Rotary and RF Rotary Joints Market Size & Overview:

Get more information on Rotary and RF Rotary Joints Market - Request Sample Report

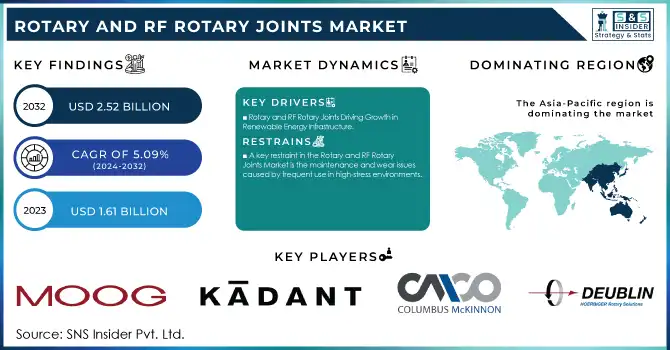

The Rotary and RF Rotary Joints Market Size was valued at USD 1.61 Billion in 2023 and is expected to reach USD 2.52 Billion by 2032, and grow at a CAGR of 5.09% over the forecast period 2024-2032.

The Rotary and RF Rotary Joints Market is witnessing substantial growth, fueled by their increasing use in aerospace and defense applications, including radar systems, satellite communication, and UAVs. RF rotary joints prevent cable entanglement in antenna testing and support high-frequency transmission in critical systems. Advanced radar systems utilizing these joints, like those offered by Diamond Antenna and Microwave Corporation, are designed for durability and precision in challenging environments. Single-channel and dual-channel configurations are becoming standard, addressing specific application needs. The market also benefits from rising investments in satellite technology and defense. Miniature in-line rotary joints, highlighted in industry reviews, are gaining traction for their compactness and efficiency in aerospace systems. Companies like Fairview Microwave and Castle Microwave are at the forefront, offering RF rotary joints designed for diverse applications, including 5G networks and robotic systems. Repair and customization services, as seen in the RF rotary joint repair offerings from Diamond Antenna, are enhancing product longevity and reducing operational downtime. With the growing emphasis on lightweight, efficient, and high-performance solutions, the market is poised for robust growth, supported by continuous technological advancements and increasing adoption across industries.

Rotary and RF Rotary Joints Market Dynamics

Drivers

-

Rotary and RF Rotary Joints Driving Growth in Renewable Energy Infrastructure

The global expansion of renewable energy infrastructure, including wind turbines and solar tracking systems, is a pivotal driver of the Rotary and RF Rotary Joints Market. These joints are essential for the efficient and uninterrupted transmission of electrical power and data in rotating components, which are fundamental to renewable energy systems' functionality.In 2023, renewable energy capacity additions reached an unprecedented 510 GW, reflecting the fastest growth in over two decades. This marked a nearly 50% year-over-year increase, with solar PV alone contributing three-quarters of these additions. In the U.S., renewable energy dominated new electricity generation sources, with solar installations achieving a record 31 GW, a 55% increase . Wind energy, though slightly slower in growth, saw total capacity reach 147 GW, representing 11% of the country’s electricity generation. Combined, renewables, including hydropower and energy storage, accounted for over 25% of the U.S. electricity generation in the first half of 2023.Global policies and legislative initiatives are fueling this momentum. The Inflation Reduction Act and Bipartisan Infrastructure Law in the U.S., alongside international goals like the COP28 target to triple renewable energy capacity , are catalyzing investments in clean energy technologies. Global renewable capacity is expected to exceed 7,300 GW, a 2.5x increase from current levels. However, achieving the COP28 target of 11,000 GW hinges on overcoming challenges such as policy delays, financing gaps, and grid infrastructure limitations. With wind and solar PV projected to contribute 95% of global renewable expansion, the demand for rotary and RF rotary joints in these applications is poised for substantial growth. These components play a critical role in ensuring the operational efficiency of wind turbines, solar trackers, and other renewable energy systems, making them indispensable to the ongoing transition to sustainable energy solutions worldwide.

