Micro Fulfillment Market Size & Growth Analysis:

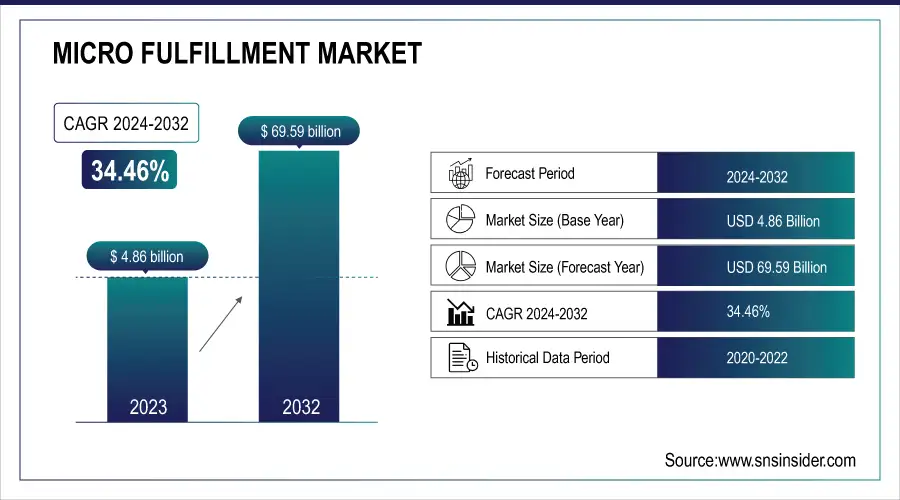

The Micro Fulfillment Market was valued at USD 4.86 billion in 2023 and is expected to reach USD 69.59 billion by 2032, growing at a CAGR of 34.46% over the forecast period 2024-2032.

Micro-fulfillment centers aim to maximize capacity utilization by using very limited space in small-scale, urban full-fulfillment centers. Their automation prowess brings down costs due to reduced human input costs & quicker order fulfillment too! Robotics automating tasks like picking and sorting is an obvious contributor, but advanced software and integration of artificial intelligence led to improvements in these metrics by optimizing inventory management, order routing, and demand forecasting. These two together make it much quicker, more accurate, and also flexible in meeting customer requirements. With more than 1,000 micro-fulfillment centers (MFCs) currently spread across the U.S., the state of MFCs is rapidly growing. There are companies like Amazon that have made a radical increase in their robotics-based work, with reports of more than 750,000 robots deployed to their fulfillment center to boost efficiency and cut costs. It is part of a trend of automation. MFCs use shuttle-based and cube-storage technologies and use automated mobile robots (AMRs) for picking and sorting. Such a transition towards automated systems is anticipated to provide hefty savings as well as better delivery duration.

To Get more information on Micro Fulfillment Market - Request Free Sample Report

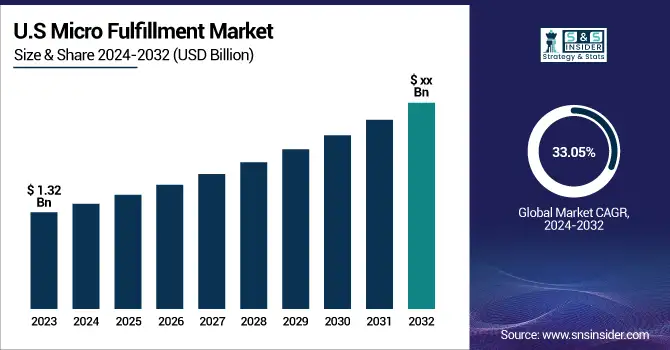

The U.S. Micro Fulfillment Market is estimated to be USD 1.32 billion in 2023 and is projected to grow at a CAGR of 33.05%. The U.S. micro-fulfillment market is expanding, driven primarily by the growing demand for quicker delivery times, escalating e-commerce, and continual advancements in automation technologies. Moving to local, automated warehouses allows your company to fill orders faster and at a lower cost. Consumer demand for ever-faster, same-day deliveries also fuels micro-fulfillment investments.

Micro Fulfillment Market Dynamics

Key Drivers:

-

Accelerating Growth of Micro-Fulfillment Centers Driven by E-commerce Demand Automation and Urban Consumer Expectations

Growing demand for faster and more efficient delivery systems, especially in the e-commerce and grocery sectors. The growth of e-commerce has made quick delivery possible, so businesses have invested in micro-fulfillment centers to offer delivery times of just a few hours. Automation, robotics, and AI advancements have also made these centers even more powerful, increasing their speed and accuracy while lowering costs. The increasing expectations from consumers are the need for faster delivery, which triggers the growth spiral of the market, particularly in densely populated urban cities.

