Organic Peroxide Market Scope & Overview:

The Organic Peroxide Market size was valued at USD 1.6 Billion in 2023. It is expected to grow to USD 2.3 Billion by 2032 and grow at a CAGR of 4.3% over the forecast period of 2024-2032.

The organic peroxide market is significantly driven by an increasing demand in various industries, including plastics, rubber, and coatings. Organic peroxides work as initiators, curing agents, or crosslinking agents, facilitating the essential chemical reactions within these applications. As per the American Chemistry Council, the U.S. plastics industry has generated USD 410 billion worth of shipments in 2022. It contributes significantly to the national economy and is among the driving forces behind an elevating demand for additives that allow for polymer production improvement, such as organic peroxides. This industrial segment heavily relies on organic peroxides to manufacture high-quality tires and parts.

The demand for protective or decorative coatings is consistently increasing in a variety of areas, including automotive, industrial, and architectural applications. Finally, many advanced industrial nations concentrate on the Asia-Pacific region, as, for instance, China and India have been actively industrializing. The nations are rich in production capacities due to the resource surplus, and, accordingly, the consumption rate of organic peroxides is going to rise. Overall, these aspects combined mean that there is a multilayered increase in the demand for organic peroxides in the above-mentioned industries due to their inherent beneficial properties aiding better performance and higher sustainability aspect.

Get More Information on Organic Peroxide Market - Request Sample Report

The organic peroxide market is likely to experience several growth-inducing trends to drive it in the coming years, such as the spread of the polymer industry. Organic peroxides are vital to a variety of polymerization processes, including curing and crosslinking. The automotive industry’s need for light, high-performance materials continue to rise as manufacturers strive to reduce fuel consumption and emissions.

For instance, in 2023, Arkema’s Kynar 2 product is a Polyvinylidene Fluoride resin that utilized organic peroxide to significantly improve the thermal balance and mechanical strength of the polymers that are used in making automotive parts.

Drivers

-

The increasing demand for lightweight and high-performance materials in the automotive industries drives the growth market

The organic peroxide market demand is rising in the automotive industry due to its lightweight and high performance. Lightweight materials have become vital as they can contribute to improved fuel consumption and reduced emissions, according to the U.S. Department of Energy, which implies that a 10% reduction in vehicle weight results in a 6% improvement in fuel efficiency. This push for lightweight has stimulated the adoption of advanced composites and polymers among automakers, where organic peroxides play an important role in curing and crosslinking. For example, they are used in the manufacture of high-performance thermoset resins, wherein the latter are increasingly used in structural elements and vehicle interiors.

The focus on these lightweight materials is further enhanced as companies are striving to meet strict environmental standards such as the Corporate Average Fuel Economy standards. In order to come closer, and align with the requirement while not losing on performance and safety, organic peroxides are further adopted in manufacturing these materials, such as reinforcing their application in the specific industry. In such a way, the application of organic peroxides in the lightweight production of materials assembled for automotive purposes is both an important driver and is well positioned with the overall industry shift towards more sustainable and innovative solutions.

Restraint

-

Safety and handling concerns hamper market growth.

One critical factor that hinders market growth is safety and handling concerns. Organic peroxides are considered hazardous materials that are capable of causing fire, skin irritation, or respiratory issues. As a consequence, safety considerations are crucial, which is manifested in the necessity to store the substance at the appropriate temperature, wear personal protective equipment, and complete all required safety exams and audits. Under such circumstances, manufacturers face increased operational costs, which results in a lower tendency to adopt organic peroxides. More specifically, the issue restricts the growth among smaller firms with limited available funds.

Market Segmentation Analysis

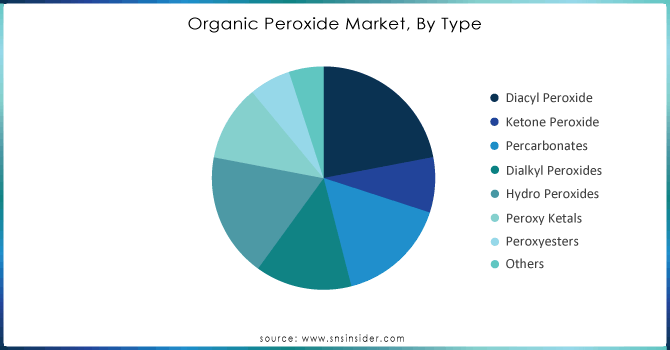

By Type

Diacyl Peroxide held the largest market share around 22% in 2023. These chemicals are extensively used in the manufacture of thermoplastics, thermosets, and elastomers, being indispensable in such sectors as automotive, packaging, and construction. Owing to their ability to decompose at relatively low temperatures, curing and crosslinking the materials can be achieved more cost-efficiently, improving mechanical properties and thermal stability. For example, diacyl peroxides, including benzoyl peroxide, are extensively employed in the production of acrylics and polyesters, which are vital for coatings and adhesives. Furthermore, the demand in the automotive sector, where lightweight and high-performance materials are required, also contributes to the use of diacyl peroxides, as they allow for enhanced fuel efficiency and reduced emissions. Thus, the fact that these products have already been firmly established on the market, alongside ongoing innovations and new formulations, suggests that diacyl peroxides will continue to be the leading chemicals, with their consumption growing in a variety of contexts.

