Power Distribution Unit (PDU) Market Report Scope & Overview:

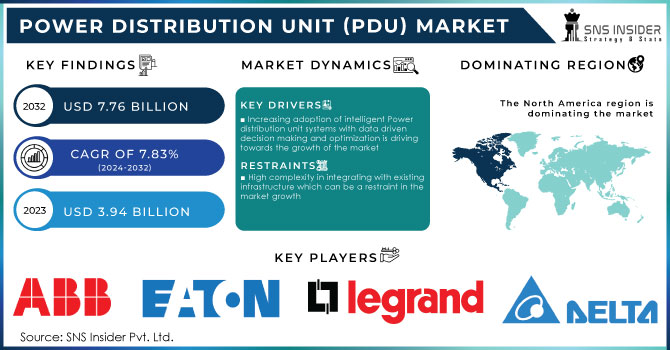

The Power Distribution Unit (PDU) Market size was USD 3.94 billion in 2023 and is expected to reach USD 7.76 billion by 2032, growing at a CAGR of 7.83% over the forecast period of 2024-2032.

The Power Distribution Units market is growing at a significant rate for a variety of reasons. The increasing number of data centres across the globe acts as one of the major factors in the growth of Power Distribution Unit market. The data centres require power stability for uninterrupted operations.

Get More Information on Power Distribution Unit Market - Request Sample Report

The data centres and factories are dependable towards even distribution of power and this growing digital infrastructure creates demand for the growth of the PDU’s. Another driving factor is the rise of smart grids and rise in renewable energy sources is demanding for PDUs. US alone uses 90 Billion KW of electricity for data centres which is about 2% of total energy consumption is helping PDU’s to grow is towards the focus on saving energy and using advanced controls. Also, the introduction of edge computing requiring even flow of energy is contributing in growth of PDU. All these factors together are making the market bigger and helping it grow.

Market Dynamics

Drivers

-

Increasing adoption of intelligent Power distribution unit systems with data driven decision making and optimization is driving towards the growth of the market

-

Rise in the number of data centres is driving the market towards its growth

The data centres are growing at an exponential rate with an ever increase demand for cloud computing, big data & AI. The data centre on an average has around 1000’s of servers on an average and these consume huge amount of power with requirement between 400 to 800 watts per server. In order to manage this PDU are of great importance and a single PDU can handle up to 17 kW per rack and has a feature of real-time load monitoring to prevent overloads and ensure uninterrupted operation. U.S. alone consumes about 90 billion kWh of electricity which represents to about 2% of the country’s total energy consumption

Restraints

-

High complexity in integrating with existing infrastructure which can be a restraint in the market growth

-

High initial investment required in the installation of PDU’s which could be a restraining factor in the growth of the market

Opportunities

-

Rise in the usage of Edge Computing across the globe is creating growth opportunities

-

Growing awareness towards energy efficiency is creating growth opportunities for the market

Businesses are starting to focus towards energy efficiency in order to reduce the environmental impact and this is where PDUs come by providing features like remote monitoring, control, identification and elimination of power wastage. Business can install PDU which can help in achieving energy savings of 15% to 25%. An average data centre consumes of around 5 MW and with PDU it can save 750 kW to 1.25 MW of power thereby saving cost and reducing carbon footprint.

Challenges

-

Security vulnerabilities related to PDU's management interface can be a challenge in the adoption of Power Distribution Units

-

High individualized and complex customer requirements for PDU’s can be a challenge for the manufacturers to cater to the requirements

Impact of Russia-Ukraine War

The Russia-Ukraine war has a huge impact on the power distribution unit market. Trade sanctions and disrupted supply chain has created hurdles in supply of raw materials with Russia as a key supplier of raw materials like nickel, copper, coal crude oil has led to shortages and driving the cost of PDU. During the war time the prices of Nickel increased by 36% which is used in making circuits, Copper by 8% used in electrical wiring, Crude oil by 29% & natural gas by 43% which is required for transportation of equipment’s. At the same time the electricity prices went up by 138% which has a caused a stagnant dip in the demand for the PDU’s. European union is greatly hit by the war because of its proximity with Russia & Ukraine. Data centres had a hit because of the war due to energy price hikes which shifted the priority towards maintaining existing PDU & optimization of Power to minimize energy consumption. But on the other side, IT sector may still prioritize in investing in PDU for the smooth operations. Also, government may encourage over local manufacturing & reduce the reliance towards global markets thus creating opportunities. Also, with increasing cybersecurity concern related to data canters might push in PDU security features like user authentication, access control can help in growth even in this war.

Impact of Economic Slowdown

Economic slowdowns have a huge impact on the power distribution unit market. Manufacturers may see a dip in the demand for PDU because business faces financial burdens and becomes more price sensitive which led to delay or cancellations of procuring PDU. The data centres pressurize in the manufacturing of more affordable PDU which might lead to consolidation of PDU manufacturing companies because of slowdowns. There might be a halt in the PDU upgradations which might lead to inefficient power distribution consecutively higher energy bills. In order to save cost, companies might look for optimization of existing PDU and exploring ways to minimize energy consumption. There can be opportunities too with manufacturers by providing value-engineering & developing more affordable PDU’s featuring optimized power distribution & reduced consumption of energy targeting cost-centric data centres. Moreover, targeting markets in developing economies where data centre is on rise can offer growth opportunities.

