MRO Protective Coatings Market Report Scope & Overview:

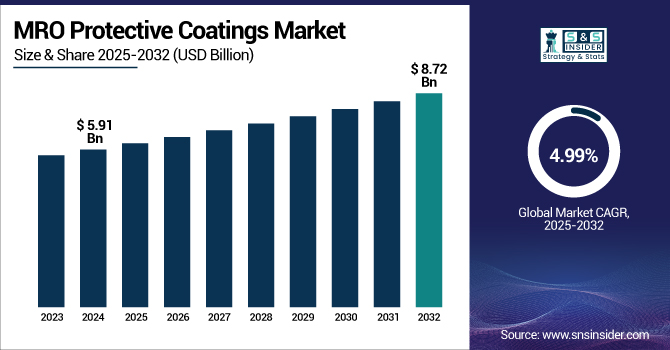

The MRO Protective Coatings Market size was valued at USD 5.91 billion in 2024 and is expected to reach USD 8.72 billion by 2032, growing at a CAGR of 4.99% over the forecast period of 2025-2032.

To Get more information on MRO Protective Coatings Market - Request Free Sample Report

The MRO Protective Coatings Market is rapidly expanding with a shift toward sustainable and high-performance maintenance solutions coming from the industries. Repacor SW-1000 and Sher-Bar TEC are some of the new innovative launches by Sherwin-Williams that have significantly boosted corrosion protection work in sectors, such as offshore wind and infrastructure. Other trends in the market are the use of AI for corrosion monitoring and digital inspections to reduce downtimes and increase asset life.

For instance, NACE International states that corrosion costs the global economy more than USD 2.5 trillion annually. The funds to replace and upgrade the pipe and wastewater system in the U.S. Infrastructure Investment and Jobs Act section, USD 15 billion each for lead pipe replacement and USD 11 billion for instances of corrosion control. This reduction of 113,500 tons of VOC emissions is recognized by the EPA as part of the industry's commitment to environmental sustainability.

MRO Protective Coatings Market Dynamics:

Drivers:

-

Infrastructure Rehabilitation Initiatives Spur Demand for Advanced Protective Coatings in Industrial Maintenance

Government-funded, public-private partnerships-driven global reclamation expeditions have expedited modernization projects on pipelines, bridges, and water treatment works. MRO protective coatings demand in the municipal and industrial sector is further supported by the U.S. infrastructure investment and jobs act, with USD 55 billion to upgrade water systems nationwide. Evonik estimates, the aging infrastructure in North America and Europe is leading to a very significant demand for high-performance coatings for restoring surfaces, mainly epoxy and polyurethane, used in corrosion and abrasion protection. This transition from brownfield to greenfield and asset rehabilitation is a significant factor responsible for the increasing demand for specialized coatings, which is driving the growth of the MRO protective coatings market and widening the industry portfolio.

-

Cost-Effective Low-VOC Coatings Adoption Drives Sustainable Market Expansion in Maintenance, Repair, and Overhaul

Increasing environmental concerns and stricter air quality regulations have fueled the demand for low-VOC MRO protective coatings in industrial sectors. More than 65,000 tons of VOCs are reduced annually, as a result of EPA regulation under the Clean Air Act that limits emissions from solvent paint and high-VOC adhesives. In turn, this has driven a transition to waterborne, high-solid, and UV-curable coatings that deliver comparable performance as traditional solvent-based systems, with lower health and compliance threats. Consequently, the MRO protective coatings market has been broadened, as companies are combining to develop new low-VOC solutions to reach sustainability targets and regulatory directives, ensuring a business expansion.

Restraints:

-

Complex Surface Preparation Requirements Increase Maintenance Downtime and Operational Expenses

Specific EPA regulations require, surface preparation for many protective coatings be performed with abrasive blasting, degreasing, and environmental conditioning. This requires extended preparation time, leading to downtime and losses, which is undesirable in high-paced sectors, such as marine and petrochemical maintenance. In infrastructure environments, limited access makes surface readiness a challenge, resulting in delayed maintenance schedules. These challenges limit the number of times and areas in which MRO protective coatings are applied subsequently restricting market growth and strategic planning in the MRO sector in turn.

