Packaging Coatings Market Report Scope & Overview:

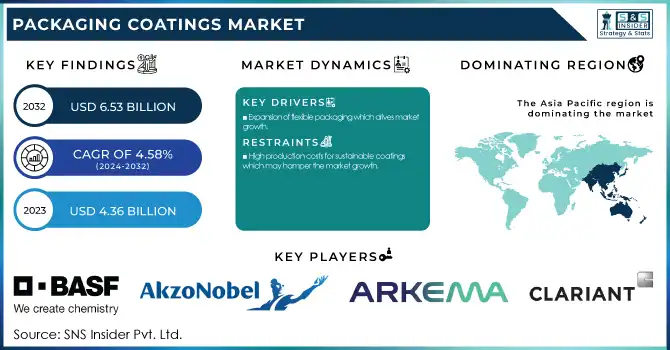

The Packaging Coatings Market size was USD 4.36 Billion in 2023 and is expected to reach USD 6.53 Billion by 2032 and grow at a CAGR of 4.58 % over the forecast period of 2024-2032. This report provides statistical insights and key trends shaping the packaging coatings market in 2023. It analyzes production capacity and utilization by country and type, along with raw material price trends across regions. The study evaluates regulatory impacts and compliance affecting market growth, while also highlighting sustainability metrics, including VOC emissions, recyclability, and eco-friendly coatings. Additionally, it covers technological advancements and R&D investments, driving innovation in water-based and UV-cured coatings. The report offers a comprehensive outlook on market adoption trends, helping stakeholders navigate evolving industry dynamics.

To Get more information on Packaging Coatings Market - Request Free Sample Report

Packaging Coatings Market Dynamics

Drivers

-

Expansion of flexible packaging which drives market growth.

The rising adoption of flexible packaging across food & beverage, pharmaceuticals, and personal care industries is one of the prominent drivers fueling the demand for the packaging coatings market. Products such as pouches, sachet, wraps, and film are lightweight compared to rigid packaging, having a longer shelf life, and needing less material than traditional packaging which is reusable, making flexible packaging cost-effective & eco-friendly. Because of this, producers are concentrating on new methods to reinforce wetness, and oxygen permeability, and safeguard high quality with the growing search for blow coating, warmth-lower accessories, and also anti-bacterial covers. Moreover, the rapid expansion of e-commerce & online food delivery has fuelled the demand for long-lasting and protective coatings that enhance the packaging integrity while in transit. The growing awareness of recyclability and biodegradability trends in flexible packaging spurring the demand for sustainable packaging has, in turn, increased the adoption of water-based and solvent-free coatings, thereby accelerating market growth.

Restraint

-

High production costs for sustainable coatings which may hamper the market growth.

Sustainable coatings face enormous production costs, which is a key hindrance to the growth of the packaging coatings market. A growing interest in eco-friendly, low-VOC, and bio-based coatings across all industries, has also led to an upward trend in RM costs for manufacturers utilizing the use of renewable resins, biodegradables, and water-based formulations. Furthermore, Research and Development (R&D) costs for developing new solutions for fresh BPA-free, solvent-free, and recyclable coatings increase production costs. Sustainable alternatives, on the other hand, call for advanced production processes and novel raw materials, hence pricier for end users compared to traditional solvent-based coatings, which are cost-effective and readily available in the market. The difference in cost can discourage small and mid-sized packaging manufacturers from adopting green coatings, hampering the growth of the market. Large-scale adoption will always be financially challenging in some industries as regulatory compliance and certifications of eco-friendly coatings also add to the cost.

Opportunity

-

Increasing investments in nanocoatings create an opportunity in the market.

Nanocoatings hold healthy opportunities in the packaging coatings market, attributed to rising investments due to their beneficial properties including better durability coupled with increased barrier performance along with superior moisture and oxygen barrier with antibacterial properties. Nanocoatings act by laying down thin, nanometer-scale layers of nanoparticles as protective barriers for a consumed product, and are slowly being recognized for having a high potential to enhance the shelf life and freshness of food, pharmaceutical, and personal care packaging. On top of that, antibacterial uses of Nano-based antimicrobial coatings are being used widely to improve food safety by preventing bacterial growth. Along with the increased focus on sustainability, manufacturers are also considering bio-based nanocoatings offering high-performance protection free of unwanted chemicals. The increasing requirement for high-barrier, lightweight, and functional packaging systems, along with technology developments, has prompted manufacturers to invest in R&D and enter into strategic alliances for technological innovations associated with nanocoatings. Nanotechnology is expected to emerge as a fundamental growth factor in the coatings market as industries seeking cost-effective, high-performance, and regulatory-compliant coatings are increasingly adopting nanotechnology-based coating solutions.

