Smart Personal Safety and Security Device Market Size Analysis:

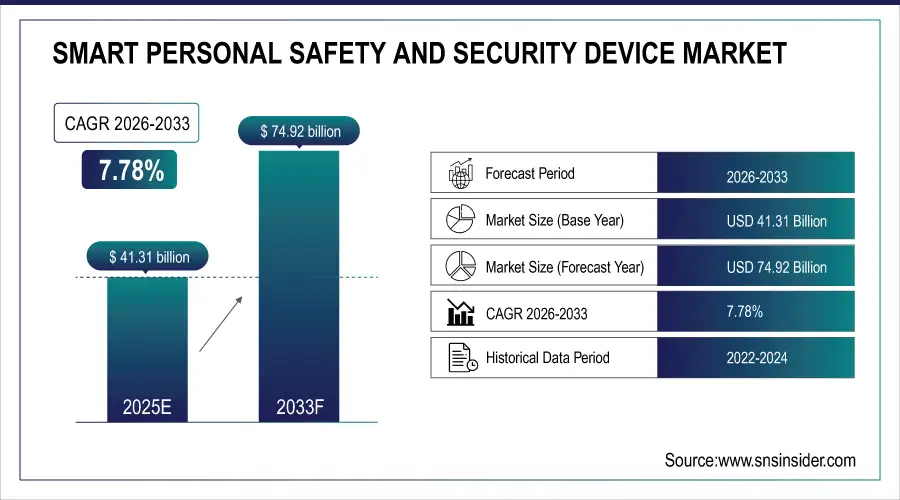

The Smart Personal Safety and Security Device Market size was valued at USD 44.52 billion in 2025 and is expected to reach USD 94.18 billion by 2035, growing at a CAGR of 7.78% over the forecast period of 2026-2035.

Smart personal safety and security device market trends are increasing adoption of wearable safety tech and AI-based alert systems. Rising personal security concerns and real-time monitoring features are fueling demand. The smart personal safety and security device market is highly driven by the growing concern about personal safety, rise in crime rates and increase in awareness about Self-defense technologies. The rapid increase in adoption of smartphones and wearables has allowed for seamless integration of features, such as GPS tracking, emergency alerts, and health monitoring. The demand is also being encouraged by the senior citizens, single travelers, and women professionals. Moreover, developments in connectivity technologies such as Bluetooth, Wi-Fi, and cellular networks are improving the efficiency and attractiveness of these appliances.

Leading Android models in 2025 Samsung Galaxy S25, Google Pixel 9, OnePlus 13 include built-in Emergency SOS, GPS location sharing, audio/photo capture, crash detection, and satellite SOS supports.

To Get more information on Smart Personal Safety and Security Device Market - Request Free Sample Report

Market Size and Forecast: 2025

-

Market Size in 2025 USD 44.52 Billion

-

Market Size by 2035 USD 94.18 Billion

-

CAGR of 7.78% From 2026 to 2035

-

Base Year 2025

-

Forecast Period 2026-2035

-

Historical Data 2022-2024

Smart Personal Safety and Security Device Market Trends:

-

Increasing adoption of wearable and smartphone-connected personal safety devices with GPS tracking, SOS alerts, and real-time monitoring features.

-

Growing focus on women, children, and elderly safety, driving demand for compact, easy-to-use smart security solutions.

-

Integration of AI-enabled analytics and predictive alerts to provide proactive threat detection and faster emergency response.

-

Expanding use of wireless technologies such as IoT, Bluetooth Low Energy, and 5G for reliable, always-connected safety devices.

-

Rising adoption in emerging economies supported by higher mobile penetration, urbanization, and increasing awareness of personal security needs.

