Vitrectomy Devices Market Size Analysis

Get more information on Vitrectomy Devices Market - Request Sample Report

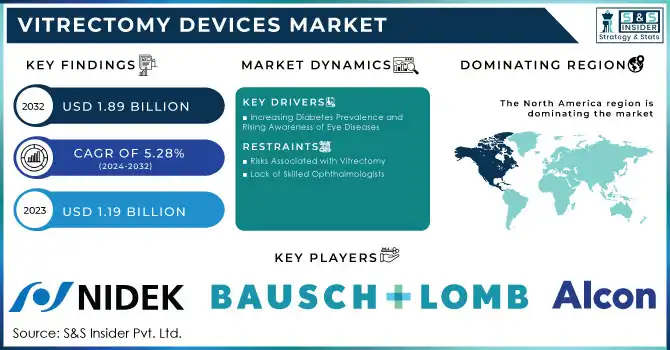

The Vitrectomy Devices Market Size was valued at USD 1.19 billion in 2023 and is expected to reach USD 1.89 billion by 2032 and grow at a CAGR of 5.28% over the forecast period 2024-2032.

The global vitrectomy devices market is experiencing robust growth due to the rising incidence of retinal-related diabetic cases that lead to most vision impairments. This is one of the primary causes of blindness in the working-age population in the world. This trend has increased the requirement for vitrectomy procedures, especially in cases involving vitreous hemorrhage and tractional retinal detachment. The diabetic retinopathy condition affected about 7.7 million Americans in 2018, according to projections from the National Eye Institute, this figure will increase to 11.3 million by 2030, making patients a powerful force for advanced vitrectomy devices. Globally, approximately 422 million individuals are affected by diabetes, with the majority living in low- and middle-income countries. Each year, diabetes-related vision complications necessitate over 1 million vitrectomy surgeries, contributing significantly to the demand for vitrectomy devices. Additionally, diabetes directly results in around 1.5 million deaths annually, highlighting the crucial role of these devices in managing diabetes-induced eye conditions and reducing the risk of vision loss.

Advances in technology for vitreoretinal devices, such as enhanced imaging features of optical coherence tomography and visualization techniques, enable more precise and less invasive surgical procedures for better patient outcomes. Designing devices in compact, portable forms also facilitates wider and easier acceptance in other healthcare settings. More importantly, a global aging population increases the likelihood of suffering retinal conditions, while there is a growing concern towards eye care and preventive medicine, driving the market further.

For example, Alcon launched the HYPERVIT Dual Blade Vitrectomy Probe, improving microincision vitrectomy surgical stability. The government and private sectors also contribute to this market with their investments. For instance, the Saudi Arabia Vision 2030 initiative will likely allocate over USD 65 billion in healthcare investments, including the privatization and development of private ophthalmic care facilities, thus increasing the commercial prospects in the vitrectomy devices market.

However, some of the other challenges facing the procedure of vitrectomy include high-cost devices and technical know-how. However, increased healthcare spending, infrastructure development, and adoption of minimally invasive techniques are anticipated to support ongoing growth in the vitrectomy devices market.

Vitrectomy Devices Market Dynamics

Drivers

-

Increasing Diabetes Prevalence and Rising Awareness of Eye Diseases

The rising incidence of diabetes is an important catalyst for the market of vitrectomy devices. Diabetes, especially type 1 and type 2, causes diabetic retinopathy, an eye disease that damages the blood vessels in the retina. Diabetic retinopathy is one of the leading causes of blindness among diabetic patients, which is divided into two stages: NPDR and PDR. With nearly 463 million adults currently suffering from diabetes worldwide, the IDF estimates this number to reach 700 million by 2045. As the disease diagnosis becomes more, the diabetic retinopathy rate will also be hastened, and thus the demand for performing vitrectomy surgeries and the treatment apparatus involved in addressing such complications in the retina due to disease illness.

