Off-Grid Battery Storage Market Report Scope & Overview:

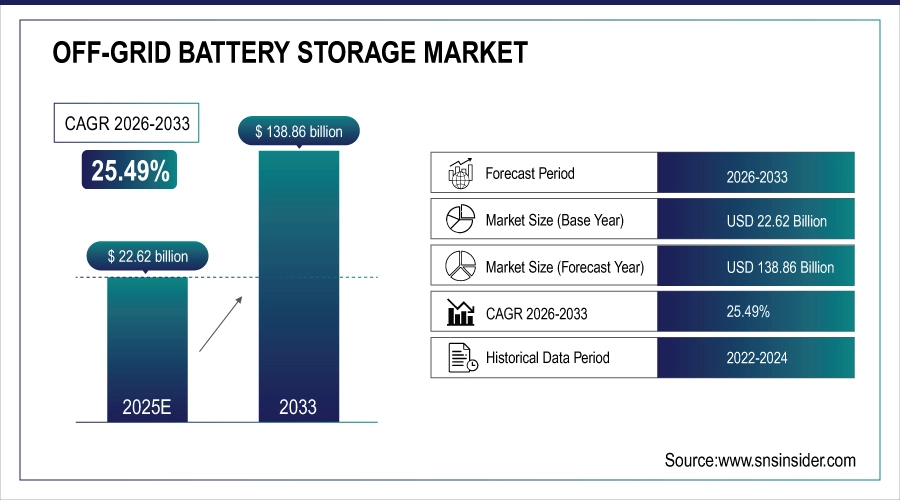

The Off-Grid Battery Storage Market size is valued at USD 22.62 Billion in 2025E and is projected to reach USD 138.86 Billion by 2033, growing at a CAGR of 25.49% during the forecast period 2026–2033.

The Off-Grid Battery Storage Market analysis report offers a wide-ranging evaluation of the market, including emerging trends, production and consumption ratio, industry cost structure and new project investments. Increasing energy requirements in off-grid remote locations and growing renewable integration, as well the demand for secure energy supply in emerging markets will secure business expansion.

Off-Grid Battery Storage is estimated at 45 GWh in 2025, driven by rural electrification, renewable adoption, and growing demand for reliable off-grid energy solutions.

Market Size and Forecast:

-

Market Size in 2025: USD 22.62 Billion

-

Market Size by 2033: USD 138.86 Billion

-

CAGR: 25.49% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Off-Grid Battery Storage Market - Request Free Sample Report

Off-Grid Battery Storage Market Trends:

-

Increasing need to access energy in isolated and rural locations is playing a role of a catalyst for the deployment of off-grid battery storage systems.

-

It’s becoming more deeply integrated with renewables, such as solar and wind power, boosting system efficiency and sustainability.

-

Progress on lithium ion, flow and hybrid battery technology is increasing storage capacity, cycle-life and reliability.

-

Growing government initiatives and incentives supporting electrification and decarbonization are encouraging adoption.

-

Increasing usage in telecom towers industrial and residential sectors is also widening market scope.

-

The trend to modular, scalable and intelligent energy storage systems is making flexible and cost-efficient energy concepts possible.

U.S. Off-Grid Battery Storage Market Insights:

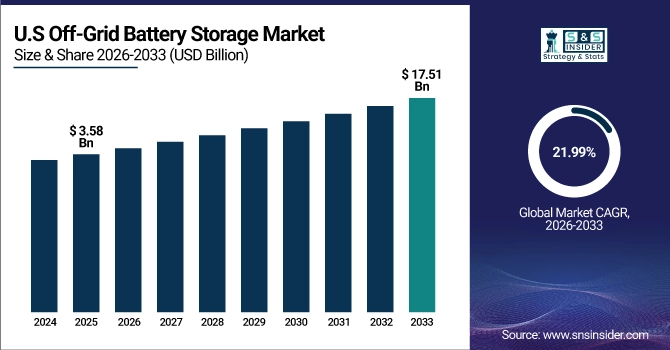

The U.S. Off-Grid Battery Storage Market is projected to grow from USD 3.58 Billion in 2025E to USD 17.51 Billion by 2033, at a CAGR of 21.99%. Growth is attributed to growing acceptance of residential and commercial solar systems, favourable government incentives and increased demand for reliable off-grid energy source.

Off-Grid Battery Storage Market Growth Drivers:

-

Rising rural electrification and renewable energy adoption driving demand for reliable off-grid battery storage solutions.

