Nanofiltration Membranes Market Report Scope & Overview:

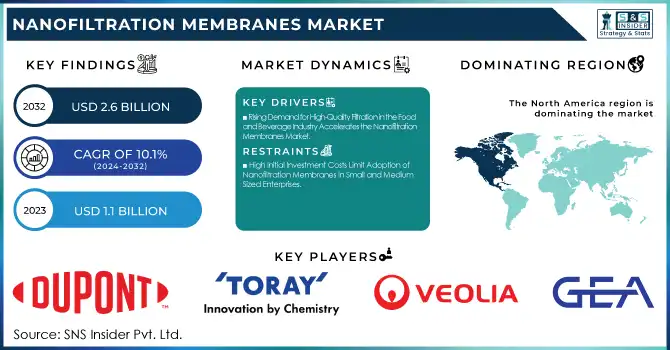

The Nanofiltration Membranes Market size was valued at USD 1.1 billion in 2023 and is expected to reach USD 2.6 billion by 2032, growing at a CAGR of 10.1% over the forecast period 2024-2032.

To Get more information on Nanofiltration Membranes Market - Request Free Sample Report

The Nanofiltration Membranes Market is rapidly changing based on demand and is growing into various industries that include water treatment and pharmaceutical applications. Our report will cover the Intellectual Property Landscape where patents and innovations are emphasized, Product Life Cycle Analysis by sustainability, and R&D/Investment Trends in research studies. We shall also give out information on Cost Structure Analysis concerning production and provide a Supply Chain Analysis to focus on key suppliers and logistics effectiveness, giving you a comprehensive look at the market.

Nanofiltration Membranes Market Dynamics

Drivers

-

Rising Demand for High-Quality Filtration in the Food and Beverage Industry Accelerates the Nanofiltration Membranes Market

Nanofiltration membranes are being used in an extensive range of applications in the food and beverage industry, with usage having grown dramatically in the last few years. Hydrophilic polymers have been developed into nano-filtration (NF) membranes characterized by efficient filtration properties that enable the removal of impurities, bacteria, and particles from food and beverages, whilst maintaining their nutritional content and flavor profile. A notable use of membranes is in whey protein concentration and sugar separation, where selective filtration is needed to obtain the required quality. Nanofiltration Technology Market: North America to Dominate as Consumers Demand Healthier High-Quality Products, Require More Quality from Food Manufacturers The growing demand for safe, pure, and superior quality in food and beverage businesses has expanded the market.

Restraints

-

High Initial Investment Costs Limit Adoption of Nanofiltration Membranes in Small and Medium-Sized Enterprises

One of the major restraining factors for this market growth is initial high investment needed in the Nanofiltration Membranes installation process. Nanofiltration systems are comparatively expensive because of the expensive raw materials and complicated manufacturing process in advanced systems. It could be beyond the financial reach of small and medium-sized businesses, particularly in developing areas of the world. High costs has made this capital expenditure so affordable that even large enterprises and municipalities can spend the money as it will be bundled with maintenance costs looking after the cleanings, replacements and monitoring of the membranes. Such cost implications will discourage many users from being able to afford nanofiltration systems, particularly for small-scale water treatment plants and food-processing industries, which is a very cost-sensitive application. Some medtechs might become early movers in taking this technology to market, yet the expensive nature of the technology serves as a barrier to wider adoption, even if big pharma or other biopharmaceutical companies selectively license this technology.

Opportunities

-

Expanding Water Treatment Infrastructure in Emerging Markets Boosts Nanofiltration Membranes Demand

The increasing penetration of water treatment infrastructure in emerging markets will further fuel the demand for nanofiltration membranes. Often, developing countries are plagued by critical water quality issues stemming from industrial waste, heavy metals, and pathogens. Improving access to safe drinking water and increasing water consumption are driving needs among these developing nations. Governments in the Asian-Pacific, the Middle East, and Africa have also started to invest in water treatment projects in terms of municipal water systems and wastewater recycling. In such applications, nanofiltration membranes can selectively remove ions, offering better solutions to address the challenges related to the purification of water in these regions. Rising sustainable water management practices, and respect for environmental norms, create tremendous scope for expansion in the market for nanofiltration membranes.

