Fill-Finish Manufacturing Market Size & Trends:

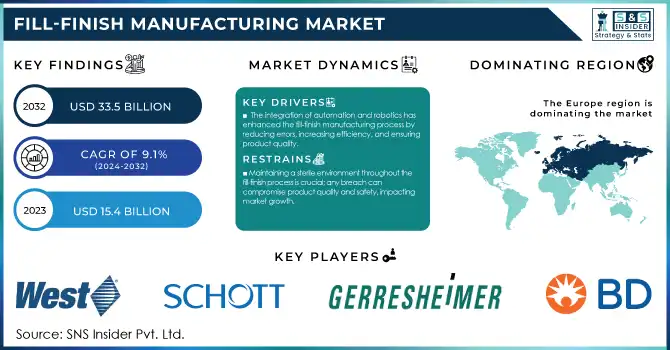

The Fill-Finish Manufacturing Market size was valued at USD 15.4 Billion in 2023 and is expected to reach USD 33.5 Billion by 2032, growing at a CAGR of 9.1% over the forecast period 2024-2032.

Get more information on Fill-Finish Manufacturing Market - Request Sample Report

Fill-finish manufacturing market is expected to grow at a considerable rate over the forecast period owing to various factors affecting the pharmaceutical and biopharmaceutical industries. A key driver has been the growth in demand for biologics and vaccines, with the World Health Organization reporting a substantial increase in the number of doses supplied globally, from 5.8 billion doses in 2019 to 16 billion doses in 2021. This also emphasizes the increasing need for fill-finish to be efficient, reliable, and ready to scale up to meet our global health requirements. In addition, the growing cases of chronic diseases have also played a significant role in growing the market. Amid an increasing elderly population and a rise in lifestyle-related diseases, there is a growing demand for complex therapies and pharmaceutical products, which necessitate advanced manufacturing capabilities. This trend is further supported by advancements in drug development technologies, which are enabling the creation of more complex and targeted therapies.

Market growth is greatly driven by government initiatives. Countries are spending on their healthcare and biopharma research more than they have previously. The governments of various countries have also initiated several measures such as the Production Linked Incentive (PLI) Schemes and the National Biopharma Mission (NBM) in India to ramp up domestic manufacturing and investment in life sciences relevant sectors. The demand for fill-finish technology is also supported by regulatory bodies as they are putting pressure on the industry with stringent quality regulations on pharmaceutical production. Schedule M (revised) of the Drugs and Cosmetic Act (DCA) in India, spells out the new quality norms and GMP (Good Manufacturing Practices) that pharmaceutical manufacturers would need to adhere. Vaccine development and monoclonal antibody production are other major drivers of the market as per the National Institute of Health. These advanced fill-finish manufacturing processes are required due to the requirements for safety, efficacy, and stability of these specialty products. While the industry matures, stakeholders are rising to meet new challenges and seize available opportunities. The adoption of sophisticated technologies such as bioinformatics, data analytics, and artificial intelligence in bioresearch services continues to expand, enabling bio-research competencies and leading to growth in the bioresearch services market. This technological integration is expected to play a crucial role in addressing the complex manufacturing requirements of emerging therapies and personalized medicines.

Market Dynamics

Drivers

-

The integration of automation and robotics has enhanced the fill-finish manufacturing process by reducing errors, increasing efficiency, and ensuring product quality.

-

Significant investments in expanding fill-finish manufacturing facilities have increased production capabilities, meeting the growing demand for pharmaceutical products.

-

The increasing prevalence of chronic diseases has led to a higher demand for biologics and injectable therapies, necessitating advanced fill-finish manufacturing processes.

The fill-finish manufacturing market is driven by the automation and robotics that have been installed in various factories and labs, which has helped in increasing the efficacy of the operations performed along with the quality of the product. With the adoption of technologies like automated opportunist filling lines, there is less human intervention, reducing possibilities for contamination. Today, facilities use robotic systems paired with 3D vision cameras and artificial intelligence (AI) to release vials and syringes while maintaining sterility and a high level of accuracy during the process.

