Transparent Conductive Films Market Report Scope and Overview:

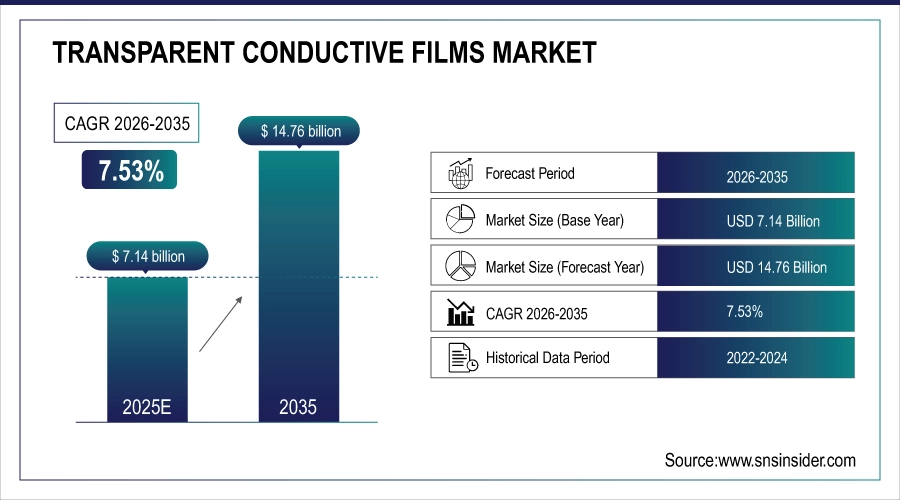

The Transparent Conductive Films Market size was valued at USD 7.14 billion in 2025 and is expected to reach USD 14.76 billion by 2035, growing at a CAGR of 7.53% over the forecast period of 2026-2035.

Transparent Conductive Films market trends is primarily driven by growing need for touch-based devices, flexible displays, and smart wearables, as well as rising application in solar cells, smart glass, and automotive applications owing to lightweight, transparent, and conductive material solution.

Advancements in the fields of nanotechnology and materials science have allowed for greater conductivity and flexibility, spurring growth in the Transparent Conductive Films market. The growing investments towards the development of sustainable and cost-effective alternatives for conventional materials including ITO are driving the innovation. The demand for consumer electronics on the budget spectrum and need for renewable energy solutions, owing to expansion in emerging economies, is another factor accelerating the global market. Moreover, increasing demand for energy-efficient and lightweight electronic components in automotive and aerospace applications has prime importance for market growth.

In January 2025, Chasm Advanced Materials, Inc. and Mativ Holdings announced an agreement to develop carbon nanotube and silver nanowire film technology for military, transportation, and architectural applications.

Transparent Conductive Films Market Size and Forecast:

-

Market Size in 2025: USD 7.14 Billion

-

Market Size by 2035: USD 13.72 Billion

-

CAGR: 7.53% (2026–2035)

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get more information On Transparent Conductive Films Market - Request Free Sample Report

Transparent Conductive Films Market Highlights:

-

Advanced nanomaterial research is accelerating the development of transparent conductive films with improved electrical conductivity, optical transparency, and mechanical flexibility for next-generation optoelectronic applications.

-

ZnO-based semiconductor nanoparticles are gaining attention as cost-effective and multifunctional materials for transparent conductive layers, particularly in electronics packaging and semiconductor interfaces.

-

Indium tin oxide (ITO) continues to dominate the market due to its proven performance, while ongoing innovations focus on improving deposition techniques, durability, and resistivity control.

-

Indium-free alternatives such as aluminum-doped zinc oxide (AZO), metal nanowires, and hybrid composites are emerging to address cost volatility and supply constraints of indium.

-

Growing demand from displays, touch panels, and flexible electronics is driving material innovation and large-scale adoption of high-performance transparent conductive films.

-

Expanding use cases in photovoltaics, sensors, smart packaging, and advanced semiconductor applications are broadening the commercial scope of transparent conductive film technologies.

