Neural Network Software Market Key Insights:

Get more information on Neural Network Software Market - Request Sample Report

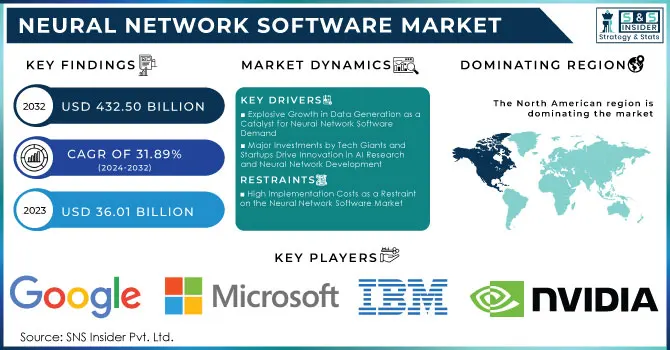

The Neural Network Software Market size was valued at USD 36.01 billion in 2023 and is expected to reach USD 432.50 billion by 2032, with a growing at CAGR of 31.89% over the forecast period of 2024-2032.

The global neural network software market is booming, owing to the rise of artificial intelligence and high demand for complex data analytics. With 91.9% of organizations reporting that they receive measurable value from their data and analytics investments in 2023, we see that AI-driven tools are essential for optimizing business uses of these assets. This growth is further fueled by the increase in ML model adoption, driven by industries such as finance, healthcare, and manufacturing that need new tools to achieve insights and predictions from large datasets. Additionally, 39% of organizations now identify AI/ML as a tier-one workload. Many use other cloud providers, beyond their primary platform, to support these heavy-hitting workloads. Cloud-based neural network solutions further democratize this access, allowing companies to leverage AI insights while upfront costs in infrastructure get lighter.

As a result, industries are in huge need of predictive analytics, fraud detection, and automation to stay ahead of their competitors which has increased the demand for neural network software. For example, 85% of enterprises want to combine human skills with AI, ML, NLP, and pattern recognition for better decision-making that could increase worker productivity by as much as 25%. 36% of executives in the financial sector have used AI for cost reductions of approximately 10%, with 46% of financial firms reporting better customer experiences after using AI. In healthcare, AI can help decrease treatment costs by up to 50% and improve health outcomes by 40%. The data is becoming ever more complicated, as are the devices–with growing demand in the Internet of Things (IoT) appliances generating large volumes of raw data almost immediately–this demands a need for able neural network software capable of handling both structured and unstructured information.

The combination of Edge, 5G, and Quantum Computing is unleashing a booming opportunity for the neural network software market. The quantum computer (58 million times faster than any supercomputer today will dramatically improve the capacity for real-time data processing. About 300 networks are now operating worldwide, with the 5G population coverage disrupted in mainland China already amounts to a whopping 40% of overall numbers which makes it uniquely suited for use increasingly faster data transferred and naturally leads to AI utilization. With the increasing need for vital applications in areas such as autonomous driving, smart cities, and industries that rely on edge devices, there will emerge a steadily growing market for specialized neural network software.

MARKET DYNAMICS

DRIVERS

- Explosive Growth in Data Generation as a Catalyst for Neural Network Software Demand

The increased rate of data generation is one of the key factors fostering the neural network software market growth. The amount of data generated in the world reached about 120 zettabytes in 2023 and is expected to continue growing by more than 150% until driving an estimated global data figure of close to 181 zettabytes by 2025. Video Content makes up, on average, more than 53.72% of total global data traffic, and social media & gaming make up 12.69% and 9.86%, respectively, for a total of almost 76.27% of all internet data traffic! In addition, the astonishing frequency of email communication—nearly 250 million emails dispatched every minute—totaling over 333.22 billion daily emails. The sheer volume of this data requires sophisticated analytics and processing, which is where neural networks have become critical for companies trying to derive value from their data and stay ahead of the competition.

- Major Investments by Tech Giants and Startups Drive Innovation in AI Research and Neural Network Development

A huge investment in artificial intelligence study is healthy for the development of the neural network software market. Intel Capital has led the charge in expanding funding to AI startups, pouring investments into 51. Tech giants managed to claim roughly two-thirds of the USD 27 billion raised by Emerging AI firms in 2023, showcasing the fierce competition for innovation. OpenAI ranks among the 100 most privately funded AI startups with USD 14 billion of capital through Microsoft and other top investors in exchange for a stake that values OpenAI at about USD 80 billion. Out of the world, the USA dominates AI with USD 328.5 billion in investments made over the last five years, then comes China, making USD 195 billion while the UK invested 25.5 billion dollars. These funds are critical for launching new and improving existing neural network solutions, paving the way for considerable market growth and innovation.

