Lithium Compounds Market Size & Overview:

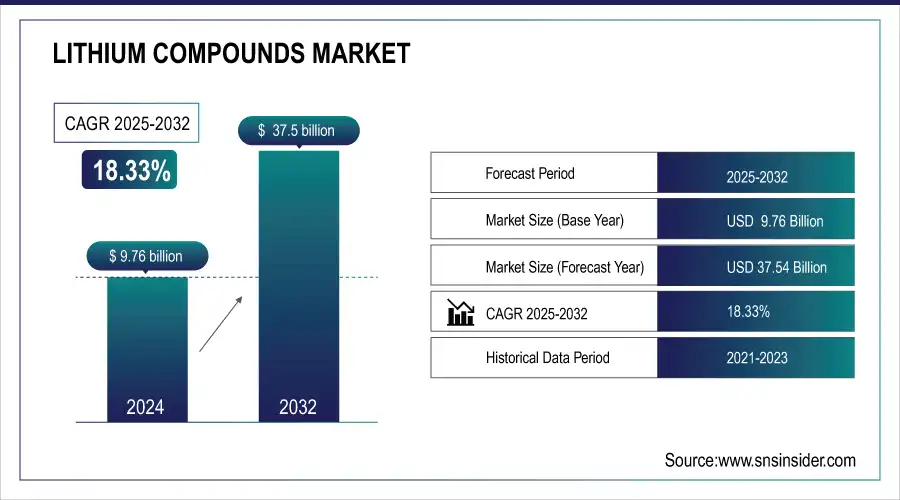

The Lithium Compounds Market size was USD 9.76 billion in 2024 and is expected to reach USD 37.54 billion by 2032, growing at a CAGR of 18.33% over the forecast period of 2025-2032.

Lithium compounds market analysis highlights that the growing adoption of electric vehicles (EVs) is fueling the surge in lithium-ion battery production. EV adoption has been accelerating rapidly because governments and consumers across the globe are pivoting to cleaner, more sustainable transportation alternatives. For many applications, including EVs, lithium-ion batteries are the number one choice for energy storage because of their high energy density, excellent design flexibility, long cycle life, and comparatively lightweight

To Get more information on Lithium Compounds Market - Request Free Sample Report

In particular, the growing popularity of electric vehicles (EVs) has a big impact on lithium-ion battery production. Global EV sales rose to 17 million units in 2024, a 25% increase over the record 2023, according to the International Energy Agency (IEA). The rapid pace of EV adoption has, understandably, driven a parallel rise in demand for batteries, breaking the one terawatt-hour (TWh) demand level for the first time in 2024, with EVs contributing about 85% of this demand.

Lithium Compounds Market Size and Forecast

-

Lithium Compounds Market Size in 2024: USD 9.76 Billion

-

Lithium Compounds Market Size by 2032: USD 37.54 Billion

-

CAGR: 18.33% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Lithium Compounds Market Trends

-

Rising demand for lithium-ion batteries in electric vehicles and consumer electronics is driving the lithium compounds market.

-

Expanding use in energy storage systems is boosting adoption for renewable integration and grid stability.

-

Increasing applications in ceramics, glass, lubricants, and pharmaceuticals are widening market scope.

-

Volatile raw material supply and pricing dynamics are influencing market stability.

-

Growing investments in lithium mining and refining projects are strengthening the supply chain.

-

Development of recycling technologies for lithium recovery is aligning with sustainability goals.

-

Collaborations between battery manufacturers, automakers, and material suppliers are accelerating innovation and capacity expansion.

Lithium Compounds Market Growth Drivers:

-

Growing Use of Lithium Compounds in Consumer Electronics and Mobile Devices Drives the Market Growth

Increase in the consumption of lithium compounds in mobile devices and consumer electronics is one of the major factors driving the lithium compounds market growth. Lithium-ion batteries are widely used in modern electronic devices, including smartphones, laptops, tablets, smartwatches, and wireless accessories, due to their high energy density, lightweight, and long lifecycle of lithium-ion batteries. With digital transformation, remote work trends, and more tech-savvy global populations, demand for portable high-performance devices continues on the steep rise steeply, pushing manufacturers to ramp production of lithium-based batteries all the more. There are also metallic compounds, such as lithium cobalt oxide and lithium iron phosphate, which are battery cathodes, meaning that they are primary building blocks in the electronics supply chain.

Household spending on electrical and electronic goods in the EU increased by more than 300% between 2000 and 2022. This time, households in the European Union spent 25 times more on mobile phones in 2022 than they did in 2000, a number that shows how much the consumption of electronic devices has increased.

