Molded Fiber Packaging Market Report Scope & Overview:

Get More Information on Molded Fiber Packaging Market- Request Sample Report

The Molded Fiber Packaging Market Size was valued at USD 10.20 Billion in 2023 and is expected to reach USD 15.69 Billion by 2032 and grow at a CAGR of 5% over the forecast period 2024-2032.

The molded fiber packaging market is experiencing significant growth, driven by rising environmental concerns and the global shift towards sustainable packaging solutions. As industries move away from traditional petroleum-based products, molded fiber packaging offers an eco-friendly alternative due to its biodegradable and compostable nature. However, to ensure product quality and functionality, certain molded fiber products require additional processes like lamination. This overview explores the factors driving the molded fiber packaging market, the role of lamination, recent innovations, and ongoing efforts to reduce plastic usage in packaging.

Increasing Demand for Sustainable Packaging

According to a survey by the United Nations Environment Programme (UNEP), over 380 million tons of plastic are produced globally each year, with almost 50% of that plastic used for single-use purposes. Additionally, around one-third of global plastic production is non-recyclable, posing a significant challenge to waste management systems and environmental sustainability.

As a result, molded fiber packaging has emerged as a preferred solution for businesses seeking to reduce their environmental impact. Made from recycled paper and natural fibers, molded fiber products are biodegradable, compostable, and more sustainable compared to conventional plastic packaging. This shift is a crucial step towards reducing plastic waste and embracing eco-friendly packaging alternatives, driving the growth of the molded fiber packaging market.

The Role of Lamination in Molded Fiber Packaging

Despite the clear advantages of molded fiber packaging, certain products need additional treatments to maintain durability and meet specific industry standards. Lamination is particularly important in the food packaging and medical packaging sectors, where product integrity and safety are paramount.

Companies like Omnipac Group, a key player in the molded fiber packaging market, stress the necessity of lamination to enhance the durability and functionality of their products. For example, in the food service industry, packaging must be grease-resistant and sturdy enough to handle various food types without compromising hygiene. In the medical field, single-use medical packaging requires a protective barrier to prevent contamination and maintain sterility, making lamination an essential process.

Innovations in Reducing Plastic in Lamination

With the rising focus on sustainable packaging, manufacturers are exploring ways to minimize or eliminate the use of plastic in lamination processes. Genera, a leading provider of compostable food service packaging, is making significant strides in creating molded fiber products that naturally break down without leaving harmful residues. By using compostable materials, Genera is helping reduce the environmental impact of single-use packaging while maintaining product quality.

Similarly, Imerys Minerals has developed innovative barrier coatings that serve as alternatives to traditional plastic-based lamination, such as polyethylene (PE) coatings. These coatings provide the necessary protection and performance without relying on plastic, improving the recyclability and compostability of molded fiber products. Such innovations are key to reducing the reliance on plastic in the molded fiber packaging market, making it a more sustainable and environmentally friendly solution.

Fiber Sourcing and Market Dynamics

In North America, the demand for pulp-quality fiber remains robust, despite challenges faced by the pulp and paper industry. Pulp markets offer landowners in North America an important outlet for managing forest resources and utilizing a mixture of timber qualities. Although the demand for pulp-quality fiber has declined since the late 1990s, other industries such as oriented strand board (OSB) and wood pellets have emerged as significant consumers of low-value fiber.

According to the Forisk U.S. Pulp Fiber Index, the total cost of fiber in the U.S. increased by 15% from 2000 to 2021, driven by inflation and rising raw material costs. During the same period, consumer inflation rose by 50%, and wood pulp prices climbed by 33%, indicating that the cost of materials for molded fiber packaging continues to rise, albeit at a slower pace than other sectors of the economy.

Market Dynamics

KEY DRIVERS:

-

Growing Demand in the Food and Beverage Industry

The rapid expansion of the food and beverage industry is expected to significantly fuel market growth, particularly for molded fiber packaging. Recent studies indicate that around 70% of consumers are now more likely to purchase products with sustainable packaging, reflecting a significant shift towards eco-friendly options. Additionally, the molded fiber packaging segment is expected to account for nearly 25% of the total sustainable packaging market by 2025. With approximately 50% of manufacturers in the food and beverage sector actively seeking sustainable packaging solutions, the demand for molded fiber packaging is poised to rise, positively impacting market performance.

-

Regulatory environment encourages manufacturers to adopt molded fiber packaging to comply with sustainability standards.

