Pulmonary Arterial Hypertension Market Size & Overview

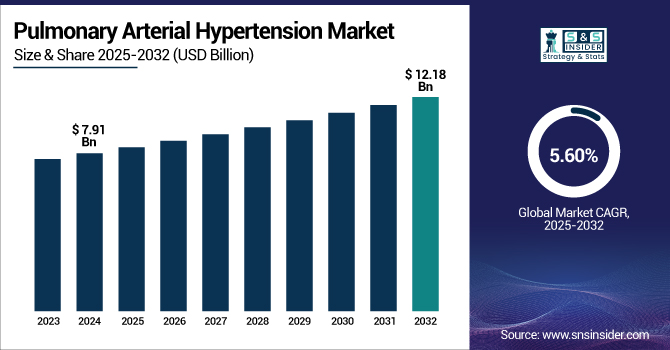

The Pulmonary Arterial Hypertension Market size was valued at USD 7.91 billion in 2024 and is expected to reach USD 12.18 billion by 2032, growing at a CAGR of 5.60% over the forecast period of 2025-2032.

To Get more information on Pulmonary Arterial Hypertension Market - Request Free Sample Report

The pulmonary arterial hypertension (PAH) market is registering constant growth with increasing prevalence, better diagnostic techniques, and greater availability of targeted therapies. Drug development advances, heightened awareness, and favorable regulatory frameworks additionally fuel the growth of the market. The rising prevalence of PAH is driving the market growth.

For instance, according to NIH, over 50% of the pulmonary arterial hypertension in the world has no definable cause. The most common cause of pulmonary hypertension in the U.S. is related to left-sided heart diseases, especially left-sided heart failure.

Strategic partnerships and expanded research spending are driving innovation, with branded and generic pharmaceuticals defining the competitive arena through multiple routes of administration.

The U.S. pulmonary arterial hypertension market size was valued at USD 2.61 billion in 2024 and is expected to reach USD 3.95 billion by 2032, growing at a CAGR of 5.36% over the forecast period of 2025-2032. The U.S. dominates the North American pulmonary arterial hypertension market with its high healthcare spending, widespread coverage of advanced treatments, and strong dominance of leading drug firms. Sound regulatory support and prevalent disease awareness also reinforce its leadership in the region.

Pulmonary Arterial Hypertension Market Dynamics

Drivers:

-

Rising Prevalence of PAH is Driving the Market Growth

The rising incidence of pulmonary arterial hypertension (PAH) is a major market driver. Aging population, rise in the prevalence of chronic diseases, such as connective tissue disorders, and congenital heart defects are all increasing the number of PAH cases globally. As cardiovascular diseases become more prevalent and the population grows older, the need for PAH treatments increases, fueling market growth.

For instance, according to ECR, the global prevalence of pulmonary arterial hypertension (PAH) was estimated at 192,000 cases (95% uncertainty interval [UI]: 155,000–236,000). Females represented 119,000 cases (62%) and males represented 73,100 cases (38%). The age-standardized prevalence was 2.28 cases per 100,000 population (95% UI: 1.85–2.80). Prevalence rates rose with age, with the highest being among those aged 75 to 79 years.

-

Advancements in PAH-targeted Therapies are Propelling the Pulmonary Arterial Hypertension Market Growth

Ongoing innovation in the creation of new and better treatments is propelling the PAH market. New drug categories, such as soluble guanylate cyclase (SGC) stimulators and combination products, are enhancing patient outcomes. Oral drug development, less invasive drugs, and more convenient drugs are also increasing access and compliance, further driving the pulmonary arterial hypertension market growth.

For instance, A newly licensed class of drug, sotatercept, a tumor growth factor-β signaling inhibitor, has been granted recent FDA approval for the therapy of PAH, on the back of encouraging results from the phase III STELLAR trial. Further, pulmonary artery denervation and balloon pulmonary angioplasty have surfaced as efficacious alternative therapies in patients with pulmonary hypertension who fail to respond favorably to traditional drug treatment.

Restraints:

-

Low Awareness and Diagnosis Difficulty Linked to the Condition are Restraining the Pulmonary Arterial Hypertension Market Trends

PAH is a condition that is rarely diagnosed, and the reason is that its symptoms of shortness of breath, tiredness, and dizziness are easily misinterpreted as some other common illness, such as asthma or heart failure. This delay in diagnosis translates to lost opportunities for early intervention, allowing the disease to progress to more advanced stages before treatment is started. Delayed diagnosis is also attributable to the difficulty in diagnosing PAH, which typically requires specialized tests, such as right heart catheterization. In addition, there is general unawareness among healthcare professionals about PAH, particularly in underserved communities with poor healthcare facilities. These challenges prevent the on-time availability of effective treatments, impacting patient outcomes and preventing market growth.