-

High Global Corrosion Costs: Stress Cost-Benefit Analysis of Maintenance Protective Coatings Investments

With the global cost of corrosion reported by NACE International at USD 2.5 trillion per year, operators in industries, such as oil and gas are forced to evaluate return on investment for protective coatings. Market uptake is delayed as budget constraints often make fortifying coatings less accessible, leading buyers to wait for urgent repairs rather than preventive ones. Additionally, extensive testing and pilot projects are needed to prove cost-effectiveness, thus elongating adoption cycles and adversely impacting the MRO protective coatings market size. These financial barriers pose a great challenge to MRO companies by limiting market share growth and capital expenditure planning.

MRO Protective Coatings Market Segmentation Analysis:

By Product Type

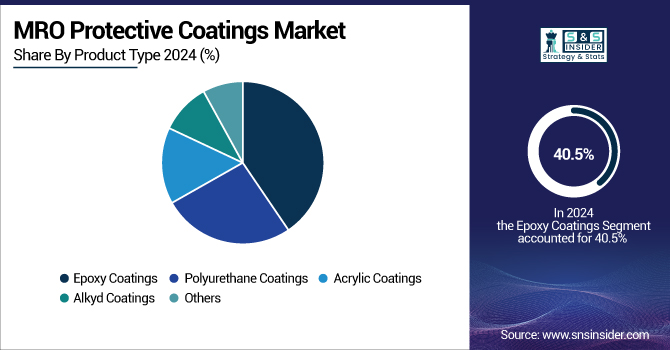

The epoxy coatings segment dominated the MRO protective coatings market with the highest market share of about 40.5% in 2024. Most of the coatings used are epoxy-based due to their superior physical properties, such as high strength and durability, and general and localized corrosion resistance. These coatings find extensive application in industrial sectors, such as marine and oil & gas, where contact with environmental factors is persistent and long-lasting protection is required. Thus, companies, such as Sherwin-Williams Company and PPG Industries, Inc. are increasing their epoxy coating portfolio to meet increasing market demand in these sectors.

Polyurethane coatings is the fastest growing segment in the MRO protective coatings market, followed by epoxy coatings, with a CAGR of 6.05% respectively. Their potential is growing due to their superior flexibility, UV ray resistance, and good durability in both outdoor and extreme industrial conditions. Low-chemical-exposure and high-quality finish polyurethane coatings gain high acceptance in automotive, construction, and other industries for durability. In addition, the environmental demand for green products can be attributed to the growth of polyurethane coatings that can be produced with low-VOC levels.

By Application

Corrosion resistance coatings hold a significant share in the MRO protective coatings market and accounted for 46.9% of the total market in 2024. The dominance of this segment is attributed to the increasing need for corrosion prevention in key end-use industries, including marine, oil & gas, and infrastructure. Overseas governments and large organizations have promoted advanced coatings to be developed for equipment and structures that are exposed to harsh environments to protect the equipment and improve its durability of the equipment.

-

For instance, the U.S. Department of Energy has emphasized the importance of protective coatings against corrosion in the context of energy infrastructure safety.

The abrasion protection is the fastest-growing segment in the MRO protective coatings market, which is projected to grow at a CAGR of 5.84% during the forecast period. Industries, such as mining, automotive, and aerospace, where equipment is subjected to high levels of abrasion, are demanding more and more abrasion-resistant coatings. These coatings are becoming an essential thing for industries as they will be giving attention to durability and reducing the maintenance cost. The abrasion-resistant coatings subsegment is particularly growing as manufacturers are investing in developing solutions that not only protect machinery from erosion but also help in reducing downtime costs and maintenance costs.

By End-use Industry

The marine industry dominated the MRO protective coatings market with a market share of 37.1% in 2024. The dominance is attributed to the fact that marine coatings are crucial for preventing corrosion of vessels and offshore structures against exposure to seawater, harsh weather conditions, and other environmental factors. The major organizations regulating safety and duration of operation of marine vessels, such as the International Maritime Organization (IMO), have established strict regulations which is anticipated to fuel the growth of high-performance coatings. To comply with these regulatory standards, there are continuous innovations in this segment.

