Compounding Pharmacies Market Size Analysis

The Compounding Pharmacies Market was valued at USD 12.6 Billion in 2023 and is projected to reach USD 19.9 Billion by 2032, growing at a CAGR of 5.2% Over the Forecast Period of 2024-2032.

Get More Information on Compounding Pharmacies Market - Request Sample Report

The rapidly increasing market growth can be attributed to a rising demand for personalized medicines. As such, the current situation can be interpreted as the manifestation of a tectonic shift from conventional methodologies that comprise more of a one-size-fits-all approach to learning towards a more symbiotic relationship with physician-patient pharmacological joint decision-making. The doctors are considering which medications to compound for which patient in response to their unique medical needs or conditions. Given the wide range of needs that a facility may have ranging from bio-identical hormone replacement therapy to competitive options for the compounds used in pediatric and geriatric formularies and no matter which area of healthcare a realized need may extend to, scientifically compounded pharmaceuticals are more up to the task in most situations that the public care to admit.

In 2023, Avita Pharmacy, a notable compounding pharmacy, expanded its services in 2023 to include personalized veterinary compounding. This move addressed the growing demand for customized medications tailored to pets, reflecting a broader application of personalized medicine beyond human healthcare and demonstrating the evolving role of compounding pharmacies in diverse therapeutic areas.

Moreover, the trend towards home healthcare and self-administration of medications is knowingly driving demand for compounded medications tailored for home use. As patients increasingly seek to manage their health from the comfort of their homes, there is a growing need for medications that are convenient and easy to use outside of traditional healthcare settings. Compounding pharmacies are meeting this demand by developing and offering customized medications in user-friendly forms and packaging designed for home administration.

Further, the increasing demand for compounded medications due to the shortage of commercial medications primarily for chronic diseases has been one of the reasons for the growth of the pharmaceutical compounding market. According to the report titled “Medicine Shortage Survey 2022” and published by the Pharmaceutical Group of the European Union, medication shortage was reported among the community pharmacists of 29 member countries out of 29 survey countries in Europe. Cardiovascular medications accounted for the majority of the shortage of medication in the region. Compounding has been mostly considered as a solution to cover the gap due to shortage of medication.

Compounding Pharmacies Market Dynamics

Drivers

-

The rising importance of compounding for enhancing medicine adherence driving the market's growth.

One of the significant drivers of compounding pharmacies’ market growth is compounding’s increasing importance in improving medication adherence. People adhering to medication regimens is a significant factor in achieving successful treatment outcomes, and compounded medicine has a role in ensuring that patients do indeed take their prescribed medications. At compounding pharmacies, specialized formulations can be created according to the specific needs of patients. This can include producing easy-to-swallow medication forms for older individuals, adjusting the dose for better treatment efficacy, or removing allergens for patients with their sensitivities.

The report that the U.S. Food and Drug Administration published in 2022 underlines the dynamics driving compounding pharmacy market growth, explaining that providing personalized medication solutions to patients was becoming increasingly important. The FDA’s goal of encouraging advancements in the compounding pharmacy industry is one of the drivers of market growth because the critical importance of this role is now recognized. A study by Uzeste, Isabelle, and Benjamin Benoit published in the Journal of Patient Compliance in 2023 also supports the idea that the need for providing alternatives to standard medications is one of the drivers of market growth as it states patients who used compounded medications adhered to their regimens more than those who used standard medications.

Government statistics also illustrate the importance of compounding pharmacies for various conditions. It is noted by the Centers for Disease Control and Prevention that about 50% of patients with chronic diseases do not take their prescribed medications, causing their health conditions to deteriorate. Compounding pharmacy solutions to this issue is a driver of market growth, and the above aspects contribute to the significance of this development as one of the primary drivers of a market that is growing exponentially.

Restrain

-

Competition from standard pharmaceuticals hampers market growth.

For compounding pharmacies, one of the major threats is competition from standard pharmaceuticals, and the main factor contributing to this rivalry is cost-effectiveness. Standard pharmaceuticals are usually mass-produced, and such an approach implies the existence of economies of scale. This means that the price of these medications is relatively low, while their availability is correspondingly high. Although in some cases, compounded medications can offer their clients more personalized solutions, implying higher customer benefits, the price of compounding solutions is also higher. This means that clients, as well as healthcare practitioners when ordering the medications for their patients, can ask themselves whether they need to pay more for the compounded medications and compounding pharmacies face the risk of not being able to compete with standard pharmaceuticals.

Compounding Pharmacies Market Segment Analysis

By Therapeutic Area

The pain management segment dominated the market and accounted for the largest revenue share of 35.1% in 2023. The high share of the segment is attributed to the growing incidence of chronic pain and side effects caused by available pain management medications. The compounded pain management medications provide various advantages, such as for patients suffering from GI problems are created in such a manner that they bypass the Gastrointestinal system and multiple compounded medications can be combined together in a single dose.

The nutritional supplements segment is expected to exhibit the fastest growth rate over the forecast period. This is due to the increased demand for personalized beauty and anti-aging products.

Therefore, many companies are providing various forms of compounded nutraceutical products to meet the growing demand. For example, Medisca Inc. offers more than 100 compounded high-quality nutraceutical products, which are tested for heavy metals. These products include prenatal multivitamins, minerals, antioxidants, and many other supplements. In 2022, the hormone replacement therapy segment contributed a significant market share.

