Home Healthcare Software - Product & Service Market Report Scope & Overview:

Get more information on Home Healthcare Software - Product & Service Market - Request Sample Report

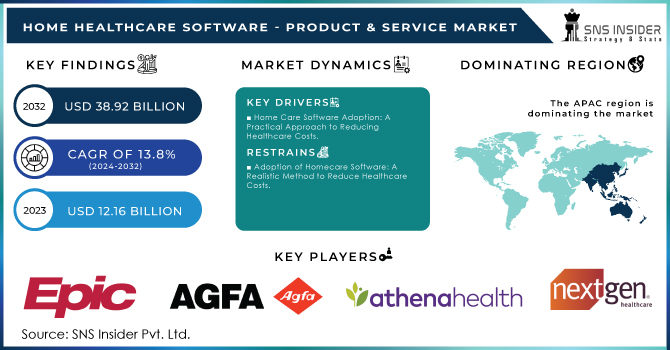

The Home Healthcare Software Market was valued at USD 12.16 billion in 2023 and is projected to reach USD 38.92 billion by 2032 and grow at a CAGR of 13.8% over the forecast period 2024-2032.

The Home Healthcare Software Market is experiencing significant growth, driven by various factors such as technological advancements, an aging population, and an increasing preference for home-based care. With a substantial shift in the healthcare landscape, patients increasingly opt for care at home instead of in institutional settings, fostering demand for efficient home healthcare solutions.

Technological advancements play a pivotal role in the expansion of this market. Integrating software solutions with telemedicine, remote patient monitoring devices, and mobile health applications enables healthcare providers to deliver personalized, continuous care to patients. For instance, AI-driven systems are revolutionizing patient care by offering tailored recommendations, predictive analytics, and real-time updates, enhancing patient experience and care outcomes. These technologies also streamline administrative tasks, reduce operational costs, and ensure better communication between healthcare providers and patients. Furthermore, the growing prevalence of chronic diseases such as diabetes, hypertension, and cardiovascular conditions is fueling the demand for home healthcare software. According to the Centers for Disease Control and Prevention (CDC), nearly half of all adults in the U.S. have at least one chronic condition, which necessitates ongoing management—often best done in the home setting. This has created an urgent need for software systems that can track and manage these conditions remotely.

The cost efficiency of home healthcare services is another driving force. According to a study published in the Journal of Medical Economics, home care services can be more affordable than inpatient care, particularly for chronic disease management and post-surgery recovery. Healthcare providers and insurers are increasingly recognizing the cost-saving potential of home healthcare, leading to greater investment in software solutions that support care at home.

Government support and initiatives to improve healthcare delivery are pushing the market further. Policies that promote home healthcare and reduce hospital readmission rates are encouraging healthcare systems to adopt integrated software solutions, thereby improving the efficiency of care delivery and patient outcomes. Overall, the Home Healthcare Software - Product & Service Market is poised for continued expansion as healthcare providers leverage technology to meet the growing demand for home-based healthcare services.

Market Dynamics

Drivers

-

Aging Population, Technological Advancements, and Cost Efficiency

One of the most significant drivers is the aging population. According to the United Nations, the global population aged 60 years or older is projected to reach 2.1 billion by 2050. This demographic shift increases the demand for healthcare solutions that cater to elderly individuals, many of whom prefer to receive care in the comfort of their homes rather than in institutional settings. This trend is further supported by the growing prevalence of chronic diseases. The Centers for Disease Control and Prevention (CDC) reports that 6 in 10 adults in the U.S. have at least one chronic condition, which necessitates continuous care management. Home healthcare software allows for remote monitoring and management, offering a convenient solution for patients and healthcare providers.

Technological advancements, such as AI, telemedicine, and IoT integration, are also fueling the market. These innovations enable healthcare providers to deliver personalized care plans, track patient data in real-time, and reduce hospital readmissions. For example, AI-driven predictive analytics can forecast potential health complications, allowing for preventive care.