Rising demand for rural electrification and renewable energy adoption is a key driver of the Off-Grid Battery Storage Market Growth. With a growing number of remote villages, industrial operations and telecommunication infrastructure requiring secure autonomous power sources, for those battery systems off-grid is expanding rapidly. These systems provide continuous energy supply, decrease dependence on traditional electricity grids and assist in integrating renewables on a sustainable basis which make off-grid storage as one of the priority technology solutions for the energy sector.

Off-grid battery storage capacity grew 23% in 2025, driven by rising rural electrification, renewable energy integration, and expanding demand for reliable off-grid power solutions.

Off-Grid Battery Storage Market Restraints:

-

High upfront costs, complex installation, and limited grid infrastructure in remote regions are constraining off-grid battery adoption.

High upfront costs, complex installation requirements, and limited grid infrastructure are major restraints for the Off-Grid Battery Storage Market. Uptake of systems in remote or rural areas may require a high capital investment, technical expertise and infrastructure support. Secondly, logistics and maintenance are also more difficult than other forms of operation. Combined, these barriers prevent widespread adoption, and particularly for small end users and rural communities, they are slowing market growth despite significant demand for off-grid power solutions.

Off-Grid Battery Storage Market Opportunities:

-

Expanding renewable energy initiatives and government incentives present opportunities for large-scale off-grid battery storage deployment.

Expanding renewable energy initiatives and supportive government incentives present a major opportunity for the Off-Grid Battery Storage Market. Expansion of solar and wind installations make it more feasible to deploy off-grid systems, while subsidies and policy support drive costs down. Businesses are creating sophisticated, modular and intelligent storage solutions to drive efficiency and to foster protection. This move away from dependence on finite energy sources generates market growth, strengthens security of supply and reinforces sustainable development in the world.

Renewable-integrated off-grid battery systems accounted for 32% of new installations in 2025, driven by government incentives and rising demand for sustainable energy solutions.

Off-Grid Battery Storage Market Segmentation Analysis:

-

By Battery Type, Lithium-Ion held the largest market share of 41.32% in 2025, while Flow Batteries are expected to grow at the fastest CAGR of 28.91% during 2026–2033.

-

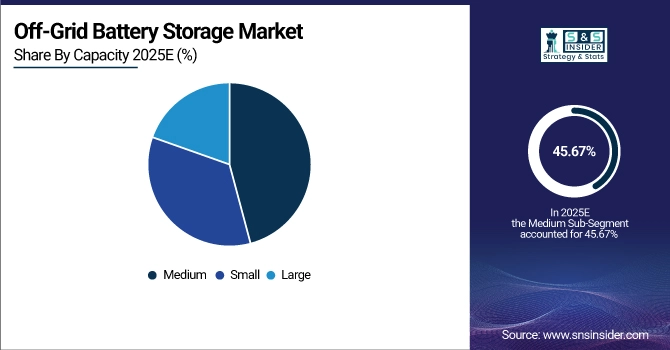

By Capacity, Medium (10–100 kWh) accounted for the highest market share of 45.67% in 2025, while Large (>100 kWh) is projected to expand at the fastest CAGR of 30.12% during the forecast period.

-

By System Type, Solar dominated with a 53.84% share in 2025, while Hybrid systems are anticipated to record the fastest CAGR of 32.05% through 2026–2033.

-

By Application, Residential held the largest share of 37.56% in 2025, while Off-Grid EV Charging is expected to grow at the fastest CAGR of 33.44% during the forecast period.

-

By Sales Channel, Direct sales accounted for the largest share of 42.19% in 2025, while EPC/Installer channels are forecasted to register the fastest CAGR of 31.22% during 2026–2033.

By Capacity, Medium Dominates While Large Expands Rapidly:

Medium segment dominated the market as much lower in price and as they are moderate in cost and between less costly and energy generation, which can be used for homes, small commercial buildings, telecom. In 2025, medium-capacity installations reached 1,250 MW, demonstrating their widespread adoption for off-grid energy needs.

Large is the fastest growing segment, as a result of greater demand from industrial, microgrid and utility scale energy storage systems with high power storing capability. In 2025, 680 MW of large-capacity off-grid battery systems were deployed, reflecting increasing adoption in large renewable projects and rural electrification initiatives.

By Battery Type, Lithium-Ion Dominates While Flow Batteries Expand Rapidly:

Lithium-Ion segment dominated the market on account of its high energy density and is expected to drive growth in terms of years when accepted across residential, commercial and industrial applications. In 2025, lithium-ion systems accounted for 18,500 units globally, reflecting strong preference for reliable and scalable battery solutions.

