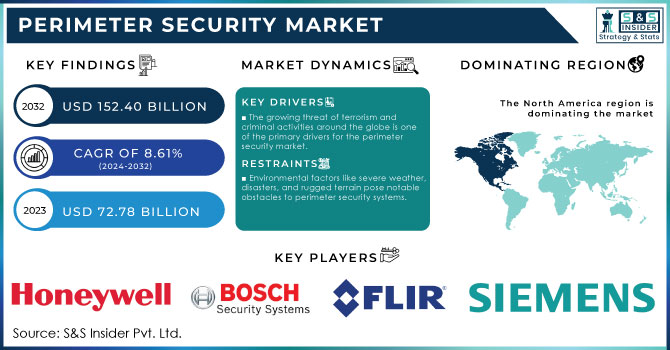

Perimeter Security Market Key Insights:

The Perimeter Security Market was valued at USD 72.78 billion in 2023 and is expected to reach USD 152.40 billion by 2032, growing at a CAGR of 8.61% over the forecast period 2024-2032.

To Get More Information on Perimeter Security Market - Request Sample Report

The perimeter security market is rapidly expanding, driven by heightened demand for safety, asset protection, and enhanced security across sectors. Technological advancements, including thermal cameras, drones, and biometric access systems, are reshaping perimeter security solutions, making them more efficient and responsive. Drones have become pivotal, providing real-time aerial surveillance over vast and hard-to-reach areas, which is invaluable for applications like border security and large industrial sites. The drone industry’s growth rate of 4.71% is a game-changer for perimeter security, enabling more robust monitoring, surveillance, and threat detection. With a workforce of 2.1 million and support from over 33,000 companies, drones are widely adopted, boosted by 29,000 patents and 6,000 grants dedicated to drone innovation.

Notably, innovation hubs like the United States, United Kingdom, India, Canada, and Australia especially in cities such as New York, London, Bangalore, Sydney, and Melbourne are leading the integration of drones into perimeter security systems, offering expansive coverage and accurate detection. Investment in drone technology is substantial, with funding rounds averaging USD 27.2 million across 7,000 rounds. Key investors, including Goldman Sachs, Baidu, Rise Fund, and General Atlantic, have collectively injected over USD 1 billion into the sector, fueling advancements in AI and automation. These investments enable drones to be optimized for continuous perimeter surveillance across diverse landscapes, enhancing response times, threat assessments, and adaptable security deployments. As drone technology evolves, it enables unprecedented precision and scalability for perimeter security, setting new benchmarks for infrastructure protection. The perimeter security market is poised to leverage these innovations, making drones indispensable for government, industrial, and high-risk sites seeking proactive and comprehensive security solutions.

Market Dynamics

Drivers

-

The growing threat of terrorism and criminal activities around the globe is one of the primary drivers for the perimeter security market.

In recent years, the rise in terrorist attacks and criminal activities such as smuggling, vandalism, theft, and trespassing has necessitated the need for businesses and governments to improve security around their properties. Prominent incidents such as terrorist attacks have led governments to implement strict security measures, including perimeter security solutions, in public areas and critical infrastructures. These actions safeguard both physical assets and human lives, especially in critical locations like transportation hubs, government buildings, military bases, and industrial facilities. Robust perimeter security systems are especially crucial in industries that handle sensitive data and valuable infrastructure, like banks, power plants, and research facilities. In these settings, a breach in security can lead to important economic, political, and social repercussions. The concern of intruders taking advantage of vulnerabilities in traditional security systems has led businesses and government agencies to invest more in perimeter security systems that offer thorough surveillance, immediate threat detection, and quick response abilities. With the increase in both direct and indirect threats, perimeter security has become a vital component of comprehensive risk management strategies. Governments and private organizations worldwide are channeling significant resources to implement advanced solutions that mitigate potential threats and ensure the safety of their premises, contributing to the growing market demand.

-

Organizations, governments, and individuals are increasingly recognizing the significance of security and safety in both private and public sectors.

The rise in high-profile security breaches, thefts, and incidents of vandalism worldwide has led to this awareness. Due to the increasing awareness of potential threats to individuals, property, and buildings, many organizations and government bodies are giving more importance to installing perimeter security systems to protect their investments. Organizations are now understanding that safeguarding their assets involves more than just protecting physical property; it also encompasses maintaining their reputation, customer trust, and operational continuity. A security breach may result in expensive harm, loss of confidential information, legal responsibilities, and a damaged reputation, with wide-ranging effects. Consequently, an increasing number of companies are putting money into perimeter security measures to decrease these dangers and guarantee the continued success of their activities. The rising number of natural calamities like floods, wildfires, and hurricanes has highlighted the importance of sturdy security systems that can endure such situations and remain operational in extreme circumstances. Perimeter security systems with disaster resilience features like waterproof sensors and backup power are crucial for critical infrastructure that needs to stay functional despite external influences.

