Alpha Olefin Market Report Scope & Overview:

Get E-PDF Sample Report on Alpha Olefin Market - Request Sample Report

The Alpha Olefin Market Size was valued at USD 10.5 Billion in 2023 and is expected to reach USD 16.6 Billion by 2032 and grow at a CAGR of 5.3% over the forecast period 2024-2032.

One of the key factors propelling the growth of the alpha-olefin market is the increasing consumption of polyethylene, which finds extensive application in the packaging, construction, and automotive industry. E-commerce, sustainability standards, and a growing interest in flexible packaging solutions have led to an increase in demand for polyethylene for packaging applications. Moreover, the high strength and light weight of polyethylene, used in piping, insulation, and geomembranes for building applications and fuel tanks, bumpers, and interior parts in the automotive industry necessitate its escalating market requirement.

In 2023, for example, Chevron Phillips Chemical declared plans to increase its alpha olefin production capacity at its Baytown site in Texas as part of efforts to ensure a sufficient supply of comonomers for the polyethylene sector. Similarly, INEOS Oligomers has been expanding its alpha-olefin capacity in order to supply a growing demand for polyethylenes, and its major new build in Jubail, Saudi Arabia is due onstream by 2024. This underscores the capital investments of leading players and aims at competitively benefiting as well as addressing current trends in this market for polyethylene into sectors like packaging, construction, automotive, etc.

The versatility and durability of polyethylene make it a preferred choice for manufacturers, leading to a surge in demand for alpha olefins as a raw material. Furthermore, the growing awareness regarding environmental concerns has prompted the adoption of bio-based alpha olefins. These renewable alternatives offer a sustainable solution, reducing the carbon footprint associated with traditional petroleum-based alpha olefins. This shift towards eco-friendly options has opened up new avenues for market players, creating opportunities for innovation and development.

However, fluctuating crude oil prices and the volatility of raw material availability pose significant hurdles for market players. Additionally, stringent regulations regarding emissions and waste management necessitate continuous research and development to ensure compliance. For instance, Shell Chemical has been advancing its bio-based alpha olefin production through the development of innovative feedstock technologies. In 2022, the company announced its intention to invest heavily in bio-based technologies to enhance the sustainability of its alpha olefin offerings.

Market Dynamics

Drivers

-

Increasing demand for polyethylene

-

Rising demand for synthetic lubricants, plasticizers, and surfactants

- Expanding automotive industry and the need for high-performance lubricants drive the market growth.

The automotive industry is experiencing significant growth, with a rising number of vehicles hitting the roads each year. As a result, the demand for lubricants that can enhance the performance and efficiency of these vehicles has also surged. This need for high-performance lubricants has become a crucial factor propelling the Alpha Olefin Market forward. Alpha olefins, which are key components in the production of lubricants, possess exceptional properties that make them ideal for this purpose. These olefins exhibit excellent thermal stability, oxidation resistance, and low-temperature fluidity, enabling them to withstand the demanding conditions within automotive engines. By utilizing lubricants derived from alpha olefins, automotive manufacturers can ensure optimal engine performance, reduce friction, and enhance fuel efficiency.

Recent events with major players have underscored this trend even more. For example, ExxonMobil Chemical is increasing its PAO production capacities to cater to the growing demand for high-performance lubricants from the automotive industry. In 2023, the company said it would expand its alpha-olefin production plant in Baytown, Texas to respond to the increased demand for synthetic lubricants in the worldwide automotive market. Meanwhile, Chevron Phillips Chemical has also been working on new generation alpha-olefin products to help improve the performance of automotive lubricants.

Moreover, the automotive industry's shift towards electric vehicles (EVs) has further amplified the demand for high-performance lubricants. EVs rely heavily on lubricants to maintain the smooth operation of their electric motors and other vital components. Alpha olefins, with their superior lubricating properties, are well-suited to meet the specific requirements of these advanced electric propulsion systems. In 2023, the company announced a major capacity expansion in its Qatar facility, aimed at producing higher volumes of alpha olefins to support the growing need for EV lubricants.

Restraint

- Availability of alternative products and the threat of substitution hamper the market growth.

The growth of the alpha olefin market is crippled by the advent of alternative products and threat to the substitution that creates a significant amount of barrier. An improved performance profile and environmental credentials is also driving acceptance of alternative materials, in particular bio-based polymers and synthetic esters across a range of applications, particularly in polyethylene production and lubricants. The replacement also commands benefits such as minimal carbon footprints and enhanced sustainability, attracting end-users seeking compliance with stringent regulatory mandates. Examples include packaging and other industry applications, where some bio-based polymers are derived from renewable sources instead of traditionally produced alpha olefins.

