Net-Zero Energy Buildings Market Report Scope & Overview:

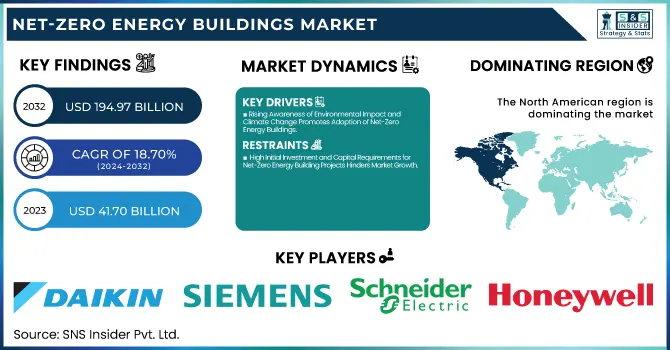

The Net-Zero Energy Buildings Market size was valued at USD 41.70 Billion in 2023 and is expected to reach USD 194.97 Billion by 2032, growing at a CAGR of 18.70% over the forecast period 2024-2032.

To Get more information on Net-Zero Energy Buildings Market - Request Free Sample Report

This research report covers significant areas such as cost analysis comparing NZEBs with conventional buildings, the policies and incentives of regional governments, investment trends in the industry, consumer awareness and the perception of net-zero technologies, and a lifecycle assessment of Net-Zero Energy Building's long-term benefits. It also focuses on the construction and maintenance cost trends as valuable information for cost-effective solutions and regional variations shaping the future of the market.

Net-Zero Energy Buildings Market Dynamics

Drivers

-

Rising Awareness of Environmental Impact and Climate Change Promotes Adoption of Net-Zero Energy Buildings

The shift to Net-Zero Energy Buildings is primarily fueled by the increased global interest in climate change mitigation. With sustainability on the priority lists of governments, corporations, and consumers alike, energy efficiency solutions in construction and renovation are increasingly in demand. Net-Zero Energy Buildings have emerged as one of the best solutions to decrease carbon footprints to significantly long-term environmentally-friendly measures. Elevated environmental awareness is slowly cultivating investment in green building technologies that provide support in developing energy-efficient materials, renewable energy systems, and advanced building management technologies. Consumers and companies are willing to adhere more stringently to environmental regulatory requirements and sustainability targets because Net-Zero Energy Buildings represent an attractive solution in compliance with international efforts aimed at reducing carbon emissions.

Restraints

-

High Initial Investment and Capital Requirements for Net-Zero Energy Building Projects Hinders Market Growth

High upfront investment in construction and retrofitting is one of the major restraints that slow down the growth of the Net-Zero Energy Buildings market. Net-Zero Energy Buildings require advanced technologies, including energy-efficient insulation, renewable energy systems, and sophisticated energy management tools, which contribute to higher upfront costs compared to traditional buildings. Although these investments result in long-term savings through reduced consumption of energy, capital expenditures formed at the initial stage remain the hurdle for most developers and property owners. This financial constraint is quite a challenge for small-scale projects or locations with fewer provisions of funding and financial incentives in bringing about widespread uptake of Net-Zero Energy Buildings.

Opportunities

-

Growth in Retrofit Market for Existing Buildings Presents Significant Expansion Potential for Net-Zero Energy Solutions

An emerging opportunity in the Net-Zero Energy Buildings market is through retrofitting older buildings to become net-zero energy. A major portion of the global building stock is older, and inefficient, and thus holds enormous potential for upgrade to improve their energy performance. Retrofitting will be a much cheaper and less disruptive alternative compared to building an entirely new Net-Zero Energy Building. Governments, as well as property owners, are making bigger investments into retrofitting programs, sustained by the availability of financial incentives and subsidies for energy-efficient upgrades. This is a huge market opportunity for firms providing retrofitting technologies, energy-efficient materials, and integration of renewable energy solutions.

