Persulfates Market Report Scope & Overview:

Get E-PDF Sample Report on Persulfates Market - Request Sample Report

The Persulfates Market size was valued at USD 869.70 million in 2023. It is expected to grow to USD 1180.17 million by 2032 and grow at a CAGR of 3.95% over the forecast period of 2024-2032.

The increasing demand for polymers and plastics in various industries, such as automotive, packaging, and construction, drives the need for persulfates as polymerization initiators. The rising adoption of electronic devices and the subsequent demand for printed circuit boards further fuel the market growth. Additionally, the growing awareness regarding water pollution and the need for effective water treatment solutions propel the demand for persulfates in this sector.

The EPA reports that approximately 40% of U.S. waterways are not safe for swimming, fishing, or aquatic life due to pollution. This highlights the growing need for effective water treatment solutions, such as those utilizing persulfates for contaminant removal and remediation in wastewater treatment.

Persulfates are salts of peroxydisulfuric acid, with the most common types being ammonium, sodium, and potassium persulfate. These compounds are highly soluble in water and possess excellent oxidative properties. Due to their stability and versatility, persulfates find extensive use in a wide range of industries.

The higher need for persulfates in the textile sector is attributed to their high bleaching features and the growing focus of the industry towards sustainability. Apparel trends have seen lighter, brighter textiles and to maintain that aesthetic persulfates are key. They have been particularly in demand for their efficiency in delivering quality bleaching results when compared to conventional bleaching agents which are also believed to cause detrimental effects on teeth. Moreover, the textile industry is experiencing a major transition toward eco-friendly operations which in turn has fueled the demand for persulfates as sustainable substitutes.

An example of this is illustrated by BASF, in 2021 introduced a new range of persulfate-based bleaching agents targeted at textile applications to help highlight the lower environmental burden when compared with established bleaching methods. The same year, Solvay launched an eco-efficient family of persulfates to accommodate the growing market trend in sustainable textiles aligning with global programs for greener production processes. These advancements demonstrate the industry's dedication to minimizing its environmental impact while satisfying demand for more vibrant, high-quality textiles. Textile manufacturers are moving towards the path of sustainability, which is paving the way for innovation and a combined push to sustainable solutions- that will help grow in case use of persulfates.

Persulfates Market Dynamics

Drivers

- Increasing demand for persulfates in various industries

- Increasing wastewater treatment projects

The use of persulfates is becoming more and more common in the treatment of water because they allow to elimination of halogenated olefins; perfluorinated substances; phenols; and pharmaceutical residuals. A focus on worldwide wastewater management efforts is also encouraging the amplification of the water treatment sector, thereby aiding in increasing the sales volume of persulfates. An article from the United Nations World Water Development Report 2021 says that within 10 years, some 1.8 billion of us will live in regions suffering from absolute water scarcity, a situation that demands prompt and efficient water treatment options.

While the U.S. Environmental Protection Agency (EPA) claims that approximately 85% of municipal wastewater is treated, they also acknowledge that there is still a long way to go in terms of ensuring that contaminants are adequately removed coining the term “advanced chemical treatments” could be one such opportunity, which includes novel methods like persulfates. Additionally, the Global Water Partnership has recognized that 15-20% reductions in water pollution have now come from nations investing in wastewater treatment, showcasing that persulfate-based treatments are indeed doing their part.

In 2022, PeroxyChem announced advancements in its persulfate-based technologies for water treatment applications, focusing on their effectiveness in degrading complex pollutants such as pharmaceuticals and perfluorinated compounds. The initiative reflects their commitment to providing innovative solutions to meet the growing demands for clean water.

Restraint

- High cost associated with the production and transportation of persulfates

- Health concerns associated with the persulfates

The utilization of Persulfates presents numerous health hazards, leading to the implementation of various restrictions on their usage. For example, the New Jersey Department of Health and Senior Services has classified sodium persulfates as a hazardous substance due to their potential to cause irritation to the eyes, nose, and skin, as well as respiratory issues. Additionally, the raw materials involved in the manufacturing of persulfates, such as persulfuric acid, have detrimental effects on human health. Consequently, these aforementioned health concerns associated with the use of persulfates may impede the expansion of the persulfates market.

Persulfates Market Segmentation Overview

By Type

The ammonium persulfates segment dominated the persulfates market with the highest revenue share of about 52% in 2023. The growth is attributed to the extensive range of applications that ammonium persulfate offers. Notably, it is widely utilized in various industries such as metal surface treatment, semiconductor manufacturing, and copper etching on printed circuit boards. Furthermore, its versatility extends to wastewater treatment, where it plays a crucial role, as well as serving as an initiator for the emulsion polymerization of acrylic monomers. Ammonium persulfate, commonly referred to as APS finds application in numerous commercial industries. Within the textile industry, it serves as a vital component for denim desizing and bleach activators. In the paper industry, APS is instrumental in the processes of de-inking and re-pulping. Moreover, its significance extends to the fields of molecular biology and biochemistry, where it acts as a reagent for the preparation of polyacrylamide gels.

By End-Use Industry

The polymers segment accounted for over 50.0% of the market revenue and emerged as the largest product segment in 2023. This has contributed to the use of all three persulfates as initiators in emulsion polymerization reactions for polystyrenes, polyvinyl chlorides, neoprene, and acrylic preparation. It is also used as a starter in concrete adhesives and to form polymeric carbon coatings in graphite threads.