Opportunities

-

Growing demand for high-performance polymers and specialty chemicals.

In recent years, there has been a remarkable surge in the need for high-performance polymers and specialty chemicals across various industries. These substances play a crucial role in enhancing the performance and durability of numerous products, ranging from automotive components to packaging materials. As a result, the Alpha Olefin Market has witnessed a substantial growth potential. These materials possess exceptional strength, chemical resistance, and thermal stability, making them ideal for demanding applications. Moreover, they offer enhanced flexibility, enabling manufacturers to create innovative and customized solutions for their customers. The automotive industry, for example, heavily relies on high-performance polymers and specialty chemicals to improve the efficiency and safety of vehicles. These substances are utilized in the production of lightweight components, such as bumpers and interior panels, which contribute to fuel efficiency and reduce emissions. Additionally, they enhance the durability and crash resistance of these components, ensuring passenger safety.

Market segmentation

By Product

1-hexene product dominated the alpha-olefin market with a revenue share of about 35% in 2023. This is attributed to the increasing utilization of 1-hexene as a widely adopted monomer for the production of High-Density Polyethylene (HDPE) and Linear Low-Density Polyethylene (LLDPE) polymers. As a result, the segment is poised for significant growth. The demand for polyethylene is on the rise, primarily driven by the flourishing automotive and consumer goods markets in the emerging economies of China, India, and Brazil. These countries have witnessed a surge in economic development, leading to an increased need for polyethylene-based products. Consequently, this surge in demand is expected to further propel the growth of the 1-hexene segment.

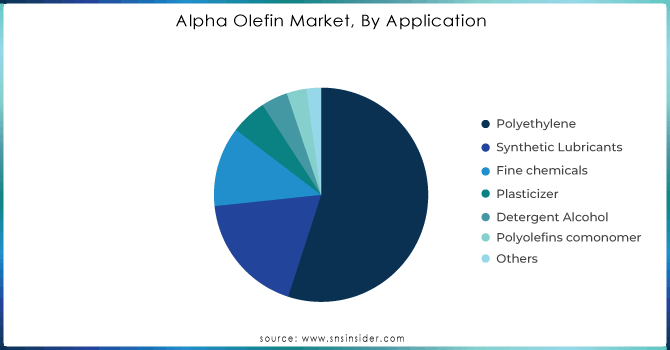

By Application

Polyethylene held the largest the market with a share of 55.0% in 2023. Polyethylene compounds find maximum adoption in construction industry, as a key market. They are also widely used in plastics industries like Manufacturing or processors and packagers since they can be produced as film, block moulding, pipe or rotational moulding which is being used for manufacturing of low-carbon duct work. Conversely, low-density polyethylene is considered the material of choice for certain applications, due to its cheapness in manufacturing, heat saleability and relatively high tensile strength that makes it deal well with stretching plus its soft nature.

Need any customization research on Alpha Olefin Market - Enquiry Now

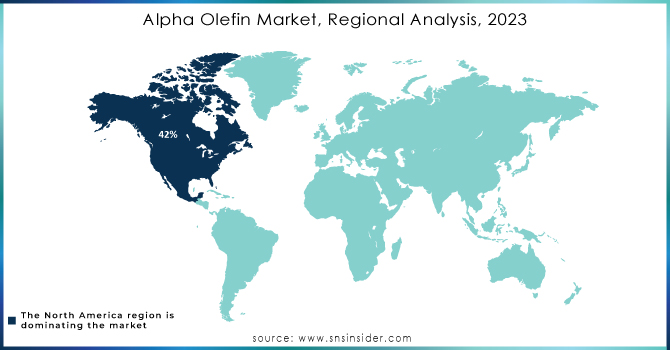

Regional Analysis

North America dominated the Alpha Olefin Market with the highest revenue share of about 42% in 2023. This is attributed to the shale gas boom in the United States, which has significantly boosted ethylene production in the region, consequently driving alpha olefin production as well. Moreover, the ongoing increase in oil exploration activities along the Gulf of Mexico is expected to further propel the growth of the alpha-olefin market. Canada, too, is poised to contribute to the surge in alpha olefin production, because of its escalating crude oil production. The region's abundant natural resources make it an attractive investment hub for both domestic and foreign businesses seeking to produce alpha olefins. Furthermore, the presence of numerous manufacturing enterprises, coupled with the expansion of petrochemical and infrastructural projects in the gas and oil sectors, is anticipated to fuel the growth of the regional market.