Restrain:

-

Overcoming Last-Mile Logistics Challenges in Micro-Fulfillment with Scalable Technologies and Real-Time Inventory

The last-mile logistics for micro-fulfillment, especially in urban areas, is a highly complex challenge. Quick deliveries entail a tight coupling between fulfilment centres, inventory, and transportation–hard to achieve at scale. Scalable technologies and processes are usually needed for accurate and real-time inventory updates in fast-moving consumer goods or groceries. Other impediments include keeping high automation levels while orders rise and fall, and the lack of an appropriate inventory, which can break efficiencies.

Opportunity:

-

Unlocking Growth Opportunities in Micro-Fulfillment Through Dark Stores Software Solutions and E-commerce Evolution

There are significant opportunities available in the micro-fulfillment market, especially within dark stores and software solutions. This demand for small-scale, urban fulfillment centers dedicated to logistics offers growth potential for operators to participate in the ever-growing e-grocery and consumer goods sectors. In addition to that, software solutions for warehouse management and automation are becoming indispensable as they can greatly improve the performance and efficiency of these centres. Utilization of services like consulting, cloud, and systems integration is also rising, providing further growth opportunities for service providers. Furthermore, as traditional retailers evolve to e-commerce, they provide additional opportunities for micro-fulfillment models to improve existing distribution and delivery systems.

Challenges:

-

Overcoming Challenges of Integrating Micro-Fulfillment Centers in Retail Infrastructure Through Strategic Solutions and Partnerships

One such impediment is the addition of a micro-fulfillment center into the current infrastructure of retail. However, the set-up of the average brick-and-mortar outlet or a retailer-owned warehouse cannot be easily reverted to a micro-fulfillment model due to space restrictions, unmatched tech capability, and much-needed change management in culture. Adopting observation-based automation is not an overnight transformation; it requires a change in operations, re-training staff, and piecing together disparate systems, all of which can delay the adoption process. Not to mention, smaller retailers that want to compete in the same playing field as larger e-commerce giants, such as Amazon, that have already created extremely efficient systems for fulfillment. Firms will need creative solutions and strategic partnerships to remove these obstacles and create economies of scale.

Micro Fulfillment Industry Segmentation Outlook

By Component

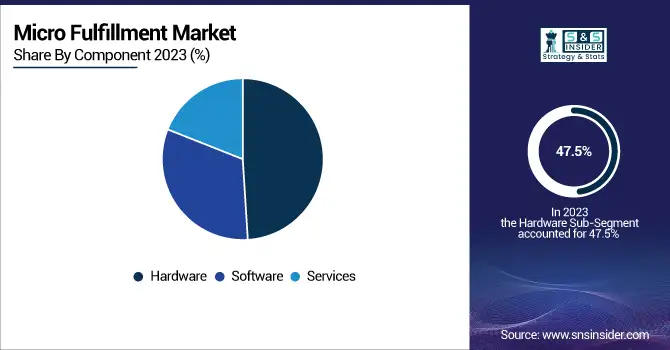

The micro-fulfillment market was mainly dominated by hardware components, accounting for a share of 47.5% in 2023. By far, this dominance is a result of the enormous dependence on hardware · automation systems, robots, conveyor racks, and so on that are critical for successfully running micro-fulfillment centers. Some of the most crucial hardware solutions required for order fulfillment, increased workflow efficiency, and reduced human intervention are contributing to the growth of the market significantly.

From 2024 to 2032, services are projected to have the highest CAGR. Micro-fulfillment and hyper-local delivery systems are expected to lead to major services such as consulting, integration, and maintenance of complex operating systems, already taking to back-end infrastructures of large-scale e-commerce, write management experts. Fulfillment centers require cloud-based solutions, AI-driven optimization, and end-to-end service harnessing, now more than ever. A growing promotion of these private label offerings suits the customized needs of the customers, has driven the market to ensure the fulfillment of business, and to enhance service scalability.

By Type

Store-integrated/in-store micro-fulfillment centers dominated the market in 2023 and accounted for a revenue share of 51.2%. Retail dominance by store-based e-fulfillment providers is due in part to the locational efficiencies of operating fulfillment in-store and in part to the fact that most of these providers initially only need to build out their operational capabilities, which allow them to benefit from existing in-store foot traffic at little marginal cost. Such a model is ideal for retailers looking to respond to the demand of fast delivery but do not wish to majorly turn the current operation of their retail core business upside down and out of control, especially in the grocery and e-commerce sectors.

Dark stores will witness the highest CAGR during 2024-2032. Those non-retail, fulfilment-first centers enable the entire fulfilment journey to be automated for ultra-efficient processing of online orders. The trend to dark stores is fueled by an increased need for quicker and cheaper last-mile delivery in cities. Amidst the growth of e-commerce, dark stores provide a scalable solution that can help in delivering products faster, which in turn meets the rising need among consumers for same-day or next-day delivery.