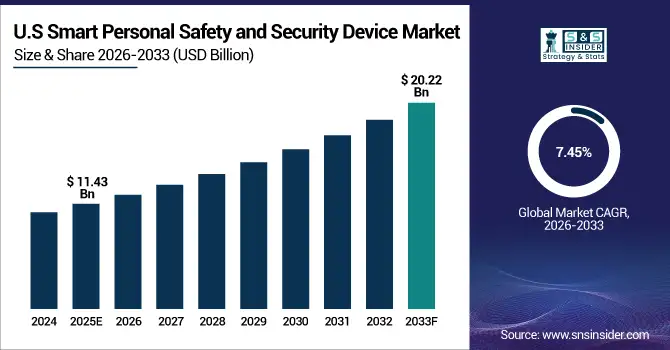

The U.S. smart personal safety and security device market size was valued at USD 12.28 billion in 2025 and is expected to reach USD 25.19 billion by 2035, growing at a CAGR of 7.45% over the forecast period of 2026-2035. The growth of the U.S. smart personal safety and security device is driven by the increasing crime awareness coupled with rising adoption of connected wearables along with high demand for real-time emergency alerts and health monitoring solutions.

Smart Personal Safety and Security Device Market Growth Drivers:

-

Rising Safety Concerns and Wearable Adoption Drive Demand for Smart Personal Security Devices Globally

The factors driving the global smart personal safety and security device market growth include increasing personal safety concerns, growing crime rates, and growing need for real-time monitoring. With the popularity of smartphones and wearables, there was an opportunity to integrate features, such as GPS tracking, SOS alerts, fall detection and health monitoring. Moreover, rising awareness regarding self-defense devices for women, children, and elderly population is driving its demand. This trend also heightens across urbanization and people living alone.

Solo female travelers increasingly depend on apps and devices for location tracking and safety planning, and 60% use location apps, and combining travel forums and planning apps is common.

Smart Personal Safety and Security Device Market Restraints:

-

Data Privacy and Security Concerns Impede Growth of Smart Personal Safety Devices Across Global Markets

Data privacy and security concerns is one of the major restraining factors for smart personal safety and security device market. With hundreds of sensitive personal data in terms of location, health metrics, and emergency contacts being captured by such devices, concerns around data breach and unauthorized access are enhancing. Users are likely being more careful about sharing real-time data with third-party applications or cloud platforms. Moreover, the lack of regulatory standards in many different countries makes it even more difficult for privacy practices to be standardized.

Smart Personal Safety and Security Device Market Opportunities:

-

Next Gen Wireless and AI Technologies Power Smarter Safer and More Connected Personal Safety Devices Globally

Wireless communication technologies, such as 5G, Bluetooth Low Energy and IoT are opening many opportunities to make smart and fast and reliable safety devices. Possible predictive alerts for safety and better integration with a cloud platform and other AI Chat Bots integrate with your current services. The emerging economies are new growth drivers based on the larger mobile penetration and increased security awareness.

In 2024, IoT added 438 million new connections, reaching 3.6 billion globally, highlighting vast potential for connected safety integrations.

Smart Personal Safety and Security Device Market Segment Analysis:

By Device Type

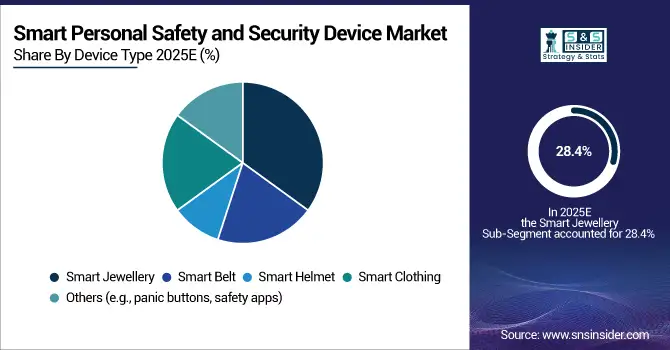

In 2025, Smart Jewellery accounted for 28.4% of the complete smart personal safety and security device market. It became a huge hit, particularly with women, for its fashionable and discreet design and seamless incorporation of safety features, such as SOS alerts, GPS tracking, and Bluetooth connectivity. Its prowess to balance style with practicality led to adoption amongst urban consumers who want the best of both worlds in their everyday accessories also security. Smart Clothing is projected to achieve the highest CAGR during the forecast period 2026–2035 owing to rising adoption of multi-functional wearables that are used for health monitoring, fall detection, and sending emergency alerts. As innovations take form and investments pour in, the segment is witnessing a focus shift toward elderly care, healthcare monitoring, and fitness tracking.