The second largest application segment is electronics, which is expected to register the highest revenue-based CAGR of 4.0% over the forecast period. The expansion is on the back of the budding electronics industry around the world with paper-thin electronic devices. Utilized as a cleaning solvent in the production of printed boards.

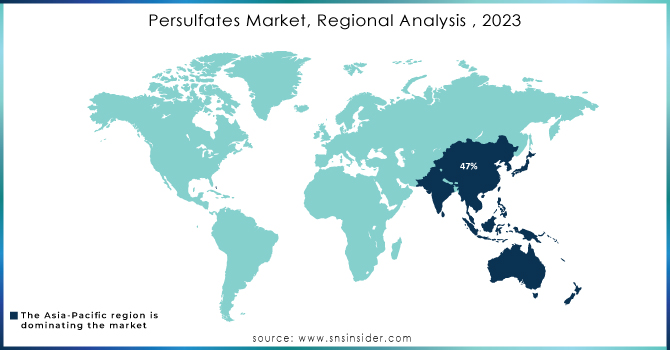

Persulfates Market Regional Analysis

Asia Pacific dominated the Persulfates Market with the highest revenue share of about 47% in 2023. The growth is attributed to the presence of a multitude of plastic manufacturing industries in countries like China, Indonesia, and, Malaysia. Notably, Thailand's plastic production industry has experienced rapid expansion in recent years, boasting an impressive number of around 5,000 operating companies. China, on the other hand, stands as the largest global producer of plastics, accounting for approximately one-third of the world's plastic production. Astonishingly, China consumed a staggering 90.88 million tons of plastic in 2020 alone. The country is home to over 17,000 plastic factories, primarily concentrated in the Eastern and Central South regions. Furthermore, China proudly hosts some of the most prominent electronic manufacturing companies, including Lenovo, BOE Technology, and Huawei. The increasing demand for persulfates in the Asia Pacific region is also driven by end-use industries such as electronics, polymer manufacturing, and cosmetics & and personal care. Additionally, the forecast period anticipates significant growth in newer applications of persulfates, such as water treatment and soil remediation. The rising concerns surrounding soil pollution are expected to fuel the consumption of persulfates in soil remediation throughout the Asia Pacific region.

North America held a significant revenue share of the Persulfates Market and is expected to grow with a CAGR of about 3.8% during the forecast period. This is attributed to the strong presence of market leaders in the plastic industry, including ExxonMobil's chemical division and DoW Chemical in the United States. It is worth noting that the plastics industry ranks as the third-largest manufacturing sector in the country. Notably, the United States is a major producer of various polymers such as high-density polyethylene, low-density polyethylene, and linear low-density polyethylene.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

- BASF SE (BASF Persulfate)

- Mitsubishi Gas Chemical Company, Inc.

- United Initiators

- Fujian ZhanHua Chemical Co.

- Ak-Kim

- Adeka Corporation

- Yatai Electrochemistry Co. Ltd.

- PeroxyChem LLC (Peroxymonosulfate)

- Solvay S.A. (Sodium Persulfate)

- Evonik Industries AG (Epsilom)

- Kemira Oyj (Kemira Persulfates)

- Hawkins, Inc. (Hawkins Sodium Persulfate)

- UI VR Persulfates

- RheinPerChemie

- Hebei Jiheng Group

- San Yuan Chemical Co. Ltd.

- Mitsubishi Gas Chemical Company, Inc. (MGC Persulfates)

- Jiangsu Ruisite Chemical Co., Ltd. (Ruisite Persulfates)

- Aditya Birla Chemicals (Aditya Sodium Persulfate)

- Peroxy Chem (Peroxydisulfate)

- Oxychem (Oxychem Sodium Persulfate)

- Nippon Soda Co., Ltd. (Nippon Sodium Persulfate)

- China National Petroleum Corporation (CNPC) (CNPC Persulfates)

Recent Development:

- In September 2022, Calibre Chemicals, a Mumbai-based company specializing in nutrition, pharmaceuticals, and personal care specialty chemicals, announced its definitive agreement to acquire RheinPerChemie GmbH (RPC) from Evonik, a leading global specialty chemical company.

- In April 2022, Evonik's Active Oxygens business line unveiled a new sustainability strategy for its hydrogen peroxide (H2O2), peracetic acid, and persulfates. This strategy aims to reduce carbon emissions and enhance resource efficiency in production, with the ultimate goal of achieving climate neutrality across the business line by 2040.

| Report Attributes | Details |

| Market Size in 2023 | US$ 869.70 Mn |

| Market Size by 2032 | US$ 1180.17 Mn |

| CAGR | CAGR of 3.95% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Sodium Persulfate, Ammonium Persulfate, and Potassium Persulfate) • By End-use Industry (Polymers, Cosmetics & Personal Care, Pulp, Paper & Textile, Electronics, Oil & Gas, Water Treatment, Soil Remediation, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Mitsubishi Gas Chemical Company, Inc., United Initiators, Fujian ZhanHua Chemical Co., Ak-Kim, Adeka Corporation, PeroxyChem, Yatai Electrochemistry Co. Ltd., UI VR Persulfates, RheinPerChemie, Hebei Jiheng Group, San Yuan Chemical Co. Ltd., Evonik Active Oxygens |

| Key Drivers | • Increasing demand for persulfates in various industries • Increasing wastewater treatment projects |

| Market Restraints | • High cost associated with the production and transportation of persulfates • Health concerns associated with the persulfates |