RESTRAINTS

- High Implementation Costs as a Restraint on the Neural Network Software Market

Deploying neural network systems comes at a significant cost, making it a challenge for most organizations. Costs will differ widely based on development, hardware and data needs as well as how complex the features are and their integration in existing systems. The costs also vary from USD 5000 for basic models, all the way up to over half a million dollars for more complex solutions. When it comes to industry-specific projects, price tags also vary from USD 20 up to USD 50k for healthcare apps and from USD 50k to USD 150k for fintech solutions due to their complexity and regulatory need. Furthermore, employing experienced experts like data scientists and machine learning engineers also incurs these expenses with average salaries in the States hovering between USD 120,000 to USD 160,000. The cost can also discourage small companies from using advanced artificial intelligence systems, thus hampering the whole growth of the neural network software market

SEGMENT ANALYSIS

BY TYPE

Analytical systems were the biggest revenue contributor to the neural network software market, contributing over 35% of revenue share in 2023 due to a growing requirement among organizations for actionable insights from large data sets This type of software helps companies analyze data better to make more informed business decisions. On the other hand Data mining and archiving is expected to expand at more than double-digit compound annual growth rate (CAGR) of 33.10% between 2024 and 2032. This expansion is fueled by a growing demand for advanced analytics and the crucial necessity for effective data governance which includes ensuring timely access to the right, high-quality data. With organizations prioritizing the best use of data, there is an increasing need for data-mining solutions

BY COMPONENT

In 2023, Neural Network Software took a leading position in the market with an approximate revenue share of 54%, as they have provided superb versatility, being capable of performing well on complicated data tasks across plenty of industries such as finance, healthcare, and technology. With the strength associated with using neural networks to learn from vast datasets and adapt continuously, they become invaluable assets in corporate enterprises that feature making informed decisions. The Services segment will continue growing at a strong CAGR (around 32.89% from 2024 to 2032), as companies also need AI solutions that are not only customized for their needs but which the neural network applications will require in terms of ongoing maintenance and support. Since businesses have realized the advantages associated with AI automated insights, such products will witness increasing demand as well as services related to neural network software which would improve their standing in the market- Vision Research Report.

By END USE

In 2023, the neural network software market revenue share of the BFSI (Banking, Financial Services, and Insurance) sector accounted for approximately 35% due to heavy reliance on advanced analytics in fraud detection, sustainable risk management practices, and personalized service across multi-channels. Neural networks are used by financial institutions to process huge volumes of transaction data as they pass, which can improve security and streamline operations. On the other hand, IT & Telecom is expected to register the highest CAGR of nearly 33.22% over the year range from 2024 to 2032 owing to escalating requirements for network security, customer analytics, and resource optimization. Telecom has been witnessing a swift growth because most of the telecom companies have started adopting AI solutions to optimize their services and infrastructure which is driven by our digital transformation trend across various industries.

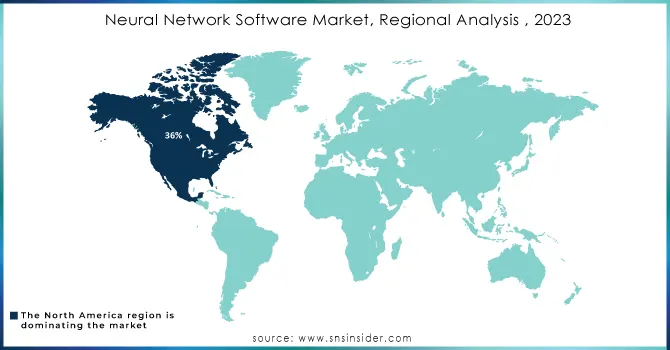

REGIONAL ANALYSIS

In 2023, North America held the largest share in terms of revenue of the neural network software market at nearly 36% owing to major technology firms being founded in this region, heavy research & development investment, and innovative industries including finance telecom & healthcare industry. Combined with the high research levels of infrastructure in this region, and at the same time high adoption rates of artificial intelligence technologies within different segments that reside in this region, it makes sense for Western Europe to be leading the trend.