Lithium Compounds Market Restraints:

-

High Production and Processing Costs of Lithium Compounds May Hamper the Market Growth

Huge manufacturing and processing costs of lithium compounds are the major restraining factor that could affect the lithium compounds market growth. Lithium from hard rock or brine deposits is even more labor-intensive, needing massive investments and infrastructure, and technical capacity to reach the extraction point. In addition, lithium refining and processing require sophisticated machinery and energy, adding to the high cost of operation. This only exacerbates those high costs, which include the investments necessary to comply with strict environmental and safety standards, and rising labor and energy costs. These rising costs can translate into price fluctuations negatively impacting the value proposition of lithium producers and the economics for downstream industries, such as battery manufacturers, subsequently impacting the economics for companies operating in this space and the lithium compounds industry.

Lithium Compounds Market Opportunities:

-

Expansion Of Lithium Market Recycling Technologies Creates Opportunities in the Market

Lithium recycling technologies are expanding, providing opportunities for lithium compounds. With the skyrocketing demand for lithium-ion batteries in electric vehicles (EVs), consumer electronics, and renewable energy storage, sustainable lithium sourcing is more important than ever. This would help decrease dependence on conventional mining as well as the associated environmental impacts by recycling lithium from used batteries. Lithium recycling technologies are becoming more efficient and cost-effective to recover lithium from end-of-life batteries, thereby facilitating a circular economy in the battery supply chaînes. Not only will this help to fulfill the increasing demand for lithium, but it will also mitigate the impact of open-pit mines on the natural environment, especially in sensitive ecosystems, and drive the lithium compounds market trends.

The DOE has prioritized the recycling of lithium-ion batteries to ensure a steady stream of critical minerals needed for clean energy technologies. In 2023, the DOE allocated USD 14 million to support thousands of consumer battery collection sites at Staples and Batteries Plus stores, increasing recycling of phones, computers, and other battery-powered electronics.

Most notably, a USD 2 billion loan was also given to battery recycling company, Redwood Materials, based in Nevada, by the Advanced Technology Vehicles Manufacturing program. Funding for this project will go towards the construction of a facility that can recover over 95% of elements like lithium, cobalt, and nickel from end-of-life batteries for the domestic supply of critical minerals.

Lithium Compounds Market Segment Analysis

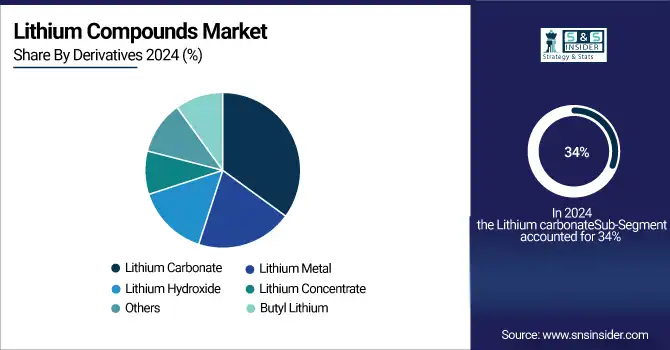

By Derivatives, Lithium carbonate dominates the lithium compounds market, Lithium hydroxide is expected to grow fastest

Lithium carbonate held the largest lithium compounds market share, around 34%, in 2024, owing to them being an electric vehicle (EV) battery component, and also being used for consumer electronics and renewable energy storage systems. Specifically, it is an important precursor for the production of cathode materials, lithium iron phosphate (LFP) and lithium cobalt oxide (LCO), which find various battery applications. Lithium-carbs are not as difficult to come by and scale as LiOH and even more so as long as you obtain lithium from brine sources. But it is not only used in batteries, they have a huge part in the glass and ceramics industry, where they fairly increase the durability and thermal resistance.

Lithium Hydroxide held a significant lithium compounds market share, due to its importance in providing a key precursor for high-nickel cathode lithium chemicals chemistries like NCA (nickel-cobalt-aluminum) and NMC (nickel-manganese-cobalt) for advanced lithium-ion batteries. The high-energy-density batteries are preferred by leading electric vehicle (EV) manufacturers for longer driving ranges and enhanced performance. Lithium hydroxide, in particular, allows these high-nickel cathodes to benefit from its thermal and chemical stoichiometric stability along the battery manufacturing process, unlike lithium carbonate.