By Age Cohort

The adult segment held the largest revenue share of 45.1% in 2023. Adult patients may require personal medication because of certain factors, which include all or some people to certain ingredients and specific dosage strengths. The needs of adult patients may be met by the compounding pharmacies by creating specialized medication, which includes creams, capsules, or gels. The pediatric segment is projected to register the fastest growth rate in the given period. This is because children may need private medicines due to their size, desired tastes, limited forms of prescription and dosage forms and limited options of absorbing solid dosage forms.

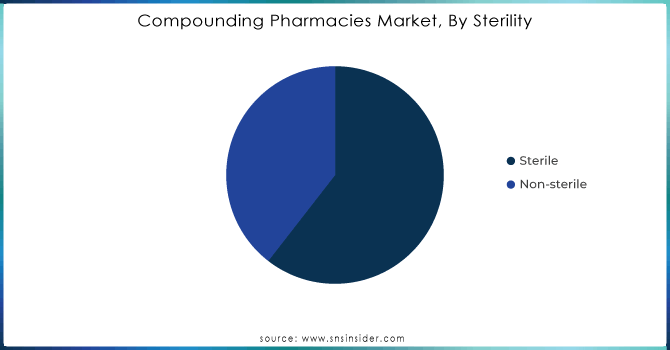

By Sterility

The sterility segment dominated the market, with the largest share of 60.52% in 2023, and is expected to grow further at the fastest growth rate over the forecast period. The growth of the market is attributed to the increasing demand for sterile-compounded medications in a variety of healthcare settings. Furthermore, the rising complexity of patient needs and advances in case of medical treatments are expected to contribute to the growth of this segment.

Need any customization research on Compounding Pharmacies Market - Enquiry Now

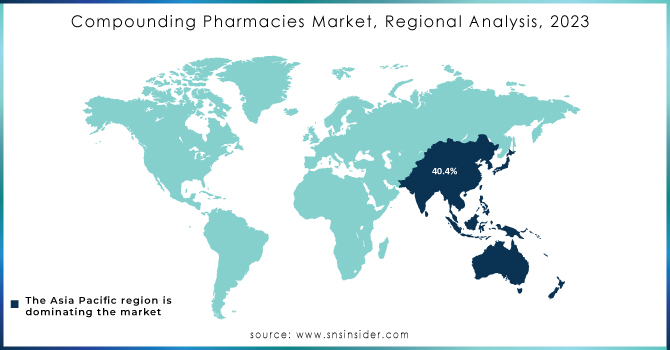

Regional Insights

Asia Pacific emerged as the largest regional market and accounted for a revenue share of over 40.4% in 2023. Over time, it is anticipated that the growing end-use industry would increase demand for lamination adhesives. The consumer goods, healthcare, and automotive industries stand to benefit from investments in new production facilities, which will increase their production capacities and spur market expansion. China and India, for example, have excelled in pharmaceutical contract manufacturing during the past few decades. Reduced operating costs for a variety of resources, including labor, have contributed to the sector's growth. The demand for medical supplies, such as labels, lids, bags, and pouches, is high in this industry.

In terms of revenue, Europe is projected to expand at a revenue-based CAGR of 7.5% from 2024 to 2032. Increasing health awareness among the populace and rising consumer spending on food and beverage and other consumer goods products are the key factors contributing to the long-term growth of the market.

Compounding Pharmacies Market Key Players

The major key players are Walgreen Co., Fagron, Albertsons Companies, The London Specialist Pharmacy Ltd, Galenic Laboratories Limited, Aurora Compounding, MEDS Pharmacy, Apollo Clinical Pharmacy, Formul8, Fusion Apothecary, and other players.

Recent Developments in the Compounding Pharmacies Market

-

In 2024, Avita Pharmacy announced a strategic collaboration with a leading research institution to develop cutting-edge compounding techniques. This partnership is focused on advancing research in personalized medicine and creating new compounded formulations that offer distinct advantages over standard pharmaceutical products.

-

In 2023, Medisca rolled out a series of new patient-centric formulations designed to cater to specific needs not addressed by standard pharmaceuticals. This included the development of innovative dosage forms and flavors to enhance patient compliance.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 12.6 Billion |

| Market Size by 2032 | USD 19.9 Billion |

| CAGR | CAGR of 5.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Therapeutic Area (Hormone Replacement Therapy, Pain Management, Specialty Drugs, Dermatology, Nutritional Supplements, Others) • By Age Cohort (Pediatric, Adult, Geriatric) • By Compounding Type (Pharmaceutical Ingredient Alteration (PIA), Currently Unavailable Pharmaceutical Manufacturing (CUPM), Pharmaceutical Dosage Alteration (PDA), Others) • By Sterility (Sterile, Non-sterile) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Walgreen Co., Fagron, Albertsons Companies, The London Specialist Pharmacy Ltd, Galenic Laboratories Limited, Aurora Compounding, MEDS Pharmacy, Apollo Clinical Pharmacy, Formul8, Fusion Apothecary, and other players. |

| Key Drivers | • The rising importance of compounding for enhancing medicine adherence driving the market's growth. |

| RESTRAINTS | • Competition from standard pharmaceuticals hampers market growth. |