Mixed Signal IC Market Size & Trends:

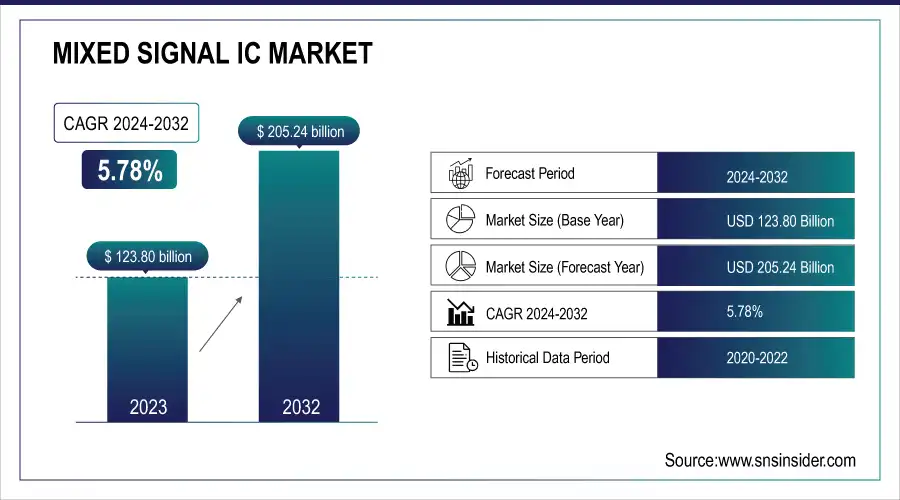

The Mixed Signal IC Market Size was valued at 123.80 Billion in 2023 and is projected to reach USD 205.24 Billion by 2032, growing at a CAGR of 5.78% from 2024 to 2032.

This growth is driven by the integration of next-gen technologies like 5G, IoT, and AI, which are increasing the demand for more advanced, efficient mixed-signal ICs. Additionally, energy efficiency trends are pushing innovation to design low-power, high-performance chips. The market is also impacted by evolving regulatory and compliance standards, such as RoHS and WEEE, which are shaping the production and distribution of mixed-signal ICs globally.

Mixed Signal IC Market Size and Growth Forecast:

-

Market Size in 2023: USD 123.80 Billion

-

Market Size by 2032: USD 205.24 Billion

-

CAGR: 5.78% from 2024 to 2032

-

Base Year: 2023

-

Forecast Period: 2024–2032

-

Historical Data: 2020-2022

To Get more information on Mixed Signal IC Market - Request Free Sample Report

Mixed Signal IC Market Trends Highlights:

-

Rising demand for smartphones, wearables, and IoT devices is accelerating mixed signal IC adoption, with the IoT device base expected to exceed 30 billion units globally.

-

Growth of automotive electronics and EVs is boosting demand for mixed signal ICs in ADAS, battery management, and infotainment, with automotive semiconductor content rising by over 12% annually.

-

Expansion of 5G infrastructure and high-speed connectivity is increasing need for data converters and RF mixed signal ICs, supporting over 50% growth in 5G device shipments.

-

Increasing integration of analog, digital, and RF functions into single chips is reducing power consumption by 20–25% and PCB footprint by 30%.

-

Adoption of AI-enabled edge devices is driving demand for high-precision data acquisition and signal conditioning, improving processing efficiency by up to 35%.

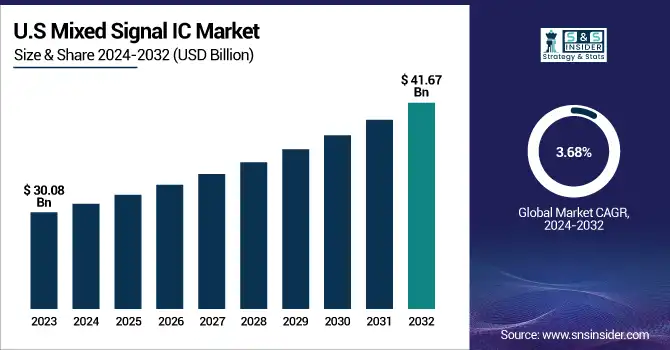

U.S. Mixed Signal IC Market Size Outlook

In the US, the Mixed Signal IC Market was valued at USD 30.08 Million in 2023 and is expected to reach USD 41.67 Billion by 2032, with a slightly lower CAGR of 3.68% over the same period. Along with these developments, failure rates and reliability data continue to improve, bolstering the adoption of mixed-signal ICs across industries such as automotive, consumer electronics, and industrial automation.