Awareness of eye-related diseases and the availability of more advanced treatment options are driving the market forward. Patients are becoming more knowledgeable of conditions such as diabetic retinopathy, macular holes, and retinal detachment, which drives the demand for effective treatments. More awareness encourages patients to become diagnosed and treated promptly, and that usually leads to surgical interventions like vitrectomy. The preference for minimally invasive techniques for eye surgery is growing, as minimally invasive eye surgeries now offer a considerably shorter recovery period and lower risks as compared to conventional eye surgeries. The trend in patient preference towards these minimally invasive procedures coupled with the growing diabetes and other retinal disorders that are now increasingly being reported ensures healthy growth for this market.

Restraints

-

Risks Associated with Vitrectomy

-

Lack of Skilled Ophthalmologists

Vitrectomy Devices Market Segment Analysis

By Product

The vitrectomy machines segment dominated the market in 2023, with a revenue share of 37.0%. The growth of this segment is also further driven by the inductivity of next-generation machines that include advanced capabilities such as better fluidics and intraocular pressure management along with a higher cut rate.

The fastest growth in the segment is expected in vitrectomy packs from 2024 to 2032. This is due to the increased acceptance of vitrectomy packs across various indications, including vitreous removal, epiretinal membrane removal, combined retinal surgeries, and posterior vitreous detachment. Additionally, portability, optical magnification, and increased sensitivity are more likely to augment market growth.

By Application

The macular hole segment held the dominated revenue share in the market and is likely to continue its place throughout the forecast period. A macular hole damages the center portion of the retina, which is termed the macula. Vitrectomy surgery can be the main treatment when losing vision due to a hole in this situation, but only if the hole impairs visual acuity. However, most macular holes do not heal by themselves, and hence, surgery is necessary. Other causes of macular holes include high myopia, eye trauma, and retinal detachment. All these conditions are on an increasing trend, and consequently, this group is bound to experience increased demand for vitrectomy surgery.

On the other hand, the retinal detachment segment is likely to experience the fastest growth from 2024 through 2032. Retinal detachment, which may mostly affect people with high myopia, often leads to irreparable vision loss if left undiagnosed and untreated. Consequently, the growing prevalence of high myopia, which involves a higher volume of vitrectomy surgeries, will be driven by it to register significant growth in the segment.

By End-Use

The hospital segment led the market in 2023, holding the largest revenue share due to the high volume of vitrectomy surgeries performed in these facilities. Many hospitals now offer comprehensive ophthalmic care, including vitrectomy procedures, supported by essential infrastructure, skilled professionals, advanced equipment with a reliable power supply, and access to additional medical staff for emergencies. These advantages have contributed to the segment's robust growth in recent years.

The ambulatory surgical centers (ASCs) segment is expected to grow steadily over the forecast period, driven by the rising incidence of ocular disorders. Both patients and healthcare professionals have increasingly favored ASCs for surgical procedures in recent years. According to the Ambulatory Surgery Center Association (ASCA), approximately 6,200 Medicare-certified ASCs operated across the U.S. in 2022, with 468 in Florida and 458 in Texas. Of these, 755 ASCs specialized in ophthalmology, providing significant care options for patients. ASCs are popular among patients for their multiple advantages, including cost savings and convenience.

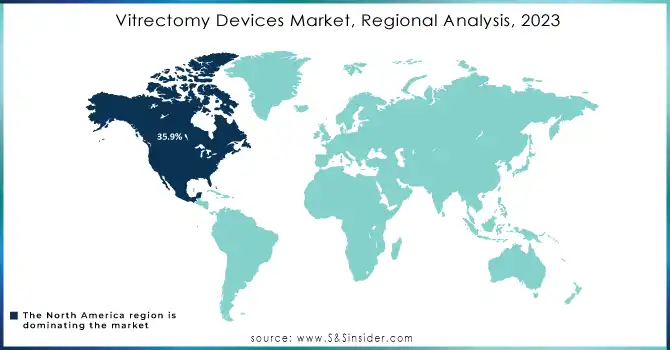

Vitrectomy Devices Market Regional Overview

North America had the highest share of 35.9% in the global vitrectomy devices market in 2023. The markets in North America are mainly stimulated by the rising prevalence of ophthalmic diseases including diabetic retinopathy, macular holes, and retinal detachment. Besides that, the region has a great market presence owing to major industry players. Most of these companies have received U.S. FDA approvals that boost their competitive advantage as well as their compulsions towards following regulations. The U.S. market for vitrectomy devices specifically is anticipated to witness CAGR growth from 2024 to 2032 based on the rise in the older population. In the United States Census, around one in six persons aged at least 65 years old in 2020. Such demographics enhance the requirement for these devices. DR was detected by the U.S. Centres for Disease Control and Prevention, which also contributed to the growth of the market as a leader among causes of blindness in American adults.