Cost efficiency is another critical driver. A study published in The Journal of Medical Economics found that home care is often more affordable than hospital care, offering savings for healthcare systems and patients. As healthcare costs continue to rise, both providers and insurers are increasingly turning to home healthcare software as a means of reducing expenses while improving care quality. These drivers collectively contribute to the ongoing growth of the home healthcare software- product & service market.

Restraints

-

Data Security and Privacy Concerns

The increasing use of connected devices and AI-driven platforms raises concerns about the security and privacy of sensitive patient data, potentially limiting the adoption of home healthcare software.

-

Lack of Technological Infrastructure

In some regions, limited access to reliable internet connectivity and modern technological infrastructure can restrict the effective implementation and utilization of home healthcare software, particularly in rural or underserved areas.

-

Regulatory Challenges

Strict government regulations and compliance requirements for home healthcare software can create barriers to market entry and innovation, hindering growth opportunities for providers.

Segmentation Analysis

By Software

In 2023, Agency Management Software dominated the home healthcare software- product & service market due to its essential role in streamlining operations for healthcare agencies. This segment accounted for a significant share, estimated at 35.0% of the overall market. The need for efficient management of patient care, scheduling, billing, and employee coordination has led agencies to adopt comprehensive software solutions. Agency management platforms help providers automate administrative tasks, improve patient outcomes, and enhance communication among care teams. These solutions also simplify compliance with healthcare regulations, which is critical for home healthcare providers.

Hospice Software Solutions is expected to be the fastest-growing segment in the software category, with a projected growth rate of 12-15% annually. This is primarily due to the increasing demand for palliative care services and hospice care at home. As the elderly population grows and chronic conditions rise, the need for specialized care such as hospice and end-of-life care has surged. Hospice software solutions help manage patient records, treatment plans, and end-of-life care coordination, making them essential for home healthcare providers in this niche.

By Service

Skilled Nursing Services emerged as the dominant segment in 2023 within the home healthcare services market, capturing around 40.0% of the total market share. Skilled nursing encompasses a broad range of services, such as wound care, pain management, and post-surgical care, provided by trained nurses in patients’ homes. This segment benefits from the aging population, particularly among individuals with chronic conditions who prefer home-based care over hospitalization. The rise in long-term conditions and the growing preference for home care over institutional settings significantly contributes to its dominance.

Infusion Therapy is forecast to be the fastest-growing segment within home healthcare services, with an expected growth rate of 20% annually. Infusion therapy involves the administration of medications directly into the bloodstream through methods such as IV or subcutaneous injection. The increasing prevalence of chronic diseases such as cancer, diabetes, and autoimmune disorders, which often require long-term medication through infusion, is driving this rapid growth. Additionally, the shift toward home-based healthcare and advancements in portable infusion technology makes home infusion therapy a more accessible and appealing option for patients and healthcare providers.

Regional Analysis

North America was the largest market for home healthcare software- product & service, with the United States leading the way. The country has a large and aging population, which is increasing the demand for home-based healthcare services. According to the U.S. Census Bureau, the elderly population is expected to double by 2060, leading to a growing need for home healthcare solutions. Additionally, advancements in telemedicine, AI, and IoT are contributing to the rapid adoption of home healthcare software. The U.S. government’s support for home healthcare services, including reimbursement programs from Medicare and Medicaid, further boosts the market growth. Furthermore, the presence of major home healthcare software providers in the region facilitates innovation and market expansion.

Europe held a significant share of the global home healthcare software- product & service market, driven by the aging demographic and a growing preference for home-based care. Countries such as Germany, the United Kingdom, and France are investing heavily in digital health solutions to improve care delivery and reduce hospital admissions. The European Union’s emphasis on digital health initiatives, such as the eHealth Action Plan, supports the integration of healthcare software solutions. Moreover, rising chronic disease prevalence in the region is increasing the need for continuous remote monitoring, propelling the market for home healthcare software.