Mixed Signal IC Market Drivers:

-

The Critical Role of Mixed-Signal ICs in the Growth of Smart Device Ecosystems

The increasing demand for smartphones, wearables, and IoT devices is driving the need for mixed-signal ICs, which are crucial for efficient signal processing. These ICs enable seamless connectivity and optimize device performance by handling both analog and digital signals. As consumers embrace smart devices more widely, mixed-signal ICs ensure high-speed data transmission, low power consumption, and superior functionality across applications like health monitoring, smart home automation, and communication systems. This rising adoption of interconnected technologies highlights the essential role of mixed-signal ICs in supporting the growing complexity and diversity of modern, smart devices.

Mixed Signal IC Market Restraints:

-

Complexity in the Design and Testing of Mixed-Signal ICs

The design and testing of mixed-signal ICs present significant challenges due to the complex integration of both analog and digital circuits on a single chip. Such dual integration demands expertise in both fields, along with the use of advanced verification/simulation tools to deliver trusted performance. Since mixed-signal ICs require tight synchronization between the analog and digital signals, testing such devices can become especially challenging, as it is much harder to identify problems and verify designs. This also includes maintaining power efficiency, signal integrity and minimization of noise interference throughout the boards and circuits. Consequently, companies operating within the mixed-signal IC market are compelled to make substantial investments in both skilled personnel and advanced technologies, ultimately resulting in an increase in the cost and time needed for development and testing of mixed-signal ICs.

Mixed Signal IC Market Opportunities:

-

The Role of Mixed-Signal ICs in Enabling Smart Manufacturing and Industry 4.0

The rise of smart manufacturing and Industry 4.0 is fueling the demand for mixed-signal ICs, real-time data processing, and efficient control systems. By integrating the Internet of Things (IoT), cyber-physical systems, and analytics, Industry 4.0 allows for managing all production processes from optimizing resource use to reducing downtimes and increasing product quality. Mixed-signal ICs are essential for converting sensor analog signals to a digital form for control systems and thus enable precise machinery monitoring and control. These chips are essential for automating manufacturing lines, operating robots, automated maintenance systems and the like. With the rise of smart factories that use interconnected devices and machines, mixed-signal ICs ensure seamless communication and high-performance functionality across the factory floor. With these technologies developing and maturing rapidly, the demand for mixed-signal ICs that can enhance manufacturing efficiency, lower costs, and support the shift towards smarter, more autonomous production sites is gradually increasing.

Mixed Signal IC Market Challenges:

-

Integrating new mixed-signal ICs with legacy systems poses compatibility challenges, necessitating extra engineering for seamless performance.

Integrating new mixed-signal ICs into existing legacy systems presents significant challenges due to compatibility issues between newer technologies and older components. Legacy systems tend to be built on older hardware and software incapable of supporting the advanced functionality and specifications of modern mixed-signal ICs. This misalignment may necessitate redesigns or further engineering work to accommodate both, leading to higher costs and longer development cycles. And getting the older systems to interoperate with the new ICs may preclude them from taking full advantage of the newest performance improvements. Ensuring smooth operation across these different generations of technology requires careful planning, testing, and potentially, additional customization to meet the demands of both legacy and modern applications.

