Oil & Gas Variable Frequency Drives Market Size Analysis:

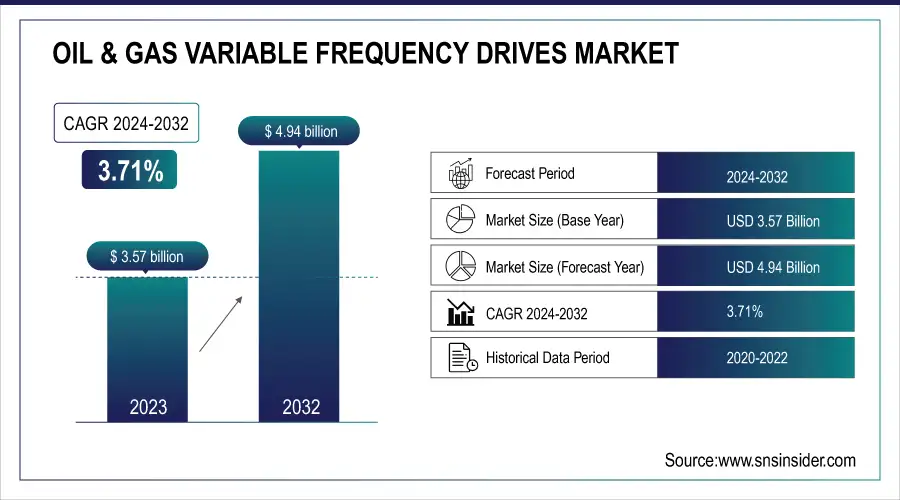

The Oil & Gas Variable Frequency Drives Market was valued at USD 3.57 billion in 2023 and is expected to reach USD 4.94 billion by 2032, growing at a CAGR of 3.71% over the forecast period 2024-2032.

The smart VFD and digitalization are transforming the Oil & Gas Variable Frequency Drives (VFD) market on a whole new level. As a result, automation technologies and Industry 4.0 are improving operational efficiency while allowing the collection of timely data for monitoring, prediction, and maintenance. As one of the critical devices in the package, a Smart VFD supports smooth integration into digital ecosystems for energy management and process optimisation. They are becoming more prevalent in both smart grids and power generation applications, which bolsters their position in providing better control, minimizing downtime, and increasing energy savings across oil and gas operations. The USD 105 billion in U.S. upstream oil and gas deals demonstrates significant investment activity. Archer has also indicated that the majority of U.S. oil and gas firms are focused on fully electric rigs, while 31% plan on a transition to partial electrification, and also show a growing focus on energy-efficient technology.

To Get more information on Oil & Gas Variable Frequency Drives Market - Request Free Sample Report

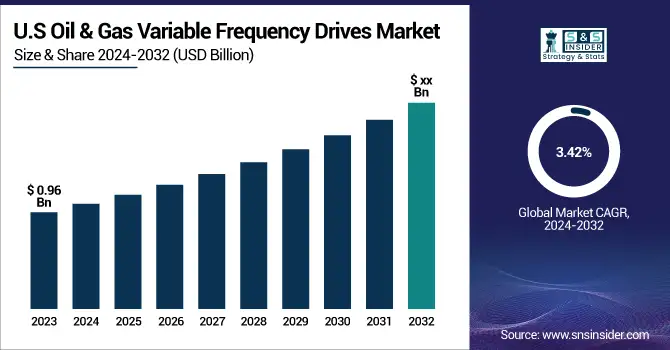

The U.S. Oil & Gas Variable Frequency Drives Market is estimated to be USD 0.96 billion in 2023 and is projected to grow at a CAGR of 3.42%. The U.S. Oil & Gas Variable Frequency Drives (VFD) market is witnessing growth due to high automation and strong energy efficiency regulations supported by the incorporation of Industry 4.0 Technologies.

Oil & Gas VFD Market Dynamics

Key Drivers:

-

Energy Efficient VFD Adoption Accelerates in Oil and Gas Sector Amid Automation and Infrastructure Modernization

The growth is expected to be driven mainly by oil & gas operators turning towards energy-efficient solutions within upstream, midstream, and downstream activities. Global oil & gas organizations have been continuously looking for ways to reduce their process operational costs, but with the new stringent environmental regulations, most companies are looking to capitalize more on the advantage of VFDs being widely accepted for motor control, better equipment life, and reduction of energy wastage. Furthermore, the increasing automation of drilling and extraction processes, especially at offshore rigs and shale gas fields, is driving up the demand for state-of-the-art VFD systems. The increasing deployment of VFDs in pumps, compressors, and fans also drives the de facto demand for market growth, mainly in regions with old infrastructure that needs modernization.

