Pharmaceutical Contract Manufacturing Market Size & Overview:

Get More Information on Pharmaceutical Contract Manufacturing Market - Request Sample Report

The Pharmaceutical Contract Manufacturing Market Size was valued at USD 161.76 bn in 2023 and will reach $300.34 bn by 2032 & grow at a CAGR of 7.15% over the forecast period of 2024-2032.

The Pharmaceutical Contract Manufacturing Market is evolving rapidly, driven by regulatory changes, technological advancements, and growing demand for innovative drug formulations. Governments worldwide are tightening policies to enhance transparency and compliance. In the U.S., the FDA's 2023 Good Manufacturing Practices (GMP) guidelines emphasize stringent manufacturing standards, while Germany’s AMNOG Act and France’s CEPS focus on price structuring and therapeutic value. Similarly, China’s NMPA reforms and Japan’s data exclusivity policies encourage innovation and improved production standards.

Technological advancements play a critical role in boosting efficiency and transparency. Artificial Intelligence is streamlining production cycles and optimizing supply chains, while blockchain technology enhances security and combats counterfeit drugs. Major players like Lonza, Catalent, and Boehringer Ingelheim are adopting advanced solutions, including continuous manufacturing and biologics production, to meet the growing demand for personalized medicines and complex formulations.

The market’s shift toward outsourcing is driven by cost optimization and increased efficiency. Rising interest in biologics, injectable treatments, and cell and gene therapy highlights the focus on personalized and advanced therapeutic solutions. As pharmaceutical companies increasingly collaborate with contract manufacturers, the market is poised for sustained growth, offering immense potential for innovation and expansion.

Pharmaceutical Contract Manufacturing Market Dynamics

Key Drivers:

-

More outsourcing by pharmaceutical companies to make low-cost production processes.

Outsourcing by pharmaceutical companies has been on an upsurge, as these companies are shifting focus to low-cost production, and this factor is primarily driving demand in the Pharmaceutical Contract Manufacturing Market. Most small and mid-sized pharma companies are thus looking towards contract manufacturers for low-cost and scalable production options. The operations of contract manufacturers are lean, and thus pharmaceutical companies make fewer capital investments and operational costs for production facilities. Government reports at the FDA indicate that in 2023, activities concerning outsourcing in the United States increased by 15% because more firms were focusing on quicker drug development and scalability in handling manufacturing. China's National Medical Products Administration, for instance, has seen consistent growth in outsourcing, with more than 20% of new drug manufacturing outsourced, an indication of cost pressures companies are experiencing around the globe.

-

Global demand for biologics and advanced therapeutic treatments is on the rise.

Among the primary factors driving the Pharmaceutical Contract Manufacturing Market is the demand for biologics. Biologics manufacturing processes that include monoclonal antibodies, cell therapies, and gene therapies are also extremely complex and unique in nature, thereby complicating the manufacturing process inside the pharmaceutical firms. The rising demand for biologics has also resulted in rising compliance issues for most contract manufacturers, who require high-quality manufacturing of such complicated pharmaceutical products. According to European Medicines Agency (EMA) reports, biologics accounted for approximately 30% of new drugs approved in Europe in 2023. For Japan, according to the Ministry of Health, Labor, and Welfare, a quarter plus one in ten parts biologics penetrated more than 25% of the total pharmaceutical market in 2023.

Restrain:

-

Operational complexity with high regulatory requirements is related to late approvals.

One of the major constraints of the Pharmaceutical Contract Manufacturing Market is a strict regulatory landscape that amplifies complexity and cost in operations. For instance, bodies like the FDA in the United States, EMA in Europe, and NMPA in China lay down the present standards for the production of drugs, quality control, validation procedures, among many others. Such demands often push the product approval times and elevates operational costs for contract manufacturers. For example, GMP on supply chain clarity enforced by FDA, manufacturers have to invest heavily in quality assurance systems that include comprehensive testing protocols and quality control measurements with ongoing compliance audits-tasks that are not only time-consuming but also costly.

