Organ Transplant Immunosuppressant Drugs Market Report Size Analysis:

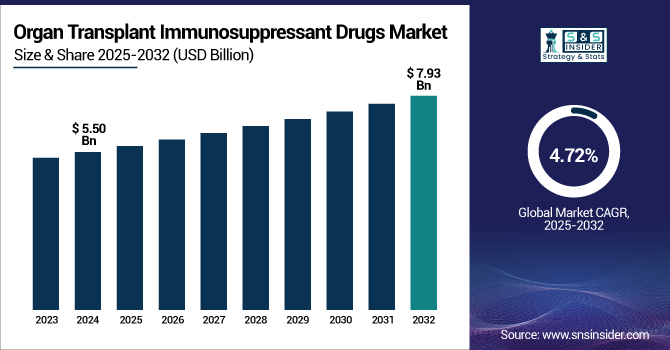

The Organ Transplant Immunosuppressant Drugs Market size was valued at USD 5.50 billion in 2024 and is expected to reach USD 7.93 billion by 2032, growing at a CAGR of 4.72% over the forecast period of 2025-2032.

To Get more information on Organ Transplant Immunosuppressant Drugs Market - Request Free Sample Report

The organ transplant immunosuppressant drugs market is showing a continuous pace, driven by the growing burden of chronic diseases and the growing frequency of organ transplantation operations worldwide.

The World Health Organization estimates that noncommunicable diseases (NCDs) accounted for 41 million deaths in 2023, 74% of worldwide mortality, emphasizing the critical need for enhanced transplant and post-transplant immunotherapy market solutions.

While the Organ Procurement and Transplantation Network (OPTN) documented a record 16,335 dead organ donors, a 9.6% increase over 2022, the United Network for Organ Sharing (UNOS) noted 46,630 organ transplants in the United States in 2023. These figures show a strong infrastructure for organ transplantation and an increasing demand for immunosuppressive drugs for organ transplantation, which are indispensable for drugs, transplant rejection avoidance, drugs, and long-term graft survival.

The growing frequency of organ failure resulting from chronic diseases, an aging worldwide population, and technical developments in transplantation drive the organ transplant immunosuppressant drugs market. The U.S. organ transplant immunosuppressant drugs market held the largest market share with a value of USD 1.71 billion in 2024 and is expected to increase with a CAGR of 4.64% over the forecast period.

The OPTN and UNOS reported 104,541 patients on the transplant waiting list and 27,332 kidney transplants performed in the U.S. in 2023, underlining the volume of demand for kidney transplant immunosuppressants and other transplant rejection prevention drugs.

Organ Transplant Immunosuppressant Drugs Market Dynamics

Drivers

-

Increasing Frequency of Chronic Diseases and Organ Failures to Drive the Organ Transplant Immunosuppressant Drugs Market Growth

The worldwide rise in chronic diseases such as kidney diseases, diabetes, and cardiovascular diseases has resulted in a significant rise in organ failures, hence increasing the need for organ transplants.

For instance, the FDA authorized Myhibbin (mycophenolate mofetil oral suspension), a ready-made immunosuppressant developed by Azuity Pharmaceuticals, therefore streamlining administration for both juvenile and adult transplant recipients in May 2024. Particularly for younger patients, this invention solves problems in dosing precision and compliance and supports the increasing need driven by nearly 46,000 U.S. transplants in 2023.

Demand for immunosuppressant medications, which are crucial to avoid organ rejection, keeps growing as more patients need life-saving transplants. An expanding geriatric population, more prone to chronic diseases and so more likely to need transplants, helps to accentuate this trend.

The World Health Organization estimates that non-communicable diseases account for a major share of world mortality, thereby stressing the important part modern transplant operations and immunosuppressive treatments play in controlling these diseases. The main reason behind the growth of the market is the synergy between increasing disease frequency and developments in transplant therapy.

Restraints

-

Possibility of Substantial Side Effects and Long-Term Consequences from Immunosuppressant Medications Limits Market Growth

Although transplant success depends on immunosuppressants, their usage is linked to a variety of side effects, including diabetes, high blood pressure, increased sensitivity to infections, and even higher cancer risk. These adverse effects can seriously affect a patient's quality of life and cause therapy to be stopped or changed, therefore compromising the results of the transplant. Using these medications long-term calls for thorough monitoring and treatment, which can be difficult and expensive. Furthermore, the medical profession is constantly investigating alternative therapies to reduce or remove the need for lifetime immunosuppression, therefore limiting the future expansion of the industry as new methods to address these safety concerns.

