Mobile TV Market Size & Trends:

The Mobile TV Market Size was valued at USD 13.26 Billion in 2023 and is expected to grow to USD 27.70 Billion by 2032 and grow at a CAGR of 8.53% over the forecast period of 2024-2032.

The Mobile TV market is growing rapidly, fueled by the increasing use of smartphones, the expansion of 4G/5G networks, and faster mobile internet access. As mobile video streaming becomes more prevalent, consumers now expect high-quality, seamless entertainment on-the-go.

Get More Information on Mobile TV Market - Request Sample Report

The expansion of mobile internet, particularly in emerging markets like India and rural regions of North America, is significantly contributing to the growth of mobile TV services. With the global roll-out of 5G networks, video quality is set to improve, supporting 4K streaming and reducing latency, which will enhance the user experience. Telecom companies such as Airtel and Verizon are heavily investing in infrastructure to provide exclusive mobile TV services, capitalizing on the rising demand for live streaming and video-on-demand content. The shift toward mobile-first video consumption, driven by the increasing affordability of smartphones and mobile data plans, is further expanding the market. The rise of cord-cutting is another key trend, as consumers move away from traditional TV services in favor of mobile platforms offering flexible, on-demand content. Improved mobile network technologies like 4G and 5G are making video streaming smoother and more reliable. According to the Global Mobile Suppliers Association (GSA) 5G-Market Snapshot, 578 operators across 173 countries are investing in 5G, with 300 operators already offering 3GPP-compliant 5G services. This rapid adoption of 5G technologies, along with the proliferation of 5G-enabled devices—1,756 now available for purchase—supports the growing demand for high-quality mobile TV experiences. As mobile network capabilities improve, mobile TV is positioned to become a key player in the entertainment industry, providing users with instant access to content anytime and anywhere.

Mobile TV Market Dynamics

Drivers

-

The rapid expansion of OTT streaming services is driving the growth of the Mobile TV market by meeting the increasing demand for mobile-first, on-the-go entertainment.

Consumers are increasingly shifting to mobile-first platforms for accessing TV content, including movies, TV shows, and exclusive programming, without the need for traditional cable subscriptions. As mobile devices such as smartphones and tablets become ubiquitous, the convenience of watching content anywhere is fueling this trend. In 2024, services like Dish TV's 'Dish TV Smart+' combine OTT and traditional TV offerings, providing access to a diverse range of content on all screens. Moreover, the demand for live streaming, personalized recommendations, and immersive content is driving OTT platforms' popularity. As mobile network speeds improve with the ongoing 5G roll-out, Over-the-top (OTT) platforms are also improving their video quality, enabling a better mobile TV experience. With companies like Verizon and Airtel enhancing mobile networks and offering exclusive content, the integration of mobile and OTT services is becoming more seamless. Affordable data plans and ad-supported free services further reduce entry barriers, making mobile TV accessible to a broader audience, including underserved regions. These factors combine to make mobile TV an attractive option for consumers, further accelerating its growth in the entertainment sector.

Restraints

-

Connectivity issues and inconsistent network quality, especially in rural areas, hinder the seamless mobile TV experience, limiting its growth and user satisfaction.

Connectivity issues are a significant challenge for the Mobile TV market, particularly in rural and remote areas where reliable, high-speed internet is often scarce. Poor network infrastructure in these regions leads to interruptions, buffering, and degraded video quality for mobile TV users. Even with advancements like 5G rollouts, internet access remains inconsistent, particularly during peak usage times. The rapid growth of OTT platforms, which rely heavily on stable connections for seamless streaming, only amplifies the issue. To achieve broader adoption and ensure a smooth user experience, addressing these connectivity gaps is crucial for the continued growth of mobile TV services, especially in underserved areas. Streaming service providers must address these challenges to offer a reliable viewing experience and drive further growth.

