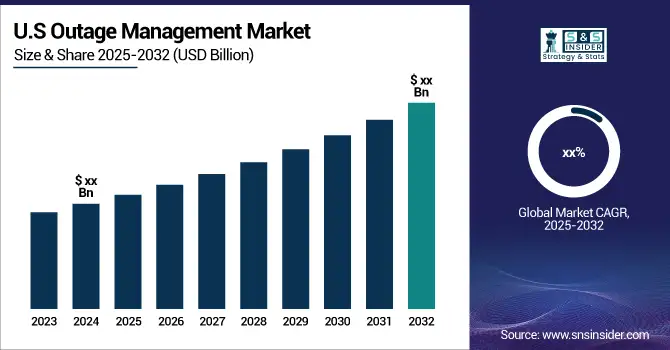

Outage Management System Market Size Analysis:

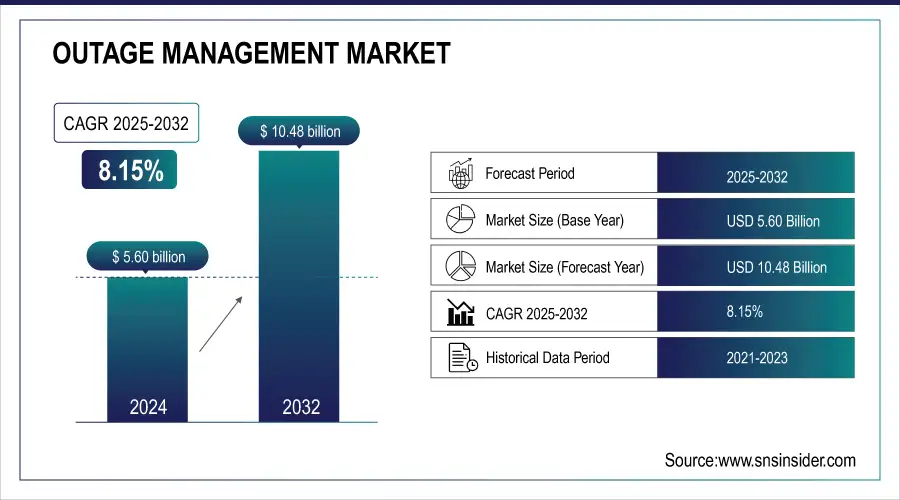

The Outage Management System Market size was valued at USD 5.60 billion in 2024 and is expected to grow to USD 10.48 billion by 2032 and grow at a CAGR of 8.15% over the forecast period of 2025-2032.

The power outages have become a part of our lives. To deal with such situations, there is an entire market dedicated to outage management. This market includes software, services, and hardware that help in dealing with power outages. These products assist and support utilities in managing outages effectively by automating the process of identification, dispatching crews to the site of the incident, and communicating updates to affected customers.

Get more information on Outage Management Market - Request Free Sample Report

The growth of this market is driven by increasing electricity demand worldwide along with the rise in renewable energy sources and advanced technologies for efficient energy distribution. The Outage Management System Market is predicted to grow rapidly owing to the increasing need among utilities for reliable and continuous power supply. As a result, we can expect more innovative solutions to emerge from this market as it continues to expand in size and importance over time.

Outage Management System Market Trends:

-

Growing adoption of smart grid and IoT-based solutions is accelerating the integration of advanced outage management systems.

-

Increasing emphasis on public safety and regulatory compliance is driving utilities to deploy rapid-response systems.

-

Rising investments in renewable energy are fueling demand for predictive and real-time monitoring software.

-

Frequent power outages due to aging infrastructure and extreme weather are boosting market demand.

-

Expanding applications across utilities, healthcare, transportation, and telecom are creating new growth opportunities.

Outage Management System Market Growth Drivers:

The rise in the adoption of smart grid technology and IoT-based solutions are also significant contributors to the market growth. Additionally, concerns around public safety and regulatory compliance have made it necessary for utilities to implement advanced outage management systems that can quickly respond to power outages and mitigate their impact on consumers. Furthermore, increased focus on renewable energy sources has spurred investments in the development of robust algorithms and predictive software that enable real-time monitoring of power networks. Overall, these drivers are shaping the Outage Management System Market towards sustainable growth while ensuring reliable energy supply to consumers around the world.

Outage Management System Market Restraints:

This could be brought on by a shortage of resources, such as money or labor, or it might be the result of regulatory restrictions that restrict what businesses can do. Technology restrictions or a delayed rate of consumer adoption are two more potential bottlenecks. Whatever the reason, these limitations might prevent the business from expanding and make it difficult for service providers to compete with one another. Decision-makers in this field must be aware of any potential obstacles they may encounter and devise imaginative ways to get around them through strategic planning to keep providing worthwhile services to their clients.