By Connectivity

In 2025, Bluetooth led the smart personal safety and security device market with 39.3% volume share, due to its universal compatibility with mobile phones, low-power consumption, and convenience in integration into smaller-sized wearable devices. Bluetooth is commonly used for smart jewelry, panic buttons, and fitness trackers, it enables short-distance communication that allows for real-time notifications and health monitoring with minimal impact on battery life. Over 2026-2035, it is anticipated that the Cellular Network segment will experience the highest CAGR during the forecast period. This makes it very well suited to elderly monitoring, lone worker safety and emergency response applications as it can give long-range communication anywhere, at any time, and without needing to be near a smartphone or Wi-Fi. Rising galore with the 4G/5G connectivity and coverage being extended in rural and urban sectors are additionally kindling its growth.

By End-User

The smart personal safety and security device market was led by Consumer Electronics in 2025 and it held a 35.7% share, and it is also projected to grow with the fastest CAGR over 2026-2035. The expanding need for incorporating safety features in daily consumer products, such as smartwatches, fitness bands, and mobile-connected accessories are driving this supremacy and furthering growth. The market for personal safety wearables is expanding due to increasing preference for multifunctional wearables that also cater to health tracking and communication needs. Moreover, high consumer awareness, growing single living style, and technological advancements have driven rapid adoption across the demographics, especially youth, working professionals, and fitness enthusiasts.

By Distribution Channel

The smart personal safety and security device market share of Online Retail reached 39.8% in 2025 and is anticipated to register the fastest CAGR over 2026-2035. This growth can largely be attributed to the increase of e-commerce platforms that facilitate online shopping and access to a broader range of goods. Consumers opting to use online means to make their safety device purchases with a plethora of user reviews, easy price comparisons and doorstep delivery options available. Moreover, the increasing penetration of smartphones and internet access in developing economies is broadening the customer base which is causing online retail to be the high impacting growth factor for the market.

Smart Personal Safety and Security Device Market Regional Analysis:

North America Smart Personal Safety and Security Device Market Insights

In 2025, North America was the largest region in the smart personal safety and security device market, accounting for a 36.5% share. The market is driven by high consumer awareness of connected wearables, and further growth is expected owing to its advanced technological infrastructure, along with wide adoption in developed economies. Robust demand in end-use industries, such as consumer electronics, healthcare monitoring, and personal emergency response systems, has positively affected the region. Adoption has also been accelerated by the introduction of supportive regulatory environments, the rise in the prevalence of solo lifestyles, and an emphasis on women and elderly personal safety.

Get Customized Report as per Your Business Requirement - Enquiry Now

High wearable penetration, a good healthcare system, and high demand for personal safety and emergency alert solutions made the North American market a stronghold for the U.S.

Asia Pacific Smart Personal Safety and Security Device Market Insights

The smart personal safety and security device market in Asia Pacific likely to witness highest CAGR of 8.54% over 2026-2035. Such growth is facilitated by growing urbanization, augmented penetration of smartphones and wearables, and growing personal wellbeing consciousness and health monitoring. The potential of the market is also gauged by governments in the region taking further initiatives to promote the digital health and smart security market. The adoption is also fast-tracked by factors, such as rapid technological advancements, growing e-commerce, and a young tech-savvy population. Moreover, the demand for smart safety devices is being driven by escalating safety concerns associated with women, children, and the elderly population living in crowded urban regions.

In 2025, China held the largest share of the Asia Pacific market due to its manufacturing facilities, quick urbanization, and high adoption of consumer smart wearable safety and health devices.