Mobile TV Market - Segmentation Outlook

by Content

The Content Video-on-Demand (VOD) segment captured the largest revenue share of approximately 52% in the Mobile TV market in 2023. This dominance stems from the growing consumer shift toward on-demand entertainment, fueled by OTT platforms like Netflix, Amazon Prime Video, and Disney+, which provide users with the flexibility to watch TV shows and movies anytime, anywhere, on mobile devices. Recent product developments, such as Disney+'s expansion into more international markets and Netflix's increased focus on interactive content, highlight the ongoing evolution of VOD services. Additionally, companies like Apple TV and Roku have introduced new hardware to optimize mobile TV experiences, such as smart TVs and streaming devices that enhance content accessibility. Moreover, mobile network providers are launching new 5G-enabled services, improving streaming quality and reducing buffering for mobile users. This evolution of both content platforms and network technology positions VOD as the dominant force in mobile TV, meeting consumers’ growing demands for seamless, personalized viewing experiences.

by Services Type

In 2023, the Free-to-Air (FTA) services segment dominated the Mobile TV market, capturing approximately 59% of the total revenue. FTA services, which provide content without requiring subscription fees, have seen significant growth due to increased accessibility, affordability, and consumer preference for free content. Companies like Sling TV and Pluto TV have launched free streaming services that allow users to access live TV, news, sports, and entertainment without any cost, driving this segment's dominance. Product development in this area has focused on enhancing user interfaces, improving content variety, and expanding regional access, allowing platforms to tap into underserved markets globally. Additionally, advancements in 5G and mobile network infrastructure have improved the streaming quality of FTA services, making them more competitive with subscription-based offerings.

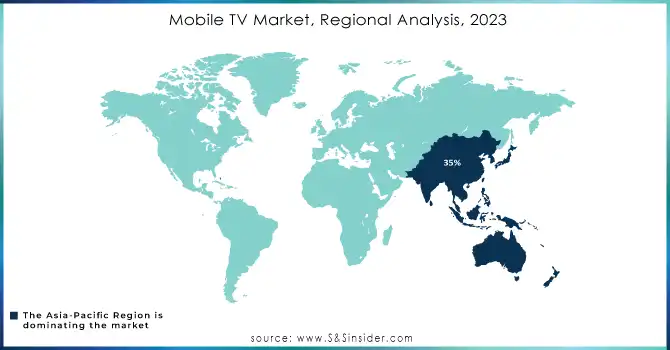

Mobile TV Market - Regional Overview

Asia-Pacific led the Mobile TV market in 2023 with a 35% share, driven by rapid smartphone adoption, expanding internet infrastructure, and the ongoing 5G rollout. Major countries like China, India, and South Korea are key players in the region, with mobile networks improving access to high-quality mobile TV services. In India, JioTV has significantly expanded its reach, offering both free and premium content to users, enhancing mobile TV accessibility. Additionally, companies such as Tencent and Baidu are innovating with mobile streaming platforms, launching mobile-optimized apps, and introducing personalized content features. South Korea's Samsung has also contributed to the growth, with the release of advanced mobile TV technologies designed for enhanced user experience. As mobile network speeds increase and OTT platforms become more prevalent, the region’s mobile TV market continues to thrive, providing a solid foundation for future growth.

North America is the fastest-growing region in the Mobile TV market, driven by robust infrastructure, particularly the expansion of 5G networks. Companies like Verizon and AT&T are investing heavily in next-generation networks, providing faster speeds and enhanced video streaming capabilities. Content providers such as Netflix, Hulu, and Amazon Prime Video continue to innovate with original content, live streaming, and integration of AI-driven recommendations to enhance the user experience. Roku’s launch of mobile-optimized smart TVs and Google’s advancements in Chromecast further fuel the region's growth.

Need Any Customization Research On Mobile TV Market - Inquiry Now

Key Players

Some of the major key players in the Mobile TV Market along with their respective products or services:

-

Netflix (Video-on-Demand Streaming)

-

Amazon Prime Video (Video-on-Demand Streaming)

-

Hulu (Video-on-Demand Streaming)

-

Disney+ (Video-on-Demand Streaming)

-

YouTube (Online Video, Live Streaming)

-

Apple TV+ (Video-on-Demand Streaming)

-

Sling TV (Pay TV, Live Streaming)

-

AT&T TV (Pay TV, Live Streaming)

-

HBO Max (Video-on-Demand Streaming)

-

Peacock (Video-on-Demand Streaming)

-

Roku (Streaming Platform, Live Streaming, TV Services)

-

Vudu (Video-on-Demand Streaming)

-

FuboTV (Pay TV, Live Streaming)

-

Sky Group (Pay TV, Online Video)

-

BBC iPlayer (Free-to-Air, Online Video)