Outage Management System Market Opportunities:

The market for outage management is a profitable and expanding sector that has been gaining ground recently. The need for efficient outage management systems has grown as power outages are growing more common as a result of rising demand, deteriorating infrastructure, and severe weather. New market players have emerged as a result, offering cutting-edge technology like real-time monitoring systems and predictive maintenance powered by AI. Businesses in this sector are in a good position to benefit from the rising demand for dependable energy services across sectors like utilities, healthcare, transportation, and telecommunications. Companies have plenty of potential to innovate and take a piece of this market, as there are an increasing number of vendors contending for market share and the landscape of customer wants is constantly changing.

Outage Management System Market Segment Analysis:

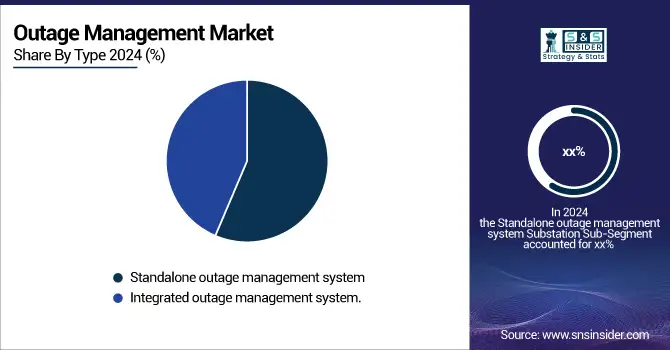

By Type

In 2024, standalone outage management systems dominated the market due to their cost-effectiveness, ease of deployment, and compatibility with existing utility infrastructure. Many small and mid-sized utilities favored these solutions for their reliable fault detection and restoration capabilities without requiring complex integrations, making them the preferred choice for immediate operational efficiency.

From 2025 to 2032, integrated outage management systems are expected to witness the fastest CAGR, driven by increasing adoption of smart grids and digital transformation across utilities. Their ability to combine GIS, SCADA, and advanced analytics for real-time network visibility and predictive maintenance is accelerating their deployment, especially among large-scale utility providers seeking comprehensive energy management.

By Component

In 2024, the software system segment dominated the Outage Management System Market, supported by growing demand for advanced analytics, real-time monitoring, and predictive outage detection. Utilities increasingly relied on software platforms for data integration, visualization, and automated restoration processes, enhancing operational efficiency and reducing downtime across power distribution networks.

From 2025 to 2032, the communication system segment is projected to record the fastest CAGR, fueled by the adoption of IoT-enabled smart grids and cloud-based communication networks. Enhanced connectivity between field devices and control centers enables faster fault detection, accurate outage reporting, and improved grid reliability, driving rapid growth in this segment globally.

By End-User Industry

In 2024, the private utility segment dominated the Outage Management System Market, driven by increased investments in grid modernization, automation, and smart infrastructure. Private utilities prioritized efficiency, reliability, and customer satisfaction through advanced outage management systems that optimize restoration times and reduce operational losses across large-scale power distribution networks.

From 2025 to 2032, the public utility segment is expected to grow at the fastest CAGR, supported by government initiatives promoting digital transformation and renewable energy integration. Public utilities are increasingly adopting intelligent outage management systems to enhance service reliability, comply with regulatory mandates, and ensure uninterrupted power supply to growing urban and rural populations.

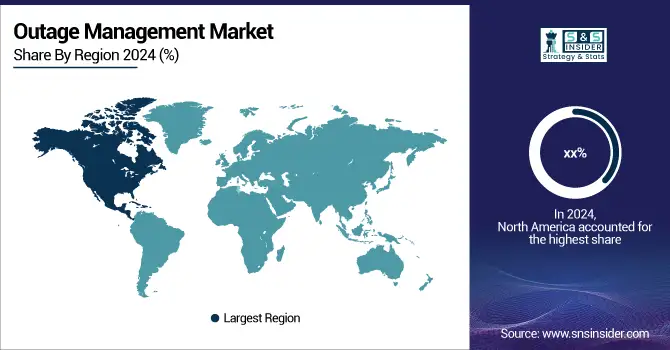

Outage Management System Market Regional Analysis:

North America Outage Management System Market Insights

The North America Outage Management System Market is driven by widespread smart grid deployment, advanced communication infrastructure, and strong regulatory support for grid modernization. Utilities across the U.S. and Canada are investing in AI-driven predictive outage systems and IoT-enabled monitoring solutions to enhance reliability, reduce downtime, and efficiently manage large-scale disruptions caused by aging infrastructure and extreme weather events.

Need any customization research on Outage Management System Market - Enquiry Now

Asia Pacific Outage Management System Market Insights

The Asia Pacific Outage Management System Market is witnessing rapid growth due to increasing urbanization, rising electricity consumption, and growing investment in smart grid infrastructure. Countries such as China, India, Japan, and South Korea are adopting digital solutions for predictive maintenance and outage restoration. The integration of IoT, AI, and real-time data analytics in outage management systems is improving operational efficiency, enhancing grid resilience, and supporting government initiatives for sustainable and reliable power distribution.