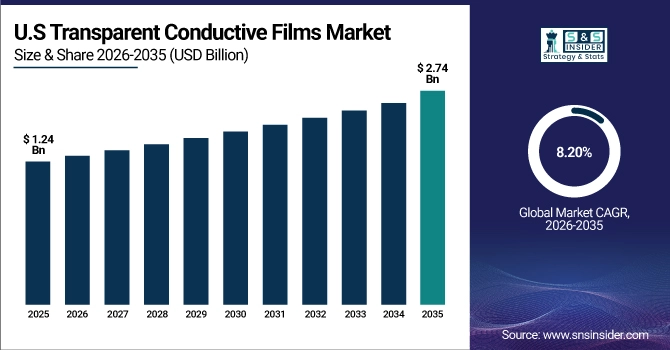

The U.S. Transparent Conductive Films Market size is estimated to be valued at USD 1.24 billion in 2025 and is projected to grow at a CAGR of 8.20%, reaching USD 2.74 billion by 2035. Demand for advanced consumer electronics such as smartphones, tablets and wearables that require high performance touch screens is driving growth in the U.S. transparent conductive films market.

Transparent Conductive Films Market Drivers:

-

Rising Demand for Flexible Touch Devices and Advanced Nanomaterials Driving Transparent Conductive Films Market Growth

The increase in popularity of touch-enabled devices including smartphones, tablets and interactive displays along with the increasing demand for flexible and foldable electronics, are some of the major market drivers for the global Transparent Conductive Films (TCF) market. With the ongoing enhancements in spectrum of nanomaterials, such as silver nanowires, graphene, and carbon nanotubes, in terms of conductivity, transparency, and mechanical durability, the future might bear a non-ITO based solution rather than a complementary one to conventional ITO solution. The growing influx of renewable energy, specifically solar photovoltaics, but also wind energy, represents another essential driver, as TCFs can be used in transparent solar cells and panels (transparent BIPV)

Huawei introduced the Mate XT, the world's first tri-foldable smartphone, featuring a 10.2-inch screen that folds twice. Despite challenges like high pricing and software limitations, the device highlights the industry's push towards innovative form factors.

Transparent Conductive Films Market Restraints:

-

Durability Challenges and Manufacturing Hurdles Limit Adoption of Alternative Transparent Conductive Films in Applications

The longevity and robustness of such alternative materials such as silver nanowires and carbon nanotubes are limited, breaking down through time and continuous exposure to heat, moisture and mechanical stress, acting as the primary restraint. This causes several problems leading to shorter lifetime and less performance stability of TCF based devices and the issues limit the adoption of these devices in more demanding application areas, such as automotive or outdoor displays. Moreover, embedding flexible and bendable films in standard fabrication processes entails engineering hurdles that complicate and delay their commercialization and scale-up.

Transparent Conductive Films Market Opportunities:

-

Wearable Tech AR and Automotive Innovations Fuel Demand for Sustainable Flexible Transparent Conductive Films

The rapid growth of wearable technology and augmented reality (AR) devices represent significant opportunities for the industry, particularly in the development of lightweight, bendable transparent conductive films (TCFs). Furthermore, automotive features such as heads-up displays, smart windows, and other aspects of infotainment also represent a fast-growing area where it will be possible to place new legitimizing applications. The world shift towards finding sustainable, inexpensive substitutes for rare materials such as indium brings even more opportunities for the development of novel materials. Long-term market growth also stems from the adoption of smart electronics and solar technology within emerging economies.

In 2024, global shipments of wearable devices reached over 490 million units, reflecting a steady annual increase driven by health monitoring, fitness, and AR applications. The rise in demand for lightweight and flexible components boosts TCF usage.

Transparent Conductive Films Market Segment Analysis:

By Application

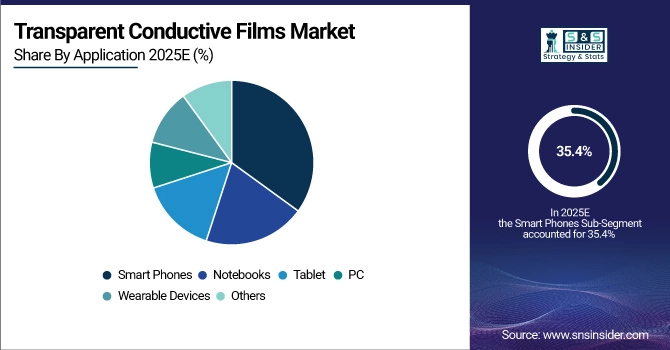

Smartphones accounted for 35.4% of the Transparent Conductive Films (TCF) market in 2025. This dominance is driven by the growing demand for touch screen, more advanced display, and improved user interface in smartphones across the globe. With consumer demand for thinner designs and enhanced performance, manufactures have leaned more than ever on TCFs, thanks to their desirable combination of conductivity and transparency, which are important for responsive, accurate, vibrant displays.