In Europe, the EMA has very strict rules for producing biologics and biosimilars, in some instances requiring additional clinical evidence of comparability, when compared to original drugs. This could at times lead to bottle-neck situations for the contract manufacturer, mainly when dealing with complex biologics. NMPA, China strengthens the regulation and the standards of manufacturing practices for international standards, which makes approval take a little longer. It means that to understand and implement such complicated regulatory mechanisms, the cost associated with maintaining compliance is significantly increased even with time-consuming delays in product launches.

Pharmaceutical Contract Manufacturing Market Segmentation Insights

By Service:

In 2023, Pharmaceutical Manufacturing Services accounted for the largest market share in the industry, capturing 32%. This dominance stems from the rising demand for advanced manufacturing solutions in the pharmaceutical sector. Companies have increasingly focused on their core business activities, such as research and development, while outsourcing non-core operations. Notably, Pharmaceutical API Manufacturing Services have gained significance, as organizations rely on specialized expertise for the production of active pharmaceutical ingredients.

The Drug Development Services segment is projected to witness the fastest growth, with a CAGR of 9.72% during the forecast period from 2024 to 2032. The surge in novel therapies, including biological agents and personalized medicines, has prompted contract manufacturers to expand their offerings to encompass drug discovery, development, and preclinical testing. This growth is driven by the increasing demand for drug development pipeline products, where contract manufacturers go beyond production to provide end-to-end support for the entire drug development process.

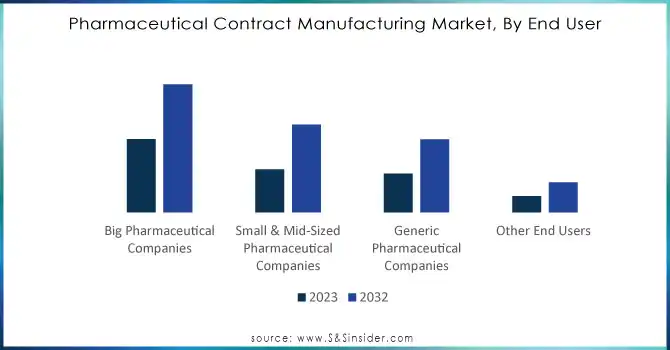

By End User

In 2023, large pharmaceutical companies dominated the market, holding approximately 30% of the share. These companies increasingly leverage contract manufacturing to enhance production efficiency while concentrating on core competencies such as drug discovery and commercialization. With rising R&D expenses, big pharma firms are outsourcing manufacturing to streamline supply chains, scale up production, and maintain stringent quality standards.

Meanwhile, small and mid-sized pharmaceutical companies are projected to experience the fastest growth rate, with a CAGR of 8.21% during the forecast period from 2024 to 2032. This growth is attributed to their limited in-house manufacturing capabilities, driving the need to outsource product development and market introduction efficiently and swiftly. Additionally, as many of these smaller firms focus on niche therapeutic areas like orphan drugs and biologics, the demand for highly specialized contract manufacturing services continues to rise.

Need Any Customization Research On Pharmaceutical Contract Manufacturing Market - Inquiry Now

Pharmaceutical Contract Manufacturing Market Regional Analysis

In 2023, North America led the market with a 25% share, largely driven by the presence of major pharmaceutical companies, advanced healthcare infrastructure, and strong government support. The United States, in particular, remains a key player, shaped by regulatory agencies like the FDA, which have established standards that define the market. Additionally, investments in biologics and personalized medicine have further boosted the region's position in contract manufacturing.

However, the Asia Pacific region is expected to experience the fastest growth during the forecast period from 2024 to 2032, with a CAGR of 8.42%. Countries like China, India, and Japan are emerging as major manufacturing hubs. Government policies and cost advantages have contributed to the growth of manufacturing activities in these nations. For instance, China’s NMPA has streamlined its approval processes to encourage innovation and attract global pharmaceutical players, while Japan’s Ministry of Health is focusing on the development of biologics and biosimilars.