Segmentation Analysis

By Type

-

Basic

-

Metered

-

Switched

-

Intelligent

-

Others

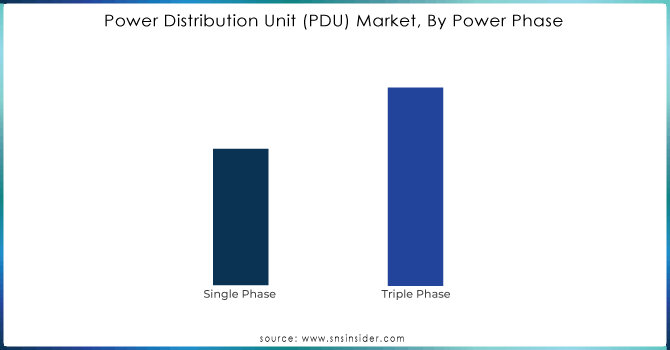

By Power Phase

-

Single Phase

-

Triple Phase

The Triple Phase is dominating the market with a share of around 58.9% of the total market. The reason for its dominance is because of higher power capacity compared to single phase, which is pre-requisite for large equipment machinery, IT infrastructure among commercial & industrial environment. The cost of 3-phase is cheaper compared to single phase with less time required for installation. Increasing cloud-based operations across various sectors increases the demand for 3-phase PDU is growing at a substantial rate.

Ask For Customized Report as per Your Business Requirement - Enquiry Now

By Application

-

Datacentres

-

Laboratories

-

Commercial application

-

Others

The Data Centres are dominating the market with a share of around 41% of the total market. Data centres are important facilities that keep servers, networking equipment, storage systems, and other IT essentials required for storage, processing and managing vast amounts of digital data. With the digitization of services like SAAS, IAAS & PAAS has increased the number of data centres which in turn requires PDU for the constant distribution of power without hampering the current operations.

Regional Outlook

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

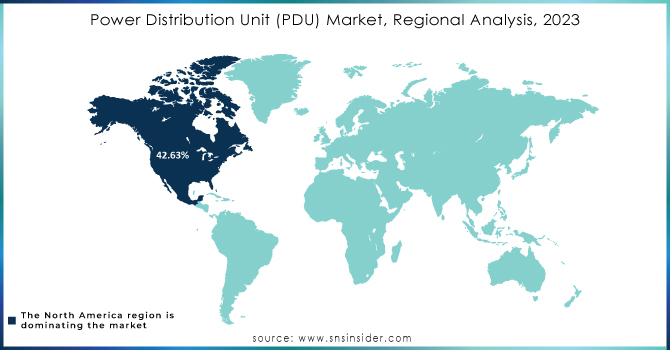

Regional Analysis

North America is dominating the market with a share of around 42.63 % of the total market. This dominance is because of the rapid growth of the industrial sector. The rising demand for energy in mining, oil & gas is making it dominant. The growth of IT infrastructure, cloud-oriented operations and an increasing number of data centres requiring constant power supply is fulfilled by power distribution units. Also, the rise in healthcare machinery requiring constant power supply is maintained via PDU.

Asia-Pacific region is the fastest growing region next to North America because of increasing IT Hubs across the region & rise in energy consumption reason being industrialization.

Key Players

The major key players are ABB Ltd., Delta Electronics Inc., Eaton Corporation, Hewlett Packard Enterprise, Legrand, Leviton Manufacturing Co., Inc., Schneider Electric, Siemens AG, Vertiv Group Corp., Panduit Corp. and other players

Recent Development

-

In January 2023, Leviton introduced the latest Whole Home Energy Monitor and 2nd Gen Smart Circuit Breakers with Remote Control, advancing their integrated home energy management approach. This allowed customers to monitor energy consumption and production from various sources such as the grid, solar, battery, and generator.

-

In August 2023, Panduit Corp. partnered with Cisco Nexus Dashboard to integrate its intelligent PDU (IPDU). This collaboration provided data centre managers with improved insights into energy usage, carbon footprint, and costs in both on-premises and multi-cloud environments.

-

In August 2023, Siemens launched SIRIUS 3UGS line monitoring relay. These relays combined established technology with new features, making monitoring grid stability and quality easier, ensuring proper system operation, and extending the lifespan of components such as motors or compressors.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.94 Billion |

| Market Size by 2032 | US$ 7.76 Billion |

| CAGR | CAGR of 7.83 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Basic, Metered, Switched, Intelligent, Others) • By Power Phase (Single Phase, Triple Phase) • By Application (Datacenters, Laboratories, It & Telecom, Healthcare, Government & Defense, Banking, Financial Services And Insurance, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ABB Ltd., Delta Electronics Inc., Eaton Corporation, Hewlett Packard Enterprise, Legrand, Leviton Manufacturing Co., Inc., Schneider Electric, Siemens AG, Vertiv Group Corp., Panduit Corp. |

| Key Drivers | • Increasing adoption of intelligent Power distribution unit systems with data driven decision making and optimization is driving towards the growth of the market • Rise in the number of data centres is driving the market towards its growth |

| Restraints | • High complexity in integrating with existing infrastructure which can be a restraint in the market growth • High initial investment required in the installation of PDU’s which could be a restraining factor in the growth of the market |