandates and consumer interest in safer vehicles. The reliability and accuracy of MEMS gyroscopes are crucial for guaranteeing the safe function of autonomous features, rendering them vital in contemporary vehicle engineering.

Restraints

-

Although MEMS gyroscopes offer great sensitivity and accuracy, they are susceptible to external environmental influences.

MEMS gyroscopes experience performance constraints under extreme conditions like high temperatures or vibrations, which can influence their precision. For instance, in automotive uses, being subjected to elevated engine temperatures can cause sensor drift, resulting in imprecise motion data. This problem limits the application of MEMS gyroscopes in sectors that function under extreme conditions, like aerospace or heavy industry, where temperature, pressure, and vibrations are heightened. To tackle these issues, manufacturers need to adopt extra strategies to shield MEMS gyroscopes from severe conditions, including temperature compensation and sensor calibration, which raise production expenses. Although these enhancements boost performance, they also increase complexity and expenses for the sensors, reducing their appeal for budget-conscious applications. Consequently, MEMS gyroscopes encounter constraints in wider industrial and environmental uses, especially in situations where durability is crucial, serving as a limitation on market expansion.

MEMS Gyroscopes Market Segmentation Analysis

by Type

The turning fork dominated with more than 35% of the market share in 2023. Tuning fork gyroscopes are commonly utilized because of their small size, minimal energy usage, and affordability, which render them perfect for devices like smartphones, tablets, and gaming consoles. Their capacity to sense rotational movement with great accuracy enables them to execute essential tasks such as image stabilization and motion tracking. Firms such as Bosch, STMicroelectronics, and Murata Manufacturing are key contributors that incorporate tuning fork MEMS gyroscopes in their offerings, utilizing this technology for its resilience and suitability for mass production needs in both consumer and industrial sectors.

The vibrating wheel segment is anticipated to grow at a faster CAGR in the MEMS gyroscopes market during 2024-2032 because of its durability and precision, making it ideal for applications that necessitate exact motion detection, like aerospace and automotive safety systems. Vibrating wheel gyroscopes offer benefits in high-quality, challenging conditions since they ensure consistent performance over a broad temperature range and are immune to outside disturbances. For instance, businesses such as Honeywell and Analog Devices utilize vibrating wheel gyroscopes in areas such as aircraft navigation and self-driving vehicle systems.

by Application

The mobile devices dominated with 41% share as of 2023. MEMS gyroscopes play a vital role in improving the features of smartphones and tablets, such as screen rotation, gesture detection, navigation, and gaming controls. These sensors offer precise orientation and motion detection, crucial for augmented reality (AR) and virtual reality (VR) uses. MEMS gyroscopes are appreciated in mobile devices due to their small size, low energy usage, and cost-effectiveness. Firms such as Apple and Samsung incorporate MEMS gyroscopes into their smartphones and tablets to enhance user experience.

The cameras and camcorders are projected to have the fastest CAGR during 2024-2032 in the MEMS gyroscope market from 2024 to 2032. The need for superior image stabilization and seamless video recording drives the use of MEMS gyroscopes in both professional and everyday cameras. These sensors assist in minimizing motion blur and stabilizing footage, guaranteeing clear, steady images even in difficult conditions. MEMS gyroscopes further improve 360-degree camera and action cameras, like those by GoPro and Sony, enabling immersive and stabilized video capture.

MEMS Gyroscopes Market Regional Outlook

North America dominated in 2023 with a 34% market share and is projected to be the fastest-growing region from 2024 to 2032. This expansion is driven by robust investments in defense, aerospace, and automotive industries in North America, where accurate gyroscopic measurements are essential. The United States, especially, excels in military-grade MEMS gyroscopes for use in drones, advanced weaponry, and aircraft stabilization systems. Moreover, North American technology leaders such as Apple and Google incorporate MEMS gyroscopes into smartphones, wearable gadgets, and AR/VR technologies. In the automotive sector, North American firms like Tesla, General Motors, and Ford employ MEMS gyroscopes for essential tasks such as vehicle stability control, anti-lock braking systems (ABS), and advanced driver assistance systems (ADAS) that improve autonomous driving features. In the realm of consumer electronics, U.S. companies Apple and Google utilize MEMS gyroscopes in smartphones, tablets, and AR/VR devices to improve functionalities such as orientation detection, motion tracking, and immersive experiences. These advancements highlight North America's crucial role in propelling the MEMS gyroscopes market with uses in emerging technologies and safety-sensitive sectors.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