The oil & gas is the fastest-growing end-use industry in the MRO protective coatings market, with a CAGR of 6.09% during the forecast period. Corrosion, ropeway, and span locations for oil & gas are done with solid coatings due to the mission & manufactory activities/operations, which need to be modified to protect from these elements. Research from Freedonia Group shows the growing global appetite for oil and gas will continue to drive from some measures of the need for sophisticated protective coatings. The eco-friendly coatings are also gaining momentum owing to the industrial shift towards sustainable and safe practices.

MRO Protective Coatings Market Regional Outlook:

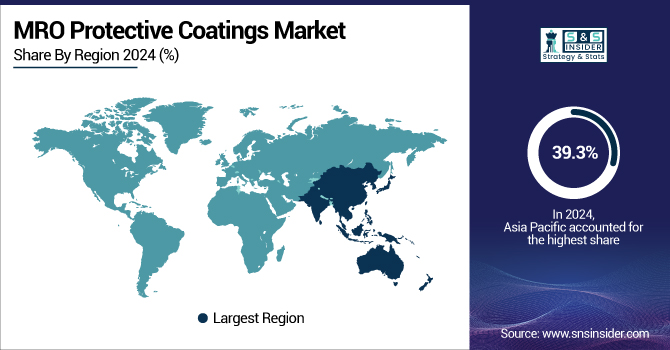

Asia Pacific held the largest share of the MRO protective coatings market in 2024 at 39.3%, with China and India dominating. Protective coatings demand bolstered by China’s upkeep of its bridges and India investing in water infrastructure projects, such as the Jal Jeevan Mission. Furthermore, the market is driven by Japan's pursuit of the modernization of nuclear and chemical facilities. These countries emphasize the importance of corrosion protection coatings in their infrastructure maintenance programs. The MRO protective coatings across the region are being driven by the growing industrialization of the region, along with improvement in the infrastructure and trends to meet environmental compliance.

North America is a growing area and is attributed with a 20.4% share in the MRO protective coatings market in 2024. The U.S. market leads with a market size of USD 850.49 million in 2024 and with a market share of 71%. Moreover, with more than 43,000 structurally deficient bridges in the U.S., demand for protective coatings to repair infrastructure is huge. Growth also comes from Canada’s oil sands and chemical plant upgrades in Mexico. The federal investments under the Infrastructure Investment and Jobs Act and the rising necessity for pipeline and facility repair also augment the need for corrosion protection coatings, especially epoxy and polyurethane-based solutions, making it a very high-potential region for MRO coatings.

In 2024, Europe had a share of 24.2% in the MRO protective coatings market. Countries such as Germany, France, and the UK have high demand for this, with stricter environmental laws and industry safety requirements. Similar to the U.K., Germany needs coatings to maintain its chemicals and power sector assets, and wind and flood defenses. The demand for corrosion-resistant coatings also increases, due to the nuclear industry of France. These nations comply with EU standards, such as REACH and ISO 12944, for the sustainability solutions for the coatings, which is making Europe a vital market for protective coatings.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major competitors in the MRO protective coatings market include The Sherwin-Williams Company, PPG Industries, Axalta Coating Systems, Jotun, RPM International Inc., Sika AG, Hempel A/S, Chugoku Marine Paints, Belzona International Ltd., Weilburger Coatings GmbH.

Recent Developments:

-

April 2024: Henkel acquired Seal for Life Industries, enhancing its MRO portfolio and focusing on sustainable corrosion protection solutions for infrastructure markets, including renewable energy and water.

-

March 2025: Sherwin-Williams expanded its global core product offering to meet evolving customer needs, enhancing competitiveness in the protective coatings market with innovative, high-performance products.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 5.91 billion |

| Market Size by 2032 | USD 8.72 billion |

| CAGR | CAGR of 4.99% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Epoxy Coatings, Polyurethane Coatings, Acrylic Coatings, Alkyd Coatings, Others) •By Application (Abrasion Protection, Corrosion Resistance, Chemical Resistance, Intumescent (Fire Protection), Others) •By End-use Industry (Marine, Oil & Gas, Petrochemical, Power Generation, Infrastructure, Water Treatment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | The Sherwin-Williams Company, PPG Industries, Axalta Coating Systems, Jotun, RPM International Inc., Sika AG, Hempel A/S, Chugoku Marine Paints, Belzona International Ltd., Weilburger Coatings GmbH |