Flow Batteries are the fastest growing segment due to they have an application in GWH scale storage, long term storage solutions and are increasingly installed in remote renewable projects. In 2025, flow batteries accounted for 12 GWh of new installations.

By System Type, Solar Dominates While Hybrid Expands Rapidly:

Solar segment dominated the market due to reduction in solar panel prices, greater chances of power generation and government backing for solar installation. In 2025, solar-based off-grid systems accounted for 6,800 MW globally, underscoring their dominance in residential and commercial sectors.

Hybrid is the fastest growing segment that can offer an uninterrupted power generation in regions with solar and wind resources of intermittent. In 2025, hybrid installations reached 850 MW globally, highlighting increasing interest in flexible, resilient and sustainable off-grid energy solutions.

By Application, Residential Dominates While Off-Grid EV Charging Expands Rapidly:

Residential segment dominated the market on account of growing rural electrification, household energy independency and deployment of rooftop solar systems with battery storage. 2025, residential installations reached 3,500 MW globally, highlighting strong consumer preference for off-grid energy solutions.

Off-Grid EV Charging is the fastest growing segment, based on rapid electric mobility in remote areas, increasing uptake of electric vehicles and demand for self-governing charging infrastructure. In 2025, off-grid EV charging installations surpassed 300 MW, reflecting the market’s shift toward electrified transport in off-grid communities.

By Sales Channel, Direct Dominates While EPC/Installer Expands Rapidly:

Direct Sales segment dominated the market as suppliers deliver off-grid batteries to residential and commercial end-users on a turnkey basis and also provide after sales support. In 2025, direct sales accounted for 1,200 units, reflecting the preference for manufacturer-backed, end-to-end energy solutions.

EPC/Installer are the fastest growing segment as they are customers that provide a full service and turnkey integration of off grid systems in rural, industrial or renewable microgrid applications. In 2025, EPC/Installer installations accounted for 450 projects, highlighting increasing reliance on expert installation and integrated energy management services.

Off-Grid Battery Storage Market Regional Analysis:

Asia-Pacific Off-Grid Battery Storage Market Insights:

The Asia-Pacific Off-Grid Battery Storage Market dominated the market in 2025, holding a market share of 38.76%. This domination is backed by swift expansion of rural electrification, huge uptake of renewables and government push toward solar, wind and hybrids in not just China and India but also Japan and Australia. The rising application in residential, commercial and industrial sector paired with decrease in battery prices and technological breakthroughs further cements Asia–Pacific as the dominated region for off-grid energy storage systems.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Off-Grid Battery Storage Market Insights:

China’s Off-Grid Battery Storage Market is being propelled on the account of swift rural electrification, incentives offered by government for renewable power adoption coupled with increasing usage of rooftop solar PV systems in residential & commercial places. Spreading of microgrid project, technological enhancement in lithium ion and flow batteries and growing industrial off grid deployments make China major contributor to the growth of Asia-Pacific off-grid battery storage market.

North America Off-Grid Battery Storage Market Insights:

North America’s Off-Grid Battery Storage Market is primarily motivated by increasing implementation of residential and commercial solar systems, rising emphasis on renewable energy incorporation, extending microgrid and rural electrification projects. Positive government policies, development of lithium-ion, hybrid batteries and increasing industrial applications continue to further drive up the market. Strong values placed in energy independence, sustainability and developed infrastructure further enhance the areas contribution as an off-grid energy solution provider.

U.S. Off-Grid Battery Storage Market Insights:

The U.S. Off-Grid Battery Storage Market is predominantly ruled by the escalating renewable energy adoption, growth in the residential & commercial solar installations and surging government incentives for energy independence. The country’s status as a leader in off-grid energy solutions is bolstered by innovations in lithium-ion and hybrid battery technologies and an increase in microgrid and rural electrification initiatives.

Europe Off-Grid Battery Storage Market Insights:

The Europe Off-Grid Battery Storage Market is on the rise owing to escalating acceptance of renewable energy, favorable government norms and surging need for energy autonomy in residential, commercial and industrial sector. There are leading distributors in the form of Germany, UK, France and Italy, strong domestic infrastructure-support measures and a growing number of microgrid and rural electrification projects. Advancements in lithium-ion and Hybrid battery systems will also continue to support Europe as a key regional market for off-grid power.

Germany Off-Grid Battery Storage Market Insights:

Germany is one of the leading Off-Grid Battery Storage Market in the European region on account of well-established energy infrastructure, favorable governmental policies and high penetration of residential and commercial solar systems. The growing number of microgrids, industrial off-grid projects and technology innovation in battery storage further underpin Germany’s dominion in the European off-grid power market.