Restrain:

-

Legacy System Challenges and Skilled Labor Shortage Hinder VFD Integration in the Oil and Gas Industry

One of the major constraints for the growth of the oil & gas variable frequency drives (VFD) market is the difficulty in retrofitting VFDs into old legacy systems. With a great percentage of oil & gas facilities working with legacy infrastructure, the integration of the latest drive systems is technically complicated. A lengthy preparation phase before adoption is problematic, and delays can be weeks or months, particularly in larger operations, where downtime is detrimental to production. Moreover, a shortage of professionals who know VFD installation, programming, and maintenance is a challenge, especially in distant locations or developing areas where trained personnel and technical support are scarce.

Opportunity:

-

Smart VFDs and IIoT Integration Unlock New Growth Opportunities Across the Global Oil and Gas Sector

IIoT and predictive maintenance technology integration open up dynamic market opportunities for VFD manufacturers. Smart VFDs are becoming more popular, and these are high-value, newly constructed components that can monitor and analyze data in real-time, especially in critical environments where downtime is expensive. In addition, there is potential growth in markets where investment in oil & gas infrastructure is going up, mainly in the Asia Pacific and Middle East, but also in small pockets elsewhere. Increase in electrification and digital oilfields, which push for offering tailor-made application-specific VFDs. Partnerships between OEMs and automation solution providers may lead to more innovation and adoption in future years.

Challenges:

-

Harsh Conditions and Cybersecurity Challenges Impact VFD Reliability and Deployment in the Oil and Gas Industry

Extreme environmental conditions in oil & gas operations also affect the VFD performance and reliability & and longevity due to high temperature, high humidity, and availability of corrosive materials. While it is critical, but technically challenging to ensure that drives meet ruggedness and reliability requirements for industry segments. The risk of cyber-nuisance linked to digital network VFDs is an unavoidable concern as the industry transitions to "smart" systems, and remote monitoring is yet another hurdle. This calls for more investments in the form of secure communication protocols and monitoring systems to protect critical infrastructure from being targets for cyber threats. For manufacturers, regulatory compliance and certification activity in various countries and regions may further impede market entry and extend timelines from concept to deployment.

Oil & Gas Variable Frequency Drive Market Segmentation Analysis

By Voltage

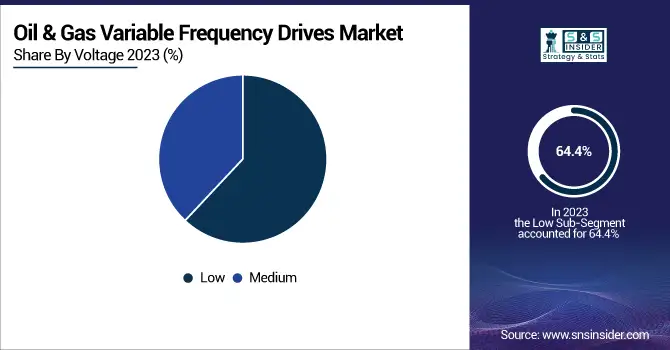

The Oil & Gas Variable Frequency Drives (VFD) market was led by the low voltage segment in 2023, which held a solid market share of 64.4%. It accounts for the vast majority of the market, primarily driven by the low cost of low-voltage VFDs, use in all stages of the oil and gas industry, such as pumps, fans, compressors, etc., and moderate power requirements for upstream and downstream operations. Their energy efficiency, ease of installation, and ease of maintenance aspects also make them a preferred choice in new installations and retrofit projects.

From 2024 to 2032, the medium voltage segment accounted for the largest CAGR. Increasing deployment of favorable midstream operation applications, especially at large power levels, compressor stations, and pipeline operations, is the key industrial application that is all set to drive this growth. With Oil & gas operators in the process of keeping their operations streamlined along with increasing automation, the segregated segment of medium voltage VFD provides a high degree of efficiency, control, and performance for heavy-duty equipment and is anticipated to gain significant growth over the forecast period.

By Drive

In 2023, the Oil & Gas Variable Frequency Drives (VFD) market is dominated by the AC drive segment with a commanding market share of 73.5%. The strong & effective presence is credited to the high adoption of AC drives in oil & gas applications, such as pumps, fans, as well as compressors. AC drives are preferred when it comes to high energy efficiency, lower maintenance, and compatibility with standard motors and are therefore deployed in a large variety of operations in both the upstream and downstream sectors.

The servo drive segment is estimated to register the fastest CAGR from 2024 to 2032. Rapid growth is projected to be led by the growing need for high-accuracy motion control and enhanced automation in key oil & gas operations, including drilling, positioning, and specialized extraction processes. Servo drives provide high precision, fast response, and great efficiency, which suits them to higher-end, high-performance environments. In line with transitioning towards digital oilfield technologies, servo drives are anticipated to witness a substantial increase in the global servo drives market.

