Military and Aerospace Sensors Market Report Scope & Overview:

To get more information on Military and Aerospace Sensors Market - Request Free Sample Report

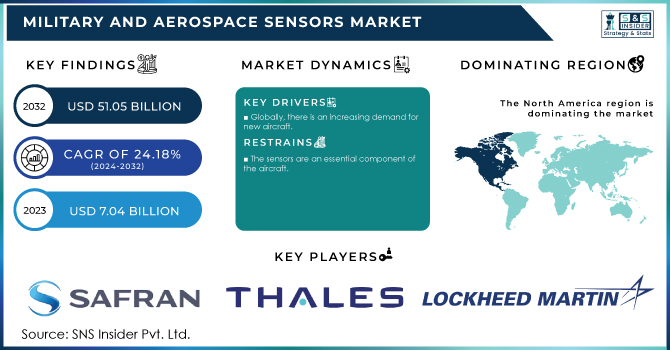

The Military and Aerospace Sensors Market size was USD 7.04 billion in 2023 and is expected to reach USD 51.05 billion by 2032 and grow at a CAGR of 24.18% over the forecast period of 2024-2032.

Many military and aeronautical systems rely heavily on sensors. Defense intelligence, surveillance, and reconnaissance equipment stationed on national borders or in remote places are linked via wireless networks that give real-time data from several sensors. Furthermore, for effective aircraft operation, new and advanced aircraft use sensors such as pressure sensors, temperature sensors, speed sensors, accelerometer, level sensors, flow sensors, gyroscopes, and radar sensors.

MARKET DYNAMICS

KEY DRIVERS

-

Sensor Technology Advances Continue

-

Globally, there is an increasing demand for new aircraft.

RESTRAINTS

-

The sensors are an essential component of the aircraft.

OPPORTUNITIES

-

The Internet of Things is becoming more popular in the aviation industry.

-

Military vessels are in high demand.

CHALLENGES

-

The number of passengers flying has increased.

IMPACT OF COVID-19

Components and raw materials needed to construct military sensors were not readily available. Due to travel restrictions and a labour scarcity, the supply chain is experiencing transportation-related delays. Production/assembly lines are also operating at reduced capacity or are totally shut down. Long-term market drivers for military sensors remain robust, and the industry has begun to show indications of recovery from the big market price reset before to the pandemic. The COVID-19 pandemic has ravaged the planet, leaving many sectors struggling to survive. Governments and companies interested in sensor technology are reacting differently to the new circumstances. Some product launches are taking place, while others are not; some testing are being conducted, while others have been postponed; and some businesses are still functioning, while others have closed.

The COVID-19 epidemic has caused supply chain and logistical difficulties throughout North America.

Airborne During the projection period, the airborne segment is expected to have the greatest CAGR. Sensors for unmanned aerial vehicles, Aero stats, and helicopters are used in airborne systems. Sensors attached on these platforms detect, record, and analyse events on the ground in real time. Land The segment dominated the market for military and aerospace sensors. For military organizations and surveillance agencies to obtain tactical intelligence, land-based systems employ radar, unmanned ground vehicles, unattended ground sensors, and target detection.

The naval segment is predicted to develop the most during the forecast period, owing to the rising use of marine communication, command, control, intelligence, and reconnaissance systems by military agencies around the world. Space During the projection period, the segment is predicted to increase steadily. Space-based systems include satellites that carry payloads and provide voice or data transmission as well as optical images. They are capable of communication, monitoring, and reconnaissance.

Intelligence and Reconnaissance: This sector led the military and aerospace sensors market. Intelligence and reconnaissance systems collect data from numerous sensors and analyse it to provide guidance and direction to commanders and aircraft operators.

Communication and navigation: This area is predicted to expand faster during the forecast period. Sensors are used by communication and navigation systems to provide proper communication, networking, and collaborative tools for effective communication and navigation.

Warfare Using Electronic Means During the projection period, this segment is expected to increase the most. Electronic warfare is a military activity in which electromagnetic energy is used to determine, exploit, reduce, or prevent the enemy's hostile usage of the electromagnetic spectrum. Furthermore, electronic warfare systems can detect difficult-to-detect naval vessels and stealth aircraft.