Restraints

-

A key restraint in the Rotary and RF Rotary Joints Market is the maintenance and wear issues caused by frequent use in high-stress environments.

Rotary joints, particularly in industries like aerospace, defense, and renewable energy, experience significant wear and tear due to the continuous rotation and transmission of power or signals. Over time, components such as seals, bearings, and contacts can degrade, leading to reduced efficiency and even failure if not properly maintained. This often results in costly repairs and downtime, which can significantly increase operational costs and affect overall productivity. Routine maintenance and servicing are essential to ensure the longevity of rotary joints, but these processes require specialized knowledge and can be time-consuming. In some cases, manufacturers provide standard maintenance procedures, including regular inspection of seals and lubrication of moving parts, to mitigate wear and tear (sources: Haga Seals, CS Rotary Joint, Maco Corporation). However, the complexity and cost of these maintenance activities remain a challenge for many users. Furthermore, the need for periodic repairs can disrupt operations and lead to financial losses, particularly in industries where reliability and uptime are crucial. As rotary and RF rotary joints are integrated into critical systems, the high maintenance demands, along with the potential for failures, can hinder their adoption in certain sectors. This challenge is compounded by the lack of adequate service infrastructure in emerging markets, where technical expertise for such specialized components may be limited. As a result, these factors can slow down the market’s growth and prevent full-scale adoption in specific industries.

Rotary and RF Rotary Joints Market Segment Analysis

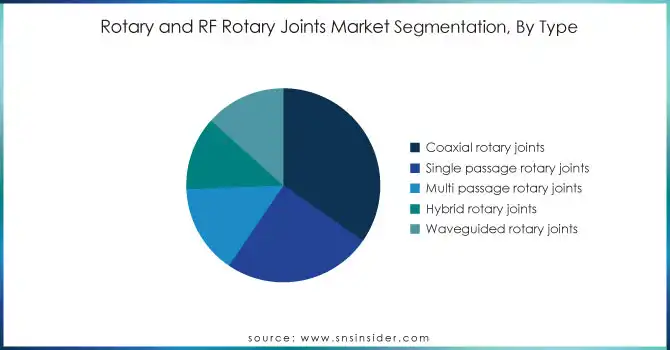

By Type

The Coaxial Rotary Joints segment dominated the Rotary and RF Rotary Joints Market in 2023, holding around 35% of the market share. This dominance is driven by their ability to transmit high-frequency signals efficiently, making them essential in industries like aerospace, defense, telecommunications, and industrial automation. Coaxial rotary joints are crucial for applications requiring uninterrupted signal transfer, such as radar systems, satellite communications, and wireless networks. The growing demand for advanced communication systems, coupled with the need for reliable power and signal transmission in rotating equipment, has further propelled their adoption. Technological advancements in materials and design continue to enhance their performance and durability, ensuring continued market growth.

Need any customization research on Gaming Hardware Market - Inquiry Now

By Medium

The Air segment dominated the Rotary and RF Rotary Joints Market in 2023, accounting for approximately 28% of the market share. This dominance is primarily due to the widespread use of air-powered rotary joints in applications that require non-contact transmission of power or signals, such as in industrial machinery, wind turbines, and military radar systems. Air rotary joints are favored for their ability to operate in high-speed environments without the need for lubrication, reducing maintenance costs and enhancing operational efficiency. Their ability to handle high-frequency signals, coupled with advancements in materials and design, has made them highly reliable in critical systems. The growing demand for energy-efficient solutions and the expansion of industrial automation continue to drive the adoption of air-powered rotary joints, fueling market growth.