The Asia-Pacific region is expected to have the highest growth rate in the coming years. This region has huge aging populations in countries like China and India, expansion in the health infrastructures, and an increased number of patients requiring ophthalmic care in the future. Regional government and non-profit healthcare initiatives also contribute to market expansion. Country-specific key market data in the Asia Pacific region come from India, with a growing incidence of retinal detachment and diabetic retinopathy. According to WHO, around 77 million Indian adults aged 18 years and above have diabetes (type 2), hence reflecting the high demand for vitrectomy devices.

The European vitrectomy devices market is expected to grow significantly in the forecast period. Growth in Europe will come from the high prevalence of ocular disorders, increased acceptance of technologically advanced products, and increased R&D spending on innovative products. Major companies that are going to lead the expansion of the local market are Carl Zeiss, Alcon, NIDEK, Bausch Health, and Danaher. It is anticipated that Germany will hold a firm grip on the regional market in Europe. This can be understood with growing awareness of diabetic retinopathy and the availability and accessibility of the devices used during vitrectomy. Moreover, the healthcare infrastructure of the nation is very robust and consists of well-qualified professionals.

Need Any Customization Research On Vitrectomy Devices Market - Inquiry Now

Key Players

-

Alcon Inc. (Constellation Vitrectomy System, Accurus Vitrectomy System)

-

Bausch + Lomb Incorporated (Stellaris PC Vitrectomy System, Bausch + Lomb Vitrectomy Packs)

-

BVI (MASTERS System, MASTERS 2 Vitrectomy System)

-

NIDEK Co., Ltd. (Vitreous Cutter, Nidek Laser System)

-

Johnson & Johnson Vision Care, Inc. (INTRARETINAL Vitrectomy System)

-

Blink Medical (Blink Vitrectomy Instruments)

-

Topcon Corporation (Topcon Vitrectomy System)

-

Carl Zeiss Meditec AG (VISALIS 500 Vitrectomy System)

-

HOYA Medical Singapore Pte. Ltd. (HOYA Vitrectomy Systems)

-

HAAG-STREIT GROUP (Oculus Vitrectomy Systems)

-

MedOne Surgical (MedOne Vitrectomy Instruments)

Recent Development

In April 2024, Carl Zeiss Meditec AG, a leading player in the ophthalmic medical devices sector, acquired the Dutch Ophthalmic Research Center (D.O.R.C.). This strategic acquisition is anticipated to strengthen Zeiss's portfolio of digital workflow solutions in the coming years.

In September 2023, BVI, a rapidly expanding and diversified surgical ophthalmic company, announced its acquisition of Medical Mix, a specialist in supplying medical devices for ophthalmic surgeries in Spain and Portugal. This acquisition aligns with BVI’s strategy for growth and geographic expansion.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.19 billion |

| Market Size by 2032 | US$ 1.89 billion |

| CAGR | CAGR of 5.28% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Vitrectomy machines, Vitrectomy packs, Photocoagulation lasers, Illumination devices) •By Application (Diabetic retinopathy, Retinal detachment, Macular hole, Vitreous hemorrhage, Others) •By End-Use (Hospitals, Ophthalmic clinics, Ambulatory surgical centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Alcon Inc., Bausch + Lomb Incorporated, BVI, NIDEK Co., Ltd., Johnson & Johnson Vision Care, Inc., Blink Medical, Topcon Corporation, Carl Zeiss Meditec AG, HOYA Medical Singapore Pte. Ltd., HAAG-STREIT GROUP, and MedOne Surgical |

| Key Drivers | • Increasing Diabetes Prevalence and Rising Awareness of Eye Diseases |

| Restraints | • Risks Associated with Vitrectomy • Lack of Skilled Ophthalmologists |