By End-Use Industry, Li-ion batteries dominate the lithium compounds market, Lubricants are expected to grow fastest

Li-ion Batteries held the largest market share, around 26%, in 2024. It is due to their wide use in various high-growth sectors, including electric vehicles (EVs), consumer electronics, and grid-scale energy storage systems. For modern portable and rechargeable devices, these batteries provide high energy density, light weight, long cycle life, and fast charge capability. In particular, the transition to electrification of the global economy, and very notably the electrification of transportation, has greatly accelerated the demand for lithium-ion batteries, and therefore driven the demand for lithium compounds like lithium carbonate and lithium hydroxide.

Lubricants hold a significant market share in the lithium compounds market owing to the high use of lithium-based greases in automotive and industrial applications. Among these, lithium greases are preferred due to their superior thermal stability, water resistance, mechanical performance, and ability to function over a broad temperature range, especially those based on lithium hydroxystearate. This makes them essential in machinery, bearings, gears, and heavy-duty equipment, especially in challenging environments. Because of continuous growth in industrialization and automotive production & sales around the world (especially in emerging markets), the demand for high-performance lubricants increased.

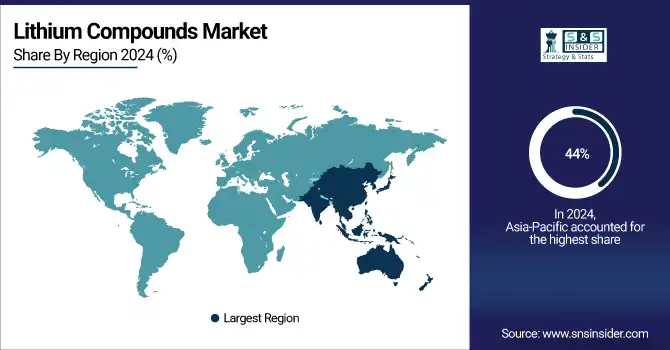

Lithium Compounds Market Regional Analysis

Asia Pacific Lithium Compounds Market Insights

Asia Pacific held the largest market share, around 44%, in 2024. It is owing to the region’s stronghold over EV manufacturing, consumer electronics production, and lithium processing capacity. China, Japan, and South Korea are big home countries of major EV manufacturers and battery producers, such as BYD, CATL, Panasonic, and LG Energy Solution, that need large amounts of lithium compounds (such as lithium carbonate and lithium hydroxide) in their supply chain. China has also opted for an integrative approach, where in the first place it reigns over lithium battery manufacture, lithium compounds companies, in the second place over lithium extracted from across the world, which are then refined and processed in China, thus creating a vertically integrated supply chain between the battery and its key elements.

Get Customized Report as per Your Business Requirement - Enquiry Now

According to the Ministry of Industry and Information Technology, the output value of lithium-ion batteries in China has reached more than 940GWh in 2023, a year-on-year increase of more than 25%. In 2020, the output value of the sector exceeded about 197 billion U.S. dollars, and exports rose by more than 33 percent to 457.4 billion yuan. Such a large-scale increase accentuates the role that China plays in the global market for lithium compounds.

North America Lithium Compounds Market Insights

North America lithium compounds market held a significant market share and is the fastest-growing segment in the forecast period. It is driven by the surge in electric vehicle (EV) production and expanding investments in battery manufacturing, as well as government-supported programs to bolster domestic lithium supply chains. Specifically, the demand for lithium compounds such as lithium carbonate and lithium hydroxide has blown up in the U.S, largely spurred by the Biden Administration's ambitious electrification and clean energy policies. Billions of dollars for EV infrastructure, battery production, and domestic sourcing of critical minerals (including lithium) have been committed under federal programs like the Inflation Reduction Act and Bipartisan Infrastructure Law.

U.S. lithium compounds market size was USD 1.69 billion in 2024 and is expected to reach USD 7.19 billion by 2032 and grow at a CAGR of 19.84% over the forecast period of 2025-2032. The growing demand from the electric vehicle (EV) industry, increasing battery manufacturing capacity, and several new federal initiatives to assure domestic supply chains for critical minerals such as lithium. With the U.S. being the largest economy in the region, the biggest EV makers such as Tesla, General Motors, and Ford are scaling up production at a fast rate, and all require plenty of lithium compounds to manufacture lithium-ion batteries.

The U.S. Department of Energy (DOE) is pursuing a number of initiatives to strengthen the domestic battery supply chain. In 2023, the U.S. had battery recycling facilities that could recover upwards of 35,000 tons of battery materials each year, and this capacity will continue to grow rapidly in the years ahead.

