Microbial Fermentation Technology Market Report Scope & Overview:

To Get More Information on Microbial Fermentation Technology Market - Request Sample Report

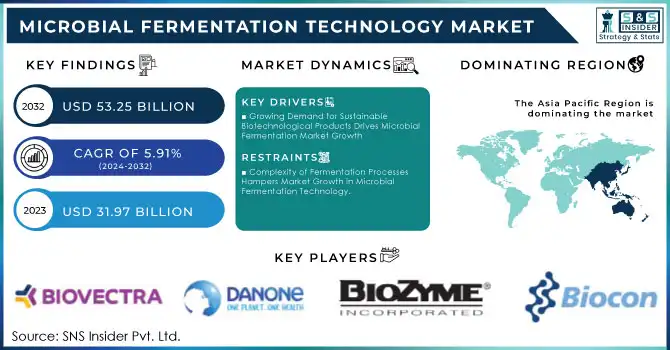

Microbial Fermentation Technology Market was valued at USD 31.97 billion in 2023 and is expected to reach USD 53.25 billion by 2032, growing at a CAGR of 5.91% from 2024-2032.

The microbial fermentation technology market is rapidly growing based on innovations in biotechnology and the increasing demand for sustainable production methods. Fermentation has become crucial in producing bio-based products as industries seek eco-friendly alternatives for their traditional manufacturing processes. Advances in microbial strain engineering have further improved fermentation processes, from efficiency to scalability. This has led to important goods from pharmaceuticals to biofuels, firmly placing fermentation within the backdrop of today's manufacturing world.

The need for microbial fermentation technology is increasing exponentially in industries like pharmaceuticals, food and beverages, and biofuels. Fermentation has become a sustainable solution for the production of key bio-based ingredients such as antibiotics, vitamins, enzymes, and amino acids due to the worldwide tendency to switch to natural and organic products. The inclination towards alternative sources of energy has also, in a similar manner, outstripped the yeast's role in biofuel production, which has mainly been in bioethanol. Furthermore, 158 companies active in fermentation for alternative proteins have been identified by the end of 2023, and USD 515 million was spent on these companies respectively, in the same year, which clearly shows the increasing need for sustainable food. The rising number of companies using microbial fermentation in almost every sector focused on alternate protein sources from the food industry through to renewable energy demonstrates the growth of the fermentation sector.

The potential for microbial fermentation is huge, primarily with the advancement in synthetic biology and genetic engineering. These developments are expected to improve the complexity of compounds produced and facilitate fermentative processes, thereby streamlining processes that become more efficient and cheaper. Another increased opportunity comes in the form of biopharmaceuticals on biologics and vaccines since microbial fermentation is indispensable in the production of those high-demand products.

Microbial Fermentation Technology Market Dynamics

DRIVERS

-

Growing Demand for Sustainable Biotechnological Products Drives Microbial Fermentation Market Growth

The microbial fermentation technology market is being significantly driven by biotechnology product demand, which is revolutionizing even fields like biofuels and pharmaceuticals. With the growing trend toward sustainability among companies and consumers, fermentation has become a key tool for producing biofuels, food additives, specialty chemicals, and pharmaceuticals. This way of manufacturing is a more environment-friendly and efficient choice compared to traditionally utilized chemical methods, thus the massive expansion of green production is the one thing that can be observed. In addition, microbial fermentation is a very adaptable method of producing bioproducts, which is the reason why it is possible to produce a variety of bioproducts in a scalable manner thus the needs of the expanding global market, which is focused on sustainability and innovation, are met. The introduction of new and improved fermentation techniques is another factor that necessitates the adoption of it; it thus becomes an important player in the biotech sector growth.

-

Rising Consumer Demand for Natural and Plant-Based Products Fuels Microbial Fermentation Technology Growth

The consumer inclination towards natural and plant-based food products is one of the major driving factors in the development of microbial fermentation technology for flavor, sweetener, and additive production. The number of people searching for healthy, sustainable, and clean alternatives to synthetic ingredients is increasing, and fermentation, therefore, is an eco-friendly and efficient option for delivering high-quality, natural food ingredients. That transition is seen in the food and beverage industry, where plant-based innovations are booming. Microbial fermentation is the enabler of the scalable production of these ingredients and thus the increasing demand for plant-derived and non-GMO products is met. The capability of fermentation to produce complicated molecules is not only a key factor in meeting consumer demand, but also it is a good strategy in achieving sustainability goals and hence, is one of the main drivers in the microbial fermentation market growth.

