Robotic Platform Market Size & Trends:

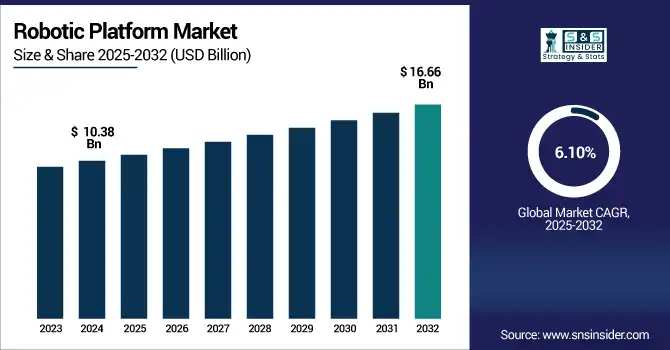

The Robotic Platform Market size was valued at USD 10.38 Billion in 2024 and is projected to reach USD 16.66 Billion by 2032, growing at a CAGR of 6.10% during 2025-2032.

To Get more information on Robotic platform market - Request Free Sample Report

The robotic platform market is experiencing rapid growth, due to the growing adoption of minimally invasive surgeries, accuracy and automation in various applications, such as healthcare, manufacturing, and logistics. The use of new technology, combining artificial intelligence (AI), sensors, and real time data processing is making robots smarter and more adaptable. Surgeons use robotic platforms to perform complex procedures with less recovery time in healthcare, and as production line tools to increase efficiency and mitigate risk in industry. Increasing labor shortage, increased need for automation investment, and the addition of industry driven operating efficiency is further speeding adoption. In the context of an increasing support of regulatory institutions for new technologies and a growing integration in a variety of sectors, robotic platforms are finding a key role for higher performance, reliability and scalability of critical applications.

June 25, 2025 – Baylor St. Luke’s surgeons performed the first fully robotic heart transplant in the U.S. using Intuitive's da Vinci Xi system, marking a major milestone in minimally invasive cardiac surgery.

The U.S Robotic Platform Market size was valued at USD 7.14 Billion in 2024 and is projected to reach USD 10.62 Billion by 2032, growing at a CAGR of 5.08% during 2025-2032. The Robotic Platform Market growth is driven by automation demand, AI integration, defense modernization, and healthcare robotics. Emerging Robotic Platform Market trends include collaborative robots, autonomous systems, edge AI, IoT-enabled platforms, and smart sensors.

Robotic Platform Market Dynamics:

Drivers:

-

Advancements in Humanoid Robotics Drive Widespread Adoption of Robotic Platforms Across Industries

Rapid advancements in humanoid robotics particularly in dexterity, mobility, and intelligent interaction are driving the robotic platform market forward. Growth of the robots market, to perform tasks that were once human with high precision, and increasing penetration of robots into sectors including healthcare, retail, tourism, and education will drive shipment volumes. New technologies, such as whole-body teleoperation, natural language interaction through AI, and high degrees of freedom, help robots to work effectively in unpredictable and dynamic environments. By combining advanced engineering and embodied AI, the way that humans and robots work together is changing. With the Robotic Platform Market demand of scalable automation systems growing increasingly critical to businesses and institutions in response to labor shortages, demands for substantially improved service delivery levels, and the streamlining of operational processes, intelligent humanoid robots are proving to be invaluable assets in a broad range of real-world scenarios.

June 2025 – China’s Robotera unveiled its humanoid service robot Q5, featuring 44 degrees of freedom, AI-powered interaction, and full-body teleoperation, designed for real-world deployment in healthcare, retail, tourism, and education.

Restraints:

-

Technical Setbacks and Deployment Failures Undermine Confidence in Humanoid Robotics Market

The humanoid robotics market faces notable restraints due to persistent technical challenges and deployment failures. Despite significant investments and public interest, such high-profile setbacks raise concerns about the scalability and consistency of humanoid platforms, particularly in commercial or critical environments. Delays in product rollouts, unmet demonstration expectations, and unresolved engineering hurdles can erode investor and customer confidence. As companies push toward as intelligent robots, these disruptions highlight the urgent need for robust testing, quality assurance, and practical validation to ensure sustained market trust and adoption.

June 26, 2025 – Germany-based Neura Robotics faced a setback as its humanoid robots failed to appear at their scheduled debut in Munich, drawing attention to ongoing technical and deployment challenges in the humanoid robotics sector.

