ZigBee Wireless Sensor Market Size & Overview:

Get more information on ZigBee Wireless Sensor Market - Request Sample Report

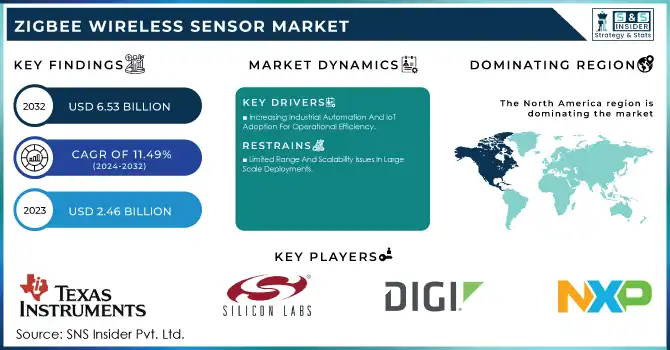

The ZigBee Wireless Sensor Market Size was valued at USD 2.46 Billion in 2023 and is expected to reach USD 6.53 Billion by 2032 and grow at a CAGR of 11.49% over the forecast period 2024-2032.

The ZigBee Wireless Sensor Market has witnessed enormous developments in the last few years due to the fast-growing use of connected devices in all sectors. Developing nations that have adopted ZigBee technology to improve automation and energy efficiency. In 2023, Japan and Germany utilized ZigBee for industrial automation through government policies to support smart manufacturing and real-time monitoring. Similarly, in India and China, it was more about energy management and agricultural applications as part of policies to utilize IoT-based solutions for sustainability.

The USA has also experienced increased healthcare applications of ZigBee sensors due to government push towards telehealth and personalized medicine. Meanwhile, France has focused on smart cities, which involve ZigBee-enabled devices for traffic management and public safety. Recent technological developments include enhanced network protocols, energy-efficient modules, and advanced security features. For instance, SONOFF ZBMINIR2 is one of those tiny ZigBee smart switches that looks identical to SONOFF ZigBee Extreme but needs a neutral wire and may act like a ZigBee router at the same time with support for up to 64 sub-devices. Notably, 2024 marked the launch of next-generation ZigBee devices with longer range and faster data transfer, particularly targeting the healthcare and home automation sectors. These developments have also been complemented by collaborations between industry leaders and governments to standardize IoT protocols, thereby ensuring broader compatibility and adoption.

Future opportunities lie in integrating ZigBee with AI and blockchain for enhanced security, predictive analytics, and intelligent decision-making. For instance, AI-driven ZigBee systems can optimize energy use in real-time, while blockchain ensures secure data sharing among devices. This opens up vast opportunities for growth in urban sustainability, industrial IoT, and smart agriculture. Moreover, 5G networks are expected to further support ZigBee applications with faster and more reliable connectivity.

ZigBee Wireless Sensor Market Dynamics

Key Drivers:

-

Increasing Industrial Automation And IoT Adoption For Operational Efficiency.

Industrial automation has seen a rapid growth in the deployment of ZigBee sensors, driven by the requirement for real-time monitoring and predictive maintenance. In 2023, Germany's "Industry 4.0" initiative reported increase in ZigBee-enabled sensor installations in manufacturing plants. ZigBee has robust mesh networking capabilities and scalability, which makes it perfect for large industrial facilities.

Additionally, governments in Japan and the USA have started offering tax incentives for using IoT-based technologies to improve productivity and reduce downtime. Predictive analytics are facilitated by these sensors, thereby ensuring timely maintenance and bringing down operational costs by as much as 25%. The integration of ZigBee with AI algorithms has further improved decision-making processes, thus contributing towards the demand for efficient industrial automation solutions.

-

Increasing Demand For Smart Home Solutions Due To Consumer Demands.

ZigBee's low power consumption and secure communication practice make it appropriate for smart thermostats, lighting, and security devices. The latest technology has also made it easier to have interoperability between devices through the introduction of ZigBee 3.0, which has increased consumer confidence. As the global middle class continues to grow, especially in countries such as India and China, the demand for affordable yet effective smart home solutions is expected to skyrocket exponentially.