RESTRAINTS

-

Complexity of Fermentation Processes Hampers Market Growth in Microbial Fermentation Technology

The microbial fermentation technology market is beset by the complications that the fermentation processes naturally have, which may result in this system not being highly scalable and cost-effective. Fermentation comprises of accuracy, regulation, and control of different environmental parameters such as temperature, pH, and oxygen levels that promote the production efficiency of microorganisms and selective production respectively. This type of control can thus be both tedious and expensive. However, in large-scale production, even minor changes in some of the parameters also result in inefficiencies which thereby drop the productivity level and consequently, the production costs increase. Also, because of the inherent complexity of the fermentation process, it is necessary to have sophisticated measurement and control systems which then become costly both from the standpoint of capital and operation. Thus, the complexity of fermentation processes acts as a major constraint, in particular when they are compared to more simplistic and cost-efficient methods of manufacturing.

Microbial Fermentation Technology Market Segment Analysis

BY APPLICATION

In 2023, the Antibiotics segment dominated the microbial fermentation technology market with a 31% revenue share mainly because the demand in healthcare for antibiotics has been established and it is a steady demand. Fermentation technology, which allows the manufacturing of potent, affordable antibiotics, has increased its market share. Still, such influence is likely to persist in the short term, and hence new producers will enter the market and incumbents will also up their game.

The Monoclonal Antibodies segment will grow at the fastest CAGR of 7.49% from 2024 to 2032 as the rising need for oncology and autoimmune diseases treatment targeted therapies is favoring the market. Improvements in fermentation techniques are of course proving the efficacy of monoclonal antibodies is increasing the production. In consequence, this success is highly expected to disinvest the traditional pharmaceuticals and move the market in biologics' favor.

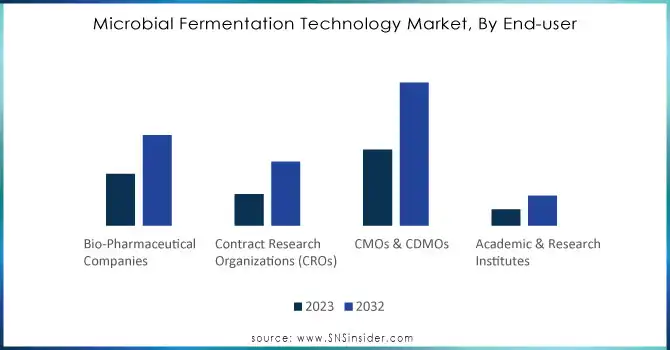

BY END-USER

The CMOs & CDMOs segment dominated the microbial fermentation technology market with the highest revenue share of 44% in 2023 and is projected to grow at the highest CAGR of about 6.81% from 2024 to 2032. This dominance is driven by the strong demand for outsourced manufacturing services, as pharmaceutical companies increasingly rely on contract manufacturers for efficient, scalable production. Technological leadership in fermentation processes, along with competitive advantages such as cost efficiency and flexibility, further solidifies the position of CMOs & CDMOs in the market. The segment’s growth is also fueled by emerging trends in biologics, the rise of personalized medicine, and the need for faster drug production. These trends are likely to shift market dynamics, attracting significant investment and driving consumer preference towards more advanced and accessible biomanufacturing solutions

Do You Need any Customization Research on Microbial Fermentation Technology Market - Enquire Now

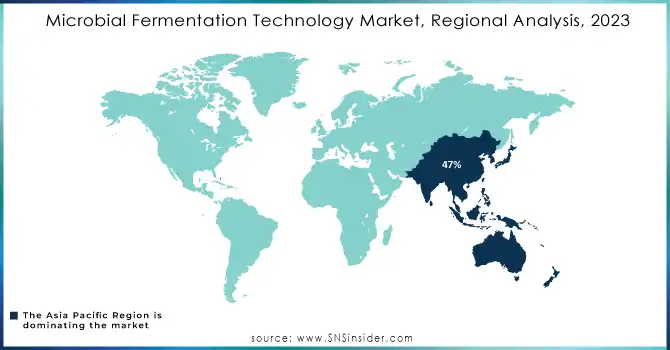

Microbial Fermentation Technology Market Regional Outlook

Asia Pacific dominated the microbial fermentation technology market with the highest revenue share of approximately 47% in 2023, mainly due to its strong manufacturing base and increasing demand for biopharmaceuticals and food products. The region benefits from cost-effective production capabilities, vast raw material availability, and growing investments in biotechnology. These factors, coupled with a rapidly expanding healthcare infrastructure, have positioned Asia Pacific as a dominant player in the market.