The regulatory environment is increasingly pushing manufacturers to adopt molded fiber packaging to comply with sustainability standards. According to a report by the European Commission, approximately 70% of European consumers are now aware of the harmful effects of single-use plastics, prompting governments to take action. The EU aims to ensure that all packaging is reusable or recyclable by 2030, significantly impacting manufacturers’ packaging choices. In the U.S., states like California and New York have implemented bans on single-use plastics, further accelerating the shift toward sustainable alternatives. A survey conducted by the Packaging Association found that 55% of companies are adopting sustainable packaging solutions in response to legislative pressures.

RESTRAIN:

-

Molded fiber packaging often requires specialized machinery and high-quality raw materials, which can lead to increased production costs compared to conventional plastic packaging.

Molded fiber packaging, while eco-friendly, often incurs higher production costs compared to conventional plastic packaging. This is primarily due to the specialized machinery and high-quality raw materials required for its production. According to industry estimates, the initial setup costs for molded fiber packaging machinery can be 20% to 30% higher than traditional plastic manufacturing equipment. Additionally, the raw materials used in molded fiber, such as recycled paper or natural fibers, can be more expensive due to their limited supply and higher processing requirements. For instance, the cost of sourcing and processing recycled paper for molded fiber packaging can be up to 15% higher than that of producing plastic packaging.

Moreover, the energy consumption involved in manufacturing molded fiber products is generally higher. Studies indicate that the production of molded fiber packaging can require up to 10% more energy compared to plastic packaging production, further adding to the operational costs. This is a significant factor, especially for small and medium-sized businesses looking to switch to sustainable packaging alternatives but struggling with tight budgets.

Despite these cost challenges, the rising demand for sustainable packaging solutions, driven by environmental regulations and consumer preferences, continues to push manufacturers towards molded fiber packaging. However, unless production technologies become more cost-efficient or raw material prices stabilize, these higher production costs may remain a key barrier to wider adoption.

Market Segmentation Analysis

BY FIBER PACKAGING TYPE

The transfer molded pulp segment holds the largest share in the molded fiber packaging market. This type of pulp is thinner compared to other varieties, with both sides polished to offer a smooth and refined finish. Its widespread use in applications such as fruit and vegetable trays, egg trays, wine shippers, slipper pans, and end caps is driving its growing demand globally. In fact, transfer molded pulp accounts for approximately 40% of the total molded fiber packaging market, primarily due to its cost-effectiveness and versatile applications. As the demand for eco-friendly and sustainable packaging solutions rises, this segment continues to expand at a steady rate.

The thermoformed pulp segment ranks second in market dominance. This type of pulp is processed to be denser and used to create more precisely shaped products. Its superior finish makes it ideal for premium applications such as molded tableware, including dinner plates, trays, cups, and soup bowls.

BY APPLICATION

The food and beverage segment dominates the molded fiber packaging market, driven by the rising demand for eggs, fruits, and vegetables. Molded fiber’s porous material provides excellent ventilation and shock absorption, reducing the risk of eggs breaking during transportation. Additionally, it helps prevent contamination, keeping products free from infections. The porous structure also absorbs moisture from fruits and vegetables, helping to maintain their freshness for longer periods and reducing food waste. With supermarkets placing emphasis on attractive packaging, colored and printed molded pulp trays have gained popularity, boosting the growth of this segment. Recent data shows that the food and beverage sector accounts for over 45% of the total molded fiber packaging demand globally.

The electrical and electronics segment ranks second, with increasing digitalization driving the demand for molded fiber packaging. These products are ideal for protecting sensitive electronics during transit, ensuring safe delivery.

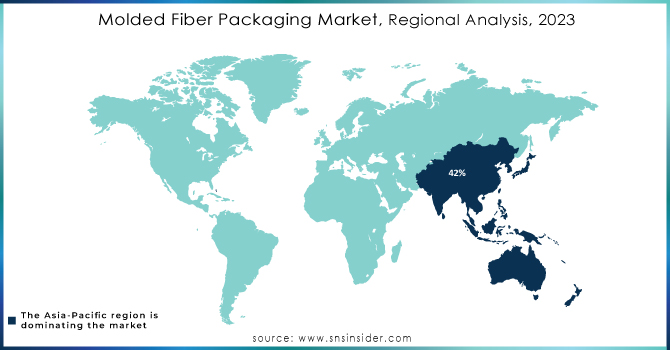

Molded Fiber Packaging Market Regional Analysis

In the Asia Pacific, the region led the global market with a revenue share of 42% in 2023, with China accounting for the largest portion. China's strong food and beverage industry, coupled with the booming electronics market, is fueling the demand for molded fiber packaging. The country's high population and rising disposable incomes are driving increased consumption of packaged goods. Furthermore, China is home to major electronics companies like Huawei, Lenovo, and Xiaomi, which boosts the need for protective packaging for delicate electronic products. The government’s push for biodegradable packaging and the ban on single-use plastics are also playing a pivotal role in market growth.