Asia Pacific is expected to grow with the highest CAGR of about 5.5% in the Alpha Olefin Market during the forecast period. This growth is attributed to the rapid urbanization and industrialization occurring in emerging economies such as China and India, which are expected to drive the demand for polyethylene products. Furthermore, the manufacturing sector in the Asia Pacific has witnessed significant growth due to various government incentives and a favorable regulatory environment in countries like China, India, Malaysia, and Indonesia. Alpha olefins find extensive applications in industries such as polyethylene, detergent alcohols, synthetic lubricants, and plasticizers. The increasing urbanization and industrialization in China and India's emerging economies are anticipated to further boost the demand for polyethylene products. Moreover, the Asia Pacific region is expected to witness a surge in the production of these products, which will contribute to the growth of the regional market. In terms of market share, China currently dominates the alpha olefins market, while India's market is experiencing the fastest growth in the Asia-Pacific region. This highlights the significant potential and opportunities present in these markets.

Key Players

-

Chevron Phillips Chemical Company LLC (1-Hexene, 1-Decene)

-

Royal Dutch Shell plc (Shell Neodene Alpha Olefins, Shell Higher Olefins)

-

INEOS Oligomers (Durasyn Polyalphaolefins, INEOS Oligomer Alpha Olefins)

-

SABIC (SABIC Alpha Olefins, SABIC Linear Alpha Olefins)

-

ExxonMobil Chemical Company (ExxonMobil Elevex PAO, ExxonMobil AlphaPlus)

-

Sasol Limited (Sasol Alpha Olefins, Sasol Oligomers)

-

Qatar Chemical Company Ltd. (Q-Chem) (Q-Chem Alpha Olefins, Q-Chem Linear Alpha Olefins)

-

Evonik Industries AG, (Viscodrive PAO, Evonik Linear Alpha Olefins)

-

Mitsubishi Chemical Corporation (Mitsubishi LAO, Mitsubishi Oligomer Alpha Olefins)

-

Idemitsu Kosan Co., Ltd. (Idemitsu PAO, Idemitsu Alpha Olefins)

-

Petrochemical Corporation of Singapore (PCS Alpha Olefins, PCS Linear Alpha Olefins)

-

Saudi Basic Industries Corporation (SABIC Low-Density Alpha Olefins, SABIC High-Performance Olefins)

-

Royal Dutch Shell

-

Petro Rabigh (Rabigh Alpha Olefins, Rabigh Higher Olefins)

-

TASCO Group (TASCO LAO, TASCO Olefins)

-

Sinopec (Sinopec Alpha Olefins, Sinopec Linear Alpha Olefins)

-

Dow Chemical Company (Dow Polyalphaolefin, Dow XLAO)

-

Westlake Chemical Corporation (Westlake LAO, Westlake Alpha Olefins)

-

LyondellBasell Industries N.V. (LyondellBasell Alpha Olefins, LyondellBasell Polyalphaolefins)

Recent Development:

-

In Sept 2023, ExxonMobil made an exciting announcement regarding the commencement of operations for two chemical production units at its Baytown manufacturing facility in Texas. This remarkable $2 billion expansion project is a crucial component of ExxonMobil's extensive growth strategy, aimed at providing enhanced value through the production of top-tier products at its refining and chemical facilities along the U.S. Gulf Coast.

-

In August 2023, Chevron Phillips Chemical achieved a significant milestone by successfully completing the construction of the world's largest on-purpose 1-hexene unit in Old Ocean, Texas. This groundbreaking achievement positions Chevron Phillips Chemical at the forefront of innovation, with operations at the plant scheduled to commence by early September.

| Report Attributes | Details |

| Market Size in 2023 | US$ 10.5 Bn |

| Market Size by 2032 | US$ 16.6 Bn |

| CAGR | CAGR of 5.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (1-butene, 1-hexene, 1-octene, 1-decene, 1-dodecene, and Others) • By Application (Polyethylene, Synthetic Lubricants, Fine chemicals, Plasticizer, Detergent Alcohol, Polyolefins comonomer, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Evonik Industries AG, INEOS Oligomers, Dow Chemical Company, Chevron Phillips Chemical Company LLC, Qatar Chemical Company Ltd, Exxon Mobil Corporation, Royal Dutch Shell, SABIC, Sasol Limited, Mitsubishi Chemical Corp. |

| Key Drivers | • Increasing demand for polyethylene • Rising demand for synthetic lubricants, plasticizers, and surfactants • Expanding automotive industry and the need for high-performance lubricants drives the market growth |

| Market Restraints | • Volatility of raw material prices • Availability of alternative products and the threat of substitution hamper the market growth |