-

Sony LIV (Video-on-Demand Streaming)

-

Hotstar (Disney+ Hotstar) (Video-on-Demand Streaming)

-

Tencent Video (Video-on-Demand Streaming, Online Video)

-

Zee5 (Video-on-Demand Streaming)

-

Tubi (Free-to-Air Streaming, Online Video)

-

AT&T (Telecommunications, Pay TV, Streaming Services)

-

Comcast (Telecommunications, Pay TV, Streaming Services)

-

MobiTV (Mobile TV Platform, Pay TV)

-

SKY (Pay TV, Streaming, Broadcasting)

-

Charter Communications (Telecommunications, Pay TV)

-

Verizon Communications (Telecommunications, Pay TV, Streaming Services)

-

Bell Canada (Telecommunications, Pay TV, Streaming Services)

-

Orange S.A. (Telecommunications, Pay TV, Streaming Services)

-

Bharti Airtel (Telecommunications, Mobile TV, Streaming Services)

-

Consolidated Communications (Telecommunications, Pay TV, Streaming Services)

List of suppliers that provide key technologies, content, or infrastructure solutions for the Mobile TV Market:

-

Qualcomm (Chipsets, 5G Solutions for mobile devices)

-

Intel Corporation (Chipsets, Processing Units for streaming devices)

-

Broadcom (Chipsets, Mobile TV Tuner Solutions)

-

MediaTek (System-on-Chip Solutions for mobile TV)

-

Harman International (Audio Solutions, Streaming Hardware)

-

Samsung Electronics (Smart TVs, Mobile Devices, TV Tuner Chips)

-

LG Electronics (Smart TVs, Mobile Devices, OLED Displays)

-

Nokia (5G Network Solutions, Mobile TV Infrastructure)

-

Ericsson (5G Solutions, Broadcast Equipment)

-

ZTE Corporation (Telecom Infrastructure, 5G Solutions)

-

Huawei Technologies (Telecom Equipment, Streaming Platforms, 5G)

-

Roku (Streaming Platform, Hardware, Content Aggregation)

-

Apple Inc. (Mobile Devices, TV+ Streaming Services, Hardware)

-

Google (Android TV, YouTube, Google Chromecast)

-

Airtel (Mobile TV Services, Telecom Infrastructure)

-

T-Mobile (Mobile TV Services, 5G Solutions)

-

Vodafone (Mobile TV, Telecom Infrastructure)

-

Sony Corporation (Content Production, TV Sets, Streaming Services)

-

Amazon Web Services (AWS) (Cloud Solutions for Streaming, Content Delivery)

-

Cisco Systems (Networking Solutions, Video Streaming Technology)

Recent Development

-

In June 2024, CTV Inc. and Bell Canada launched new mobile video news services for CTV News and ROBTv, providing Bell Mobility users in Canada with exclusive access to regularly updated news and business reports. The initiative aimed to deliver timely, mobile-friendly news coverage across the country.

-

In August 2024, Airtel became the first provider to offer connectivity in Phobrang, India’s remotest border village, potentially extending mobile TV access to remote areas.

-

In 2024, SKY plans to launch new TV models with advanced technologies, including MLA tech and Mini LEDs.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 13.26 Billion |

| Market Size by 2032 | USD 27.70 Billion |

| CAGR | CAGR of 8.53% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Content Type (Video-on-Demand, Online Video, Live Streaming) • By Service Type (Free-to-Air Services, Pay TV Services) • By Technology (IPTV, OTT, Satellite, Others) • By Application (Commercial, Personal) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Netflix, Amazon Prime Video, Hulu, Disney+, YouTube, Apple TV+, Sling TV, AT&T TV, HBO Max, Peacock, Roku, FuboTV, BBC iPlayer, Sony LIV, Hotstar, Tencent Video, Zee5, Tubi, and telecommunications companies like AT&T, Comcast, Verizon, Bharti Airtel, and Bell Canada, offering a variety of pay TV, streaming, and mobile TV services globally. |

| Key Drivers | • The rapid expansion of OTT streaming services is driving the growth of the Mobile TV market by meeting the increasing demand for mobile-first, on-the-go entertainment. |

| Restraints | • Connectivity issues and inconsistent network quality, especially in rural areas, hinder the seamless mobile TV experience, limiting its growth and user satisfaction. |