Challenge

-

Membrane Fouling and Cleaning Challenges Pose Operational Hurdles for Nanofiltration Membranes

Membrane fouling is one of the main challenges facing the Nanofiltration Membranes Market. Fouling causes a decline in the efficiency of filtration systems by reducing the permeability through the membrane and increasing the pressure drop due to an accumulation of particulate matter, microorganisms, and other organic compounds on the surface of the membrane. Cleaning and maintenance of the fouled membranes are labor-intensive, time-consuming, and very expensive. In some instances, the cleaning processes may damage the membrane, which shortens its lifespan and calls for replacement. Fouling is a significant challenge in managing large-scale water treatment applications, making nanofiltration systems less efficient and expensive to maintain. This issue poses a significant operational challenge, especially in industries with high volumes of filtration, and is one of the major challenges to be overcome for the market's growth.

Nanofiltration Membranes Market Segments

By Type

In 2023, polymeric membranes dominated and accounted for the largest market share of 65% in the Nanofiltration Membranes Market. Polymeric membranes are most commonly used due to their relatively lower cost of production, simplicity of manufacturing process, and compatibility with a range of applications. It is utilized mainly for better filtration selectivity performance and finds applications in many municipal and industrial water treatment facilities. Advanced polymeric nanofiltration membranes for large-scale water treatment projects are offered by companies such as DuPont Water Solutions and Hydranautics. Additionally, governments and environmental agencies give priority to the use of polymeric membranes in their purification projects because these are efficient with low operational costs.

By Membrane Module

Spiral-wound membranes dominated the Nanofiltration Membranes Market in 2023, with an expected share of around 45% of the total market. Spiral-wound modules are commonly favored for their high surface area, space efficiency, and easy implementation into large-scale filtration modules. However, spiral-wound modules are typically used for desalination and water treatment. Companies such as Toray Industries and GEA Group go to market by providing spiral-wound nanofiltration membranes to their respective industries. The application lies primarily in treating municipal water since large volumes of water need to be treated efficiently. This modular design also cuts energy usage, echoing the global pivot towards sustainable solutions for various challenges in water management.

By Application

In 2023, Water & Wastewater Treatment dominated and accounted for the largest share of over 55% of the total Nanofiltration Membranes Market. This sector has been the main force behind the adoption of nanofiltration membranes with the rising demand for clean water and a growing focus on recycling wastewater. Governments worldwide are pouring money into water treatment infrastructure, and nanofiltration membranes are perfect for removing pollutants like heavy metals, salts, and bacteria. Advanced filtration methods, including nanofiltration, have even been supported by organizations such as the World Health Organization (WHO) and other regulating authorities to achieve demanding water quality standards. This is driving demand for these membranes in water consumption and industrial wastewater treatment applications in municipal water systems.

By End-Use

In 2023, the municipal end-use dominated the nanofiltration membrane accounting for a market share of 50%. However, the increasing need for safe drinking water globally has driven municipalities to adopt cutting-edge water treatment technologies such as nanofiltration membranes. Such membranes are showing good performance in water purification, pollutant reduction, and water quality improvement. This issue is a central focus for governments all over the world, which involves investing in big water purification projects. For instance, campaigns such as Global Water Partnership are aimed at enhancing water accessibility and quality, thereby propelling the need for nanofiltration membranes in municipal applications. With increasing awareness regarding environmental sustainability and access to clean water, this segment is anticipated to continue sustaining its dominance.

Nanofiltration Membranes Market Regional Analysis

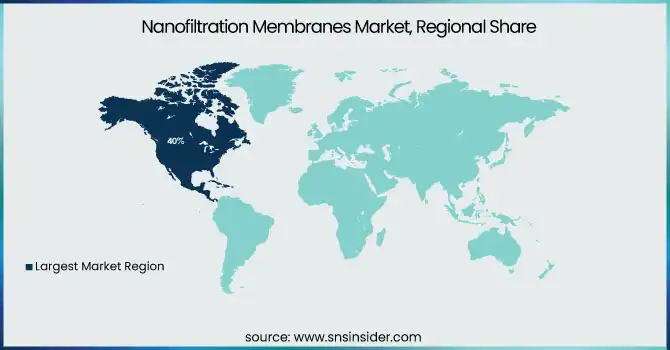

In 2023, North America dominated the Nanofiltration Membranes Market with an estimated 40% market share. The growing need for advanced water treatment technologies and stringent environmental regulations will cement the leading position of North America. The United States is especially active, motivated by huge investments in urban water systems and industries like oil and gas. Nanofiltration membranes are increasingly adopted for drinking water and wastewater treatment, as strict water quality regulations are enforced by the U.S. Environmental Protection Agency (EPA). California and Texas are examples of U.S. major cities that lead the way in water reuse and desalination projects, with nanofiltration being a frequently used technology. Another major player is Canada, which has become a contributing factor to its water sustainability and environmental conservation efforts. North America dominates the market for nanofiltration membrane type, supported by its established infrastructure, regulatory framework, and proactive approaches in promoting water conservation, which would continue to augment investments and increase renewable demand for sustainable water treatment solutions in the forthcoming future.