Asia-Pacific is expected to experience the fastest growth in the home healthcare software- product & service market. The region’s increasing urbanization, rising healthcare expenditure, and expanding elderly population are significant drivers of this growth. Countries like China, Japan, and India are embracing home healthcare technologies to meet the demands of their aging populations and provide affordable care solutions. In particular, Japan has a high proportion of elderly citizens, pushing the government to invest in telemedicine and home healthcare services. Additionally, the growing adoption of mobile health apps and wearable devices in this region is enhancing the overall healthcare experience and contributing to market expansion.

Need any customization research on Home Healthcare Software - Product & Service Market - Enquiry Now

List of Players Offering Software Related to Home Healthcare:

-

-

Electronic Health Records (EHR)

-

Home healthcare software for remote monitoring and care coordination

-

-

McKesson Corporation

-

Homecare management software

-

EHR and patient management software for home healthcare agencies

-

-

Cerner Corporation

-

Remote patient monitoring solutions

-

EHR and telemedicine platforms for home healthcare

-

-

Epic

-

Home Health EHR

-

Integrated software for remote patient monitoring and home care management

-

-

-

Remote patient management solutions

-

EHR platforms for home healthcare providers

-

-

ClearCare Inc. (WellSky)

-

Homecare management software

-

Remote monitoring solutions for healthcare agencies and patients

-

-

Kinnser Software

-

Homecare management software

-

Patient scheduling and remote monitoring tools

-

-

Netsmart Technologies

-

Healthcare management software for home care

-

EHR software tailored for home healthcare providers

-

-

Thornberry Limited

-

Home healthcare software solutions

-

EHR and patient care management systems

-

-

Alora Healthcare Systems

-

Home healthcare EHR software

-

Remote patient monitoring solutions

-

-

Healthcare Provider Solutions

-

Home healthcare software for care management and scheduling

-

-

CareTime

-

Homecare management software

-

Electronic Visit Verification (EVV) system for home healthcare

-

-

Delta Health Technologies

-

Homecare management solutions

-

Patient management and remote monitoring software

-

-

Centex AxisCare, LLC

-

Homecare software solutions

-

Remote patient monitoring and care coordination tools

-

List of Players Offering Services Related to Home Healthcare:

-

athenahealth

-

Cloud-based EHR services

-

Telemedicine and remote care management services

-

-

Carecenta

-

Home healthcare services including remote care management

-

Care coordination services for home care patients

-

Recent Development

In Nov 2024, Heim Health secured £2.2 million in funding to revolutionize home healthcare delivery. The company aims to reshape community-based healthcare with a scalable, technology-driven model designed to alleviate pressure on hospitals.

In April 2024, The FDA introduced an innovative initiative, "Home as a Health Care Hub," aimed at transforming the home environment into a comprehensive healthcare system. This initiative will leverage augmented and virtual reality technologies to enhance healthcare delivery, with a focus on improving health equity. Through this initiative, the FDA envisions a future where the home becomes a central space for healthcare, offering innovative solutions to address various health needs and disparities.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 12.16 billion |

| Market Size by 2032 | US$ 38.92 billion |

| CAGR | CAGR of 13.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Software (Agency Management, Clinical Management, Hospice Software Solutions, Other Software) • By Service (Rehabilitation, Infusion Therapy, Respiratory Therapy, Pregnancy Care, Skilled Nursing, Others) • By Mode of Delivery (Cloud-Based Software, On-Premises Software, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ResMed, Agfa Healthcare, GE Healthcare, Siemens Healthcare, Veradigm, McKesson Corporation, Cerner Corporation, Epic, NextGen Healthcare, ClearCare Inc. (WellSky), Kinnser Software, Netsmart Technologies, Thornberry Limited, Alora Healthcare Systems, Healthcare Provider Solutions, CareTime, Delta Health Technologies, Centex AxisCare, LLC, Carecenta. |

| Key Drivers | • Aging Population, Technological Advancements, and Cost Efficiency |

| Restraints | • Data Security and Privacy Concerns • Lack of Technological Infrastructure • Regulatory Challenges |