Opportunities:

-

Surging AI Infrastructure Demand Unlocks Growth Opportunities for Robotic Platforms

The rapid expansion of AI infrastructure across Europe is creating significant growth opportunities for the robotic platform market. As industries increasingly adopt AI to enhance automation, optimize logistics, and drive innovation, the need for intelligent robotic systems is rising. This trend is particularly strong in manufacturing, automotive, and healthcare sectors, where AI-powered robotics can streamline operations, reduce costs, and improve precision. The development of localized AI compute capacity and support for sector-specific applications is enabling faster deployment and integration of robotic platforms. This shift positions robotics as a critical enabler of next-generation, AI-driven industrial transformation.

June 2025 – Nvidia announced its first AI data center in Germany focused on industrial applications, aiming to boost Europe’s AI infrastructure and support sectors, such as automotive, robotics, and pharma through sovereign AI and large-scale compute capacity.

Challenges:

-

Integration Complexity and Infrastructure Gaps Limit Scalable Deployment of Robotic Platforms

Despite rapid advancements, the robotic platform market faces key challenges that hinder widespread adoption. One major issue is the complexity of integrating robotics with existing infrastructure, software systems, and workflows, particularly in legacy industrial environments. High upfront costs, along with the need for skilled personnel to manage, maintain, and program these platforms, also restrict scalability. Limited standardization across hardware and software further complicates cross-platform compatibility and interoperability. Additionally, concerns around cybersecurity, data privacy, and operational safety present barriers in sensitive sectors, such as healthcare and defense. These challenges collectively slow down deployment, reduce ROI, and deter small to mid-sized enterprises from fully embracing robotic automation.

Robotic Platform Market Segmentation Outlook:

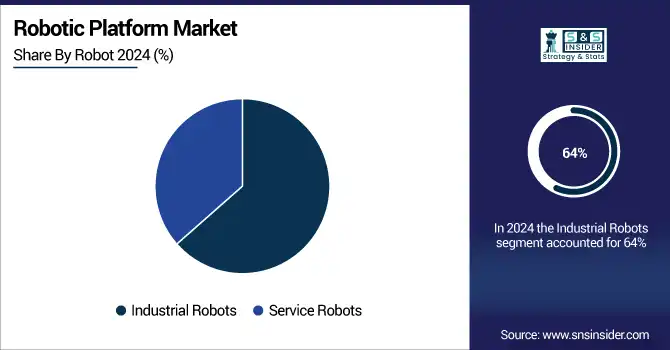

By Robot

The Industrial Robots segment held a dominant Robotic Platform Market share of around 64% in 2024, driven by increasing automation across manufacturing, automotive, and electronics industries. High precision, repeatability, and ability to operate in hazardous environments make industrial robots essential for streamlining production, reducing labor costs, and enhancing operational efficiency.

The Service Robots segment is expected to experience the fastest growth in the Robotic Platform Market over 2025-2032 with a CAGR of 7.14%. This growth is fueled by increasing adoption in healthcare, logistics, and retail sectors, where robots enhance efficiency in tasks such as patient support, delivery, sanitation, and customer engagement, driving widespread automation.

By Deployment

The On-premises segment held a dominant Robotic Platform Market share of around 51% in 2024, driven by demand for greater data control, security, and customization in industries, such as manufacturing and defense. Organizations with strict regulatory requirements or limited cloud access preferred on-site deployment for real-time processing, reliability, and integration with existing infrastructure.

The Cloud segment is expected to experience the fastest growth in the Robotic Platform Market over 2025-2032 with a CAGR of 8.15%. This growth is driven by increasing demand for scalable, cost-effective solutions that enable remote monitoring, real-time data processing, and seamless updates. Cloud platforms enhance flexibility and accessibility, accelerating adoption across logistics, healthcare, and smart manufacturing.

By Type

The Mobile segment held a dominant Robotic Platform Market share of around 63% in 2024, driven by rising demand for autonomous navigation and flexible operations across logistics, warehousing, and surveillance applications. Mobile robots offer enhanced mobility, adaptability, and efficiency in dynamic environments, making them ideal for tasks, such as goods transport, inspection, and real-time data collection.

The Stationary segment is expected to experience the fastest growth in the Robotic Platform Market over 2025-2032 with a CAGR of 8.53%. This growth is driven by increasing deployment in manufacturing, assembly lines, and precision-based operations, where high stability, repeatability, and integration with fixed automation systems are essential for enhancing productivity, accuracy, and operational efficiency.