During 2026 to 2035, the fastest growth is projected for wearable devices. As Health monitors, smartwatches, and fitness trackers gain popularity, demand for lightweight, flexible, and durable transdermal drug delivery patches (TCFs) is increasing. This trend is also accelerated by the tendency of creating foldable, bendable, and transparent electronics. Advancements in nanomaterials and flexible conductive films will enable rapid growth of wearable technology, which will be an important driver of the Transparent Conductive Films market growth under consideration.

By Material

Indium Tin Oxide (ITO) on glass remains the largest portion of the Transparent Conductive Films market share in 2025, representing around 36.5% of the total global demand. This material is extensively used due to its superior optical transparent, electrical conductivity and established manufacture process options, which makes it an ideal choice for touch screens, displays and solar panels. Yet, weaknesses like fragility and the limited availability of indium are driving a quest for substitutes.

A silver nanowire-based film is one of the fastest-growing segments during 2026 to 2035. They provide lower barrier property, light in weight, and improved mechanical strength, which makes them suitable for next-generation flexible and programmable electronics. Silver nanowires also offer high conductivity without sacrificing transparency, overcoming some of the drawbacks of ITO films on the whole.

By End Use

The Transparent Conductive Films (TCF) market was led by the Consumer Electronics segment in 2025, which accounted for 50.3% of the market. This leadership is supported by large-scale application of TCFs in devices like smartphones, tablet computers, laptops and TVs containing transparent and conductive materials required for touchscreens, displays and other interactive parts. This leadership position is sustained by ongoing innovation and consumer demand for high-performance electronics.

The Solar Cells segment is anticipated to grow at the fastest CAGR from 2026 to 2035. The increase in global renewable energy initiatives is raising the demand for transparent conductive films from solar photovoltaics, including building-integrated photovoltaics (BIPV), and transparent solar panels. Material technology advancements such as lightweight and thin films allow more efficient and attractive solar solutions, propelling the TCFs into the solar energy market and making it one of the growth opportunities in the near future.

Transparent Conductive Films Market Regional Analysis:

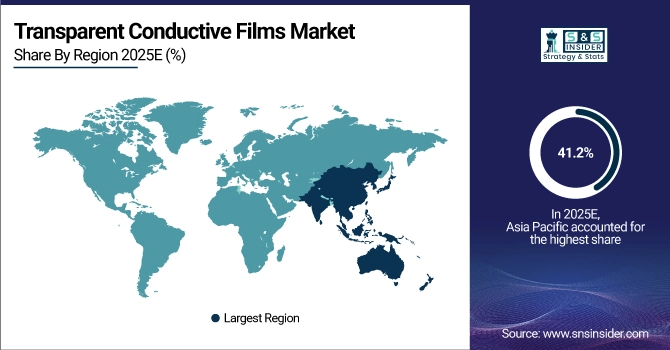

Asia-Pacific Transparent Conductive Films Market Trends:

Asia Pacific held the largest share of 41.2% in 2025, owing to rapid industrialization and high demand for consumer electronics. Furthermore, Thailand has strong infrastructures in manufacturing and technology for large scale production and innovations in TCF materials and applications. The market benefits from the increasing use of flexible and foldable devices, and the growing number of solar energy and wind energy projects. Rising investments towards research & development for 2nd generation of nanomaterials including silver nanowires and CNTs for improving product performance and stability are driving the industry growth. Demand for energy-efficient electronic components is enhanced in automotive and smart building-oriented verticals, which creates growth opportunities for the analog integrated circuit and amplifier manufacturers.

Get Customized Report as per Your Business Requirement - Enquiry Now

The large electronics manufacturing base, strong government support for renewable energy, high R&D investment levels as well as swift adoption of advanced display technologies in China have driven the growth of the Asia Pacific transparent conductive films market in the examined period.

North America Transparent Conductive Films Market Trends:

North America is projected to be the fastest-growing region in the Transparent Conductive Films market, with a CAGR of 8.34% from 2026 to 2035. This growth is supported by increasing demand for high-performance transparent conductive materials in high-end consumer electronics such as smartphones, tablets & wearable devices. The market growth is also attributed to the growing investments in renewable energy technologies including solar cells, smart windows, and others. The emphasis on innovation in the region supported by strong R&D infrastructure and clean energy ownership supporting data in this region enhances the adoption even further. Furthermore, the increasing use in automotive heads-up displays and flexible electronics is further expected to drive the North America market.