Restraints

-

Environmental factors like severe weather, disasters, and rugged terrain pose notable obstacles to perimeter security systems.

Numerous perimeter security devices, such as cameras and sensors, are at risk from environmental factors such as heavy rain, snow, or strong winds. In regions susceptible to floods, earthquakes, or hurricanes, it can be challenging and expensive to upkeep perimeter security systems. To maintain the dependability of their security infrastructure, companies working in those areas must allocate resources for extra protective measures, like waterproof casings for cameras and backup power systems. These extra requirements can raise the total expenses of installing perimeter security systems and might deter businesses from using them in specific areas.

Market Segmentation Analysis

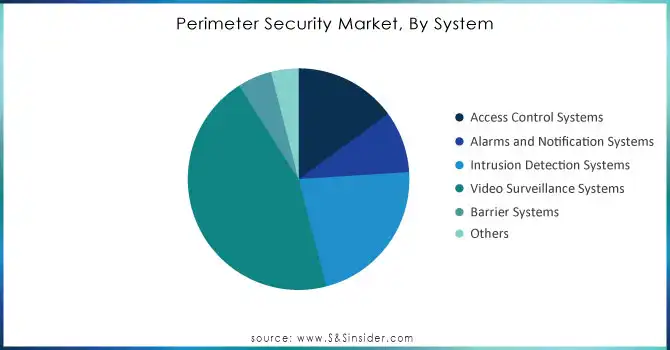

By System

Video surveillance systems dominated the segment in 2023 with a 45% market share because they are efficient in monitoring and preventing possible security breaches. These systems are essential for monitoring in real time and can be combined with advanced technologies like artificial intelligence (AI) and machine learning to improve threat detection. The growth of video surveillance solutions has been further boosted by the increasing demand for remote monitoring and the expansion of smart city projects. Companies such as Hikvision and Dahua Technology offer sophisticated video surveillance systems with AI features for facial recognition and motion detection, commonly utilized in airports, shopping centers, and public areas to ensure comprehensive perimeter security.

The intrusion detection systems (IDS) are projected to grow rapidly with a faster CAGR during 2024-2032 because of growing security worries and the importance of safeguarding sensitive assets from unauthorized access. These systems are created to identify unauthorized entry, either by people or harmful gadgets, and instantly notify security teams for a quick reaction. The rise of smart technologies, IoT gadgets, and escalating cybersecurity risks has led to a strong need for intrusion detection systems that provide both physical and network protection. ADT and Honeywell provide sophisticated intrusion detection systems for use in residential, commercial, and industrial settings.

Do You Need any Customization Research on Perimeter Security Market - Inquire Now

By Service

System integration and consulting services led in 2023 with a 51% market share in the perimeter security market. This service integrates different security elements like access control systems, surveillance cameras, alarm systems, and others to offer complete and strong perimeter defense solutions. The main goal is to guarantee smooth functioning among various security technologies, providing businesses with a comprehensive security solution. Businesses such as Honeywell International offer system integration and consulting services to big corporations, combining advanced video surveillance, motion detectors, and access control systems to create a complete perimeter security solution.

The risk assessment and analysis segment is expected to experience the fastest CAGR during 2024-2032. This part emphasizes the identification and assessment of potential security risks, vulnerabilities, and threats to the perimeter of a facility. The procedure involves evaluating the current security setup, pinpointing vulnerabilities, and proposing measures to reduce security risks. Bosch Security Systems offers risk evaluation and analysis services, assessing risks and providing custom perimeter security solutions with threat detection systems, alarm management integration, and real-time monitoring, helping clients reduce vulnerabilities.

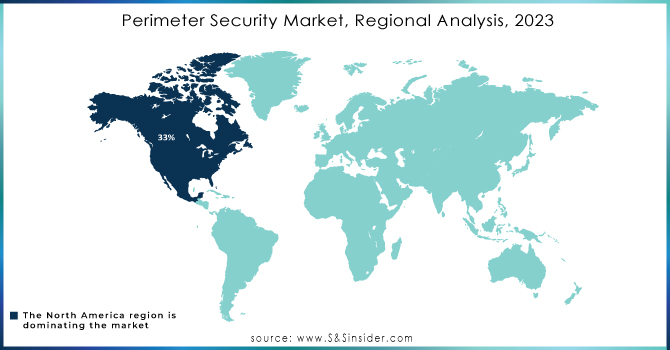

Regional Analysis

North America dominated in 2023, holding a 33% market share. This region’s leadership can be attributed to heightened security concerns, significant technological advancements, and an increased adoption of cutting-edge security solutions. The U.S. leads the way with key investments in perimeter security systems by both public and private sectors, including AI-powered surveillance, intrusion detection, and perimeter fence security. For instance, Honeywell’s intelligent video surveillance systems are extensively used to secure high-risk locations, enhancing situational awareness and response times.