Europe Lithium Compounds Market Insights

Europe held a significant market share in the forecast period. It is due to the aggressive push towards clean energy, electric mobility, and localization of battery manufacturing. The Green Deal highlights and the "Fit for 55" package further tightened carbon neutrality targets, forcing a fast-moving transition to EVs and renewable energy systems, which every day increasingly depend on lithium-ion batteries. Europe, in turn, has poured billions of euros into creating a strong battery supply chain, with the creation of gigafactories already being developed at Northvolt, Volkswagen, and BASF in Germany, Sweden, France, and elsewhere throughout the EU.

Middle East & Africa and Latin America Lithium Compounds Market Insights

The Lithium Compounds Market in the Middle East & Africa and Latin America is gaining momentum with rising investments in lithium extraction and processing. Latin America, led by Argentina, Chile, and Bolivia, holds abundant reserves, attracting global companies for large-scale projects. Meanwhile, Africa, particularly Zimbabwe, is emerging as a lithium hotspot. These regions are becoming vital in securing global supply for EV batteries and energy storage applications.

Lithium Compounds Market Competitive Landscape:

Rio Tinto

Rio Tinto is a leading global mining group focusing on finding, mining, and processing mineral resources. With operations spanning several continents, the company plays a key role in supplying essential materials for energy transition and sustainable technologies. Its investment in lithium highlights its strategic shift toward clean energy minerals, strengthening its portfolio in battery-grade lithium production and positioning it for long-term growth.

-

2024: Rio Tinto acquired the Rincon Project for USD 2.5 billion and committed to producing 60,000 tonnes of battery-grade lithium annually by 2031 in Argentina.

Albemarle Corporation

Albemarle Corporation is a global leader in specialty chemicals, with a strong position in lithium, bromine, and catalysts. The company supports critical industries like energy storage, mobility, and electronics through innovative lithium compounds. Its expansion of production facilities in Australia and the United States reflects its strategy to meet rising global demand, reinforcing its role as a dominant player in the energy transition value chain.

-

2024: Albemarle expanded its lithium production facilities in Australia and the U.S. to meet the surging demand for lithium compounds worldwide.

Lithium Americas Corp.

Lithium Americas Corp. engages in the development of lithium projects focused on powering next-generation batteries and supporting the electric vehicle revolution. Its flagship Thacker Pass project in Nevada represents the largest known U.S. lithium deposit. The company’s partnership with General Motors, backed by a USD 945 million investment, emphasizes its importance in securing domestic lithium supply chains, boosting growth prospects, and enhancing North American battery independence.

-

2023: General Motors invested USD 945 million in Lithium Americas to develop the Thacker Pass lithium project through a joint venture.

Key Players

Some of the Lithium Compounds Market Companies

-

SQM

-

Ganfeng Lithium Co., Ltd.

-

Livent Corporation

-

Tianqi Lithium Corporation

-

Lithium Americas Corp.

-

Mineral Resources Limited

-

Orocobre Limited (Allkem)

-

AMG Lithium

-

FMC Corporation

-

Sichuan Yahua Industrial Group Co., Ltd.

-

Jiangxi Special Electric Motor Co., Ltd. (Jiangte Lithium)

-

Altura Mining Limited

-

Piedmont Lithium Inc.

-

Sayona Mining Limited

-

Sigma Lithium Corporation

-

Galaxy Resources Limited

-

Critical Elements Lithium Corporation

-

European Lithium Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 9.76 Billion |

| Market Size by 2032 | USD 37.54 Billion |

| CAGR | CAGR of 18.33% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Derivatives (Lithium Carbonate, Lithium Hydroxide, Lithium Concentrate, Lithium Metal, Butyl Lithium, Others) •By End Use Industry (Li-ion Batteries, Glass & Ceramics, Medical, Lubricants, Metallurgy, Polymers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Albemarle Corporation, SQM, Ganfeng Lithium Co., Ltd., Livent Corporation, Tianqi Lithium Corporation, Nemaska Lithium, Lithium Americas Corp., Mineral Resources Limited, Orocobre Limited (Allkem), AMG Lithium, FMC Corporation, Sichuan Yahua Industrial Group Co., Ltd., Jiangxi Special Electric Motor Co., Ltd. (Jiangte Lithium), Altura Mining Limited, Piedmont Lithium Inc., Sayona Mining Limited, Sigma Lithium Corporation, Galaxy Resources Limited, Critical Elements Lithium Corporation, European Lithium Ltd. |