Mixed Signal IC Industry Segmentation Overview:

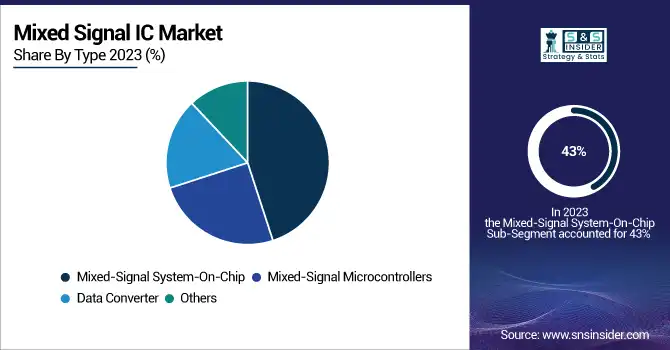

By Type

The Mixed-Signal System-On-Chip (SoC) segment held the largest share of approximately 43% in the market in 2023, reflecting its significant role in various applications, including consumer electronics, automotive, and industrial automation. System-On-Chip designs integrate multiple functions, such as analog, digital, and mixed-signal components, into a single chip, offering advantages in size, cost, and power efficiency. These integrated solutions are increasingly preferred for their ability to enhance performance while minimizing space and energy consumption. As the demand for smaller, faster, and more efficient devices grows, the adoption of Mixed-Signal SoCs is expected to continue expanding. Their ability to streamline complex functions, like communication and signal processing, in a single chip makes them ideal for next-generation technologies, driving their dominance in the market.

The Mixed-Signal Microcontrollers segment is expected to be the fastest-growing segment from 2024 to 2032, due to their versatility to handle both analog and digital tasks. These microcontrollers are typically used in applications broadly such as automotive systems, IoT devices, and industrial automation, where real-time operation and low operational power are vital along with the integration of analog functions. Microcontrollers are adopted across various industries; they achieve lower system complexity and cost by integrating many functions on a single microcontroller. The growing use of smart devices in connected environments will see continued demand for mixed-signal microcontrollers, which provide improved performance and energy efficiency to such systems, and will become a major driver within the mixed-signal IC segment.

By End Use Industry

The Consumer Electronics segment dominated the mixed-signal IC market with the largest share of around 38% in 2023, driven by the increasing demand for advanced, efficient, and compact electronic devices. Mixed-signal ICs play a critical role in consumer electronics by integrating both analog and digital functions, enabling features like high-speed processing, enhanced connectivity, and energy efficiency. The proliferation of smartphones, wearables, smart home devices, and other personal electronics has significantly boosted the demand for mixed-signal ICs. These chips are essential for improving the performance and power efficiency of devices, facilitating seamless user experiences. As the consumer electronics industry continues to evolve with innovations like 5G connectivity, IoT, and AI integration, the demand for advanced mixed-signal ICs is expected to grow, further solidifying their dominance in the market.

The automotive segment is expected to be the fastest-growing segment in the mixed-signal IC market over the forecast period from 2024 to 2032. The rising demand for advanced driver assistance systems (ADAS), electric vehicles (EVs), and autonomous driving technologies drive this growth, as all of these fields require complex mixed-signal ICs to handle signal processing, power management, and real-time data processing. Mixed-signal integrated circuits (ICs) support key functions in automotive applications, including sensor fusion, radar, lidar, and camera systems, which are required for safety, navigation, and connectivity. Moreover, as vehicles are increasingly becoming smart and connected through IoT, the demand for streamlined and integrated solutions will also increase. The increased adoption of electric vehicles further drives demand for mixed-signal ICs, particularly for battery management systems (BMS), motor control, and energy efficiency. With a wave of new tech such as electric and autonomous vehicles, the automotive is expected to lead a rapid growth over the next few years in the mixed-signal IC Market.

Mixed Signal IC Market Regional Outlook:

North America Mixed Signal IC Market Insights:

North America dominated the mixed-signal IC market in 2023, accounting for approximately 36% of the total revenue share, driven by strong demand from advanced consumer electronics, automotive innovations, and industrial automation. The region benefits from the presence of leading semiconductor manufacturers, robust R&D infrastructure, and high adoption of next-generation technologies like 5G, IoT, and AI. The U.S., in particular, plays a critical role due to its thriving tech ecosystem and substantial investments in smart manufacturing and electric vehicles. Additionally, government support for domestic chip production and strategic partnerships with major tech companies have further strengthened the region's market position. With an emphasis on innovation and a mature industrial base, North America continues to lead the global mixed-signal IC landscape, attracting consistent demand across multiple sectors and maintaining its dominance through the forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Mixed Signal IC Market Insights:

Asia Pacific is the fastest-growing region in the mixed-signal IC market over the forecast period 2024–2032, driven by rapid industrialization, expanding electronics manufacturing hubs, and high consumer demand for smart devices. Countries like China, South Korea, Taiwan, and India are heavily investing in semiconductor fabrication and R&D, supported by government initiatives such as China’s “Made in China 2025” and India’s “Semicon India Programme.” The region benefits from a strong supply chain, low production costs, and a growing middle class fueling demand for smartphones, wearables, and electric vehicles—all of which require efficient mixed-signal ICs for power management and signal processing. Asia Pacific's strategic importance as both a manufacturing base and a high-consumption market ensures its rapid expansion and significant contribution to global revenue in the coming years.

Key Mixed Signal IC Companies with their Products:

-

Analog Devices, Inc. (United States) – Data converters, analog front ends, mixed-signal microcontrollers

-

Infineon Technologies AG (Germany) – Power management ICs, sensor interfaces, automotive mixed-signal ICs

-

Microchip Technology Inc. (United States) – Mixed-signal microcontrollers, power ICs, interface ICs

-

NXP Semiconductors N.V. (Netherlands) – Mixed-signal SoCs, RF and analog front ends, sensor interface chips

-

STMicroelectronics N.V. (Switzerland) – Mixed-signal MCUs, analog ICs, power and connectivity ICs

-

Texas Instruments Inc. (United States) – Data converters, signal chain ICs, analog/digital interface solutions

-

Broadcom Inc. (United States) – Mixed-signal ASICs, communication interface ICs, RF ICs

-

Cypress Semiconductor Corporation (United States) – Mixed-signal PSoCs (Programmable System on Chips), memory interface ICs

-

Dialog Semiconductor (United Kingdom) – Power management mixed-signal ICs

-

EnSilica Ltd (United Kingdom) – custom mixed-signal ASICs and IP cores

-

Renesas Electronics Corporation (Japan) –automotive-grade mixed-signal ICs

-

Telephonics Corporation (United States) – Develops communication and radar mixed-signal ICs

List of companies that supply raw materials and components for mixed-signal IC manufacturing:

-

SUMCO Corporation

-

Shin-Etsu Chemical Co., Ltd.

-

GlobalWafers Co., Ltd.

-

BASF SE

-

DuPont

-

JSR Corporation

-

Henkel AG & Co. KGaA

-

AGC Inc.

-

Showa Denko K.K.

-

Linde plc

-

Tokai Carbon Co., Ltd.

-

AT&S

-

Ibiden Co., Ltd.

-

Unimicron Technology Corp.

-

Toppan Inc.

Recent Development:

-

November 12, 2024, Renesas Launches SLG47011 AnalogPAK IC with Industry-First Low-Power 14-bit SAR ADC. The new SLG47011 enhances analog front-end performance and reduces system complexity with integrated measurement, logic, and power-saving features.

-

March 6, 2025, Broadcom Inc. (AVGO) has started early manufacturing tests with Intel’s signal AI chip, marking a significant step in expanding its AI capabilities.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 123.80 Billion |

| Market Size by 2032 | USD 205.24 Billion |

| CAGR | CAGR of 5.78% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Mixed-Signal System-On-Chip, Mixed-Signal Microcontrollers, Data Converter, Others) • By End Use Industry (Consumer Electronics, Healthcare, Telecommunication, Automotive, Aerospace & Defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Analog Devices, Inc. (United States), Infineon Technologies AG (Germany), Microchip Technology Inc. (United States), NXP Semiconductors N.V. (Netherlands), STMicroelectronics N.V. (Switzerland), Texas Instruments Inc. (United States), Broadcom Inc. (United States), Cypress Semiconductor Corporation (United States), Dialog Semiconductor (United Kingdom), EnSilica Ltd (United Kingdom), Renesas Electronics Corporation (Japan), Telephonics Corporation (United States). |