Asia-Pacific is anticipated to become the fastest-growing region during 2024-2032 in the perimeter security market. This growth is driven by rapid urbanization, increasing infrastructure developments, and rising security threats across countries like China, India, and Japan. Government initiatives and investments in smart cities further fuel the demand for advanced perimeter security solutions. Hikvision, for instance, provides AI-enabled surveillance solutions that are increasingly used to monitor large public spaces and transportation hubs, contributing significantly to the growth trajectory of perimeter security in APAC.

Key Players

The major key players in the Perimeter Security Market are:

-

Honeywell (Pro-Watch Integrated Security Suite, Honeywell Digital Video Manager)

-

Axis Communications (AXIS Q6100-E PTZ Network Camera, AXIS P3245-LVE Network Camera)

-

Bosch Security Systems (Bosch Autodome IP Starlight 7000i, Bosch DIVAR IP 3000)

-

Flir Systems (FLIR Sarix Professional IP Cameras, FLIR AtlasAI Edge Solutions)

-

Tyco International (Johnson Controls) (ExacqVision Video Management Software, C•CURE 9000 Security Management System)

-

Siemens (Siemens Siveillance VMS, Siemens Perimeter Intrusion Detection System)

-

Videotec (Videotec ULISSE IP, Videotec HERCULES IP)

-

Dahua Technology (Dahua Thermal Cameras, Dahua Network Video Recorder)

-

Avigilon (Avigilon Control Center, Avigilon H4 Thermal Cameras)

-

Schneider Electric (Pelco Video Management Systems, Pelco Spectra Enhanced PTZ)

-

Anixter (Weidmüller Industrial Ethernet Switches, Panduit Perimeter Security Solutions)

-

Ubisense (Ubisense Real-Time Location System, Ubisense Spatial Intelligence Platform)

-

Leidos (Leidos Security Screening Solutions, Leidos Perimeter Security Systems)

-

Perimeter Protection (Perimeter Intrusion Detection Systems, Fencing Systems)

-

Magal Security Systems (Magal IP Video Surveillance System, Magal Perimeter Intrusion Detection)

-

Smiths Detection (Smiths Detection IONSCAN, Smiths Detection MDSi Systems)

-

Geutebrück (Geutebrück G-SIM, Geutebrück G-Cam IP Cameras)

-

Northrop Grumman (Perimeter Security Systems, Automated Access Control Solutions)

-

Vicon Industries (ViconNet Video Management Software, Vicon Cameras)

-

Kantech (Tyco Security Products) (EntraPass Security Management Software, KT-1 Single Door Controller)

Suppliers for Raw Materials/Components to Perimeter Security Companies:

-

3M

-

Rohm Semiconductor

-

Sony

-

Qualcomm

-

Broadcom

-

Intel

-

MaxLinear

-

Panasonic

-

Texas Instruments

-

Microchip Technology

Recent Developments

-

September 2024: The SDX 6040 Enhanced Image Quality (EIQ) by Smith Detection, is an advanced screening solution created to address the changing needs of contemporary security settings.

-

January 2024: Honeywell introduced Advance Control for Buildings, a revolutionary platform that represents one of the company's biggest advancements in building control innovation so far. Advance Control is created to streamline building management and lay the groundwork for a building's energy efficiency plan by integrating cutting-edge technologies and years of industry knowledge and creativity.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 72.78 Billion |

| Market Size by 2032 | USD 152.40 Billion |

| CAGR | CAGR of 8.61% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By System (Access Control Systems, Alarms and Notification Systems, Intrusion Detection Systems, Video Surveillance Systems, Barrier Systems, and Others) • By Service (System Integration and Consulting, Risk Assessment and Analysis, Managed Services, Maintenance and Support) • By End User (Government, Military and Defense, Transportation, Commercial, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Honeywell, Axis Communications, Bosch Security Systems, Flir Systems, Tyco International (Johnson Controls), Siemens, Videotec, Dahua Technology, Avigilon, Schneider Electric, Anixter, Ubisense, Leidos, Perimeter Protection, Magal Security Systems, Smiths Detection, Geutebrück, Northrop Grumman, Vicon Industries, Kantech (Tyco Security Products) |

| Key Drivers | • The growing threat of terrorism and criminal activities around the globe is one of the primary drivers for the perimeter security market. • Organizations, governments, and individuals are increasingly recognizing the significance of security and safety in both private and public sectors. |

| RESTRAINTS | • Environmental factors like severe weather, disasters, and rugged terrain pose notable obstacles to perimeter security systems. |