Rotary and RF Rotary Joints Market Regional Outlook

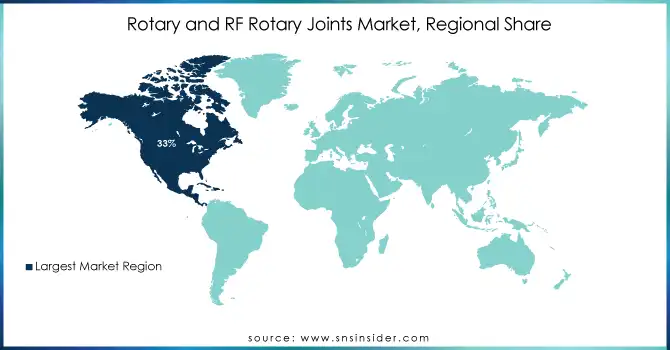

Asia-Pacific held a dominant share of approximately 33% in the Rotary and RF Rotary Joints Market in 2023, driven by rapid industrialization and technological advancements across the region. Countries like China, Japan, South Korea, and India are key contributors to this growth. China’s strong manufacturing sector, coupled with its investments in aerospace and defense, drives the demand for rotary joints, while Japan and South Korea lead in high-tech applications such as robotics, telecommunications, and renewable energy. India’s growing energy sector, particularly in wind power, further accelerates market growth. Additionally, Asia-Pacific's focus on infrastructure development, increasing automation in industries, and the rise of electric vehicle adoption are expected to fuel continued demand for rotary joints, making the region a key growth hub.

North America is projected to be the fastest-growing region in the Rotary and RF Rotary Joints Market from 2024 to 2032. The U.S. plays a key role in driving this growth, with significant investments in aerospace, defense, and renewable energy sectors. The increasing demand for advanced communication systems in defense applications, such as radar and satellite communication, is a major factor. Additionally, the expansion of renewable energy infrastructure, particularly wind and solar power, drives the need for efficient data and power transmission systems. North America's emphasis on smart manufacturing, automation, and the rise of electric vehicles further fuels market growth. With continuous technological advancements and robust industry applications, North America is poised to experience substantial market expansion in the coming year.

KEY PLAYERS:

Some of the major key players in Rotary and RF Rotary Joints Market along with their product:

-

Moog Inc. (Rotary Joints, Slip Rings, Electrical and Fluid Rotary Unions)

-

Kadant Inc. (Rotary Unions, Swivels, and Transfer Systems)

-

Columbus McKinnon Corporation (Rotary Joints, Crane Components, Motion Control Systems)

-

Deublin Company (Rotary Unions, Fluid Rotary Joints, Air Rotary Joints)

-

Dynamic Sealing Technologies Inc. (Rotary Joints, Mechanical Seals, Custom Sealing Solutions)

-

Macartney Underwater Technology (Underwater Rotary Joints, Sealing Solutions for Underwater Applications)

-

Cobham France SAS (RF Rotary Joints, Microwave Components, Signal Transmission Solutions)

-

Pasternack Enterprises Inc. (RF Rotary Joints, Antennas, RF Cables)

-

Spinner GmbH (RF Rotary Joints, Antenna Systems, Signal Transmission Equipment)

-

Spectrum Control (RF Rotary Joints, Signal Integrity Solutions, Custom RF Products)

-

Rotary Systems Inc. (Rotary Unions, Slip Rings, Custom Rotary Joints)

-

Schleifring GmbH (Slip Rings, Rotary Joints, Custom Engineering Solutions)

-

Molex (Rotary Unions, RF Rotary Joints, Electrical Contacting Solutions)

-

Electro-Miniatures Corporation (Slip Rings, Rotary Joints, Custom Interconnection Solutions)

-

JINPAT Electronics Co. Ltd. (Rotary Joints, Slip Rings, Through-hole Rotary Unions)

-

Cavotec (Rotary Unions, Slip Rings, Power and Data Transmission Systems)

-

Rota Engineering (Rotary Joints, Swivels, Pneumatic Rotary Unions)

-

Stäubli Robotics (Rotary Joints, Slip Rings, Robotics Automation Solutions)

-

ACE Technologies (Slip Rings, Rotary Joints, Electrical and Fiber Optic Rotary Solutions)

-

LUQING (Rotary Joints, Multi-passage Rotary Unions, Fluid Rotary Unions)