Europe Outage Management System Market Insights

The Europe Outage Management System Market is driven by stringent regulations promoting grid modernization, renewable energy integration, and enhanced power reliability. The region’s focus on decarbonization and smart energy transition has accelerated the adoption of advanced outage management systems. Utilities across Germany, the U.K., France, and the Nordics are implementing AI-based predictive tools, real-time fault detection, and automation technologies to minimize outage duration and ensure efficient grid performance.

Latin America (LATAM) and Middle East & Africa (MEA) Outage Management System Market Insights

The LATAM and MEA Outage Management System Market is gradually expanding due to increased investments in grid digitalization and modernization of legacy infrastructure. Countries like Brazil, Saudi Arabia, and South Africa are adopting smart technologies to enhance power reliability and reduce downtime. Growing renewable energy integration, combined with government initiatives to strengthen utility infrastructure, is boosting the adoption of advanced outage management systems across both regions.

Outage Management System (OMS) Companies are:

-

ABB

-

Oracle

-

Schneider Electric

-

Siemens

-

CGI Inc

-

FUTURA SYSTEMS, INC

-

Intergraph Corporation

-

Milsoft Utility Solutions

-

Survalent Technology Corporation

-

S&C Electric Company

-

Open Systems International, Inc

-

FirstEnergy Corp

-

Hexagon AB

-

Kaihen

-

Westinghouse Electric Company LLC.

-

Power System Engineering, Inc

-

Ripley Power & Light Company

-

SEDC

RECENT DEVELOPMENTS

ABB is a Switzerland-based leader in electrification, automation, and grid solutions, specializing in outage management, distribution automation, and grid resiliency software. With decades of experience, the company designs, engineers, and integrates advanced outage management systems (OMS), distribution automation controllers, and grid-edge hardware to help utilities detect faults, restore service faster, and optimize asset performance. ABB operates globally through direct utility partnerships, managed services, and local service centers. Its role in the Outage Management System Market is critical, as it delivers end-to-end solutions that improve reliability, reduce SAIDI/SAIFI, and enable smarter grid operation.

-

In 2025, ABB previewed an upgraded OMS suite with enhanced predictive-restoration analytics and tighter integration with distributed energy resources (DERs).

General Electric is a U.S.-based industrial technology conglomerate offering power generation, grid technologies, and software solutions for utilities. The company provides outage management platforms, grid automation devices, and analytics-driven asset health tools that enable utilities to accelerate fault detection, optimize crew dispatch, and improve restoration timelines. GE pairs hardware, grid controls, and grid-scale software with professional services to support planning, operations, and field maintenance. Its role in the market is pivotal, supplying scalable OMS technology for large utilities and complex networks worldwide.

-

In 2025, GE launched an enhanced grid operations package combining OMS, workforce management, and AI-based fault localization to reduce restoration times.

Oracle is a U.S.-based enterprise software leader that delivers cloud-based outage management and utility enterprise solutions as part of its broader utilities portfolio. The company offers integrated OMS, customer information systems (CIS), and workforce management platforms that streamline outage communications, automate trouble-ticketing, and improve customer experience during disruptions. Oracle’s cloud-first approach supports rapid deployment, scalability, and secure data integration across billing, CRM, and field systems. Its role in the Outage Management System Market is significant, enabling utilities to modernize operations while improving transparency and response.

- In 2025, Oracle introduced a cloud-native OMS accelerator featuring real-time customer impact mapping and automated customer notifications

Advanced Control Systems (ACS) is a U.S.-based specialist in utility automation, providing tailored outage management and SCADA integration services for electric and water utilities. The company focuses on custom OMS deployments, telemetry integration, and field-proven SCADA/RTU solutions that improve situational awareness and streamline outage restoration workflows. ACS operates through consultancy, system integration, and long-term managed services for regional utilities seeking flexible, interoperable outage solutions. Its role in the market is valuable for utilities requiring bespoke implementations and rapid on-the-ground support.

- In 2025, ACS rolled out a modular OMS package tailored for mid-sized utilities, emphasizing fast integration with legacy SCADA and GIS systems

| Report Attributes | Details |

| Market Size in 2024 | USD 5.60 Billion |

| Market Size by 2032 | USD 10.48 Billion |

| CAGR | CAGR of 8.15% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Standalone outage management system, Integrated outage management system.) • By Component (Software System, Communication System) • By End-User Industry (Private Utility, Public Utility) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | ABB, General Electric, Oracle, Schneider Electric, Siemens, CGI Inc., Advanced Control Systems, Inc., FUTURA SYSTEMS, INC., Intergraph Corporation, Milsoft Utility Solutions., Survalent Technology Corporation, S&C Electric Company, Open Systems International, Inc., FirstEnergy Corp., Hexagon AB, Kaihen., Westinghouse Electric Company LLC., Power System Engineering, Inc., Ripley Power & Light Company, SEDC. |