Organ Transplant Immunosuppressant Drugs Market Segmentation Analysis

By Drug Class

The calcineurin inhibitors segment accounted for the largest share of 40% in 2024 and is expected to rise at the fastest CAGR during the forecast period. There are numerous main reasons behind the organ transplant immunosuppressant drugs market growth. The calcineurin inhibitors, such as cyclosporine and tacrolimus, are the backbone of immunosuppressive treatment for solid organ transplantation, including kidney and liver transplant immunosuppressive therapy and heart transplant immunosuppressive therapy. These drugs inhibit T-cell activation, preventing acute and chronic rejection, and are widely used due to their proven effectiveness and manageable safety profile.

For instance, reflecting the active organ transplantation drug pipeline and pharmaceutical company competitiveness, Dr. Reddy's Laboratories completed Phase I investigations for a biosimilar immunosuppressant in June 2023.

The U.S. FDA has approved cyclosporine for allogeneic organ transplant rejection prevention drugs and tacrolimus for multiple organ types, including recent expansions for lung transplants. This regulatory environment ensures broad access and continued innovation in the organ transplant immunosuppressant drugs market.

For instance, United Therapeutics revealed in April 2024 the first successful xenothymokidney transplant into a live patient utilizing FDA-approved immunosuppressive medications, therefore illustrating the changing function of calcineurin inhibitors in advanced transplantation situations.

The Health Resources and Services Administration claims that over 90% of kidney transplant recipients in the United States are kept on tacrolimus-based regimens, therefore highlighting the firmly established role of calcineurin inhibitors in the post-transplant immunotherapy scene. For instance, the U.S. carried out 27,332 kidney transplants in 2023, most of which received calcineurin inhibitor-based therapy for maintenance immunosuppression, therefore guaranteeing good graft survival rates and reduced rejection incidences.

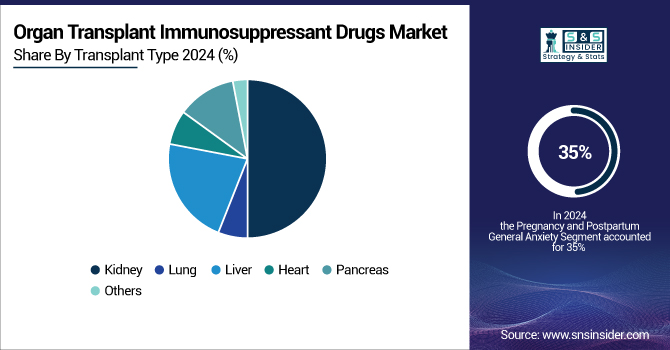

By Transplant Type

The kidney transplant segment led the global organ transplant immunosuppressant drugs market in 2024 with a 50% revenue share. With many of those suffering from chronic kidney disease (ESRD), which calls for transplanting and the use of kidney transplant immunosuppressants, an approx. 850 million individuals globally suffered from this chronic kidney disease in 2023. The National Institutes of Health estimates that over 37 million Americans alone have chronic renal disease; many cases of this condition are associated with diabetes and high blood pressure.

Further driving demand for immunosuppressive treatments is kidney transplantation, which reduces dialysis needs, lowers healthcare costs and improves survival and quality of life. In February 2022, the U.S. FDA fast-track designation for Veloxis Pharmaceuticals' VEL-101, an experimental maintenance immunosuppressive medication for kidney transplants, marks the active organ transplantation therapeutic pipeline.

Over the forecast period, lung transplants are expected to experience the fastest growth rate. Rising instances of respiratory diseases, more R&D activity, and more transplant operations all help to explain this. Policy improvements and improved clinical procedures helped the United States saw a 10.4% rise in lung transplants in 2024 over 2023.

Following a continuous distribution strategy for lung transplants in March 2023, the OPTN saw a 16% rise in transplant rates and a 29% decrease in waiting list mortality in one year.

Advances in organ preservation techniques and donor-recipient matching have increased the pool of qualified lung transplant candidates, hence promoting segment expansion.