Challenges

-

Consumer preference for cost-effective solutions may challenge the market growth.

One of the major challenges of the Packaging Coatings market is consumer tendency towards economical solutions, especially in the case of high-value and green offerings. Most industries are now moving towards eco-friendly and regulatory-compliant coatings, but several businesses, particularly in price-sensitive domains, consider affordability a bigger concern than sustainability. Due to lower production costs, availability, and proven performance, legacy solvent-based and BPA-containing coatings are still the predominant choice. Comparatively, waterborne, bio-based , and recyclable coatings tend to be costly because of high raw material costs and/or complicated production methods. The greater investment required to adopt sustainable packaging may be less justifiable for small and mid-sized packaging manufacturers operating in developing economies, stalling wider adoption. Also, lowcost consumers through the food & provide personal care, and pharmaceutical industries are impartially not sophisticated in their packaging and prefer the benefit and cost to package than the ecosystem, which is also restraining the market from growing in scope.

Packaging Coatings Market Segmentation Analysis

By Resin

Epoxies held the largest market share around 28% in 2023. This is owing to their better chemical resistance, adhesion, and durability as compared to other coating types. In metal packaging applications, epoxy-based coatings are used in a variety of uses including food and beverage cans, bottle caps, and aerosol containers providing outstanding corrosion protection, durability at high temperatures, and extended food shelf life. Because of their unique ability to create a robust barrier against acidity, oil, and moisture, they are ideal for packaging high-acid products like carbonated drinks, canned foods, and dairy products. Further, the versatility of formulations with epoxies allows coatings to be developed to comply with various regulations and performance requirements. Epoxy coatings also lead the market due to the widespread industrial adoption of epoxy coatings at a cost-effective price.

By Packaging Type

Insulation held the largest market share around 34% in 2023. Flexible packaging has better barriers, longer shelf life, and convenience than rigid packaging. Especially, in the food industry the growing trend of single-use and on-the-go packaging has accentuated its adoption. Further, the design progress made in high-performance coatings such as barrier, heat-seal, and antimicrobial coatings, continues to improve the functionality of flexible packaging while also extending its moisture, oxygen, and contaminants protection abilities. The increasing penetration of e-commerce and online food delivery services has created a surge in demand for flexible packaging with performance coatings to maintain product quality during transport. Moreover, the development of sustainable and recyclable packaging alternatives or solutions has opened several growth pathways for innovative or water-based and solvent-free coatings, thus strengthening the flexible packaging market share.

By End User Industry

Food & Beverage held the largest market share around 30% in 2023. It is owing to the demand for protective, safe food coatings that comply with regulations to ensure the safety and extended shelf life of Foods & Beverages. As, the consumption of processed, packaged and ready-to-eat foods has been increasing, the demand for barrier coating that minimizes moisture, oxygen, chemicals, and microbial contamination is also increasing. For metal cans, flexible pouches, cartons, and glass bottles, packaging coatings are critical in preventing corrosion, spoilage, and flavor degradation. In addition, rigorous food safety regulations by the FDA, EFSA, and other authorities are driving food packaging towards fast adoption of BPA-free, solvent-free, and food-grade coatings. Additionally, the explosion of e-commerce, online food delivery, and convenience packing trends have escalated the demand for durable, heat-seal, and antimicrobial coating.