North America is expected to grow at the fastest CAGR of 7.39% from 2024 to 2032, driven by robust investments in research and development, along with the rising demand for biologics and specialty chemicals. The presence of key market players and continuous innovation in fermentation technologies further fuel the region’s growth. As the demand for sustainable and efficient manufacturing solutions increases, North America is poised to see significant market expansion, attracting greater investments and accelerating technological advancements.

LATEST NEWS -

-

In June 2024, Danone launched a biotech accelerator to advance precision fermentation for bio-based ingredients. This initiative, with a €16m investment, aims to enhance sustainability and nutrition in food products, with a new fermentation production line set to open by 2025

-

On September 5, 2024, Lonza completed the expansion of its microbial manufacturing facility in Visp, Switzerland. This new facility, with two 4,000L fermenters, increases capacity for producing microbially-derived biologics

KEY PLAYERS

-

Biocon Ltd. (Insulin, CytoSorb)

-

BioVectra Inc. (API Manufacturing, Biologics)

-

Danone UK (Activia Yogurt, Alpro Plant-Based Beverages)

-

F. Hoffmann-La Roche AG (MabThera, Herceptin)

-

Koninklijke DSM NV (Maxilact, DSM Nutritional Products)

-

Lonza (Xolair, BLA-Lonza)

-

Novozymes A/S (Viscozyme, Cellulase)

-

TerraVia Holdings, Inc. (Algal Oils, AlgaPur)

-

BIOZEEN (BioZEEN Probiotics, BioZEEN Enzymes)

-

United Breweries Ltd. (Kingfisher Beer, UB Malts)

-

BASF (Germany) (Cymbalta, ZymeMax)

-

Ajinomoto Company Incorporation (Japan) (AminoSweet, Ajinomoto Fermented Soy Sauce)

-

The Dow Chemical Company (US) (Dow AgroSciences, Dow Corning)

-

Amano Enzyme Inc. (Japan) (Amano 4000, Amano 15000)

-

AB Enzymes (Germany) (Powerzyme, Fiberzyme)

-

Archer Daniels Midland Company (US) (ADM Enzyme Solutions, ADM Sweeteners)

-

Du Pont Danisco A/S (Denmark) (Danisco Enzymes, DuPont Nutrition & Biosciences)

-

Cargill Inc. (US) (Cargill Enzyme Solutions, Cargill Sweeteners)

-

Evonik Industries AG (Germany) (Avicel, BioEnzyme Solutions)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 31.97 Billion |

| Market Size by 2032 | USD 53.25 Billion |

| CAGR | CAGR of 5.91% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Antibiotics, Probiotics Supplements, Monoclonal Antibodies, Recombinant Proteins, Biosimilars, Vaccines, Enzymes, Small Molecules, Others) • By End-user (Bio-Pharmaceutical Companies, Contract Research Organizations (CROs), CMOs & CDMOs, Academic & Research Institutes) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Biocon Ltd., BioVectra Inc., Danone UK, F. Hoffmann-La Roche AG, Koninklijke DSM NV, Lonza, Novozymes A/S, TerraVia Holdings, Inc., BIOZEEN, United Breweries Ltd., BASF, Ajinomoto Company Incorporation, The Dow Chemical Company, Amano Enzyme Inc., AB Enzymes, Archer Daniels Midland Company, Du Pont Danisco A/S, Cargill Inc., Evonik Industries AG. |

| Key Drivers | • Growing Demand for Sustainable Biotechnological Products Drives Microbial Fermentation Market Growth • Rising Consumer Demand for Natural and Plant-Based Products Fuels Microbial Fermentation Technology Growth |

| Restraints | • Complexity of Fermentation Processes Hampers Market Growth in Microbial Fermentation Technology |