Organ Transplant Immunosuppressant Drugs Market Regional Analysis

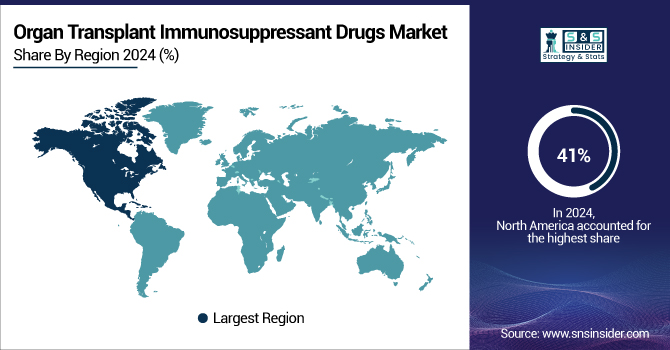

North America dominated the market in 2023 with 41% of the global organ transplant immunosuppressant drugs market share. The U.S. had the largest share of the organ transplant immunosuppressant drugs market in North America in 2024. The advanced medical system of the nation and the rising number of organ transplant surgeries define this leadership role mostly.

Data from the Health Resources and Services Administration show that 27,332 kidney transplants were carried out in the United States in 2023, therefore underscoring the great demand for post-transplant immunosuppressive treatments.

Strong governmental frameworks and funding for transplant programs have pushed market growth and enhanced access to transplant rejection-preventing medications. Reflecting successful government initiatives and a mature market, the U.S. completed 46,630 organ transplants in 2023 and OPTN recorded a record 16,335 deceased donors.

The organ transplant immunosuppressant medication market is expected to show the fastest growth in the Asia Pacific region. An increasing load of chronic diseases and rising transplant operations throughout the region are driving this development. Moreover, helping to expand the market are several campaigns aiming at increasing awareness of organ donation. Along with a high frequency of diseases such as COPD, which affects around 43 million people in China, healthcare reforms and investment in transplant services are driving demand in this country. Improvements in healthcare infrastructure and rising transplant activity, such as the lung transplant carried out by Rela Hospital in 2024, are driving market growth in India.

Supported by a well-developed healthcare system, increasing organ transplants, and government policies, the European market is predicted to grow significantly throughout the forecast period. Demand for associated drugs and organ donation is being driven in great part by public awareness initiatives, including the European Day for Organ, Tissue, and Cell Donation. The opt-out mechanism for organ donation, which has raised organ availability, is driving market expansion in the UK.

The organ transplant immunosuppressant medicine market is predicted to increase gradually in the LAMEA (Latin America, Middle East, and Africa) region. Rising knowledge about organ donation, bettering healthcare infrastructure, and the growing frequency of chronic diseases all help to push this. Initiatives driven by governments and NGOs supporting transplanting campaigns help to shape the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Organ Transplant Immunosuppressant Drugs Market Key Players

Astellas Pharma d.o.o., Accord Healthcare, Novartis AG, Viatris Inc., Sanofi, F. Hoffmann-La Roche Ltd, Veloxis Pharmaceuticals, Inc., GlaxoSmithKline plc, Bristol-Myers Squibb Company, Pfizer, Viatris, Inc.

Recent Developments in the Organ Transplant Immunosuppressant Drugs Market

-

Researchers at the University of Alabama at Birmingham found in February 2024 that, when paired with a complement inhibitor, FDA-approved immunosuppressants approved for human transplants could also be quite successful in pig-to-human transplants.

-

By completing Phase I trials for a biosimilar immunosuppressant, in June 2023, Dr. Reddy's Laboratories expanded the organ transplantation medicine pipeline and, therefore, increased the competitiveness among pharmaceutical companies in transplant drugs.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 5.50 Billion |

| Market Size by 2032 | USD 7.93 Billion |

| CAGR | CAGR of 4.72% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Drug Class (Calcineurin Inhibitors, Steroids, Antiproliferative Agents, mTOR Inhibitor, Other Drug Classes) • By Transplant Type (Kidney, Lung, Liver, Heart, Pancreas, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Astellas Pharma d.o.o., Accord Healthcare, Novartis AG, Viatris Inc., Sanofi, F. Hoffmann-La Roche Ltd, Veloxis Pharmaceuticals, Inc., GlaxoSmithKline plc, Bristol-Myers Squibb Company, Pfizer, Viatris, Inc. |