Need Any Customization Research On Organic Peroxide Market - Inquiry Now

By Application

The largest share of the organic peroxide market is held by the chemicals and plastics segment around 24% in 2023. This fact is explained by the substantial contribution of these compounds to the technological advancement used for constituting and ensuring the operation of a wide scope of polymeric materials. Organic peroxides are critical for the initiation of numerous processes of polymerization, which helps create diverse high-performance plastics and resins. They are necessary for the packaging industry, for manufacturing various automotive crew, constructing materials, and others. These materials are increasingly demanded as lightweight and, at the same time, solid and resilient, which allows different industries to increase their energy efficiency and sustainability levels.

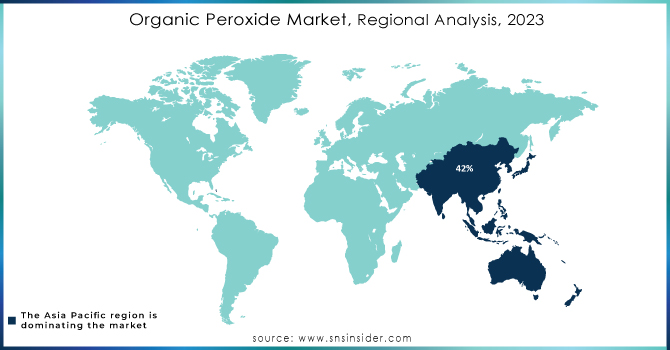

Regional Analysis

Asia Pacific held the highest market share around 42% in 2023. The Asia Pacific region is the leading in the organic peroxide market. The reason is that Asia Pacific is rapidly industrializing, increasing the number of manufacturing industries, and demand in different end-use industries. Based on the Asian Development Bank, the region’s manufacturing output will cover more than 50% of the global manufacturing output by 2025. In this respect, different sectors including the automotive, packaging, and construction will require organic peroxides, consequently increasing the demand for organic peroxides. China and India are also key players in the market as China owns the largest production of polymers and plastics globally, which correlates with the growing use of organic peroxides in manufacturing, especially polymers and plastics as a vital curing agent and initiator. For example, the production of plastics in China by the end of 2021 was scale about 77 million metric tons according to the statistics of China statistics and forecast.

Key Players

-

BASF SE (Peroxide 50)

-

Arkema Group (Luperox)

-

AkzoNobel N.V. (Dibenzoyl Peroxide)

-

PeroxyChem LLC (Luperox)

-

Evonik Industries AG (Vulcup)

-

Huntsman Corporation (Diketone Peroxide)

-

NOF Corporation (NOF-210)

-

DOW Chemical Company (DOW Peroxide 50)

-

Solvay S.A. (Peroxide 25)

-

Mitsubishi Gas Chemical Company, Inc. (Peroxyacetic Acid)

-

Chang Chun Plastics Co., Ltd. (Cyanuric Peroxide)

-

Ferro Corporation (Vulcan)

-

Eastman Chemical Company (Vazo)

-

Wacker Chemie AG (Wacker Peroxide)

-

Kraton Corporation (Kraton G)

-

Shivam Peroxide Pvt. Ltd. (Shivam Peroxide 40)

-

Fujifilm Wako Pure Chemical Corporation (Peroxide A)

-

Nouryon (formerly AkzoNobel Specialty Chemicals) (Benzoyl Peroxide)

-

Oltchim SA (Oltchim Peroxide)

-

United Initiators (U.P. 70)

Recent Developments:

-

In 2023, BASF launched a new line of sustainable organic peroxides, focusing on reducing environmental impact during production and application, particularly in the automotive and construction sectors.

-

In 2023, NOF Corporation unveiled a new formulation of NOF-210, enhancing its effectiveness as a polymerization initiator for high-performance plastics.

-

In 2022, Arkema expanded its production capacity for Luperox organic peroxides at its facility in Brazil, enhancing its supply chain and meeting the growing demand in the South American market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.6 Billion |

| Market Size by 2032 | US$ 2.3 Billion |

| CAGR | CAGR of4.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Diacyl Peroxide, Ketone Peroxide, Percarbonates, Dialkyl Peroxides, Hydro Peroxides, Peroxy Ketals, Peroxyesters, Others) •By Application (Chemicals & Plastics, Coatings & Adhesives, Elastomers, Paper & Textiles, Detergents, Personal Care, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Arkema Group, AkzoNobel N.V., PeroxyChem LLC, Evonik Industries AG, Huntsman Corporation, NOF Corporation, DOW Chemical Company, Solvay S.A., Mitsubishi Gas Chemical Company, Inc., Chang Chun Plastics Co., Ltd., Ferro Corporation, Eastman Chemical Company, Wacker Chemie AG, Kraton Corporation, Shivam Peroxide Pvt. Ltd., Fujifilm Wako Pure Chemical Corporation, Nouryon, Oltchim SA, United Initiators. |

| Key Drivers | •The increasing demand for lightweight and high-performance materials in the automotive industries drives the growth market. |

| RESTRAINTS | •Safety and handling concerns hampers market growth. |