In addition, the use of machine learning (ML) algorithms enhances quality control processes by improving defect detection rates. A recent study also showed that ML models outperformed in prediction volume with 99.4% accuracy in injection molding product quality and this power of AI-driven product quality assurance can be utilized in the manufacturing industry as well. Such technologies not only lead to enhanced operational processes but also the ability to conduct real-time monitoring as well as process optimizations. Deployment of smart sensors and embellishing data analytic platforms enables real-time monitoring of key parameters, and takeover of immediate corrective actions in the event of deviation. Such holistic control enables them to maintain product quality and adhere to the highest quality regulatory standards.

Restraints

-

Establishing fill-finish manufacturing facilities requires substantial investment in infrastructure, equipment, and regulatory compliance, posing a barrier for new entrants.

-

Compliance with strict regulations and guidelines to ensure product safety and quality can be challenging, especially for companies operating across multiple jurisdictions.

-

Maintaining a sterile environment throughout the fill-finish process is crucial; any breach can compromise product quality and safety, impacting market growth.

Fill finish manufacturing requires a high upfront investment in specialized infrastructure, advanced equipment, and cleanroom environments. The purchases of costly technology to ensure precision, sterility, and compliance with regulatory requirements Further, the incorporation of automation and robotics in fill-finish processes also improves efficiency but raises capital costs.

This extreme cost serves as a significant hurdle for smaller firms or new entrants to the market, often limiting their ability to create competitive facilities. Although on the whole, it is highly cost-efficient, scaling operations or shifting to more recent tech can be a challenge for established players. In addition to these investments, it is unlocking a flow of monthly costs to cover things that have to be continually paid for, such as staff training, equipment upkeep, and quality control processes. This makes the aspect of cost management extremely important to survive in this market, and the low tolerance towards any kind of contamination that happens at any point of the manufacturing process further drives up costs due to huge losses in the case that the process is not sterility which is valid in all aspect of FDA approved phases.

Fill-Finish Manufacturing Market Segmentation Overview

By Sterilization

In 2023, the fill-finish manufacturing market was dominated by the aseptic processing segment owing to its importance in maintaining the sterility of heat-sensitive drugs, including biologics and vaccines. Demand for injectable medications has increased and as a result, the sterilization process is much more stringent to minimize any sort of contamination. Government statistics show a substantial increase in the number of such activities being approved; the U.S. Food and Drug Administration (FDA) has recorded the highest number of biologic license applications approved in recent years, again reflecting the increasing demand for aseptic processing capacity.

In addition, improved operational efficiencies and contamination prevention have given aseptic technology a stronger position, and are the main reasons behind this segment leading. As global vaccination efforts escalate, the WHO has underscored maintaining aseptic conditions in drug manufacturing as critical to patient safety. As a result, there are expected to be continued investments in aseptic processing technologies, even as pharmaceutical manufacturers look to meet regulatory requirements with increased production capacity.

By Product

The consumables segment held the largest share of the fill-finish manufacturing market in 2023. This is attributed to the increasing demand for parenteral drug delivery systems. Government reports say healthcare providers like pre-filled syringes and vials due to their ease of use and lower contamination risk. Characteristics like prefilled devices that provide accurate dosing with little handling error are seeing increasing attractiveness, the FDA said.

Furthermore, increasing biologics and biosimilars will raise demand for consumables that aid the special packaging needs of these products. This trend is also supplemented by government initiatives favoring the development of biosimilars that promote pharmaceutical manufacturers to spend on high-quality consumable solutions to stabilize and increase the product shelf-life. Consequently, stakeholders are now emphasizing greater reach by expanding their offerings in the segment to capitalize upon a larger market opportunity.

By End User

In 2023, the Contract Manufacturing Organizations (CMOs) segment accounted for the dominant share of the global fill-finish manufacturing market. Such dominance stems from several factors like cost efficiency and CMOs providing their expertise in handling and managing complex manufacturing processes. According to the government, outsourcing trends in the pharmaceutical industry are increasing this is because companies across the globe want to focus on core competencies and thus, are increasingly opting to facilitate their business operations with services provided by CMOs.