The major key players in the MEMS Gyroscopes Market are:

-

Analog Devices, Inc. (ADXL345, ADXRS646)

-

TDK Corporation (InvenSense MPU-9250, ICM-20948)

-

STMicroelectronics (L3GD20H, LSM6DSOX)

-

KIONIX Inc. (KXG08, KMX62)

-

ASC GmbH (ASC 271, ASC 551)

-

Seiko Epson Corp. (XV-8000CB, XV-3500CB)

-

Murata Manufacturing (GYROSTAR ENC-03R, SCC2000)

-

Maxim Integrated (MAX21000, MAX21010)

-

Althen Sensors & Controls (GRA100, GRS200)

-

Safran Colibrys SA (VS9002, VS1000)

-

Panasonic Corporation (AN32150A, AN6000)

-

Silicon Sensing Systems (CRG20, DMU11)

-

Texas Instruments Incorporated (MPU-6000, LDC1101)

-

Bosch Sensortec (BMI160, BMG250)

-

Honeywell International Inc. (GG1308AN, HG1120CA50)

-

Qualcomm Technologies, Inc. (QDM4500, QDR6100)

-

NXP Semiconductors (FXAS21002, FXOS8700)

-

Teledyne DALSA (TS8550, TS8200)

-

Sensonor AS (STIM210, STIM300)

-

Invensense Inc. (MPU-6500, ICM-20648)

Suppliers of Raw Materials/Components:

-

Amkor Technology, Inc. (packaging solutions)

-

TDK Electronics AG (capacitors, inductors)

-

Robert Bosch GmbH (ASICs, sensor elements)

-

Dow Inc. (silicon-based materials, adhesives)

-

Cadence Design Systems (EDA software for chip design)

-

Lam Research Corporation (deposition and etching equipment)

-

Synopsys, Inc. (design and simulation software)

-

ULVAC, Inc. (vacuum equipment for MEMS processing)

-

ASML Holding NV (lithography systems)

-

Taiyo Yuden Co., Ltd. (ceramic materials for sensors)

Recent Development

-

In January 2024, Bosch introduced the smallest MEM accelerometers globally for smartwatches, earphones, and more. These MEM accelerometers conserve energy and prolong battery life in earphones.

-

In March 2023, TDK Corporation (TSE: 6762) unveils the Tronics GYPRO ®4300, a digital MEMS gyroscope designed for dynamic applications, offering high stability and resistance to vibrations.

-

In November 2022, TDK launched its first monolithic stand-alone Gyroscope for non-safety automotive uses. It provides precise angular-rate detection over a temperature range of -40 °C to 105 °C.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.11 Billion |

| Market Size by 2032 | USD 3.72 Billion |

| CAGR | CAGR of 6.58% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Vibrating Wheel, Tuning Fork, Foucalt Pendulum, Wine Glass Resonator, Others) • By Application (Mobiles, Cameras & Camcorders, Gaming Consoles, Others) • By End User (Consumer Electronics, Automotive, Aerospace and Defense, Industrial, Marine, Others |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Analog Devices, Inc., TDK Corporation, STMicroelectronics, KIONIX Inc., ASC GmbH, Seiko Epson Corp., Murata Manufacturing, Maxim Integrated, Althen Sensors & Controls, Safran Colibrys SA, Panasonic Corporation, Silicon Sensing Systems, Texas Instruments Incorporated, Bosch Sensortec, Honeywell International Inc., Qualcomm Technologies, Inc., NXP Semiconductors, Teledyne DALSA, Sensonor AS, Invensense Inc. |

| Key Drivers | • The demand for consumer electronics is one of the most significant drivers of the MEMS gyroscopes market. • The automotive sector is a significant growth area for MEMS gyroscopes because of the increase in safety features and advanced driver assistance systems (ADAS). |

| RESTRAINTS | • Although MEMS gyroscopes offer great sensitivity and accuracy, they are susceptible to external environmental influences. |