Naphtha Market Analysis & Overview:

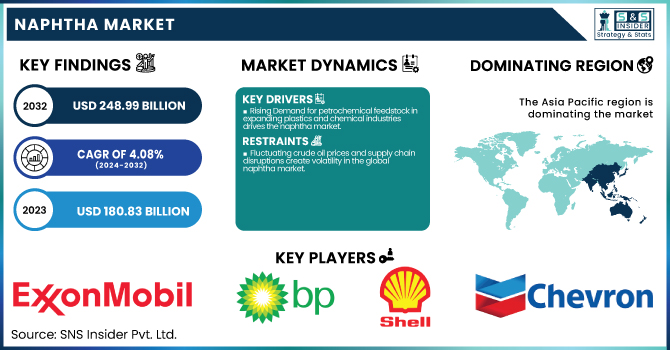

The Naphtha Market size was USD 180.83 billion in 2023 and is expected to reach USD 248.99 billion by 2032 and grow at a CAGR of 4.08% over the forecast period of 2024-2032.

To Get more information on Naphtha Market - Request Free Sample Report

This report provides a comprehensive analysis of production capacity and utilization by country and type in 2023, highlighting key trends in supply dynamics. It examines feedstock prices across regions and types, offering insights into cost fluctuations and market impact. The regulatory landscape is assessed, detailing policy influences on production and trade. Environmental metrics, including emissions data, waste management practices, and sustainability initiatives, are analyzed to gauge industry efforts toward greener operations. Innovation and R&D trends by type are explored, showcasing advancements in technology and product development. The report delivers a holistic view of market shifts, regulatory challenges, and sustainability trends. These insights help stakeholders navigate industry dynamics and strategic decision-making.

The United States held the largest market share, accounting for 76% of the total market, with a valuation of USD 29.62 billion. This dominance is driven by its well-established industrial infrastructure, high production capacity, and advanced technological innovations across key sectors. The country benefits from abundant raw material availability, a strong regulatory framework supporting industry growth, and significant investments in research and development. Additionally, the presence of major market players, coupled with a robust supply chain and increasing demand across various industries, has solidified the U.S. position as the market leader. Favorable government policies and continuous advancements in sustainability practices further contribute to its market strength.

Naphtha Market Dynamics

Drivers

-

Rising Demand for petrochemical feedstock in expanding plastics and chemical industries drives the naphtha market.

The increasing demand for petrochemical feedstock, particularly in the rapidly expanding plastics and chemical industries, is a key driver for the naphtha market. As industries shift toward high-performance polymers and synthetic materials, naphtha remains a crucial raw material for ethylene and propylene production. Emerging economies, particularly in the Asia-Pacific, are witnessing a surge in manufacturing activities, further fueling demand for naphtha. Additionally, advancements in refining technologies have enhanced the efficiency of naphtha cracking, optimized production processes, and lowered costs. The growing consumption of consumer goods, automotive components, and industrial chemicals has further strengthened the demand for naphtha-based petrochemicals. Governments in leading economies are also supporting infrastructure development and industrialization, contributing to higher consumption of naphtha in downstream applications. These factors collectively position naphtha as a vital component of the global petrochemical value chain.

Restrain

-

Fluctuating crude oil prices and supply chain disruptions create volatility in the global naphtha market.

The naphtha market is significantly influenced by crude oil price fluctuations, creating uncertainty in production costs and profitability for industry players. Since naphtha is derived from crude oil, any volatility in global oil prices directly impacts its pricing structure, affecting supply stability. Geopolitical tensions, trade restrictions, and energy crises have further contributed to unpredictable oil price swings, making long-term procurement planning challenging for manufacturers. Additionally, disruptions in the global supply chain, such as port congestion, transportation bottlenecks, and regulatory constraints, have hindered the steady availability of naphtha. Refineries dependent on imported crude face production slowdowns due to inconsistent supply, raising concerns over operational efficiency. These factors have forced market participants to explore alternative feedstocks or adopt cost-effective refining techniques to mitigate the risks associated with price fluctuations and supply instability.

Opportunity

-

Advancements in naphtha cracking technologies enhance production efficiency and reduce environmental impact in refineries.

Technological advancements in naphtha cracking have created significant opportunities for market expansion, improving production efficiency while addressing environmental concerns. Innovations in catalytic cracking and steam reforming techniques have enabled refiners to maximize yields while minimizing waste generation and energy consumption. Enhanced cracking processes have also facilitated the production of higher-value petrochemical derivatives, meeting the rising demand for plastics, synthetic rubber, and specialty chemicals. Moreover, the integration of carbon capture technologies in refining units has helped reduce greenhouse gas emissions, making naphtha-based production more sustainable. With stricter environmental regulations worldwide, refineries are investing in cutting-edge technologies to enhance operational efficiency and comply with sustainability targets. These advancements position naphtha as a competitive feedstock in the global petrochemical industry, offering long-term growth potential for market players adapting to evolving industry demands.

Challenge

-

The transition toward alternative feedstocks and bio-based chemicals poses competition for naphtha-based production.