In addition, CMOs are essential in regulatory compliance with the standards set by organizations such as the FDA and EMA (European Medicines Agency). Thanks to their existing infrastructure, they can deliver what the market demands either quickly or within a short time, as part of strict quality control. With pharmaceutical companies looking more and more in the direction of outsourcing their fill-finish processes, this trend could potentially prove hugely lucrative for the CMO sector.

Regional Analysis

The fill-finish manufacturing market in Europe has been majorly driven by improved healthcare infrastructure and a large number of leading pharmaceutical companies located in the region in recent years. The growth rate of this segment is driven by government-funded continued investment in biopharmaceutical research and development projects, which held about 35% of the global market revenue share.

Asia-Pacific is estimated to witness the maximum CAGR over the predicted timeframe. Such expansions are driven by rising foreign direct investments (FDIs) across biopharmaceutical sectors in China, India, and other countries. This region has already seen a rise in domestic manufacturing capabilities through government initiatives like China's "Made in China 2025" plan.

The U.S., holding a substantial share of the market, global pharmaceutical production according to the International Trade Administration (ITA), continues to lead in innovative drug development and fill-finish solutions due to its robust regulatory framework and investment climate.

Need any customization research on Fill-Finish Manufacturing Market - Enquire Now

Key Players

Key Service Providers/Manufacturers

-

Becton, Dickinson and Company (BD Hypak™, BD Sterifill)

-

Gerresheimer AG (Gx RTF® Vials, Gx Elite Vials)

-

West Pharmaceutical Services, Inc. (Daikyo Crystal Zenith®, NovaPure® Stoppers)

-

Stevanato Group (EZ-fill® Vials, SG Alba® Syringes)

-

Schott AG (SCHOTT EVERIC®, TopLyo®)

-

SGD Pharma (Sterinity Vials, Type I Plus)

-

Berkshire Sterile Manufacturing (Isolator-Based Filling Line, Lyophilized Vial Solutions)

-

OPTIMA packaging group GmbH (Optima H4, Optima VFVM)

-

IMA Group (IMA Life Easy Freeze, IMA Life Fillers)

-

Recipharm AB (Lyophilized Vials, Aseptic Filling Solutions)

Key Users

-

Pfizer Inc.

-

Johnson & Johnson

-

Roche Holding AG

-

Moderna, Inc.

-

AstraZeneca

-

Merck & Co., Inc.

-

Sanofi

-

Novartis AG

-

GlaxoSmithKline (GSK)

-

Eli Lilly and Company

Recent Developments

-

In February 2024 National Resilience Inc. a biomanufacturing company, increased its clinical and commercial drug product manufacturing capabilities throughout its network.

-

Gerresheimer launched Gx Elite, a unique range of glass injection vials, which combines enhanced patient safety and production efficiency with high shatter resistance in Oct 2023.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 15.4 Billion |

| Market Size by 2032 | USD 33.5 Billion |

| CAGR | CAGR of 9.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Consumables {Vials, Pre-Fillable Syringes, Vial Stoppers, Cartridges, Other Consumables} Instruments {System Type, Machine Type}) • By Sterilization (Terminal Sterilization, Aseptic Processing) • By End User (Pharmaceutical & Biopharmaceutical Companies, Contract Manufacturing Organizations, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Becton, Dickinson and Company, Gerresheimer AG, West Pharmaceutical Services, Inc., Stevanato Group, Schott AG, SGD Pharma, Berkshire Sterile Manufacturing, OPTIMA packaging group GmbH, IMA Group, Recipharm AB |

| Key Drivers | • The integration of automation and robotics has enhanced the fill-finish manufacturing process by reducing errors, increasing efficiency, and ensuring product quality. • Significant investments in expanding fill-finish manufacturing facilities have increased production capabilities, meeting the growing demand for pharmaceutical products. |

| Restraints | • Establishing fill-finish manufacturing facilities requires substantial investment in infrastructure, equipment, and regulatory compliance, posing a barrier for new entrants. • Compliance with strict regulations and guidelines to ensure product safety and quality can be challenging, especially for companies operating across multiple jurisdictions. |