By End-Use Industry

The Manufacturing segment held a dominant Robotic Platform Market share of around 63% in 2024, driven by widespread automation across automotive, electronics, and heavy industries. Robotic platforms enhance precision, reduce labor costs, and increase production efficiency. Their integration into assembly lines, welding, material handling, and quality inspection has made them essential for maintaining competitiveness and meeting rising demand.

The Logistics and Transportation segment is expected to experience the fastest growth in the Robotic Platform Market over 2025-2032 with a CAGR of 9.85%. Growth is driven by rising e-commerce, demand for faster delivery, and automation of warehousing and last-mile operations. Robotic platforms improve inventory management, reduce labor dependency, and enhance supply chain efficiency across dynamic logistics environments.

Robotic Platform Market Regional Analysis:

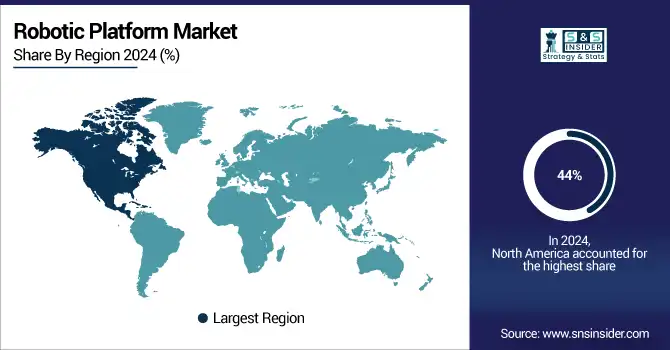

In 2024, North America dominated the Robotic Platform market and accounted for 44% of revenue share, driven by early technology adoption, strong presence of key players, and significant investments in automation across manufacturing, healthcare, and logistics. Supportive regulatory frameworks, R&D funding, and demand for advanced AI-integrated robotics further strengthened the region’s leadership in robotic platform deployment and innovation.

Asia-Pacific is expected to witness the fastest growth in the Robotic Platform Market over 2025-2032, with a projected CAGR of 7.75%, This growth is fueled by rapid industrialization, government support for automation, rising labor costs, and strong adoption across manufacturing and logistics sectors in countries, such as China, Japan, South Korea, and India, driving demand for advanced robotic platforms.

In 2024, Europe emerged as a promising region in the Robotic Platform Market, driven by increasing investment in AI infrastructure, automation in manufacturing, and supportive regulatory frameworks. Strong presence of automotive, healthcare, and aerospace industries, along with initiatives promoting digital transformation and sovereign AI, is accelerating the adoption of robotic platforms across various European economies.

LATAM and MEA is experiencing steady growth in the Robotic Platform market, supported by gradual industrial automation, infrastructure development, and rising interest in robotics for sectors, such as oil & gas, agriculture, and security. Government initiatives, foreign investments, and a growing focus on efficiency and innovation are contributing to the market’s regional expansion.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The Robotic Platform Companies are IBM Corporation, NVIDIA Corporation, Amazon.com, Inc., Google LLC, Microsoft, ABB Ltd., KUKA AG, Universal Robots, Dassault Systèmes, Clearpath Robotics, and Others

Recent Developments:

-

In Jan 2025 – NVIDIA launched its Cosmos platform to teach AI physical world understanding using "world models," enabling advanced robotic interaction; partners include Uber, Figure AI, and Waabi.

-

In Feb 2025 – Dassault Systèmes partnered with KUKA to integrate its 3DEXPERIENCE platform into the mosaixx digital ecosystem, aiming to enhance robotics and automation efficiency through virtual twin technology and real-time collaboration.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 10.38 Billion |

| Market Size by 2032 | USD 16.66 Billion |

| CAGR | CAGR of 6.10% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Robot(Industrial Robots, Service Robots), • By Deployment(On-premises and Cloud) • By Type(Mobile and Stationary) • By End Use Industry(Manufacturing, Healthcare, Logistics and Transportation, Retail and E-commerce, Residential and Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | The Robotic Platform Market companies are IBM Corporation, NVIDIA Corporation, Amazon.com, Inc., Google LLC, Microsoft, ABB Ltd., KUKA AG, Universal Robots, Dassault Systèmes, Clearpath Robotics, and Others. |