The rising focus on sustainability and the transition toward alternative feedstocks have emerged as significant challenges for the naphtha market. Increasing investments in bio-based chemicals, such as bioethanol, bio-naphtha, and synthetic gas, are shifting the industry's reliance away from traditional fossil-based naphtha. Governments worldwide are promoting green alternatives through subsidies, carbon taxes, and stricter environmental policies, encouraging industries to adopt eco-friendly feedstocks. Additionally, advancements in plastic recycling technologies and the circular economy approach have reduced the demand for virgin petrochemicals, indirectly impacting naphtha consumption. The growing penetration of hydrogen-based and electric vehicle technologies is also limiting demand for naphtha-derived gasoline, creating long-term market uncertainty. As industries explore sustainable alternatives, naphtha producers must innovate and diversify their product portfolios to maintain competitiveness in the evolving energy and chemical landscape.

Naphtha Market Segmentation Analysis

By Product Type

The Light Naphtha segment held the largest market share at around 64% in 2023. owing to their heavy application as primary feedstock being used in petrochemicals such as ethylene and propylene for steam cracking. Its narrower boiling range and greater hydrogen content make it a suitable feedstock for the production of plastics, synthetic rubbers, and other high-value chemicals. Light naphtha is also benefiting from the increased consumption of the light naphtha associated with the gasoline blending demand, which improves fuel efficiency as well as lowers emissions. Downstream applications have tightened the demand for light naphtha due to rising investments at petrochemical infrastructure hubs, particularly in the Asia-Pacific region and the Middle East. Additionally, processing technologies and catalytic cracking yields have further made light naphtha an attractive option for refineries. So, these are the factors that lead to light naphtha's heavy position in the market.

By Application

The chemical segment accounted for the largest share, around 65% in 2023 of the naphtha market. They provide base materials for a wide range of products such as plastics, synthetic rubber, adhesives, and industrial chemicals, which have huge demand in various sectors like packaging, automotive, construction, and others. The growth of the petrochemical sector, especially in the Asia-Pacific, has substantially propelled naphtha consumption for chemical production. Moreover, the development of naphtha cracking technologies has improved efficiency with the potential for larger production of key chemicals. The chemical sector holds the major share of the naphtha market, which is further expected to be bolstered by the rising demand for specialty chemicals and performance materials against the backdrop of industrialization and infrastructure growth.

Naphtha Market Regional Outlook

Asia Pacific held the largest market share, around 45.23%, in 2023. It is owing to the developments in the petrochemical industry in the region, alongside rapid industrialization and increasing demand for plastics, synthetic fibers, and specialty chemicals. Naphtha is a feedstock for such a complex, massive naphtha-based petrochemical complexes that have been built in countries such as China, India, Japan, and South Korea to produce ethylene, propylene, and aromatics. Demand for naphtha-based products was further stoked by a rise in consumer goods, auto parts, and packaging. Moreover, increasing refinery investments coupled with expansions throughout the region have improved the production capacity of naphtha, which promises a steady supply for the downstream applications. The region's dominance in the naphtha market can also be attributed to positive government industrial initiatives along with a robust manufacturing base. Gaining attraction in the region powers the need for energy, and increasing vehicle sales also form a major fraction of the market leadership

North America held a significant market share. It is due to advanced refining capabilities, captive production, and consumers of petrochemicals throughout the region. The U. This has further solidified its market position based on the increasing desire for ethylene and propylene from the growing plastics, automotive, and packaging industries within the region. Also, the productivity in refining technologies and shale oil extraction has improved the production of naphtha and cost-effective supply in naphtha production. North America's petchem supremacy is also bolstered by its highly favorable government policies in support of the petrochemical industry and growing naphtha exports to Asia and Europe. Moreover, its overall market share is further strengthened in the region due to high gasoline consumption, in which naphtha is a major blending component.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Exxon Mobil Corporation

-

BP PLC

-

Shell Chemicals

-

Saudi Arabian Oil Co. (Saudi Aramco)

-

Reliance Industries Limited

-

China Petrochemical Corporation (Sinopec)

-

Indian Oil Corporation Ltd

-

Formosa Petrochemical Corporation

-

LG Chem

-

Novatek

-

Mitsubishi Chemical Corporation

-

PetroChina Company Limited

-

SABIC

-

TotalEnergies

-

Petróleos Mexicanos (Pemex)

-

Sasol Limited

-

QatarEnergy

-

SK Innovation

Recent Developments:

-

In 2025, Shell finalized the sale of its Singapore refinery and refining assets to a joint venture formed by Chandra Asri and Glencore. This transaction encompassed the Bukom and Jurong Islands facilities, strengthening Chandra Asri’s presence in Southeast Asia’s petrochemical industry.

-

In 2024, the Indian Oil Corporation announced plans to invest 610 billion rupees (USD 7 billion) in a naphtha cracker project in Paradip, Odisha. The project aims to enhance its existing refinery operations and boost its petrochemical production capacity.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 180.83 Billion |

| Market Size by 2032 | USD 248.99 Billion |

| CAGR | CAGR of 4.08% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Light Naphtha, Heavy Naphtha) • By Application (Chemicals, Energy/Fuel, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Exxon Mobil Corporation, BP PLC, Shell Chemicals, Chevron Corporation, Saudi Arabian Oil Co. (Saudi Aramco), Reliance Industries Limited, China Petrochemical Corporation (Sinopec), Indian Oil Corporation Ltd, Formosa Petrochemical Corporation, LG Chem, Novatek, Mitsubishi Chemical Corporation, PetroChina Company Limited, Lotte Chemical Corporation, SABIC, TotalEnergies, Petróleos Mexicanos (Pemex), Sasol Limited, QatarEnergy, SK Innovation |