Control and command During the projection period, the segment is expected to increase steadily. Command and control systems use information from multiple sensors to plan, coordinate, and control military forces and assets.

KEY MARKET SEGMENTATION

By End-Use

-

OEM

-

Aftermarket

By Platform

-

Airborne

-

Land

-

Naval

-

Space

By Application

-

Intelligence & Reconnaissance

-

Communication & Navigation

-

Combat Operations

-

Electronic Warfare

-

Target Recognition

-

Command and Control

-

Surveillance & Monitoring

By Type

-

Pressure Sensors

-

Torque Sensors

-

Accelerometer

-

Level Sensors

-

Flow Sensors

-

Proximity Sensors

-

Gyroscopes

-

Radar Sensors

-

Magnetic Sensors

-

Others

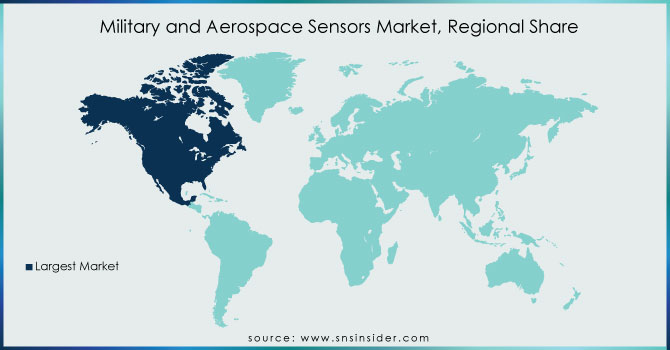

REGIONAL ANALYSIS

North America controls the market for military and aerospace sensors. This trend is expected to continue during the forecast period due to the presence of prominent players such as Honeywell International Inc., Ametek, Inc., and Raytheon Company, as well as their significant investments in the development of military and aerospace sensors.

Europe The increased use of modern combat vehicles and aircraft by armed forces for tactical operations is likely to drive expansion in the European market over the study period.

Asia-Pacific During the forecast period, the market in this area is expected to expand at a rapid pace. Increasing defence spending in nations such as India and China, as well as increased demand for new aircraft, are driving regional market expansion.

Africa and the Middle East Defense spending increases in nations such as Saudi Arabia, the United Arab Emirates, and Israel are driving market expansion in the Middle East and Africa area.

South America The employment of combat vehicles and planes for information collection on drug trafficking and rebel groups, monitoring deforestation, and controlling illegal migration has increased in Latin America, which is projected to boost market expansion.

Need any customization research on Military and Aerospace Sensors Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are Lockheed Martin Corporation, Safran Electronics & Defense, BAE Systems PLC, Ametek, Inc., Thales Group, Honeywell International Inc., TE Connectivity Ltd, Raytheon Company, General Electric Company, Ultra-Electronics, and other players

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 7.04 Billion |

| Market Size by 2032 | US$ 51.05 Billion |

| CAGR | CAGR of 24.18% From 2024 to 2032 |

| Base Year | 2022 |

| Forecast Period | 2023-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform (Airborne, Land, Naval and Space) • By Application (Intelligence & Reconnaissance, Communication & Navigation, Combat Operations, Electronic Warfare, Target Recognition, Command and Control and Surveillance &Monitoring) • By End-Use (OEM and Aftermarket) • By Type (Pressure Sensors, Temperature Sensors, Torque Sensors, Speed Sensors, Accelerometer, Level Sensors, Flow Sensors, Proximity Sensors, Gyroscopes, Radar Sensors, Magnetic Sensors and Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Lockheed Martin Corporation, Safran Electronics & Defense, BAE Systems PLC, Ametek, Inc., Thales Group, Honeywell International Inc., TE Connectivity Ltd, Raytheon Company, General Electric Company, Ultra-Electronics, and other players. |

| Key Drivers | • Sensor Technology Advances Continue • Globally, there is an increasing demand for new aircraft. |

| Restraints | • The sensors are an essential component of the aircraft. |