Middle East and Africa Off-Grid Battery Storage Market Insights:

The Middle East & Africa Off-Grid Battery Storage Market is growing at a CAGR of 31.30%, due to rise in the share of renewable energy in the grid mix, rural electrification programs and government policies supporting distributed power generation. Investments toward microgrids, industrial and residential off-grid systems across prominent countries including Saudi Arabia, UAE and South Africa have fueled the market growth while promoting regional energy independence.

Latin America Off-Grid Battery Storage Market Insights:

The Latin America Off-Grid Battery Storage Market is growing on account of adoption of renewable energy, rural electrification programs and favorable government policies in Brazil, Mexico and Argentina. Residential, C&I and industrial off-grid deployments are increasing and investment in solar and hybrid battery systems is growing to fuel growth, energy access in the region.

Off-Grid Battery Storage Market Competitive Landscape:

CATL, headquartered in Ningde, China, is a leader in lithium-ion batteries for electric vehicles, renewable energy, and large-scale energy storage systems. Established in 2011, the company has high-speed production with its superior 'cell-to-pack' technology that ensures maximised energy density and reduces manufacturing costs. R&D strength, strategic partnerships and integrated industrial supply chain enable CATL to lead off-grid battery storage applications in residential, C&I and other applications around the globe with reliable products as a competitive market leader.

-

In April 2025, CATL launched its Naxtra sodium‑ion battery, designed for energy storage with abundant materials, good energy density, and safety. This diversification beyond lithium‑ion strengthens CATL’s position in residential, commercial and utility-scale off-grid markets.

BYD (Build Your Dreams), based in China, is a vertically integrated company combining electric vehicle manufacturing with in-house battery production. The Blade Battery guarantees high safety, long range and service life and lower investment cost. BYD’s penetration in residential, commercial and utility-scale energy storage system puts it in a dominant position on the off-grid battery storage market. Powerful innovation, deep deployment experience and durable solutions across a variety of organizations affirm BYD’s status as the leader in renewable energy and off-grid applications.

-

In March 2025, BYD introduced the Battery‑Box HVE and Battery‑Box HVB, modular residential energy storage systems using Blade battery technology. High energy density, safety, and scalable capacity support residential and commercial off-grid deployments, reinforcing BYD’s market dominance.

LG Energy Solution, a South Korean company spun off from LG Chem, is a leading manufacturer of lithium-ion batteries for automotive, industrial and energy storage applications. The firm offers residential, commercial and grid scale solutions that are engineered to excellence with a singular focus on safety, efficiency and advanced chemistries. Heavy R&D, new technologies and project experience have put LG Energy Solution on top of the off-grid battery storage market in terms of performance, reliabilities and large-scale businesses.

-

In May 2025, LG Energy Solution unveiled a next-generation containerized LFP ESS system in Europe and secured a 981 MWh grid-scale supply deal with Poland’s PGE, enhancing its presence in large-scale off-grid and utility storage markets.

Medical Foods Market Key Players:

Some of the Medical Foods Market Companies are:

-

CATL

-

BYD

-

Tesla, Inc.

-

Samsung SDI

-

EnerSys

-

SAFT Groupe S.A.

-

Sonnen GmbH

-

Schneider Electric SE

-

ABB Ltd.

-

Siemens AG

-

VARTA AG

-

NEC Energy Solutions, Inc.

-

Aquion Energy, Inc.

-

Sunverge Energy, Inc.

-

SimpliPhi Power, Inc.

-

Blue Planet Energy

-

Trojan Battery Company

-

Eos Energy Storage

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 22.62 Billion |

| Market Size by 2033 | USD 138.86 Billion |

| CAGR | CAGR of 25.49% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Battery Type (Lead-Acid, Lithium-Ion, Flow Batteries, Nickel-Based, Sodium-Based, Others) • By Capacity (Small, Medium, Large) • By System Type (Solar, Wind, Hybrid, Diesel-Integrated) • By Application (Residential, Commercial, Industrial, Telecom, Rural Electrification, Off-Grid EV Charging, Others) • By Sales Channel (Direct, EPC/Installer, Distributors, Online) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | CATL, BYD, LG Energy Solution, Tesla, Samsung SDI, Panasonic, EnerSys, SAFT Groupe S.A., Sonnen GmbH, Schneider Electric SE, ABB Ltd., Siemens AG, VARTA AG, NEC Energy Solutions, Aquion Energy, Sunverge Energy, SimpliPhi Power, Blue Planet Energy, Trojan Battery Company, Eos Energy Storage |