Pulmonary Arterial Hypertension Market Segmentation Analysis

By Drug Class

The prostacyclin and prostacyclin analogs segment led the pulmonary arterial hypertension market share of 48.10% in 2024, due to their proven efficacy for the treatment of late-stage disease. These treatments, such as epoprostenol and treprostinil, act on the prostacyclin pathway directly, causing the blood vessels to dilate and enhancing blood flow in PAH patients. They are usually prescribed to patients with serious symptoms and have become the gold standard for enhancing exercise tolerance and survival. Furthermore, the presence of several formulations, including intravenous, subcutaneous, inhalational, and oral, broadened their reach and reinforced their firm market status.

The SGC stimulators segment will experience the fastest growth over the forecast period in the pulmonary arterial hypertension market analysis on account of their new mechanism of action and increasing clinical use. Soluble guanylate cyclase (SGC) stimulators, such as riociguat act by augmenting nitric oxide signaling, which results in enhanced vascular relaxation and reduced pulmonary pressure. Their availability for use both as monotherapy and concomitantly with other PAH therapy provides greater flexibility for disease treatment. Further clinical evidence of their long-term safety and efficacy, combined with increasing physician acceptance and broader regulatory approvals, is fueling the growth of the segment in the market.

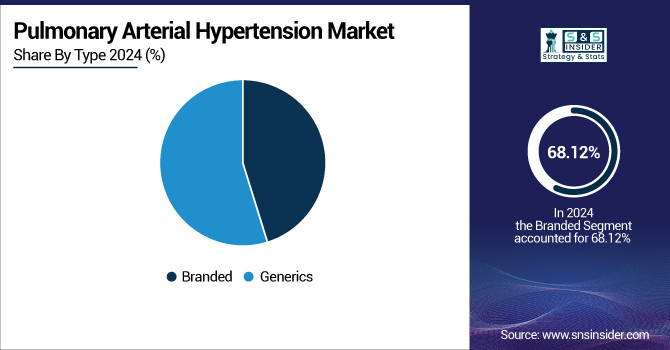

By Type

The branded segment led the PAH drugs market by type in 2024 with a market share of 68.12% due to the wide range of uses of patented therapies by well-established drug firms. The branded drugs, such as Opsumit, Tyvaso, and Adempas, have established efficacy and safety profiles, which result in them being the most preferred choice among doctors to treat PAH. High support through marketing, physician acceptance, and listing in guidelines helped them to lead.

The generics segment is expected to grow at the fastest rate during the forecast period as a result of growing patent expirations and increased need for affordable treatment alternatives. With global healthcare systems seeking to limit costs, especially in developing regions. the adoption of generic substitutes is increasing in momentum. Generics provide equal efficacy at a lower cost and hence are opening up to treat a larger number of patients. Furthermore, regulatory favor for generic approvals and initiatives to cut down on the costs of treatment are anticipated to fuel their fast adoption during the forecast period.

By Route of Administration

The oral segment dominated the pulmonary arterial hypertension market by route of administration in 2024, with 52.11% share due to its ease of use, convenience, and patient preference. Oral drugs, including macitentan and ambrisentan, have the advantage of high patient compliance since they do not need to be administered in specialized healthcare settings. These drugs are preferred for long-term treatment of PAH owing to their efficacy, safety profiles, and convenience, enabling patients to treat their condition from home without the necessity of frequent hospital visits or injections. The fact that several oral treatment options are available also made the segment supreme.

The Intravenous/Subcutaneous segment is anticipated to exhibit the fastest growth rate during the forecast period due to the increased demand for more aggressive treatment in advanced PAH patients. Intravenous and subcutaneous therapies, such as epoprostenol and treprostinil, are vital for patients with advanced PAH and require immediate and effective therapy to control symptoms and improve survival. These routes of administration have higher bioavailability and more immediate effects than oral drugs.