By Application

The pump segment of the Oil & Gas Variable Frequency Drives (VFD) market accounted for the largest share in 2023 at 39.4%. Pumps circulate crude oil, water, and other fluids in all oil & gas operations, upstream extraction, downstream refining, or otherwise, and are thus critical assets. VFDs are used in pump applications to improve energy efficiency, reduce mechanical strain, and provide accurate flow control, which is economical, sustainable, reliable, and continuous operation.

The compressor segment is projected to have the highest CAGR during the forecast period (between 2024 and 2032). Compressors are therefore key to midstream and downstream operations, most notably gas transportation and processing. With more natural gas demand worldwide and the infrastructure day-by-day expands, a higher capacity of compression systems is required. The adoption of VFDs in high-performance, mission-critical oil & gas environments is driven by increased control, better energy saving, and decreased wear & tear on compressors.

Oil & Gas Variable Frequency Drives Market (VFD) Regional Overview

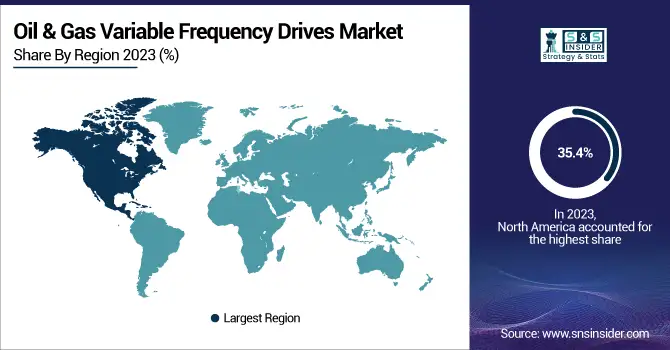

North America led the Oil & Gas Variable Frequency Drives (VFD) market in terms of revenue percentage in 2023, which was 35.4%. This lead was due particularly to its mature oil & gas infrastructure and its widespread adoption of automation and energy-efficient technologies, notably in the U.S. and Canada. Companies like ExxonMobil, Chevron, and Enbridge are currently using it as VFDs to lower emissions and boost efficiency. A direct example is the shift towards VFD operating electric submersible pumps (ESPs) by operators in the Permian Basin to minimize oil-flattening electricity usage. Moreover, an increasing demand for low and medium-voltage VFDs in different applications due to the midstream infrastructure and refinery modernization is another contributing factor driving the market demand.

Get Customized Report as per Your Business Requirement - Enquiry Now

The Asia Pacific region is estimated to record the fastest CAGR in the period 2024 to 2032, on account of faster industrialization, rising energy demand, and increasing investment in oil & gas infrastructure. Exploration and refining capacity are expanding in countries including China, India, and Indonesia. An instance of this would be the implementation of VFDs in offshore drilling platforms by India-based ONGC to enhance control of operations and reduce wear & tear of mechanical devices. Likewise, China National Petroleum Corporation (CNPC) has incorporated VFD technology across its pipeline networks and processing units for the sake of performance improvements and increased availability.

Major Players in the Oil & Gas Variable Frequency Drives Market are:

-

ABB (ACS880)

-

Siemens (SINAMICS G120)

-

Schneider Electric (Altivar Process ATV900)

-

Rockwell Automation (PowerFlex 755)

-

General Electric (GE) (AF-6 Series Drive)

-

Danfoss (VLT AutomationDrive FC 302)

-

Eaton (PowerXL DG1)

-

Yaskawa Electric Corporation (GA800 Drive)

-

Mitsubishi Electric (FR-F800 Series)

-

Toshiba International Corporation (T300MVi)

-

WEG Electric Corp. (CFW11)

-

Hitachi Industrial Equipment Systems (SJ700D)

-

Fuji Electric (FRENIC-MEGA)

-

Nidec Control Techniques (Unidrive M700)

-

LS Electric (LSIS) (iS7 Series VFD)

Recent Trends

-

In April 2025, ABB integrated Samotics' SAM4 Electrical Signature Analysis (ESA) into its ACS880 variable frequency drives, enabling real-time condition monitoring and predictive maintenance.

-

In April 2024, Rockwell Automation expanded its PowerFlex 6000T medium voltage VFDs to support permanent magnet motors, enhancing efficiency in high-speed applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.37 Billion |

| Market Size by 2032 | USD 4.94 Billion |

| CAGR | CAGR of 3.71% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Voltage (Low, Medium) • By Drive (AC, DC, Servo) • By Application (Pump, Fan, Conveyor, Compressor, Extruder, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ABB, Siemens, Schneider Electric, Rockwell Automation, General Electric (GE), Danfoss, Eaton, Yaskawa Electric Corporation, Mitsubishi Electric, Toshiba International Corporation, WEG Electric Corp., Hitachi Industrial Equipment Systems, Fuji Electric, Nidec Control Techniques, LS Electric (LSIS). |