The North American molded fiber packaging market is expected to experience the fastest growth during the forecast period, driven by increasing digitization and efforts to reduce plastic usage, particularly in the packaged food and food service industries. The growing emphasis on environmental regulations and the need for easy disposal of packaging materials are accelerating the demand for bio-based molded fiber packaging. This shift toward sustainability is expected to boost market growth in the region.

In the U.S., the molded fiber packaging market is projected to grow at a significant CAGR, largely due to strategic acquisitions and partnerships. For example, ProAmpac Intermediate, Inc., a leader in flexible packaging, acquired Irish Flexible Packaging and Fispak. This acquisition bolsters ProAmpac’s sustainability-focused packaging offerings in Europe and the U.K., demonstrating how such collaborations are driving market demand in the U.S.

In Europe, the molded fiber packaging market is driven by its widespread use in the food service and packaging industries. In 2022, the EU had close to one million restaurants and mobile food services, a number expected to grow, driving up demand for sustainable packaging solutions. Additionally, stringent environmental regulations across EU member countries continue to promote the use of eco-friendly materials in packaging, contributing to market expansion.

Need Any Customization Research On Molded Fiber Packaging Market - Inquiry Now

Key Players

Some of the major players in the Molded Fiber Packaging Market are:

-

Brodrene Hartmann A/S

-

Genpak, LLC

-

Huhtamako Oyj

-

Eco-Products, Inc.

-

Fabri-Kal

-

Thermoform Engineered Quality LLC

-

Cullen Packaging

-

Pulpac AB

-

Pactive LLC

-

International Paper Company

-

ProAmpac

-

Dongguan City Luheng Papers Company Ltd.

-

Hartmann

RECENT TRENDS

-

Suzano has commenced operations at its new paper mill in Ribas do Rio Pardo, Brazil, with an annual production capacity of 2.55 million tonnes of eucalyptus pulp. This USD 4.3 billion project increases Suzano's total production capacity by over 20%, reaching 13.5 million tonnes annually, including packaging products.

-

In February 2024, Sanofi Consumer Healthcare will join PA Consulting and PulPac’s Blister Pack Collective to develop fiber-based blister packs that are recyclable in the paper waste stream, aiming to eliminate 'problem plastics' in pharmaceutical packaging.

-

Tanbark Molded Fiber Products, a Saco-based packaging manufacturer, is set to receive over USD 2 million in financing to create nine jobs and retain 23 in Maine. On February 15, the Finance Authority of Maine (FAME) approved USD 1.59 million in loans, alongside USD 500,000 from the Maine Technology Institute, to support equipment purchases for Tanbark's micro-fiber manufacturing expansion.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 10.20 Billion |

| Market Size by 2032 | US$ 15.69 Billion |

| CAGR | CAGR of 5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Fiber Packaging Type (Thick Wall, Processed Pulp, Transfer Molded, Thermoformed Fiber) • By Product Type (Boxes & Cartons, Inserts & Dividers, Trays, Cups & Bowls, Clamshells, Others) • By Application (Electrical & Electronics, Healthcare, Industrial, Food & Beverage, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Brodrene Hartmann A/S, CKF Inc, Pro-Pac Packaging Limited, Hentry Molded Products, Inc., Genpak, LLC, Huhtamako Oyj, Eco-Products, Inc., Fabri-Kal, Sabert Corporation, Thermoform Engineered Quality LLC, Cullen Packaging, Pulpac AB, Pactive LLC, International Paper Company, ProAmpac, Dongguan City Luheng Papers Company Ltd., Hartmann |

| Key Drivers | • Growing Demand in the Food and Beverage Industry • Regulatory environment encourages manufacturers to adopt molded fiber packaging to comply with sustainability standards. |

| Restraints | • Molded fiber packaging often requires specialized machinery and high-quality raw materials, which can lead to increased production costs compared to conventional plastic packaging. |