By End-user

The share of e-commerce in the micro-fulfillment market was 53.7% in 2023. A lot of this is the result of the explosion in e-commerce, with the pandemic only exacerbating the need for speedy, high-performance delivery options. As consumers demand same-day or next-day deliveries across all e-commerce platforms, businesses have to make huge investments in micro-fulfillment centers to maximize the speed and cost-effectiveness of their logistics operations.

The highest CAGR from 2024 to 2032 is anticipated for the traditional retailers & distributors segment. With the move towards omnichannel, where online orders are fulfilled in-store as much as possible, retailers are looking at micro-fulfillment as a supply chain upgrade. By switching, this allows them to increase last-mile delivery efficiency while bringing down their inventory spending. As more retailers move to optimize their logistics to compete with e-commerce, traditional retailers will quickly adopt micro-fulfillments in the coming years.

Micro Fulfillment Market Regional Analysis

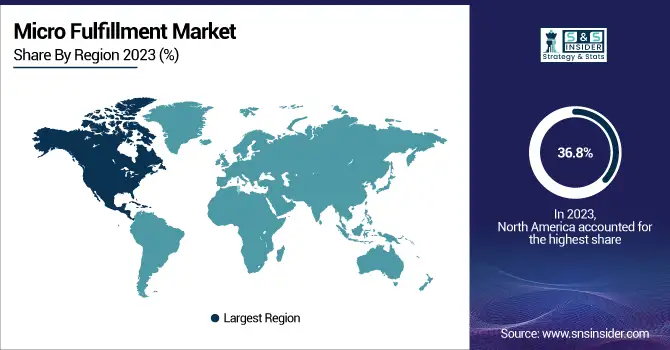

North America led the micro-fulfillment market, holding a share of 36.8% in 2023. The growth of e-commerce and the demand for fast delivery will continue to be the driving force behind the leadership of the region. Similarly, Walmart and Amazon are the ones that invest huge efforts in putting micro-fulfillment centers within urban areas to satisfy the customers who want their goods delivered on the same day or the next day. For example, automation and robotics at fulfillment centers at Amazon speed up order processing, while Walmart is integrating store-based models to simplify the process and improve efficiency. Such investments highlight the region's focus on innovation and technology in logistics.

Get Customized Report as per Your Business Requirement - Enquiry Now

The Asia Pacific region is anticipated to hold the fastest CAGR from 2024 to 2032 due to rapid urbanization, increasing adoption of e-commerce, and demand for last-mile delivery solutions. Leading the pack are Chinese Alibaba and Japanese Rakuten. Alibaba has unveiled its plans to build “smart warehouses” to optimize the supply chain over the last mile in urban cities, while Rakuten is researching increasingly micro-fulfillment solutions to speed up delivery tasks. High potential territory for micro-fulfillment providers: With booming e-commerce across densely populated countries such as China and India, the Asia Pacific region offers great potential for strengthening demand for efficient micro-fulfillment logistics solutions.

Key players Listed in the Micro Fulfillment Market are:

-

Takeoff Technologies (Automated Micro Fulfillment Centers)

-

Fabric (Robotic Fulfillment Solutions)

-

Locus Robotics (Autonomous Mobile Robots)

-

Exotec (Skypod System)

-

Attabotics (3D Robotics System)

-

Dematic (Automated Storage and Retrieval System)

-

Swisslog (AutoStore)

-

GreyOrange (Butler Robots)

-

Zebra Technologies (Robotic Picking Solutions)

-

6 River Systems (Chuck Robot)

-

RightHand Robotics (RightPick)

-

Vanderlande (Smart Automated Warehouse Solutions)

-

OCADO Solutions (Ocado Smart Platform)

-

Honeywell Intelligrated (Automated Conveyor Systems)

-

Manhattan Associates (Manhattan Active Warehouse Management)

Micro Fulfillment Market Trends

-

In February 2025, Dematic and Transcend Retail Solutions partnered to enhance grocery picking through advanced micro-fulfillment technologies, aiming to improve productivity and customer experience.

-

In January 2025, Finland's leading grocery chain, Osuuskauppa Arina, is set to build its third micro-fulfillment center in Oulu with Swisslog, featuring advanced automation systems to double delivery capacity.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.86 Billion |

| Market Size by 2032 | USD 69.59 Billion |

| CAGR | CAGR of 34.46% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Standalone, Store-integrated/in Store, Dark Stores) • By Component (Hardware, Software, Services) • By End-user (E-commerce, Traditional Retailers & Distributors, Manufacturers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Takeoff Technologies, Fabric, Locus Robotics, Exotec, Attabotics, Dematic, Swisslog, GreyOrange, Zebra Technologies, 6 River Systems, RightHand Robotics, Vanderlande, OCADO Solutions, Honeywell Intelligrated, Manhattan Associates. |