-

HOERBIGER (Rotary Unions, Slip Rings, Maintenance-free Roll-Rings® Slip Rings)

List of suppliers in the Rotary and RF Joints Market for raw materials and components:

Raw Material Suppliers:

-

ThyssenKrupp Materials (Metals, Steel, Aluminum, Copper)

-

ArcelorMittal (Steel, Alloy Steels)

-

POSCO (Steel, Stainless Steel, High-strength Materials)

-

Nippon Steel Corporation (High-performance Steel, Stainless Steel)

-

Alcoa Corporation (Aluminum, Aluminum Alloys)

-

Materion Corporation (Advanced Materials, Specialty Alloys, Metal Powders)

-

BASF (Engineering Plastics, Thermoplastics, Lubricants)

-

3M (Adhesives, Polymers, Coatings)

-

SABIC (Engineering Plastics, Polymer Solutions)

-

DuPont (Polymer Materials, Teflon, Advanced Materials)

Component Suppliers:

-

TE Connectivity (Connectors, Cable Assemblies, RF Components)

-

Amphenol Corporation (Connectors, RF Components, Interconnection Systems)

-

Molex (Interconnects, RF Rotary Joints, Cable Assemblies)

-

Schleifring GmbH (Slip Rings, Electrical Components, Rotary Joints)

-

Smiths Interconnect (RF Rotary Joints, Microwave Components, Antennas)

-

Luxshare Precision Industry (Connectors, Electrical Components, Cable Assemblies)

-

Panduit (Cable Management, Connectors, Wire and Cable)

-

Dai-ichi Seiko (Slip Rings, Electrical Components, Rotary Unions)

-

Hubbell Incorporated (Electrical Components, Rotary Unions, Connectors)

-

Jinpat Electronics (Slip Rings, Rotary Joints, Through-hole Components)

Recent Development

-

July 2024, SPINNER launched a 1.0 mm high precision coaxial calibration kit and connectors, offering reliable measurements up to 120 GHz. These solutions ensure secure connections, addressing common issues with loosening connectors in high-precision applications like RF labs and aerospace.

-

June 2024, Kadant Inc. has acquired Dynamic Sealing Technologies (DSTI) for $55 million in cash, expanding its Flow Control segment with DSTI's expertise in engineered fluid sealing and transfer solutions, including fluid rotary unions and electrical slip rings.

-

April 2024, HOERBIGER has acquired Diamond-Roltran, a leading manufacturer of maintenance-free Roll-Rings® slip rings, expanding its rotary unions and slip rings portfolio through its subsidiary Deublin, with the acquisition aimed at enhancing performance in new markets and industries.

| Report Attributes | Details |

| Market Size in 2023 | USD 1.61 Billion |

| Market Size by 2032 | USD 2.52 Billion |

| CAGR | CAGR of 5.09% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Coaxial Rotary Joints, Single Passage Rotary Joints, Multi Passage Rotary Joints, Hybrid Rotary Joints, Waveguided Rotary Joints) • By Medium (Air, Oil, Steam, Gas, Water, Coolant) • By Industry Verticals (Aerospace, Food & Beverages, Oil & Gas, Semiconductors, Medical, Commercial, Industrial Automation, Energy, Military) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Moog Inc., Kadant Inc., Columbus McKinnon Corporation, Deublin Company, Dynamic Sealing Technologies Inc., Macartney Underwater Technology, Cobham France SAS, Pasternack Enterprises Inc., Spinner GmbH, Spectrum Control, Rotary Systems Inc., Schleifring GmbH, Molex, Electro-Miniatures Corporation, JINPAT Electronics Co. Ltd., Cavotec, Rota Engineering, Stäubli Robotics, ACE Technologies, LUQING, and HOERBIGER. |

| Key Drivers | • Rotary and RF Rotary Joints Driving Growth in Renewable Energy Infrastructure. |

| Restraints | • A key restraint in the Rotary and RF Rotary Joints Market is the maintenance and wear issues caused by frequent use in high-stress environments. |