Pulmonary Arterial Hypertension Market Regional Outlook

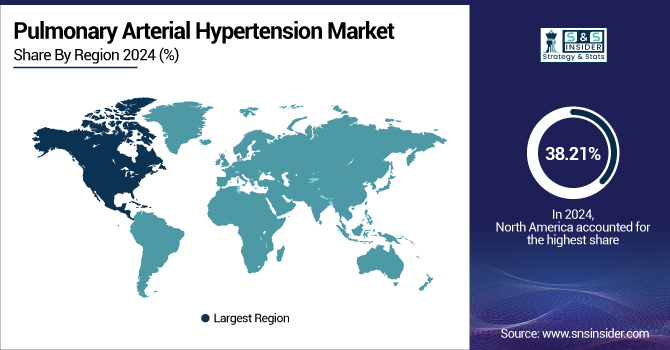

North America dominated the pulmonary arterial hypertension market with a 38.21% share in 2024, owing to its established healthcare infrastructure, good disease awareness, and extensive presence of leading pharma companies. The region has access to superior diagnostic facilities, extensive availability of specialized care, and good reimbursement policies. Further, the high prevalence of PAH-associated conditions, such as connective tissue diseases and congenital heart diseases, especially in the U.S., drives demand for targeted drugs. Regulatory promotion of agencies, such as the FDA for new drug approvals, combined with the early uptake of new treatments, supports North America's dominance in the global PAH market further.

Asia Pacific is the fastest-growing region in the market with 6.53% CAGR during the forecast period, with growth encouraged by a growing patient population, improved access to healthcare, and increased government expenditure on rare disease awareness and treatment. China, India, and Japan are seeing growing developments in healthcare infrastructure and increasing participation in PAH therapy clinical trials. In addition, growth in emerging economies has brought about rising healthcare expenditure and rising insurance coverage, enabling more patients to be diagnosed and treated. Growth of strategic markets for multinationals and growing availability of generic drugs also fuel the region’s growth.

Europe leads the Pulmonary Arterial Hypertension (PAH) Market owing to its robust pharmaceutical research environment, early diagnosis programs, and universal access to sophisticated therapies through national healthcare networks. Furthermore, increasing awareness and well-established treatment guidelines in countries such as Germany, France, and the UK also reinforce market leadership in the region.

Germany leads the European pulmonary arterial hypertension market with its strong healthcare system, early access to sophisticated therapies, and established network of PH specialist centers. Coupled with high disease awareness, favorable reimbursement policies, and active pharmaceutical research, it further solidifies its position. Moreover, an aging population and increasing incidence of PAH-related conditions continue to fuel demand, affirming Germany's top regional position.

Latin America and the Middle East & Africa (MEA) are witnessing moderate growth in the pulmonary arterial hypertension market due to improved healthcare infrastructure, increasing awareness of orphan diseases, and incremental increases in healthcare spending. Rarity of access to emergent therapy and comparatively lower diagnosis rates compared to developed markets are reasons that reduce their overall market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Pulmonary Arterial Hypertension Market

-

Johnson & Johnson

-

Bayer AG

-

Gilead Sciences, Inc.

-

Merck & Co., Inc.

-

Novartis AG

-

AbbVie Inc., Acceleron Pharma, Inc.

-

Arena Pharmaceuticals, Inc.

-

Sandoz and other players.

Recent Developments

-

January 2025 — United Therapeutics Corporation a public benefit corporation, reported that five posters from its commercial and development pipeline in pulmonary hypertension (PH) will be presented at the Pulmonary Vascular Research Institute (PVRI) 2025 Annual Congress, which is set to be held from January 29, 2025 to February 1, 2025, in Rio de Janeiro.

-

March 2024 — Johnson & Johnson announced that the U.S. Food and Drug Administration (FDA) has approved OPSYNVI, a single-tablet combination of macitentan (an endothelin receptor antagonist, ERA) and tadalafil (a phosphodiesterase 5, PDE5, inhibitor). OPSYNVI is approved for the chronic treatment of adults with pulmonary arterial hypertension (PAH) that falls under World Health Organization (WHO) Group I and WHO functional class (FC) II-III.

Pulmonary Arterial Hypertension Market Report Scope:

Report Attributes Details Market Size in 2024 USD 7.91 Billion Market Size by 2032 USD 12.18 Billion CAGR CAGR of 5.60% From 2025 to 2032 Base Year 2024 Forecast Period 2025-2032 Historical Data 2021-2023 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Drug Class (Endothelin Receptor Antagonists (ERAs), PDE-5 Inhibitors, Prostacyclin and Prostacyclin Analogs, SGC Stimulators)

• By Type (Branded, Generics)

• By Route of Administration (Oral, Intravenous/Subcutaneous, Inhalational)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) Company Profiles Johnson & Johnson, United Therapeutics Corporation, Bayer AG, Gilead Sciences, Inc., Merck & Co., Inc., Novartis AG, AbbVie Inc., Acceleron Pharma, Inc., Arena Pharmaceuticals, Inc., Sandoz, and other players