Challenge

-

Balancing Cost-Effectiveness with High Performance Remains a Key Challenge for Net-Zero Energy Buildings Implementation

Cost-effectiveness and high performance are two key challenges that will face the market of Net-Zero Energy Buildings. Long-term energy savings, as well as environmental benefits, are possible with Net-Zero Energy Buildings, but such buildings are initially expensive to build and integrate because of the various energy-efficient systems. Achieving high energy performance without a tremendous increase in costs is a highly complex challenge. The rapid growth of technology creates uncertainty about what investments will produce the best return in terms of long-term energy efficiency. In this regard, developers and owners of properties face the challenge of ensuring that the Net-Zero Energy Buildings will be financially sound and effective at achieving net-zero energy consumption.

Net-Zero Energy Buildings Market Segmentation Analysis

By Component

Energy Storage Systems dominated the Net-Zero Energy Buildings Market in 2023 and accounted for the maximum market share of around 30%. Energy storage systems are of prime importance in Net-Zero Energy Buildings since they enable proper management of renewable energy, mainly when integrating the intermittent sources, such as solar and wind energy. In 2023, the demand for energy storage solutions increased due to the development in battery technologies such as lithium-ion and solid-state batteries. These systems store extra energy generated in the daytime to use later. The buildings stay energy-efficient and self-sufficient this way. The U.S. Department of Energy, as well as many other governments and organizations, has been encouraging energy storage as part of broader goals on energy efficiency and sustainability. In response, companies like Tesla and Siemens have diversified their offerings to include more energy storage products.

By Building Type

In 2023, Residential buildings dominated the Net-Zero Energy Buildings market and accounted for a market share of around 40%. The biggest driver for the Net-Zero Energy Buildings market was the residential sector, mainly on account of ever-growing consumer interest in sustainable ways of living. Homeowners nowadays are in growing demand for more energy-efficient houses that reduce the utility cost associated with the built environment and thereby reduce their negative impact on the environment. Government policies, including the promotion of green building certifications like LEED, have made the same the more significant contributor to this trend. For instance, U.S. Energy Star-initiated programs provide rebates and incentives to homeowners to implement energy-efficient technologies, which has forced the growth of Net-Zero homes in the market.

By Technology

Solar Energy dominated and accounted for the largest share of 45% in the Net-Zero Energy Buildings Market in 2023. The share of solar energy has dominated the Net-Zero Energy Buildings market by almost half due to declining prices of solar panels and the wide implementation of photovoltaic (PV) systems in residential and commercial buildings. In general, it is one of the prime enabling technologies that contribute to net-zero energy consumption. Solar technology represents a source of renewable energy harnessed directly from sunlight. Governments have been offering financial incentives and tax credits for solar installations to accelerate the deployment of solar-powered Net-Zero Energy Buildings across the world, including the European Union and the United States. Companies like SunPower and First Solar are leading the market with advanced, efficient solar panel solutions.

By End-Use

New Construction dominated the Net-Zero Energy Buildings Market in 2023, accounting for 55% of the market share. The market shares of the Net-Zero Energy Buildings market are relatively higher due to the rise in the trend of designing and constructing energy-efficient structures from scratch. Developers and builders are seeking to build sustainable buildings that can meet stringent energy performance standards from the ground up. For example, such initiatives as "Net Zero Energy Building" run by the United States Department of Energy outline principles and funding available for building new net zero energy consumption structures. Regulations along with these funds foster new and green building initiatives as the whole building construction and refurbishment works for achieving maximum sustainability in all directions.

Net-Zero Energy Buildings Market Regional Analysis

The North American region dominated the Net-Zero Energy Buildings Market and held approximately 40% of the market share in the year 2023. Due to the increase in the United States of America and Canada towards sustainability and energy efficiency, North America has accounted for the highest share in the global Net-Zero Energy Buildings market. In the United States particularly, the Energy Star program and tax benefits for solar installations have spurred demand for Net-Zero homes. For example, California is a major contributor, where the state has made all new homes Net-Zero household by 2025 mandatory and it is turning into a driving force for demand. Furthermore, initiatives like the Investment Tax Credit (ITC) run by the U.S. government that work toward advancing clean energy options in buildings have played a role in helping North America take the lead in this space. Canada, which puts a huge emphasis on green building certifications such as LEED, comes next and the region will see a further increase in its market share due to energy-efficient construction. Furthermore, big players including Tesla, Johnson Controls and Honeywell participate extensively in the region and accelerate the advancement of energy storage and energy-efficient building products.