In the North American Transparent Conductive Films market, the United States was in the forefront as a result of its advanced technology ecosystem supported by electronics manufacturing industry, and high expenditure on global R&D, combined with a current trend of fast-growing renewable energy and automotive industry for last the decade.

Europe Transparent Conductive Films Market Trends:

Transparency Conductive Films in Europe exhibits strong growth from consumer electronics, automotive and renewable energy markets. It focuses on sustainability and innovation in the region, creating space for development of sustainable materials and advanced flexible films. Market growth is also facilitated by government initiatives supporting clean energy and smart infrastructure. On top of that, the fact that Europe is focusing on smart glass and energy-efficient buildings also brings about new opportunities. Europe is expected to be a key participant in the transparent conductive film (TCF) market globally owing to capabilities for manufacturing and increased usage of transparent solar cells in the region.

Latin America and Middle East & Africa Transparent Conductive Films Market Trends:

Transparent Conductive Films Market in Latin America, and Middle East & Africa (MEA) markets are emerging at a steady pace, majorly powered by rising demand for consumer electronics, as well as upsurge in several renewable energy projects throughout the region. These regions are from both sides in terms of solar energy expansion and smart infrastructure developments. While challenges such as manufacturing constraints and supply chain issues persist, they are being progressively mitigated via strategic partnerships and supportive government policies. The rapid growth in urbanization, along with extensive digitization initiatives, accelerates the adoption of TCF devices in these regions.

Transparent Conductive Films Market Competitive Landscape:

DuPont – Founded in 1802, DuPont de Nemours, Inc. is an American multinational chemical and materials science company headquartered in Wilmington, Delaware. Originally established by Éleuthère Irénée du Pont as a gunpowder manufacturer, it evolved into a global leader in advanced materials and specialty chemicals used across industries such as electronics, automotive, construction, agriculture, and safety.

- In April 2025, DuPont unveiled its silver nanowire-based transparent conductive films, such as Activegrid™ ink and Activegrid™ film, at the Electronics Manufacturing Korea (EMK) and Automotive World Korea (AWK) exhibitions.

AGC Inc. (Asahi Glass Co., Ltd.) Established in 1907 is a Japan-based global leader in glass, electronics, chemicals, and ceramics. The company supplies advanced materials including display glass and transparent conductive films for automotive, construction, electronics, and renewable energy applications, with a strong focus on innovation and sustainability.

- In September 2024, AGC showcased its transparent conductive films at the SID Vehicle Displays and Interfaces 2024. The company highlighted its advancements in materials for automotive displays and interfaces, focusing on enhancing display performance and functionality.

Transparent Conductive Films Market Key Players:

-

3M Company

-

AGC Inc. (Asahi Glass Co., Ltd.)

-

Nippon Electric Glass Co., Ltd.

-

Eastman Kodak Company

-

Indium Corporation

-

Corning Incorporated

-

DuPont

-

Planar Systems, Inc.

-

ITOCHU Corporation

-

Nitto Denko Corporation

-

TDK Corporation

-

Teijin Limited

-

Toyobo Co., Ltd.

-

Cambrios Technologies Corporation

-

Canatu Oy

-

Heraeus Holding GmbH

-

C3Nano, Inc.

-

Gunze Limited

-

Nanofilm Technologies International Limited

-

Blue Nano, Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 7.14 Billion |

| Market Size by 2035 | USD 14.76 Billion |

| CAGR | CAGR of 7.53% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Indium Tin Oxide (ITO) on Glass, Indium Tin Oxide (ITO) on PET, Silver Nanowire, Carbon Nanotubes, Conductive Polymers, and Others) • By Application (Smart Phone, Notebooks, Tablet, PC, Wearable Devices, and Others) • By End Use (Consumer Electronics, Automotive, Smart Glass, Solar Cells, Transparent, Heaters, and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | 3M Company, AGC Inc. (Asahi Glass Co., Ltd.), Nippon Electric Glass Co., Ltd., Eastman Kodak Company, Indium Corporation, Corning Incorporated, DuPont, Planar Systems, Inc., ITOCHU Corporation, Nitto Denko Corporation, TDK Corporation, Teijin Limited, Toyobo Co., Ltd., Cambrios Technologies Corporation, Canatu Oy, Heraeus Holding GmbH, C3Nano, Inc., Gunze Limited, Nanofilm Technologies International Limited, Blue Nano, Inc. |