On the other hand, Asia-Pacific has emerged as the leading region in the Nanofiltration Membranes Market with an estimated CAGR of 7.8% during 2023. The drivers for this growth are rapid industrialization and urbanization, coupled with increasing attention toward water sustainability. China is leading these efforts with large-scale water treatment projects through support from the Ministry of Water Resources to prevent water pollution. Increasing water scarcity in India and governmental initiatives such as the Jal Jeevan Mission to improve access to clean water are gaining their shares. Increasing industries and population growth in Southeast Asian nations including Indonesia and Vietnam are adopting nanofiltration membranes at a much higher rate. Governments in these countries prefer the construction of treatment plants for wastewater and supplying clean water, which accelerates the demand for nanofiltration technologies. Desalination projects and efficient water purification systems are also in focus, strengthening APAC's growth. With the rapid development of the region, coupled with considerable investments in water infrastructure and environmental protection, the fastest growing market for nanofiltration membranes is APAC.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

DuPont Water Solutions (FilmTec NF membranes, FilmTec NF Plus membranes)

-

Toray Industries, Inc. (Toray NF membranes, Toray NF-90 membranes)

-

Veolia Environnement S.A. (Hydranautics ESPA NF membranes, Hydranautics LFC1 membranes)

-

Alfa Laval AB (Alfa Laval NF membranes, Alfa Laval RO/NF membranes)

-

GEA Group AG (GEA NF membranes, GEA Reverse Osmosis membranes)

-

Hydranautics (ESPA NF membranes, LFC3 membranes)

-

NX Filtration (NX Filtration NF membranes, NX Filtration NF100)

-

Pall Corporation (Pall Nanofiltration membranes, Pall Aria NF membranes)

-

Pentair (Pentair X-Flow NF membranes, Pentair RO/NF membranes)

-

Koch Separation Solutions (Koch TFC NF membranes, Koch Sepro NF membranes)

-

Pure Aqua Inc. (Pure Aqua NF membranes, Pure Aqua NF-4040 membranes)

-

Synder Filtration Inc. (Synder NF membranes, Synder 8040 NF membranes)

-

Applied Membranes Inc. (Applied NF membranes, Applied Membranes NF-400)

-

Nitto Denko Corporation (Nitto NF membranes, Nitto NF-90 membranes)

-

Osmotech Membranes Pvt. Ltd. (Osmotech NF membranes, Osmotech NF-4040)

-

SPX FLOW Inc. (SPX FLOW membrane filters, SPX FLOW NF membranes)

-

Vontron Technology Co., Ltd. (Vontron NF membranes, Vontron NF-4040)

-

Argonide Corporation (Argonide NF membranes, Argonide NF-90)

-

Danaher (Danaher NF membranes, Danaher reverse osmosis membranes)

-

Merck & Co. (Merck NF membranes, Merck Millipore NF membranes)

Recent Development:

-

January 2025: Scientists of the Chinese Academy of Sciences developed an advanced nanofiltration membrane which is a new class of smart materials capable of selective ion transport, with high salt permeability and organic matter rejection under shear force for high salinity wastewater in wastewater treatment and resource recovery.

-

September 2024: DuPont's FILMTEC Nanofiltration Membranes received the "2024 Sustainability Technology of the Year" title for improving water quality and reducing energy consumption — an example of the company's ongoing drive to provide sustainable solutions in water treatment.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.1 Billion |

| Market Size by 2032 | US$ 2.6 Billion |

| CAGR | CAGR of 10.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Polymeric, Ceramic, Hybrid) •By Membrane Module (Spiral wound, Tubular, Hollow fiber, Flat sheet, Others) •By Application (Water & Wastewater Treatment, Food & Beverage, Pharmaceutical & Biomedical, Chemical & Petrochemical, Others) •By End-Use (Municipal, Industrial, Commercial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | DuPont Water Solutions, Toray Industries, Inc., Veolia Environnement S.A., Alfa Laval AB, GEA Group AG, Hydranautics, NX Filtration, Pall Corporation, Pentair, Koch Separation Solutions and other key players |