Key Pharmaceutical Contract Manufacturing Companies

Some of the major players in the Pharmaceutical Contract Manufacturing Market are

-

Catalent (Sterile Manufacturing, Oral Solid Dose Manufacturing)

-

Lonza (Biologic Drug Substance Manufacturing, Cell Therapy Manufacturing)

-

Boehringer Ingelheim (Biopharmaceuticals, Contract Development)

-

Samsung Biologics (Biologics Manufacturing, Fill/Finish Services)

-

WuXi AppTec (Small Molecule Manufacturing, Biologics Manufacturing)

-

Patheon (Pharmaceutical Development, API Manufacturing)

-

AMRI (API Development, Drug Product Manufacturing)

-

Recipharm (Inhalation Product Manufacturing, Drug Development Services)

-

Siegfried (Drug Substance Manufacturing, Drug Product Manufacturing)

-

Jubilant Life Sciences (Sterile Injectable Manufacturing, Solid Oral Dosage Manufacturing)

-

Famar (Sterile Manufacturing, Packaging Services)

-

Thermo Fisher Scientific (Pharmaceutical Development, Biologics Manufacturing)

-

Piramal Pharma Solutions (API Manufacturing, Drug Product Manufacturing)

-

Almac Group (Drug Development Services, Clinical Trial Manufacturing)

-

Cambrex (API Manufacturing, Drug Substance Manufacturing)

-

BioDuro-Sundia (Biologics Manufacturing, Drug Discovery)

-

Vetter Pharma (Fill & Finish Services, Packaging Services)

-

AbbVie Contract Manufacturing (API Development, Solid Oral Dose Manufacturing)

-

Baxter BioPharma Solutions (Injectable Manufacturing, Biologics Manufacturing)

-

Pfizer CentreOne (API Manufacturing, Biologics Manufacturing)

Major Suppliers (Components, Raw Materials)

-

BASF

-

DSM

-

Thermo Fisher

-

Evonik

-

Lonza Raw Material Supply

-

Eastman Chemical Company

-

Solvay

-

Honeywell

-

Sigma-Aldrich

-

Merck KGaA

Major Clients

-

Johnson & Johnson

-

Novartis

-

Merck & Co.

-

Roche

-

GlaxoSmithKline

-

Sanofi

-

Eli Lilly

-

AstraZeneca

-

Pfizer

-

Amgen

Recent Trends

-

October 2024: South Korea-based global Contract Development and Manufacturing Organization (CDMO) Samsung Biologics has revealed that it has entered into a contract manufacturing deal with an Asia-based pharmaceutical company. This is the biggest contract signed by a single client, standing at USD 1.24 billion. The production will be done in its biomanufacturing site in Songdo, South Korea, and it will operate through December 2037. From the latest deal, accumulated contract for 2024 stands over at USD 3.3 billion for the company.

-

In 2024, Eli Lilly and Company and Nexus Pharmaceuticals, LLC announced a definitive agreement under which Lilly will acquire a manufacturing facility from Nexus, a prominent sterile manufacturer in the pharmaceutical sector.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 161.76 Billion |

| Market Size by 2032 | US$ 300.34 Billion |

| CAGR | CAGR of 7.15 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service (Pharmaceutical Manufacturing Services, Pharmaceutical API Manufacturing Services, Pharmaceutical FDF Manufacturing Services, Drug Development Services, Biologic Manufacturing Services, Biologic API Manufacturing Services, Biologic FDF Manufacturing Services) • By End User (Big Pharmaceutical Companies, Small & Mid-Sized Pharmaceutical Companies, Generic Pharmaceutical Companies, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Catalent, Lonza, Boehringer Ingelheim, Samsung Biologics, WuXi AppTec, Patheon, AMRI, Recipharm, Siegfried, Jubilant Life Sciences, Famar, Thermo Fisher Scientific, Piramal Pharma Solutions, Almac Group, Cambrex, BioDuro-Sundia, Vetter Pharma, AbbVie Contract Manufacturing, Baxter BioPharma Solutions, Pfizer CentreOne. |

| Key Drivers | • More outsourcing by pharmaceutical companies to make low-cost production processes. • Global demand for biologics and advanced therapeutic treatments is on the rise. |

| Restraints | • Operational complexity with high regulatory requirements is related to late approvals. |