On the other hand, Asia Pacific is predicted to display the maximum growth with a CAGR of nearly 33.24% from 2024 to 2032. Such rampant growth is being driven by increasing digitization, a higher number of start-ups concentrating on Artificial intelligence, and major government initiatives towards technological development. Demand for neural network solutions will rise sharply because businesses in the Asia Pacific understand the value of AI and how it can help improve operational efficiency as well as consumer experiences.

Do You Need any Customization Research on Neural Network Software Market - Inquire Now

LATEST NEWS

- In July 2024, a group of ex-executives from the self-driving technology sector launched a new AI video startup designed to revolutionize the entertainment industry. Titled Odyssey, the company has successfully secured USD 9 million for developing cutting-edge AI models that would be capable of manufacturing the best quality video content in movies and video games.

- in 2024 that Zoom is using artificial intelligence to automatically generate patient notes from telehealth appointments. The company is scanning for improving the experience of its users and patient care through a new partnership with the company Suki AI, adding advanced AI capabilities to the site. Zoom plans to make use of the Suki Platform-a speech recognition mechanism-to generate clinical notes and documentation fluidly during virtual consultations.

KEY PLAYERS

- Google LLC (Google Cloud AI, TensorFlow)

- Microsoft (Azure Machine Learning, Microsoft Cognitive Services)

- IBM Corporation (IBM Watson, IBM SPSS Statistics)

- Intel Corporation (Intel AI Analytics Toolkit, Intel Nervana Neural Network Processor)

- NVIDIA Corporation (NVIDIA CUDA, NVIDIA DeepStream)

- Oracle (Oracle Cloud Infrastructure AI Services, Oracle Digital Assistant)

- Qualcomm Technologies, Inc. (Qualcomm Snapdragon AI Engine, Qualcomm Neural Processing SDK)

- Neural Technologies Ltd. (Neural ProfitGuard, Neural Performance Analytics)

- Ward Systems Group Inc. (Ward Neural Network Toolkit, Ward Probabilistic Neural Networks)

- SAP SE (SAP Leonardo, SAP AI Core)

- Slagkryssaren AB (Slagkryssaren’s AI-Driven Analytics, Slagkryssaren Optimization Suite)

- Starmind International AG (Starmind Knowledge Management System, Starmind AI Assistant)

- Neuralware (NeuralPower, Neural Engine)

- Salesforce (Einstein AI, Salesforce AI Research)

- Amazon Web Services (AWS) (Amazon SageMaker, AWS DeepLens)

- H2O.ai (H2O Driverless AI, H2O-3)

- DataRobot (DataRobot AI Cloud, Automated Machine Learning)

- C3.ai (C3 AI Suite, C3 AI Ex Machina)

- OpenAI (ChatGPT, DALL-E)

- Hugging Face (Transformers, Datasets)

- Element AI (AI Solutions, Element AI Platform)

- TIBCO Software (TIBCO Spotfire, TIBCO Data Science)

- SAS Institute (SAS Viya, SAS Visual Data Mining and Machine Learning)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 36.01 Billion |

| Market Size by 2032 | USD 432.50 Billion |

| CAGR | CAGR of 31.89% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Data mining and archiving, Analytical software, Optimization software, Visualization software) • By Component (Neural Network Software, Services, Platform and Other Enabling Services) • By Industry (BFSI, IT & Telecom, Healthcare, Industrial manufacturing, Media, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Google LLC, Microsoft, IBM Corporation, Intel Corporation, NVIDIA Corporation, Oracle, Qualcomm Technologies, Inc., Neural Technologies Ltd., Ward Systems Group Inc., SAP SE, Slagkryssaren AB, Starmind International AG, Neuralware, Salesforce, Amazon Web Services (AWS), H2O.ai, DataRobot, C3.ai, OpenAI, Hugging Face, Element AI, TIBCO Software, SAS Institute. |

| Key Drivers | • Explosive Growth in Data Generation as a Catalyst for Neural Network Software Demand • Major Investments by Tech Giants and Startups Drive Innovation in AI Research and Neural Network Development. |

| RESTRAINTS | • High Implementation Costs as a Restraint on the Neural Network Software Market |