In 2023, more than half of households in the USA and Europe were interested in home automation, which was attributed to energy-saving technologies as well as enhanced security features. Governments across the world have incentivized smart home adoption with energy efficiency policies. For example, France's Energy Transition Law encourages smart devices to help households save 20% of energy consumption by 2030.

Restrain:

-

Limited Range And Scalability Issues In Large-Scale Deployments.

The ZigBee Wireless Sensor Market predominantly faces a challenge with its limitation of range and scalability as well, particularly in extending environments of industrial or urban kind. While ZigBee's mesh networking is scalable, its range is limited to about 10-100 meters per node. This will make it challenging to implement ZigBee networks seamlessly in applications requiring extensive coverage, such as smart cities or large agricultural fields.

This problem is even worse in rural region due to the lack of infrastructures that amplifies the connectivity problems. These competing technologies like LoRaWAN and NB-IoT provide better range, so there is a real chance that ZigBee is going to lose in this market share. ZigBee Pro will have to really make some serious investments into R&D to enhance range capabilities and seamless integration with such new emerging technologies.

ZigBee Wireless Sensor Market Segments Analysis

By Application

Industrial Management segment was the largest application in 2023 with a market share of 44%. This was because of the growing demand for smart manufacturing technologies. Reliability, low power consumption, and robust network capabilities are reasons ZigBee is preferred in industrial applications involving predictive maintenance and operational monitoring.

The Energy Management segment is expected to grow at the fastest pace, at a CAGR of 11.77%, during the forecast period of 2024-2032, with growing concerns about energy efficiency and sustainability worldwide. Energy efficiency device policies introduced by the governments of Japan and France have increased demand for ZigBee-enabled solutions. Health care is another emerging trend because of remote patient monitoring, especially among elderly people. Smart agriculture and smart cities are significant growth areas as ZigBee enables cost-effective and reliable solutions for optimizing resource utilization and enhancing infrastructure.

By End Use

Home Automation segment dominated in 2023 with a 29% market share, driven by the growing interest of consumers in smart living solutions. Low-power operation and secure communication protocol make ZigBee particularly suitable for devices such as smart lighting, thermostats, and home security systems. This trend is further bolstered by government initiatives towards energy-efficient homes, including India's "Smart Cities Mission."

The Industrial Automation segment is expected to grow at the fastest CAGR of 12.47% during the forecast period of 2024-2032. The increasing adoption of IoT technologies in manufacturing for productivity improvement and reducing down time is a significant driver. The German and Japanese governments have implemented policies that promote smart manufacturing. Healthcare and agriculture are contributing to market growth, because ZigBee sensors allow efficient remote monitoring of healthcare activities and remote resource management for agriculture.

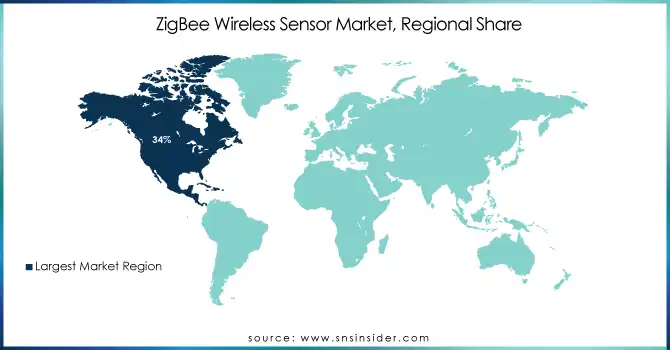

ZigBee Wireless Sensor Market Regional Outlook

North America dominated the market in 2023, accounting for 34% of the market share, due to the widespread adoption of smart home solutions and industrial automation. The USA, in particular, has seen a surge in healthcare applications supported by government policies promoting telehealth and IoT-based medical devices.

The Asia-Pacific region is expected to be the fastest-growing region with a CAGR of 12.24% in the forecast period of 2024-2032. The rapid urbanization and industrialization in countries like China and India are major drivers for this growth. ZigBee-enabled technologies in smart cities, agriculture, and energy management are also encouraged by government initiatives such as China's "Made in China 2025" and India's "Digital India.".