Moreover, the Asia Pacific region emerged as the fastest growing region for the Net-Zero Energy Buildings Market with an approximate CAGR of 18% in the forecast period. It is led by increasing urbanization, government initiatives, and energy demands. China and India are the major players in this sector, making considerable progress toward the adoption of green building technologies. For example, China's 13th Five-Year Plan focuses on green building standards, and the country is actively pursuing net-zero energy buildings in its smart city projects. India is increasingly seeing Net-Zero homes and commercial buildings attributed to the likes of the Smart Cities Mission-a mission that fosters sustainable development in urban communities. Other than this, some countries like Japan, South Korea, and Singapore are setting lofty targets for buildings to be 'energy-efficient and are offering considerable financial incentives as well for its green building projects. Growth in demand for renewable energy technologies, including solar and wind power, coupled with strong government support, is likely to drive the region through progress in the Net-Zero Energy Buildings market. A stellar CAGR for the Asia Pacific market indicates the region has the potential to become a leader in years ahead as these initiatives continue to grow.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Daikin Industries Ltd. (VRV Heat Recovery System, Altherma Heat Pump)

-

General Electric Company (GE Solar Inverters, LED Lighting Solutions)

-

Siemens AG (Desigo CC Building Management System, GAMMA KNX Smart Building Technology)

-

Schneider Electric SE (EcoStruxure Microgrid, Wiser Energy Management System)

-

Honeywell International Inc. (Forge Energy Optimization, Solstice N41 Refrigerant)

-

Johnson Controls International plc (Metasys Building Automation System, YORK Absorption Chillers)

-

Kingspan Group Plc (QuadCore Insulated Panels, Kooltherm Insulation Boards)

-

Canadian Solar Inc. (HiKu Solar Panels, BiHiKu Bifacial Modules)

-

Rockwool Group (Rockpanel Facade Boards, Rockwool Thermal Insulation)

-

SunPower Corporation (Total SE) (Maxeon Solar Panels, Performance Series Modules)

-

Integrated Environmental Solutions Ltd. (VE Energy Modeling Software, iSCAN Building Analytics)

-

Saint-Gobain (SageGlass Dynamic Glazing, Isover Insulation Solutions)

-

Mitsubishi Electric Corporation (Ecodan Heat Pumps, CITY MULTI VRF Systems)

-

Trane Technologies PLC (Thermo King Refrigeration, Tracer SC+ Building Automation)

-

Carrier Global Corporation (AquaEdge Chillers, Infinity Heat Pump)

-

Solatube International Inc. (Brighten Up Daylighting System, Smart LED System)

-

SAGE Electrochromics Inc. (Compagnie de Saint-Gobain S.A.) (SageGlass, Harmony Electrochromic Glass)

-

Skanska AB (Deep Green Buildings, Passive House Construction)

-

Lendlease Corp (Climate Positive Buildings, Timber High-Rise Structures)

-

Panasonic Corporation (HIT Solar Panels, EverVolt Energy Storage System)

Recent Development:

-

June 2024: CREDAI collaborated with AEEE to endorse Net-Zero buildings in India, emphasizing energy efficiency and sustainable construction practices.

-

March 2024: India progressed toward its goal of having Net-Zero carbon buildings. It highlighted aspects of energy efficiency, sustainable material usage, and renewable energy utilization.

-

March 2024: Mahindra Lifespace launched Mahindra Zen in Bengaluru-the first Net-Zero waste and energy homes with features of energy efficiency.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 41.70 Billion |

| Market Size by 2032 | USD 194.97 Billion |

| CAGR | CAGR of 18.70% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Component (Building Envelope, HVAC Systems, Lighting Systems, Energy Storage Systems, Others) •By Building Type (Residential, Commercial, Industrial) •By Technology (Solar Energy, Wind Energy, Geothermal Energy, Biomass Energy, Others) •By End-Use (New Construction, Renovation & Retrofitting) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Daikin Industries Ltd., General Electric Company, Siemens AG, Schneider Electric SE, Honeywell International Inc., Johnson Controls International plc, Kingspan Group Plc, Canadian Solar Inc., Rockwool Group, SunPower Corporation and other key players |