Europe Smart Personal Safety and Security Device Market Insights

Europe also holds a moderate share in smart personal safety and security device market with high consumer awareness, and a large number of consumers adopting wearable technology, plus strict safety-and-security regulations. Growing needs for elder care, healthcare monitoring, personal alert systems are contributing toward the growth of market in the larger economies. The advanced healthcare infrastructure, driven mainly by proactive government initiatives pertaining to the digital safety and data privacy, also promotes the adoption of smart safety devices in this region.

Latin America (LATAM) and Middle East & Africa (MEA) Smart Personal Safety and Security Device Market Insights

Latin America and Middle East & Africa are the emerging markets to this smart personal safety and security device, which is gradually adopted owing to improved urbanization, mobile penetration and security concerns. Demand is driven by crime rates and awareness of the importance of personal security in Latin America. On the other hand, building up digital infrastructure and increasing investments in healthcare and smart city projects are propelling the market growth in the Middle East & Africa.

Smart Personal Safety and Security Device Companies are:

The Key Players in smart personal safety and security devices Market are

- Revolar Inc.

- Safelet B.V.

- WearSafe Labs Inc.

- UnaliWear Inc.

- Silent Beacon LLC

- Zembro (Smartwatcher Technologies)

- Bay Alarm Medical

- KORE Wireless Group Inc.

- Apple Inc.

- Samsung Electronics Co., Ltd.

- Garmin Ltd.

- Fitbit (a Google LLC company)

- Philips Healthcare

- GreatCall (now part of Lively Inc.)

- Tata Communications

- Life360 Inc.

- AngelSense Inc.

- myHalo (a division of MobileHelp)

- V.ALRT (by VSN Mobil)

- Kanega Watch

Recent Developments:

Apple Inc. is a leading player in the smart personal safety and security device market through its Apple Watch and iPhone ecosystem. The company integrates advanced safety features such as emergency SOS, fall detection, crash detection, GPS tracking, and health monitoring, enabling real-time personal protection through tightly integrated hardware, software, and services.

-

In 2025, Apple Watch SOS alert enabled rescuers to locate injured backcountry skiers near Steven’s Pass, WA, highlighting the device’s lifesaving potential in emergencies.

Samsung Electronics Co., Ltd. is a key participant in the smart personal safety and security device market through its Galaxy smartphones and wearable devices. The company integrates features such as emergency SOS, location sharing, fall detection, health monitoring, and AI-powered alerts, delivering comprehensive personal safety solutions within its connected ecosystem.

-

In 2025, Samsung urged Galaxy users in India and the UK to activate the new One UI 7 theft‑protection suite, which includes Identity Check, Security Delay, Offline Device Lock, and Remote Lock.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 44.52 Billion |

| Market Size by 2035 | USD 94.18 Billion |

| CAGR | CAGR of 7.78% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device Type (Smart Jewellery, Smart Belt, Smart Helmet, Smart Clothing, and Others (e.g., panic buttons, and safety apps)) • Connectivity (Bluetooth, Wi-Fi, Cellular Network, and Others (e.g., Zigbee, RFID)) • End User (BFSI, Healthcare, Telecommunication, Defence, and Consumer Electronics) • Distribution Channel (Online Retail, Offline Retail (Supermarkets, Specialty Stores), Direct Sales, and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Revolar Inc., Safelet B.V., WearSafe Labs Inc., UnaliWear Inc., Silent Beacon LLC, Zembro (Smartwatcher Technologies), Bay Alarm Medical, KORE Wireless Group Inc., Apple Inc., Samsung Electronics Co., Ltd., Garmin Ltd., Fitbit (a Google LLC company), Philips Healthcare, GreatCall (now part of Lively Inc.), Tata Communications, Life360 Inc., AngelSense Inc., myHalo (a division of MobileHelp), V.ALRT (by VSN Mobil), Kanega Watch. |