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Some of the major players in the ZigBee Wireless Sensor Market are

-

Texas Instruments (ZigBee modules, ZigBee development kits)

-

Silicon Labs (ZigBee chips, IoT development kits)

-

Digi International (ZigBee gateways, ZigBee adapters)

-

NXP Semiconductors (ZigBee transceivers, wireless MCU solutions)

-

Microchip Technology (ZigBee modules, ZigBee protocol stacks)

-

Honeywell International (ZigBee-enabled thermostats, ZigBee security sensors)

-

Schneider Electric (ZigBee energy management systems, ZigBee lighting controls)

-

STMicroelectronics (ZigBee SoCs, ZigBee development boards)

-

Qualcomm (ZigBee modules, ZigBee connectivity solutions)

-

Bosch Sensortec (ZigBee environmental sensors, ZigBee motion sensors)

-

Johnson Controls (ZigBee-enabled building management systems, ZigBee HVAC controls)

-

Atmel (ZigBee transceivers, ZigBee development tools)

-

Murata Manufacturing (ZigBee RF modules, ZigBee IoT components)

-

Renesas Electronics (ZigBee MCU solutions, ZigBee wireless systems)

-

Panasonic (ZigBee lighting systems, ZigBee energy controls)

-

TE Connectivity (ZigBee antennas, ZigBee modules)

-

OSRAM (ZigBee lighting controls, ZigBee smart lighting systems)

-

Enocean (ZigBee wireless sensors, ZigBee energy harvesting solutions)

-

Hager Group (ZigBee smart home systems, ZigBee energy management tools)

-

Legrand (ZigBee building automation systems, ZigBee lighting solutions)

Major Suppliers (Components, Technologies)

-

TDK Corporation (ceramic capacitors, inductors)

-

Kyocera (ceramic components, RF filters)

-

Samsung Electro-Mechanics (MLCCs, RF components)

-

Vishay Intertechnology (resistors, capacitors)

-

AVX Corporation (capacitors, RF components)

-

Murata Manufacturing (ceramic resonators, RF modules)

-

Amphenol (connectors, antennas)

-

Molex (connectors, interconnect systems)

-

Analog Devices (semiconductors, RF amplifiers)

-

Broadcom Inc. (RF transceivers, semiconductors)

Recent Trends

-

August 2024: Silicon Labs' MG21 2.4GHz wireless SoC has been adopted by SONOFF for the latest ZBMicro smart switch. SONOFF's Micro ZigBee USB Smart Adaptor is a groundbreaking development in smart home technology. With a role as a smart switch for USB devices to becoming a ZigBee router, coupled with fast charging capabilities, the ZBMicro has brought about an unmatched user experience that enhances connectivity and convenience in modern smart homes.

-

Feb 2024: SMLIGHT has recently launched ZigBee Ethernet/WiFi/USB coordinators and USB dongles utilizing Texas Instruments CC2652P7 or CC2674P10 wireless microcontrollers, featuring updates to the SLZB-06 ZigBee 3.0 to PoE Ethernet, USB, and WiFi adapter, as well as Silicon Labs EFR32MG21-based SLZB-07 ZigBee 3.0 USB adapter.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.46 Billion |

| Market Size by 2032 | USD 6.53 Billion |

| CAGR | CAGR of 11.49% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Temperature Zigbee Sensor, Humidity Zigbee Sensor, Light Zigbee Sensor, Other) • By Application (Industrial Management, Energy Management, Other) • By End Use (Home Automation, Industrial Automation, Healthcare, Agriculture, Smart Cities) • By Connectivity (Low Power Wide Area Network, Mesh Network, Point-to-Point Network, Cellular Network) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Texas Instruments, Silicon Labs, Digi International, NXP Semiconductors, Microchip Technology, Honeywell International, Schneider Electric, STMicroelectronics, Qualcomm, Bosch Sensortec, Johnson Controls, Atmel, Murata Manufacturing, Renesas Electronics, Panasonic, TE Connectivity, OSRAM, Enocean, Hager Group, Legrand. |

| Key Drivers | • Increasing Demand For Smart Home Solutions Due To Consumer Demands. • Increasing Industrial Automation And Iot Adoption For Operational Efficiency. |

| Restraints | • Limited Range And Scalability Issues In Large-Scale Deployments. |