Packaging Coatings Market Regional Analysis

Asia Pacific held the largest market share around 40% in 2023. This is due to high industrialization, flourishing food & beverage and pharmaceutical sectors, and the growing need for flexible and eco-friendly packaging solutions in the region. The e-commerce and packaged food consumption in these regions is rising significantly due to urbanization and growing population, hence, boosting the demand for advanced packaging coatings with barrier protection, heat, and shelf-life stability. In addition, increasing disposable income and shifting consumer lifestyles have resulted in increased consumption of convenience foods, beverages, and personal care products, thus creating demand for coated packaging materials. It is also one of the centers for the manufacturing of packaging materials, owing to the facile availability of raw materials at economical rates, giving a huge dominance on the global level. In addition, the growing government regulations are used to avoid food safety and sustainable packaging practices, creating the impetus to develop a cost-effective yet high-performance alternative to synthetic coatings that are completely BPA-free, as well as water-based and bio-based, accelerating the transition even further cementing the leadership of Asia-Pacific in the market.

North America held a significant market share in 2023. This is due to the strong regulatory framework, a high rate of consumption of packaged food & beverages, and advanced packaging technologies. Strong demand for high-performance packaging coatings for food, beverage, pharmaceuticals, and personal care industries in the U.S. and Canada has led to the high revenue during this forecast period which collectively have a high presence in the U.S. and Canada. Stringent regulations by the FDA, EPA, and other agencies have also driven the development of BPA-free, solvent-free, food-grade coatings, especially in applications for metal cans, flexible packaging, and rigid plastic containers. Additionally, the presence of a developed e-commerce and retail industry in the region is also expected to drive the demand for protective, heat-seal, and antimicrobial coatings in packaging applications. As a result, the rise in demand for sustainable and recyclable packaging solutions among consumers has driven bio-based & waterborne coatings and has reaffirmed North America with the larger market share.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Akzo Nobel NV (Dulux, Sikkens)

-

BASF SE (Functional Packaging Coatings, Heat Seal Lacquers)

-

Arkema Group (Sartomer Specialty Resins, Kynar Coatings)

-

Berger Paints India Limited (Bison Acrylic Emulsion, Luxol High Gloss Enamel)

-

Clariant (Hostavin Light Stabilizers, Hostanox Antioxidants)

-

Chemetall (Oxsilan Pretreatment, Gardobond)

-

Chugoku Marine Paints Ltd (SEAFLO NEO, FASTAR)

-

HEMPEL A/S (Hempadur, Hempathane)

-

Jotun (Penguard Primer, Hardtop AX)

-

Kansai Paint Co. Ltd (Ales Shiquy, Eco-Gloss)

-

Axalta Coating Systems (Imron, Alesta Powder Coatings)

-

DowDuPont (Surlyn, Nucrel)

-

Evonik Industries AG (TEGO Additives, Dynasylan)

-

Henkel AG & Co. KGaA (Loctite, Technomelt)

-

Allnex (Crylcoat Powder Coating Resins, EBECRYL)

-

Sun Chemical (SunPak Packaging Inks, SunCure Coatings)

-

Sherwin-Williams (Sherwin-Williams Industrial Enamel, Kem Aqua)

-

H.B. Fuller (Swifttak, Advantra Packaging Adhesives)

-

Mondi (BarrierPack Recyclable, FunctionalBarrier Paper)

-

Amcor (AmLite Ultra Recyclable, UltraFlex)

Recent Development:

-

In November 2024, AkzoNobel introduced a new range of antimicrobial coatings designed for the food and beverage packaging sector, focusing on improving product durability and safety.

-

In May 2023, In January 2024, Stahl unveiled a refreshed visual brand identity, highlighting its strategic evolution to meet customer needs while reinforcing its dedication to innovation in specialty coatings and treatments.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.36 Billion |

| Market Size by 2032 | US$ 6.53 Billion |

| CAGR | CAGR of 4.58 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Resin (Epoxies, Acrylics, Polyurethane, Polyolefins, Polyester, Other), • By Packaging Type (Rigid Packaging, Flexible Packaging, Others), • By End Use Industry (Food & Beverages, Cosmetics, Pharmaceuticals, Consumer Electronics, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Akzo Nobel NV, BASF SE, Arkema Group, Berger Paints India Limited, Clariant, Chemetall, Chugoku Marine Paints Ltd, HEMPEL A/S, Jotun, Kansai Paint Co. Ltd, Axalta Coating Systems, DowDuPont, Evonik Industries AG, Henkel AG & Co. KGaA, Allnex, Sun Chemical, Sherwin-Williams, H.B. Fuller, Mondi, Amcor |